Bulls hold on! Recession risk will provide long-term support for gold prices When to buy?

Although optimistic about the market, but in the context of short-term gold price weakness, it may be too early to "buy on dips"。

Last week, spot gold fell 1.90%, closed at 1920.$80 an ounce, the biggest weekly drop since February this year。On the monthly line, gold prices have broken through all-time highs since May 2079.After $76 / oz, the price of the precious metal has been fluctuating all the way down and is now trading in 1928..$86 / oz。

Morgan Stanley: Fed expected to raise interest rates by 25 basis points next month

While markets thought Russia's geopolitical problems over the weekend could spur gold risk aversion this week, that vision doesn't seem to be coming true, and the hastily ended crisis hasn't caused much of a stir in the gold market.。Historical experience also suggests that geopolitical risk-driven gold price rallies tend to be short-lived, and gold prices will also be more influenced by the Fed's interest rate outlook。

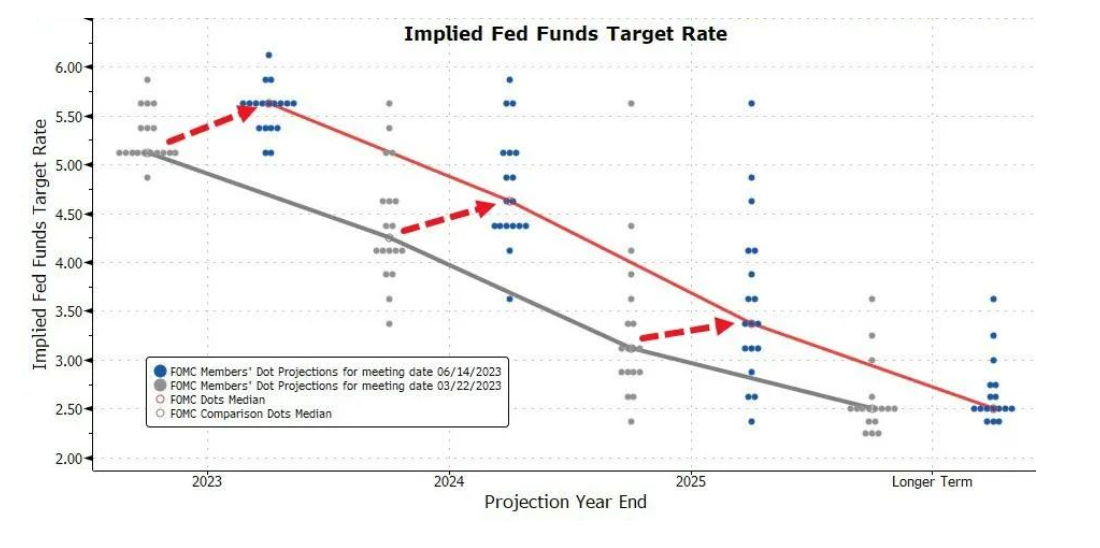

In mid-June, after a 15-month cycle of rate hikes, the Fed finally hit the pause button to keep the policy rate ceiling at 5.25%。However, such news did not ignite the mood of gold bulls。According to a dot plot released along with the Fed, the bank's median interest rate forecast for the end of the year was raised sharply to 5.625%, which means the Fed will raise interest rates at least twice in the next four meetings of the year.。

In addition, according to the dot-plot vote, 12 of the 18 policymakers expect interest rates to reach 5.5% -5.75% or higher, and three of them even hope that the terminal rate has reached 5.Continue to raise interest rates on the basis of 625%。In a press conference after the resolution, Federal Reserve Chairman Jerome Powell (Jerome Powell) said that, as shown in the SEP dot plot, the FOMC committee agreed on the need to reduce inflation to the target level of 2%, and will do whatever it takes to do so (Whatever it takes)。

Last week, Powell reiterated the need for a rate hike in the current scenario while attending hearings before the U.S. House Financial Services Committee and the Senate Banking Committee。He said the U.S. is far from meeting its inflation target and will vote for two more rate hikes during the year if the economy performs as expected。He also revealed that the vast majority of the committee believes there is still a little bit of room for interest rates to rise。

In response, Morgan Stanley said in a research note that they now judge that the threshold for a rate hike in July is much lower than they initially expected, and expect the Fed to raise rates by 25 basis points next month.。Some Fed watchers were previously puzzled as policymakers, while keeping interest rates unchanged, predicted further rate hikes would still be needed to keep inflation in check.。That led Powell last week to try to dispel any notion that future rate hikes were impossible.。

Damo also quoted Powell's remarks in the economic forecast, noting that the "Fed chief" had made his view clear that "he is one of those on the committee who strongly believes that interest rates should be higher."。

