May price payment index plunges US index under pressure, gold price looks up at US $2,000

The price of gold has been boosted by cooling inflation and weakening expectations of a rate hike, with spot gold standing at $1,980 per ounce as of press time, at 1982..$28 / oz, the daily level is likely to record 5 consecutive positive。Some analysts believe that if the dollar falls further, gold prices are expected to challenge the $2,000 / oz mark。

On the first day of June, the United States released a series of economic data。

Beijing time on June 1 evening, the United States automatic data processing company announced the United States in May ADP employment。US ADP employment recorded 27 in May, data show.80,000, significantly better than the forecast of 170,000, slightly lower than the previous value of 29.10,000 people。After the data was released, the dollar index pulled up nearly 0 in the short term..1% at 104.28。

15 minutes later, U.S. jobless claims for the week ending May 27 are revealed。According to the U.S. Department of Labor, this initial request recorded 23.20,000, slightly better than the previous value of 22.90,000, but still below forecast of 23.50,000, up from the sequential declines of the previous three data。The dollar index is down 0 in the short term as the market is highly sensitive to current unemployment data.05%, minimum to 104.13。

In addition to employment data, last night the United States also released May ISM manufacturing PMI data。The data was released by the Institute for Supply Management, the first monthly economic report focused on manufacturing.。Although manufacturing does not account for a high proportion of GDP, its fluctuations can significantly affect changes in GDP, so the market usually regards the development of manufacturing as a leading indicator of the overall economy and has an important impact on the market.。

According to the published data, the index fell further this time to 46.9, below the boom-bust line for seven consecutive months, and even weaker than the expected value of 47。Dollar index falls quickly to new intraday low after data。

Among them, the U.S. ISM Manufacturing New Orders Index remained in contraction, recording 42.6, up from 45 in April.7 down by 3..1 percentage point, reflecting the continued plunge in new orders。In addition, the U.S. ISM Manufacturing Price Payments Index unexpectedly fell 9 percentage points from its previous value, recording only 44.2, well below the expected value of 52.0 and previous value 53.2。

DailyFX senior analyst Legen Tang (Legen Tang) said the ISM price indicator reveals that manufacturing inflation may cool significantly in May, if so then the recent strengthening of interest rate hike expectations may be a dream, the basis for a stronger dollar will be weakened。He also said that last night's initial jobless claims and ISM manufacturing PMI data revealed a message: inflation is cooling.。

On the sticking side, weak U.S. manufacturing data also implicated U.S. debt。Yesterday, U.S. 10-year Treasury yields fell 2.9 basis points, at 3.608%, the lowest hit 3.567%, the lowest since May 18; 30-year Treasury yield down 2.3 BPS, to 3.834%。

Padhraic Garvey, head of research at ING Americas, said the ISM manufacturing PMI data was the main market driver on Thursday as it would reduce pressure on the Fed to raise interest rates at its meeting later this month.。That means the Fed doesn't need to raise rates too much.。"

On Wednesday, the Fed's vice chairman nominee, Philip Jefferson, said that not raising interest rates in June would give policymakers more time to evaluate the data, but did not rule out the possibility of future policy tightening.。Previously, Jefferson's wording on monetary policy and the Fed's FOMC statement released at the beginning of the month were consistent, both mentioned the need to observe the "lag effect" of monetary policy, and in this speech, in fact, also continued this view, that future monetary decisions need more data and time to do the assessment。

Philadelphia Fed Chairman, FOMC Vote Committee Huck (Patrick Harker) also said on Thursday that he does believe the Fed is close to being able to keep interest rates unchanged, let monetary policy work, and bring inflation back to target levels in time。Speaking at an online event with the National Association for Business Economics, he said: "I think we should suspend (the rate hike), and the suspension means that we are going to remain inactive for a period of time, and we may do so.。We should at least skip the rate hike at this (June) meeting。We can let some of these issues resolve themselves, at least to the extent that they can be resolved, and then consider raising rates again。"

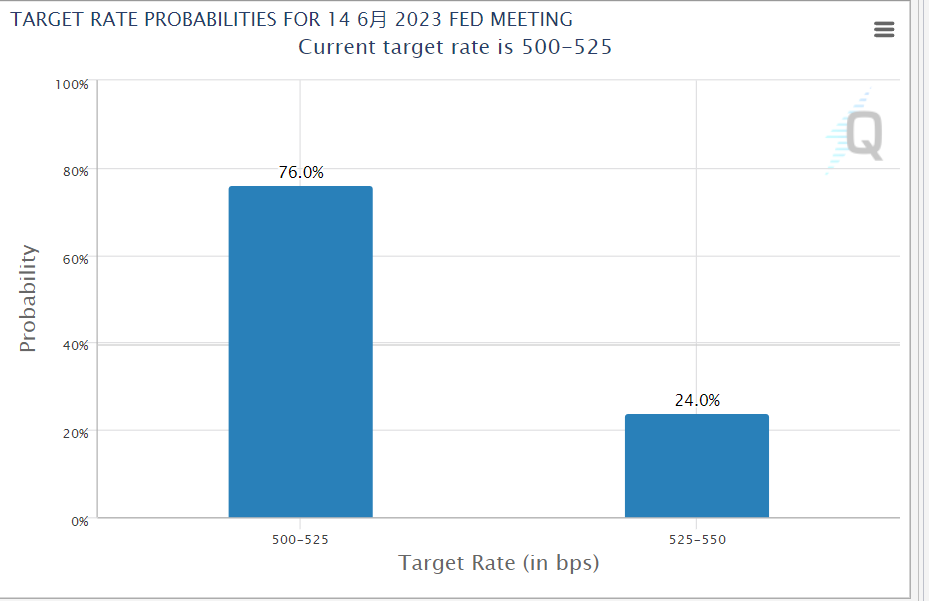

According to CME Fed Watch, the probability of the Fed suspending rate hikes at its June policy meeting has come to 76.0%, while a week ago, the data was only 48.3%。

Beijing time tonight, the U.S. Department of Labor will also release U.S. May quarter-adjusted non-farm payrolls data and U.S. May unemployment data.。According to the forecast, the US non-farm payrolls will increase by 19% in May..50,000 people, wages will increase by 0.3%, the biggest gain in a year。In addition, the U.S. unemployment rate is expected to increase by 0 in May..1% to 3..5%, a slight increase, estimated to be roughly equivalent to the Fed's Beige Book revelations。

The price of gold has been boosted by cooling inflation and weakening expectations of a rate hike, with spot gold standing at $1,980 per ounce as of press time, at 1982..$28 / oz, the daily level is likely to record 5 consecutive positive。Some analysts believe that if the dollar falls further, gold prices are expected to challenge the $2,000 / oz mark。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.