Inflation expectations rise gold under pressure again IG says PCE data tonight may push gold to $2,000

On the evening of April 27, the U.S. Bureau of Economic Analysis released the initial annualized quarterly rate of the U.S. core PCE price index for the first quarter.。Data show that the core PCE price index in the United States in the first quarter of 2023 was 4.9%, higher than expected and previous values。

4On the evening of July 27, the U.S. Bureau of Economic Analysis (US Bureau of Economic Analysis) released the initial annualized quarterly rate of the U.S. core PCE price index for the first quarter.。Data show that the core PCE price index in the United States in the first quarter of 2023 was 4.9%, higher than expected and previous values。

After the release of the data, inflation fears led to interest rate hike expectations were strengthened again, gold short-term decline of 0.27%, falling back below $2,000 / oz again and shaking to the downside。

In addition, at the same time the initial annualized quarterly rate of U.S. real GDP for the first quarter was announced, well below expectations of 2.00% and previous value 2.60%, only 1 recorded.1%。Some analysts pointed out that although the U.S. GDP growth in the first quarter was not satisfactory, but high personal consumption sentiment, rising inventory accumulation and higher inflation are more worrying for investors.。

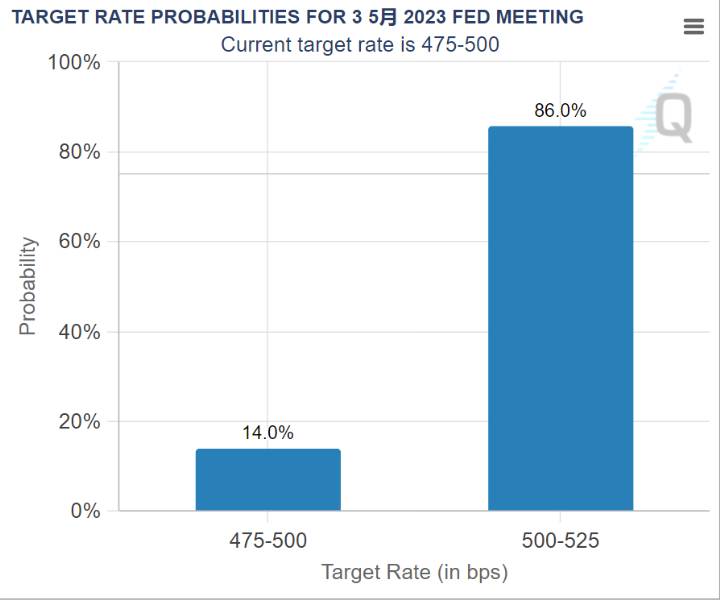

According to the latest data from CME "Fed Watch," the probability of the Fed raising interest rates by 25 basis points in May has reached 86%, and the probability of keeping interest rates unchanged is only 14%.。The consensus is that the Fed will raise interest rates by 25 basis points at its May policy meeting, followed by a pause in the rate hike cycle.。

Some investors are also concerned that banking risks have not yet dissipated and that further rate hikes could lead to an early recession in the United States.。

on april 24, the first republic bank released its first quarter financial report。Data show that by the end of the first quarter, the bank's deposit loss of more than 100 billion, which caused panic among investors, the First Republic Bank in the U.S. stock market after the plunge of more than 22%, and then on the 25th and 26th U.S. stocks plunged again.。Due to the first Republic Bank's performance "thunder," the market is concerned that depositors' behavior has once again triggered a bank run crisis, and banking risks have widened.。

Chris Zaccarelli, chief investment officer at the Union of Independent Advisers, said the two worst figures were released on Thursday, with economic growth falling and inflation rising.。Given that the core PCE is far from the Fed's 2% target, it is clear that the Fed needs to continue raising interest rates and is raising them at a time of economic slowdown。

Joe Brusuelas, chief economist at RSM, argues that the Fed has decided that restoring price stability is the best option in the long-term interest of the economy.。With underlying inflation still in the 4-5% range, it will be some time before (the Fed) announces the lifting of the inflation alert and cuts interest rates。

Notably, Navellier & Associates founder Louis Navellier expressed a different view, saying that while consumer spending is the biggest contributor to GDP, U.S. GDP growth slowed more than expected in the first quarter。He said: "While the consensus on Wall Street is that the Fed is going to raise interest rates by 25 basis points, frankly I think it's a mistake.。"

In the face of debate, the market is focusing on the annual rate of the U.S. core PCE price index for March released this evening。The data is a key indicator of U.S. private consumption inflation and was included in policy guidance by the Federal Open Market Committee (FOMC), the Fed's decision-making body, in 2002.。

IG market analysts said the PCE price index data, due out on Friday, would provide more information, with the market expecting a slight decline in the index.。However, any rise in price pressures could push up U.S. bond yields and the dollar and weigh on gold, while lower-than-expected data could push gold above the $2,000 mark。

As of press time, spot gold fell 0% in the day..23%, reported in 1983.$11 / oz。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.