Federal Reserve's March interest rate decision: Hold still, but slow down the contraction of the balance sheet

It is worth noting that the most unexpected action at this meeting was not the interest rate decision, but the adjustment of the pace of shrinking the balance sheet.

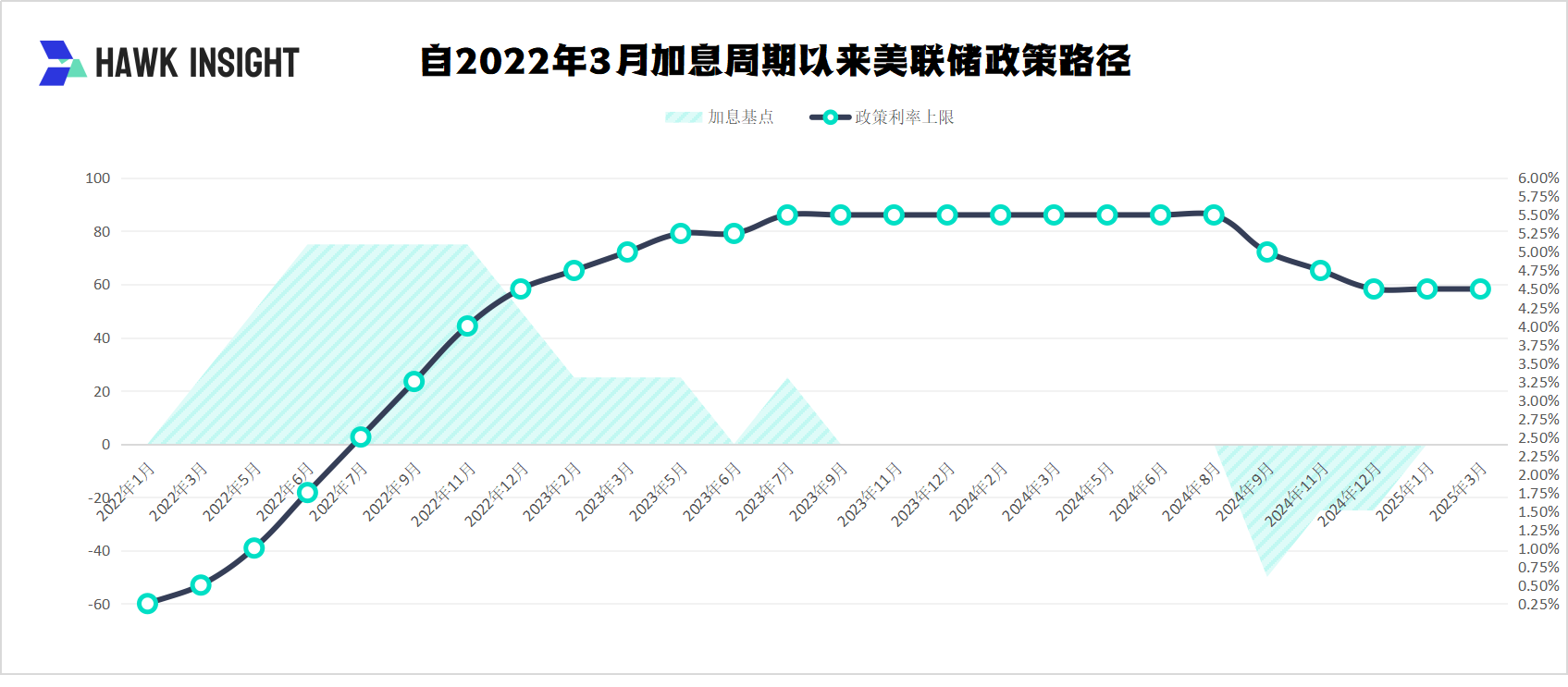

On March 20, the Federal Reserve voted 11:1 to keep the target range of the federal funds rate unchanged at 4.25%-4.50%.

