For the Fed "back pot"! Tesla extended auto loan installments to 84 months

Tesla made a point of announcing this extended installment plan ahead of that meeting, most likely to downplay the impact of the Fed's rate hike on the purchasing power of the auto market。

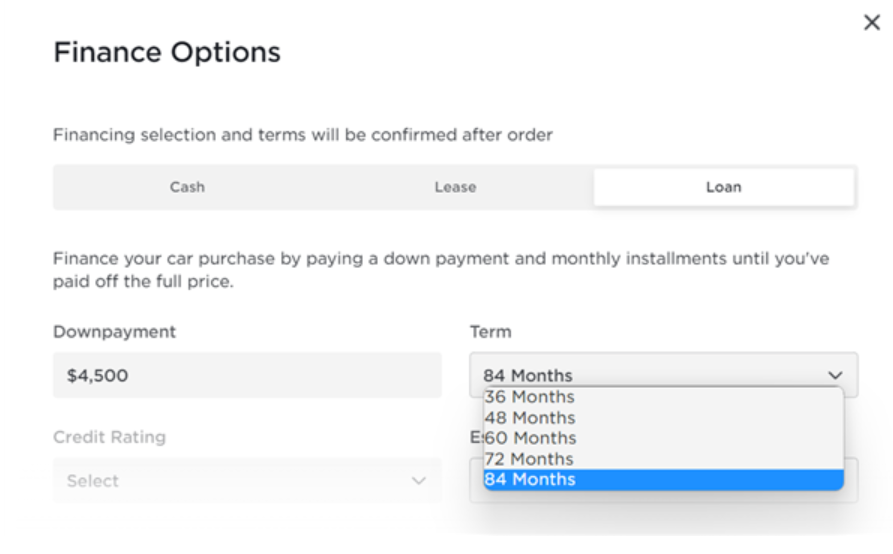

On July 23, according to Tesla's U.S. website, the manufacturer has opened up 84 months (7 years) of loan options on its car purchase loan page, compared with the previous maximum period of 72 months (6 years) for Tesla's U.S. website car purchase installment.。In other words, Tesla extended the longest installment of its U.S. car loan by a full year.。

For consumers who want to buy a car, Tesla's move has its pros and cons。According to the analysis, while Tesla's move to extend the loan term can reduce the monthly repayment of car buyers, consumers tend to pay more interest and face a higher risk of arrears than the value of the vehicle。

However, Tesla's move may be a last resort。In the high interest rate environment facilitated by the Federal Reserve, the price of U.S. cars has risen with the increase in interest rates, which has deterred some consumers interested in buying cars。Since March last year, in order to curb the high level of inflation, the Federal Reserve has raised interest rates 10 times in a row, the cumulative range of a staggering 500 basis points, the lives of U.S. residents have caused no small impact, especially in the field of credit.。

Last week, according to a data released by the New York Fed, more and more Americans were being turned down when they sought a loan。The overall rejection rate for credit applicants rose to its highest level since June 2018, up from 17 in February..3% to 21.8%。

According to the report, auto loan rejections in the United States reached their highest level since 2013, up from 9 in February..1% to 14.2 per cent; mortgage rejections rose to 13 per cent in June from 10 per cent in February..2%; the rejection rate for mortgage refinancing also increased from 16% in the last survey..3% jump to 20.8%。