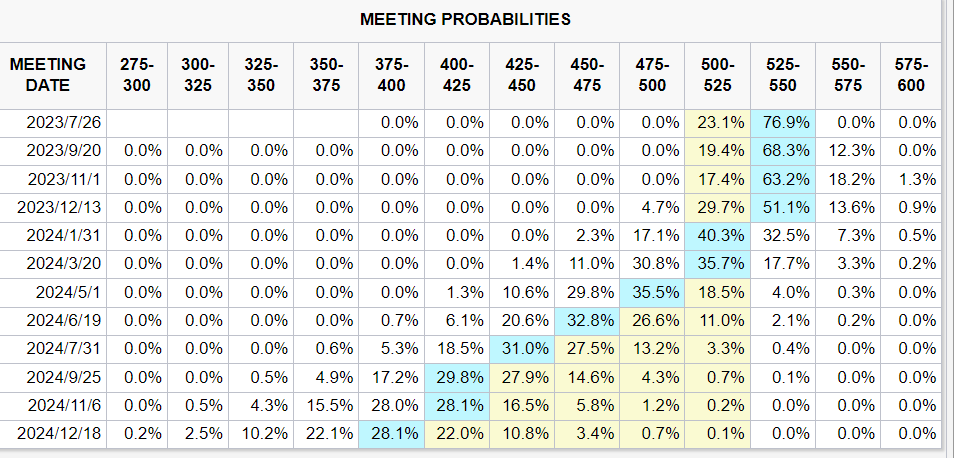

According to CME Fed Watch, the probability of the bank raising interest rates in July has now come to 76.9%, but did not indicate the second rate hike of the year in the dot plot, maintaining the policy rate cap for the year at 5.5% judgment, i.e., one rate hike during the year, by 25 basis points。

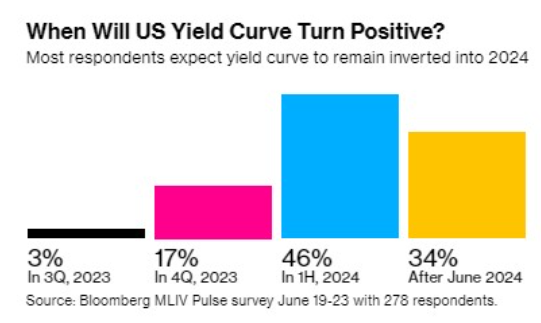

80% of respondents: yield curve inversion will continue until 2024

Although the trend of gold is volatile, but the global central bank demand for gold has not weakened, on behalf of gold safe-haven demand will continue to bottom the gold price。Public information shows that, following the record-breaking net purchase of 1078 tons of gold in 2022, global central banks continue to purchase large amounts of gold from 2023 onwards。According to the data, in the first quarter of this year, the total net demand for global central bank gold was 228 tons, up 34% year-on-year, the strongest quarter for global central bank purchases in a decade.。

In this regard, the World Gold Council believes that gold investment demand will continue to grow this year, while gold manufacturing demand (including gold jewelry and technology gold two parts) will remain relatively stable.。Global central banks may continue to buy gold in 2023。In addition, global gold mine production and gold recovery are likely to grow moderately。

In fact, despite the positive signals from the global economy, recession fears remain, which is what central banks consider when they reserve gold。

One signal is that U.S. long- and short-term Treasury yields, known as the bellwether of the recession, are upside down and have recently recorded new highs.。Data show that the difference between the U.S. 10-year Treasury yield and the 2-year Treasury yield reached 97 basis points in early trading on Tuesday, the largest inversion of the yield curve in more than 40 years.。

For a normal interest rate term structure, the longer the bond maturity, the higher the effective interest rate。But U.S. 10-year Treasury yields have been lower than two-year notes since last July, often seen as a warning of a looming recession.。

For nearly half a century, the yield curve inversion has lasted only two periods, from August 1978 to May 1980 and from September 1980 to October 1981, and if the current inversion continues until April next year, it will be the longest on record.。

The market also has low expectations of a short-term change in the inverted yield curve.。According to a mid-year survey by Markets Live Pulse (MLIV Pulse), 80% of respondents predict that the inversion of the U.S. Treasury yield curve will continue until 2024, suggesting that the unusual volatility in the bond market over the past 15 months will continue.。

Gold prices may gain long-term support

Some analysts said that although U.S. officials tried their best to "sing more" about the U.S. economy, the risk of a future U.S. recession still exists.。The current U.S. economic data is mixed, except for employment indicators, other U.S. economic indicators have reached recession levels, and even most indicators have been much worse than the average before the previous recession.。However, employment performance was unusually strong, significantly better than previous pre-recession levels, a "poor other indicators, strong employment indicators" never seen before in history, which means that the outlook for the U.S. economy is more uncertain.。

In addition, the well-known investment bank JPMorgan Chase also warned that a recession in the U.S. economy will be "inevitable."。Recently, Xiao Mo pointed out in an investor report that while the recent rebound in the economy may delay the arrival of a recession, a recession may not be avoided given that most of the effects of the Fed's sharp rate hikes over the past year have not yet been felt.。

In the report, JPMorgan simulated four possible economic scenarios for 2023 and 2024, and identified the most likely scenario as a "boil the frog" -style recession - where people fail to act on stubbornly high inflation, sending the global economy into a downturn in 2024.。

In such a scenario, gold prices may gain long-term support。Jingchuan, deputy general manager and chief economist of Zhongda Futures Co., Ltd. said that the short-term is expected to remain volatile, and in the medium and long term, there is still room for gold prices to rise.。He pointed out that the driving factors of the current round of gold prices did not change fundamentally, the recent volatility of gold is mainly constrained by the short-term Fed interest rate policy, but interest rate hikes into the end has been inevitable, the short-term rebound of the dollar has limited impact, gold prices are expected to show first weak and then strong trend。

Although optimistic about the market, but in the context of short-term gold price weakness, it may be too early to "buy on dips"。Citigroup strategists said in a report that the technical downturn may cause the price of gold to fall to between $1,875 and $1,880 per ounce, but the price of gold is unlikely to fall below $1,800 per ounce, "We believe that by the end of 2023, the price should be more bullish, breaking $2,000 per ounce, although it may be too early to 'buy on dips'。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.