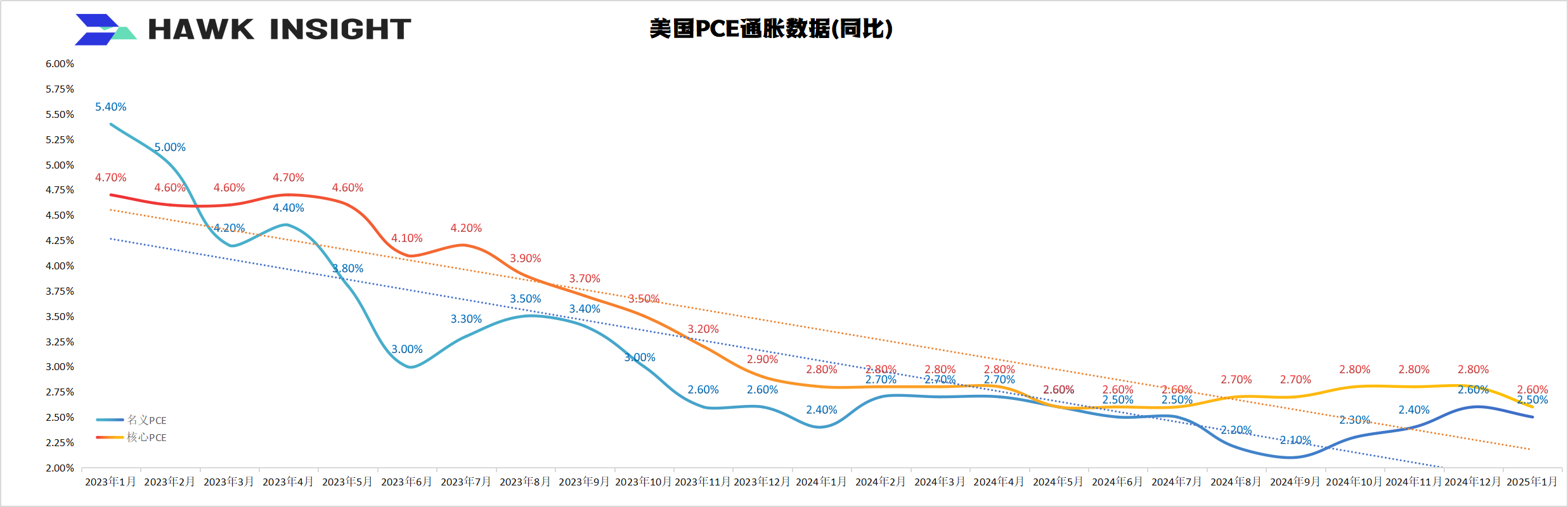

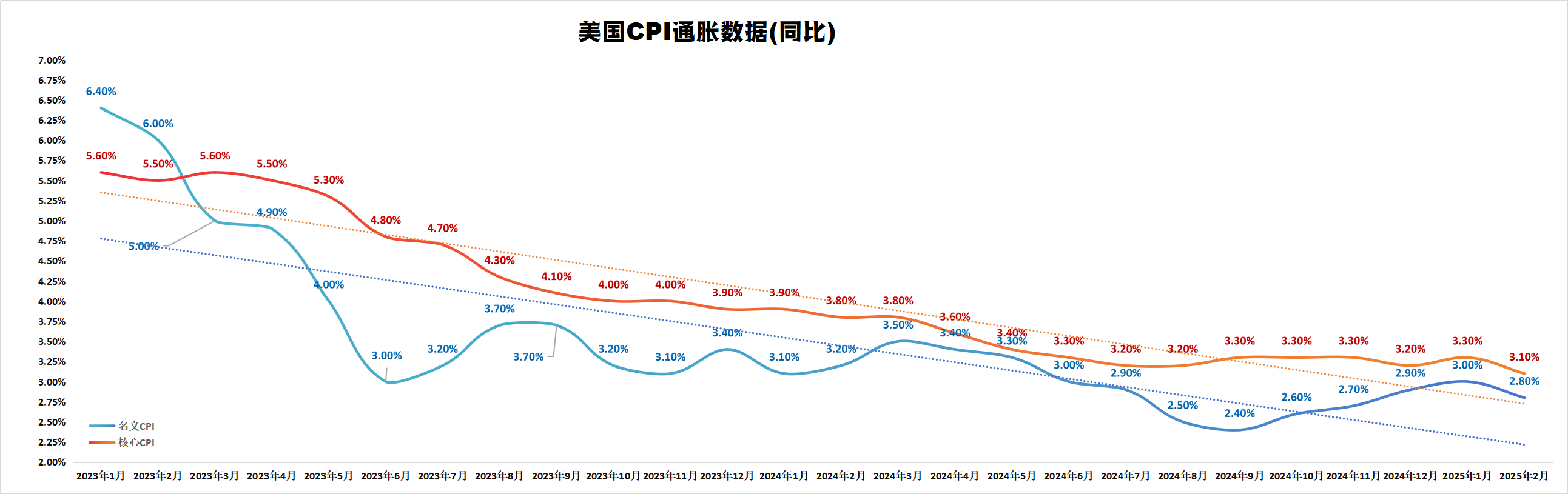

Judging from the adjustment of economic forecasts, the Fed's cautious attitude is further highlighted.The GDP growth forecast in 2025 is revised down significantly from 2.1% to 1.7%, which is close to the lower limit of long-term potential growth;PCE and core PCE inflation expectations are revised up by 0.2 and 0.3 percentage points to 2.7% and 2.8%, respectively, and the unemployment rate is fine-tuned from 4.3% to 4.4%.This combination of "downward revision of growth + upward revision of inflation" is like a low-profile version of the stagflation cycle of the 1970s, but Powell tried hard to downplay this type of ratio at the press conference, emphasizing that current "hard data"(such as employment and consumption) are still resilient, and long-term inflation expectations have not yet been unanchored.However, the policy statement deleted the expression "roughly balanced risks" and instead emphasized "increased uncertainty", implying that the Fed's internal assessment of the economic outlook has shifted from "two-way risks" to "asymmetric concerns."

The focus of market attention has always focused on the path of interest rate cuts.Although the dot chart maintained the median forecast of 50 basis points in interest rate cuts during the year (corresponding to two 25BP interest rate cuts), the divergence of opinions among officials intensified: the number of members supporting no interest rate cuts increased from 1 to 4, and the number of members who cut interest rates only once is expected to increase by 1, while the number of members supporting interest rate cuts three or more times has decreased by 3.This change in distribution reflects that the Fed is facing dual pressures-if inflation continues to exceed expectations due to factors such as tariffs, the interest rate cut window may close; and if the economy slows faster than expected, easing needs to be accelerated to avoid the risk of "policy lag."CITIC Securities Research News pointed out that under the current combination of "temporary inflation + weak growth + high uncertainty", any factor deviating from the predetermined track may trigger a reduction in the number of interest rate cuts.

