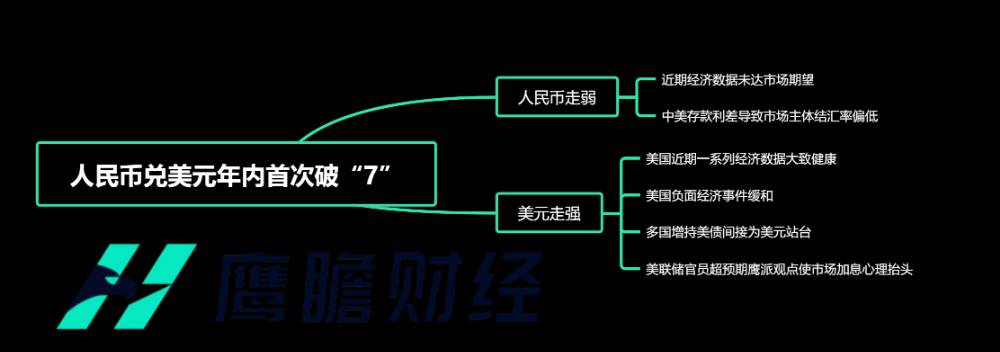

RMB against the U.S. dollar for the first time in the year to break the "7" four factors to accelerate the upward trend of the U.S. dollar.

In the morning session of May 17 in Asia, the offshore yuan fell below 7 again against the dollar after eight months..0 mark, for the first time in the year。During the afternoon session in Asia, the onshore yuan also broke through 7 against the dollar..0 psychological mark, reported 7.0017。

In the morning session of May 17 in Asia, the offshore yuan fell below 7 again against the dollar after eight months..0 mark, for the first time in the year。During the afternoon session in Asia, the onshore yuan also broke through 7 against the dollar..0 psychological mark, reported 7.0017。

It is reported that since the beginning of March this year, the currency pair was once at 6..9 near the shock repeated, almost to break 7.0 mark, but has never been able to break through this psychological line of defense。However, since May, the RMB exchange rate at home and abroad has suddenly shown a faster downward trend.。As of the close of trading on May 16, the domestic RMB exchange rate had increased from 6.9 quickly fell to 6.Near 9783。As a result, on May 17, the central parity of the RMB / USD exchange rate was quoted at 6.9748, down 242 basis points from the previous session。

Where is the exchange rate support??Economic data less than expected, low settlement and sales of foreign exchange jointly drag down the RMB.

The market was quite surprised by the rapid decline of the RMB.。According to the analysis of foreign exchange traders, China's recent foreign trade surplus remains at a high level, foreign investment still maintains a net inflow, global capital is still adding positions in domestic equity and debt assets, the RMB exchange rate should be strongly supported.。

The reason, on the one hand, the poor performance of the RMB, internal factors are the main cause。

Fundamentally, from the recent release of data, China's economy is currently in the consumer side, industrial side, investment side of the performance has failed to meet market expectations, the market began to bet that the central bank will ease monetary policy。

Specifically, according to the latest data from the National Bureau of Statistics, the total retail sales of consumer goods in April increased by 18.4%, the national industrial value added above designated size increased by 5.6%, are less than 20.20% and 9.70% of expected value。On the investment side, data show that from January to April this year, national fixed asset investment (excluding farmers) increased by 4.7%, down 0% from January-March.4 percentage points。

Jerry Chen, a senior analyst at Jiasheng Group, said the offshore yuan fell below the 7 mark against the dollar on May 17, and the yuan weakened significantly on May 16.。In addition to the strength of the dollar index, China recently released April economic data seems to be less than expected, showing that the momentum of economic recovery has slowed, the market is expected to cut interest rates again "ignited."。

In addition, the deposit spread between China and the United States this year has led to a low exchange rate for market participants, which has also hit the demand for the yuan.。

According to the latest data, due to the Fed's aggressive interest rate hikes led to a sharp rise in China's domestic dollar deposit rates, China's January-April settlement rate of 65.8%, at the lowest level in nearly 3 years, while the same period to sell the exchange rate as high as 68.9%, the highest in nearly 5 years。

Wang Qing, chief macro analyst at Oriental Jincheng, said that since the beginning of the year, the domestic settlement rate is generally low and the sales rate is high.。This means that the high trade surplus is converted more into domestic dollar deposits than into RMB, which will also have an impact on the balance of supply and demand in the foreign exchange market, pushing the RMB down against the dollar.。

Why the dollar suddenly strengthened?Four major reasons to support the dollar upward.

