Why the United States is fundamentally different from Australia and Canada in the same interest rate hike?

On June 7, the Bank of Canada announced its interest rate decision, raising the benchmark interest rate by 25 basis points to 4.75%。Prior to this, the Bank of Canada has twice suspended interest rate hikes, and after this resumption of interest rate hikes, the level of interest rates in Canada has reached the highest level since 2001。

On June 7, the Bank of Canada announced its interest rate decision, raising the benchmark interest rate by 25 basis points to 4.75%。Prior to this, the Bank of Canada has twice suspended interest rate hikes, and after this resumption of interest rate hikes, the level of interest rates in Canada has reached the highest level since 2001。

Inflation governance twists and turns repeat Australia, Canada in a week of unexpected interest rate hikes.

According to data released by Statistics Canada in mid-May, the country's inflation rate rose by 4% year-on-year in April..4%, although only 4 in March.3% increased by 0.1 percentage point, but it changes the trend of inflation that has been falling for nearly a year, and is also higher than experts predict.。Inflation is said to have unexpectedly picked up this time, mainly driven by higher costs of gasoline, rent and mortgage interest。

The stubbornness of inflation is a wake-up call to Canada, which has suspended two rate hikes.。Since announcing a conditional moratorium on rate hikes in late January, Bank of Canada officials have issued warnings that further rate hikes may be necessary.。While some Canadians are feeling the pinch of higher borrowing costs, the central bank's move suggests officials are concerned that without another rate hike, economic growth momentum will not slow enough.。

The Bank of Canada said that "monetary policy was not sufficiently restrictive to balance supply and demand and to bring inflation back to its 2 percent target on a sustained basis," citing evidence including stronger-than-expected first-quarter output growth, rising inflation and a rebound in housing market activity.。In addition, the Bank of Canada statement removed language from April that the central bank was prepared to raise interest rates further if necessary.。In its interest rate statement, it said: "Overall, excessive demand in the economy appears to be more persistent than expected.。"

As a result, the sell-off in the U.S. Treasury market accelerated, with the largest intraday gains in 2-year to 30-year U.S. bond yields exceeding 10 basis points.。2-year U.S. bond yields rose by more than 10 basis points and rose above 4 at one point..61%; both 10-year base and 30-year long bond yields rose by more than 10 basis points to 3.80% and 3.95%。

This week, Australia also raised interest rates unexpectedly.。On June 6, the RBA announced its interest rate decision.。Under the resolution, the bank raised its cash rate target by 25 basis points to 4.10%, the highest since 2012。It is understood that in the media survey of 30 economists, only 10 predicted that the RBA will raise interest rates, in addition, the money market on its rate hike action pricing probability is only one-third。

After the policy announcement, the RBA said in its interest rate decision that Australia's inflation had peaked but was still at 7 per cent, which was high and would take some time to return to its target range.。The further increase in interest rates is to be more confident in ensuring that inflation returns to target within a reasonable time frame.。The bank also said further monetary tightening may be needed to ensure inflation returns to target within a reasonable time frame, but this will depend on the evolution of the economy and inflation.。

The surprise rate hikes announced by the two central banks in a week's time portray the twists and turns of countries on the road to fighting inflation.。Among the major central banks now, the European Central Bank on Wednesday issued a hawkish view, the British economy is also struggling under high inflation, only the Bank of Japan and the Bank of New Zealand issued a dovish argument, now the pressure to the Fed's side。

There is a fundamental difference between an interest rate hike in Australia, Canada and a rate hike by the Federal Reserve.

For now, the complex external environment has created complications for the Fed's monetary policy, which is now less than a week away from its June policy meeting.。

According to the latest U.S. non-farm payrolls data for May, the number of new non-farm payrolls under CES (Enterprise Survey) statistics is quite strong, at 33.90,000, significantly exceeding expectations 19.50,000 and previous value 29.40,000, which was recorded in April when the data was significantly revised up。

According to this data, U.S. wages cooled slightly in May from the same month last year.。Among them, the average hourly wage in the United States in May increased by 4.3%, lower than the expected value and the previous value 4.4%; month-on-month growth of 0.3%, also lower than the expected value of 0.3% and previous value 0.4%。It is understood that the overall hourly wage decline is mainly due to the low-income service industry hourly wage action can drag down, on behalf of the United States as a whole and low-income service industry supply and demand mismatch are marginal easing, according to the CPS (household survey) caliber survey of the unemployment rate unexpectedly rebounded to 3..7%。From this perspective, U.S. inflationary pressures have eased slightly。

