Debt ceiling "final battle" hit spot gold stopped falling and rebounded Fed officials put the hawk does not work.?

The U.S. debt ceiling crisis has been slow to resolve, and concerns about the risk of a U.S. debt default continue to provide safe-haven support for gold prices。On the first trading day of the week, gold prices stopped falling and recovered, stopping their daily line for three consecutive years.。

On May 15, U.S. Treasury Secretary Janet Yellen sent a letter to Congress and issued a warning that the Treasury Department would run out of cash as soon as June 1 without raising the federal debt ceiling, and the White House and Congress still haven't agreed on the issue.。

May 16 talks or "final battle" The federal government will be forced to live on quarterly taxes!?

in the previous talks, the two sides still differed on some key issues。Republicans have hit the Republicans' bottom line by insisting on across-the-board spending cuts as a condition of the bill, but Democrats have proposed other fiscal austerity measures that Republicans have rejected while insisting on keeping the budget measure separate.。

Last week, Rep. Dusty Johnson, one of the drafters of the House bill, said Republicans have three red lines: no more debt, no more taxes, and the bill must reduce the deficit.。

It is reported that on May 16, U.S. Democratic President Joseph Biden (Joseph Biden) will have another face-to-face meeting with Republican House Speaker Kevin McCarthy (Kevin McCarthy) and other congressional leaders on the matter, and a day later, Biden will leave for Japan to attend the Group of Seven (G7) summit.。In addition, next Monday coincides with Memorial Day (Memorial Day), and the House of Representatives is expected to adjourn before the end of the week.。Arguably, the May 16 talks will have a major impact on whether the debt ceiling crisis can be successfully resolved, as the number of times the two sides can meet before June is running out.。

Yellen wrote in the letter, "We continue to estimate that if Congress fails to raise or suspend the debt ceiling by early June, the Treasury will not be able to meet all of the government's debt service obligations, which could happen as soon as June 1.。"

In her letter, she again urged Congress and the White House to act as soon as possible, "We have learned from past debt ceiling gridlocks that delaying a last-minute moratorium or increase in the debt ceiling could cause serious damage to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States."。"

Yellen also stressed that Congress's eventual failure to raise the debt ceiling would cause serious hardship for American families, undermine America's global leadership and raise questions about America's ability to defend its national security interests.。

On Friday, the Congressional Budget Office said the federal government could run out of all cash at some point in the first two weeks of June.。According to budget experts speculate, if the federal government can think of a way to hold out until mid-June, when the arrival of quarterly tax revenue may be able to "renew" for a period of time.。

U.S. debt crisis supports gold price bridge water "out of line" Fed officials put eagle was "automatically shielded"?

The U.S. debt ceiling crisis has been slow to resolve, and concerns about the risk of a U.S. debt default continue to provide safe-haven support for gold prices。On the first trading day of the week, gold prices stopped falling and recovered, stopping their daily line for three consecutive years.。

Daniel Ghali, commodity strategist at TD Securities, said: "Investors continue to deploy their money in the gold market and the outlook for a rate cut cycle over the next 12 months remains solid.。"

Karen Karniol-Tambour, co-chief investment officer of Bridgewater Associates, the world's largest hedge fund, also said recently that gold may be at the beginning of a period of sustained growth as the global de-dollarization trend continues。

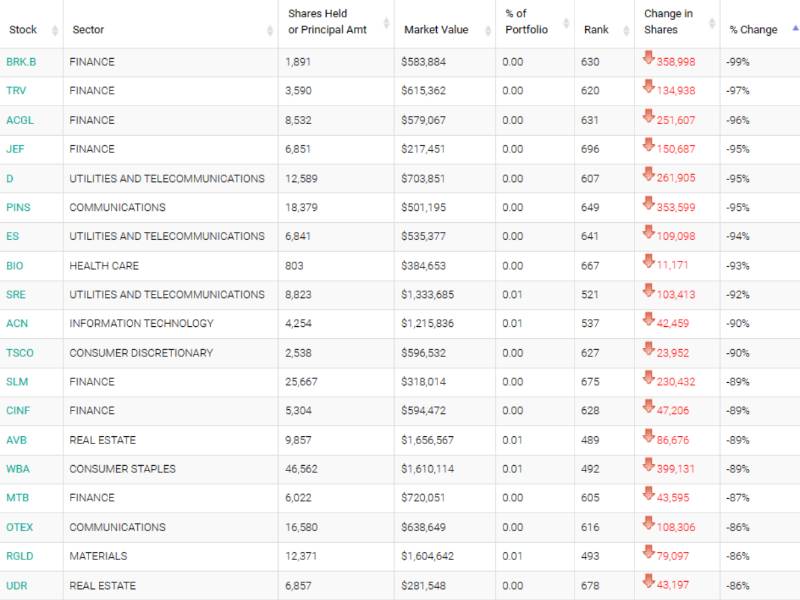

It is worth noting that in the first quarter 13F form disclosed yesterday, Bridgewater has significantly reduced its holdings of gold ETFs during the period, causing long concerns。

In addition, while expectations of a pause in the rate hike cycle are kicking off ahead of the June meeting, Fed officials' heightened vigilance about the inflation outlook could also hit gold prices。

On Friday, Federal Reserve Governor Michelle Bowman took the lead.。He said the Fed may need to raise rates further if inflation remains high。On Monday, Atlanta Fed President Raphael Bostic continued his hawk, first dismissing financial markets' bets that the Fed would cut rates this year and then giving his own predictions on the issue。He said no rate cut is expected until at least the end of 2023, even if there is a recession.。

"What we've seen is that inflation has been high, consumers have been very resilient in terms of spending, and the labor market remains very tight," he said.。All this suggests that prices will remain under upward pressure。If you were to ask me about my propensity to act, I might be more in favor of further rate hikes than rate cuts。"

In addition, Minneapolis Fed President Neel Kashkarif (Neel Kashkarif) also believes that although inflation is starting to fall, it is still too high and the labor market is still hot, so the Fed has a long way to go to reach its inflation target.。He said: "We should not be fooled by months of good data.。"

However, in response to these remarks, Ghali said that any hawkish statements "are basically ignored" because the market is based on the data released to infer what the Fed may eventually do, rather than what policymakers say.。

As of press time, spot gold edged up 0% in the day.02%, currently traded in 2016.$88 / oz。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.