On the other hand, the recent rise in the value of the dollar is an unavoidable topic.。

First, a series of recent U.S. economic data has been broadly healthy, bringing investor confidence in the dollar back up.。

On May 17, according to the Atlanta Fed's GDPNow model, real U.S. GDP is expected to grow at an annualized rate of 2 in the second quarter of this year..9%, corresponding to 2.3%, pushing back US recession expectations。In addition, although the "horror data" released the previous day, the monthly rate of retail sales in the United States in April was less than expected, but its breakdown of food service sales increased by 9% compared with the same period last year..4%, boosted market confidence to some extent。In commercial real estate, the U.S. NAHB Housing Market Index recorded 50 in May, a new high since July 2022 and the first time it has touched the 50-year-old line since that month.。

Last night, the U.S. Department of Labor also released the number of initial jobless claims for the week ending May 13.。Initial jobless claims for the week were 24, data show.20,000, below expectations of 25.40,000 and previous value 26.40,000; continuing jobless claims down to 179.90,000, market expected 182.90,000。Some analysts say the data shows that the U.S. job market is still tight。

Recently, continued positive U.S. economic data has been bottoming out the dollar's fundamentals, guiding investors to build confidence in the dollar.。

In addition, a series of recent negative economic events in the United States have moderated, boosting the dollar to some extent.。

On the debt ceiling crisis, both the White House and Congress have now made breakthroughs on this issue。Yesterday, U.S. House Speaker Kevin McCarthy (Kevin McCarthy) high-profile said that the House is expected to reach an agreement on the debt ceiling next week。He had declared on Wednesday that he "does not believe the United States will default," and said he was optimistic about the ability of all parties to continue working together, saying a debt ceiling deal this week was "doable."。In addition, according to McCarthy, the two sides will negotiate 2-3 times a day, the agreement already has the relevant framework, is still exploring the size of the spending cuts, as well as the size of the debt ceiling increase or the time to suspend the debt ceiling.。

Previously, negotiations on this issue have been deadlocked, the market has been worried that the federal government will default on the debt issue, a repeat of 2011, gold prices soared。In response, U.S. Treasury Secretary Janet Yellen has written to Congress twice in a short period of time, asking the two sides to reach an agreement on this issue as soon as possible.。It is reported that without raising the federal debt ceiling, the U.S. Treasury Department will run out of cash reserves as soon as June 1.。

In terms of the banking crisis, the problem seems to be better controlled at the moment。On Thursday, Yellen told an executive meeting at the Bank Policy Institute that the U.S. banking system is well capitalized and liquid。As things stand, the U.S. banking crisis is well confined to regional banks and may not have a tendency to develop into systemic risk。

For the U.S. dollar, the continued improvement of economic problems will make the demand for the U.S. dollar continue to heat up, building investor confidence; and for the yuan, the risk of economic problems such as the U.S. debt default crisis is increasing, many European and American investment institutions will withdraw funds from emerging markets to local "proactive," triggering the yuan exchange rate oversold。

Second, the recent abrupt increase in U.S. debt holdings by many countries also provides confidence support for the dollar。

On May 15, according to the U.S. Treasury Department's latest International Capital Flows Report (TIC), both of the world's top two U.S. debt holders increased their holdings of U.S. Treasuries in March.。Among other things, Japan's holdings of U.S. Treasuries increased by $5.9 billion in March from February to 1.$1 trillion; China's holdings of U.S. Treasuries in the month rose $20.5 billion from February to $869.3 billion, ending a series of reductions since July last year.。

In addition, the top ten U.S. debt-holding countries and regional central banks in March also appeared extremely rare "collective increase" situation, in addition to China and Japan to increase their holdings, the United Kingdom, Switzerland, Canada in March all increased their holdings of U.S. debt, the scale reached 71 billion U.S. dollars, 15.4 billion U.S. dollars, 10 billion U.S. dollars.。According to the data, non-U.S. households as a whole increased their holdings of U.S. debt by 2,296 in March.$200 million。

In this regard, some analysts believe that in March the bond market appeared obvious risk aversion, especially the Silicon Valley bank run bankruptcy forced many capital management institutions have bought U.S. government bonds.。On top of that, U.S. 10-year Treasury yields saw a wave of declines in March, leading to higher valuations of U.S. Treasuries and increasing the attractiveness of the asset。