It is worth noting that according to Cox Automotive, the largest automotive O2O trading platform in the United States, the Manheim Used Car Value Index, which tracks used car auction prices, was 224 in May this year..5, down 7 from a year ago.6%, nine consecutive months of year-on-year decline and an accelerated decline from March and April, which was blamed by the U.S. government last year for rising inflation。

On the liquidity side, the U.S. Treasury's campaign to rebuild its coffers is also progressing steadily.。According to the announcement on the 6th, in order to expand the scale of the minimum maturity Treasury bill tender, the department will increase the auction of Treasury bills with maturities of 4 weeks, 8 weeks and 17 weeks by a total of $42 billion.。The size of 4-cycle Treasury bills increased by $25 billion to $60 billion, 8-cycle Treasury bill issuance increased by $15 billion to $50 billion, and 17-cycle Treasury bill issuance increased by $2 billion to $46 billion.。

Previously, according to Wall Street estimates, by the end of the third quarter, the U.S. Treasury could borrow more than $1 trillion.。Bank of America said that if the U.S. Treasury issued Treasury bills on a large scale, the impact on the economy would be equivalent to a 25 basis point rate hike by the Federal Reserve。

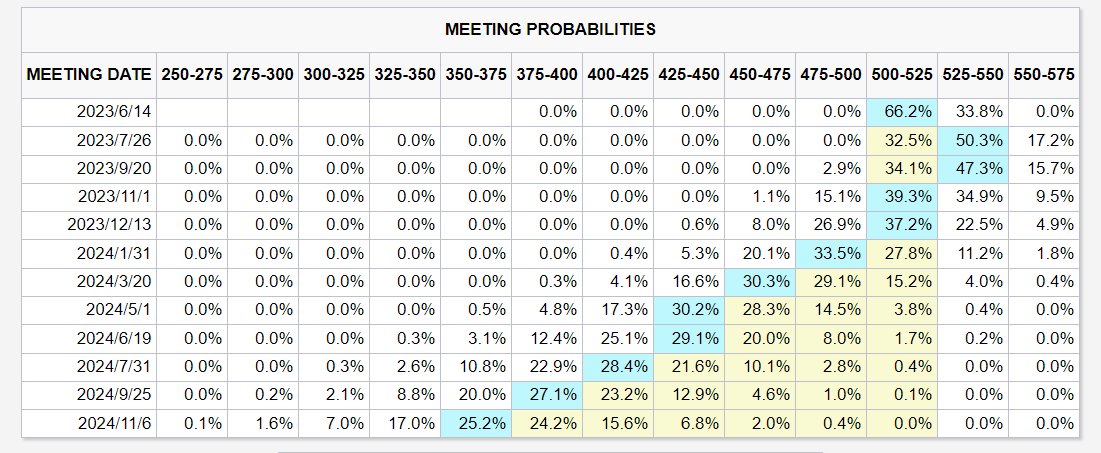

As of press time, according to CME Fed Watch, the market priced the bank's probability of suspending rate hikes in June at 66.2 per cent, then restarted rate hike action in July and left rates unchanged at the September policy meeting, cutting rates back to 5 in November..25% level, with one rate cut during the year and a terminal rate of 5.25%。

On June 13-14, the Federal Reserve will hold its June monetary policy meeting, and officials have now entered a regular period of silence before the meeting。According to the minutes of the May monetary policy meeting, there were already officials at that meeting who were divided over the rate hike。In addition, this month, a number of officials, including Federal Reserve Chairman Jerome Powell (Jerome Powell), hinted at a pause in rate hikes this month, but did not rule out the possibility of hawks gaining the upper hand at this meeting。

In fact, although the same central bank's monetary policy behavior, but if the Fed does choose to raise interest rates, and Australia and Canada's interest rate policy is essentially different.。Australia, Canada this week's unexpected interest rate hike belongs to the assessment of the effect of the suspension of interest rate hike after the restart, for the assessment period after the review of the operation behavior again;。

On the other hand, if the Fed announces a suspension of interest rate hikes, it can be announced that it has officially entered the assessment period, marking a new policy node, and the market will explore the possibility of more suspension of interest rate hikes in the future, which is a step further from the opening of the interest rate cut window.。But in any case, the Fed is still at a relatively lagging stage relative to Australia and Canada.。If nothing else, the Fed may also embark on this "stop-and-go" path in the future.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.