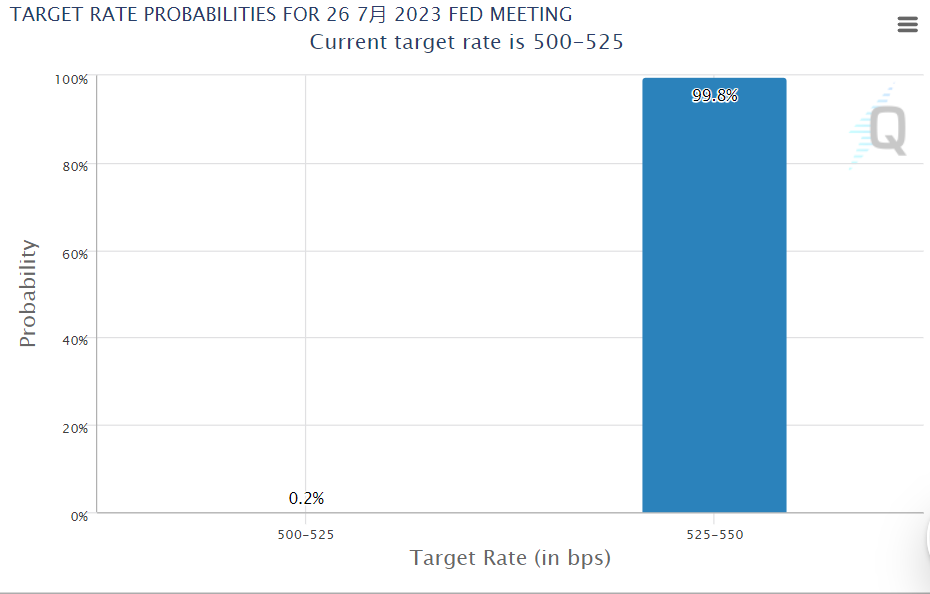

Now, that will probably continue.。Currently, based on money market pricing, the Fed will continue to raise interest rates by 25 basis points in July, pushing the policy rate ceiling to 5.5% and refused to open a rate cut window during the year。According to the Fed's official website, the interest rate decision was announced on July 26, a day later, and Tesla deliberately rushed to announce the extension of the installment plan before the meeting, likely to play down the impact of the Fed's rate hike on the purchasing power of the auto market.。

In fact, Tesla CEO Elon Musk has long been quite critical of the Fed's aggressive rate hikes.。Last November, he warned on Twitter that the Fed's rate hike "greatly increases the likelihood of a severe recession."。He also said the Fed had raised interest rates on money market accounts (Treasuries) to about 4.5%, while the interest rate on the bank account is below 1%, creating a huge gap, which is a powerful incentive for money to flow out of the bank account。

On Tesla's second-quarter earnings call just on July 19, Musk spoke out again, saying: "When interest rates go up significantly, we actually have to lower the price of the car because paying interest raises the price of the car," he continued, "so we have to do something about it."。"

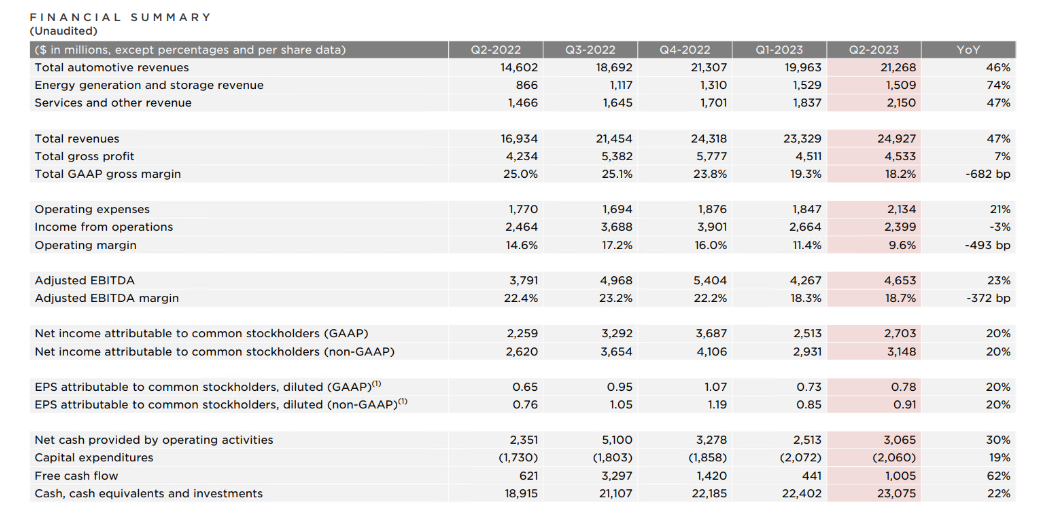

In the three months to June, Tesla's strong performance surprised the market, with double-digit revenue and profit gains.。Among them, Tesla Q2 total revenue of 249.$2.7 billion, up 47% YoY; net profit attributed to parent 27.$03 billion, up 20% year-over-year; Non-GAAP net profit attributed to 31.$4.8 billion, up 20%。

At the earnings meeting, Musk also made it clear that Tesla will cut prices if the economic environment is not good.。While the sharp price cuts have put pressure on Tesla's auto gross margins, which are a closely watched indicator in the industry, Musk said Tesla will sacrifice gross margins to drive sales growth。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.