Previously, due to the existence of "de-dollarization" and other disturbing factors, U.S. debt has been "cold" for some time, but the countries collectively increased their holdings, especially China's unexpected increase in holdings in the month, or indirectly make the "de-dollarization" event marginal weakening, to a certain extent, to stimulate the dollar to strengthen。

Finally, Fed officials' more-than-expected hawkish views have also raised the market's interest rate hike psychology, accelerating the dollar's upside.。

On May 3, the Federal Reserve released the minutes of the May Federal Open Market Committee (FOMC) monetary policy meeting, raising the target range for the federal funds rate by 25 basis points to 5% to 5%..Between 25%。So far, the Fed has raised interest rates ten times since March 2022, a staggering 500 basis points.。

At the time, Fed Chairman Jerome Powell (Jerome Powell) said that the current monetary policy is tight, the real interest rate is about 2%, significantly higher than the neutral rate.。He said it would take time for the full impact of the monetary tightening to be felt, and it could take months of data to prove that the Fed's policy is correct, and more data is needed to verify it.。

After the release of the statement, the market generally believed that the Fed will suspend the process of raising interest rates and open the rate cut window within the year。

However, a series of hawkish remarks by Fed officials recently have made markets suspicious。

On May 16, Cleveland Fed President Loretta Mester (Loretta Mester) said that given the stubbornness of inflation, he believes the Fed's policy rate has not yet reached a level that can be maintained for some time.。Earlier, there have been regional Fed chairmen who have expressed hawkish views that inflation is improving more slowly and that economic weakness is not serious, and that interest rates will remain high and are likely to rise further.。

Mestre noted that policymakers know the effects of their rate hikes are not yet fully felt in the economy, and she wants to see more data before the Fed's next meeting in mid-June, including data reflecting tighter bank credit.。It's worth noting that Mester has also made several hawkish views before this, but she doesn't have a vote on the Federal Open Market Committee (FOMC) this year.。

On the same day, Thomas Barkin, chairman of the Richmond Fed, also suggested that he liked the "selectivity" implied in the Fed's latest policy statement, but was "willing" to raise interest rates further if needed to reduce inflation.。

Yesterday, Dallas Fed President Lorie Logan (Lorie Logan) is in the Texas Bankers Association held a meeting directly said that the reason for the suspension of interest rate hikes at the June meeting is not clear, which is also considered by the market is by far the most hawkish remarks.。

Expectations of continued Fed rate hikes in June rise sharply as hawks rumble。Currently, according to CME Fed Watch, the bank's probability of raising interest rates at its June policy meeting has soared to 36.7%, while a week ago, the data was only 15.5%。

In summary, the four factors together pushed the value of the dollar upward, accelerating the depreciation of the yuan against the dollar.。

Experts say the devaluation of the yuan is limited Yi Gang: the foreign exchange market is resilient and capable of achieving dynamic equilibrium

After the market, the room for the RMB to continue to depreciate has been limited。

Wang Qing said that looking ahead, along with the Fed's current round of interest rate hike process into the closing stage, coupled with the impact of the banking crisis, the downward pressure on the U.S. economy further increased, the possibility of the dollar index continued to rise later.。In addition, the current domestic dollar deposit rate has entered the top range, the probability of further rise is very small; and with the continued repair of the domestic economy, including RMB deposit rates, all kinds of market interest rates are the general trend.。In this way, the current trend of low settlement rate and high sale rate is difficult to sustain, and the RMB exchange rate trend will return to fundamental dominance in the later period.。Under the prospect of overseas economic downturn and sustained domestic economic recovery this year, there is no room for RMB depreciation.。

Everbright Bank Financial Markets Department macro researcher Zhou Maohua also believes that although the domestic economic data appear short-term fluctuations, domestic demand recovery progress is slow, but the economy to maintain the recovery trend;。

Earlier, China's central bank governor Yi Gang mentioned in his speech at the 2023 China Financial Academic Annual Conference and China Financial Forum Annual Conference that in the past five years, the RMB has "broken 7" against the US dollar three times, the first time in August 2019, the second time in February 2020, the third time in September last year, the first two times took five months to return to below 7, last year took three months。Yi Gang said, "This is the result of market supply and demand, indicating that China's foreign exchange market is resilient and capable of achieving dynamic equilibrium.。"

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.