It is worth noting that the most unexpected action at this meeting was not the interest rate decision, but the adjustment of the pace of shrinking the balance sheet.The Federal Reserve announced that it would reduce the ceiling on debt reduction from US$25 billion to US$5 billion per month starting in April, and the pace of MBS reduction remained unchanged.This "technical adjustment" was likened by Powell to a "soft landing for a plane landing" and was aimed at easing liquidity pressure in the money market while avoiding releasing a turning signal for monetary policy.However, Governor Waller's negative vote exposed divisions at the decision-making level: some officials worried that a premature slowdown in the balance sheet reduction could undermine anti-inflation credibility, especially in the context of expanding government debt.Historical experience shows that the synergy between balance sheet reduction and interest rate policy is crucial-the "money shortage" in 2019 forced the Federal Reserve to urgently expand its balance sheet, and it remains to be seen whether this adjustment can avoid repeating the same mistakes.

The polarization of the inflation narrative became another dark line at the meeting.

Although Powell acknowledged that tariffs pushed up commodity prices, he insisted on defining such shocks as "temporary" and argued that the impact was difficult to quantify.This subtly echoes the "inflation temporary theory" in 2021, but the context is completely different: then it was to postpone interest rate hikes, and now it is to retain flexibility in interest rate cuts.The Huachuang macro report pointedly pointed out that if tariffs trigger a "wage-price spiral", the passive decline in real interest rates may force the Federal Reserve to restart raising interest rates, and the dot chart has not yet reserved room for this.In addition, the deviation between the jump in consumer short-term inflation expectations and the stability of long-term expectations in financial markets further exacerbates the difficulty of policy calibration.

From a market perspective, the Federal Reserve's "wait-and-see strategy" temporarily calmed anxiety.After the resolution was announced, U.S. stocks rebounded for a time, the U.S. bond yield curve leveled, the U.S. dollar index fell, and gold exceeded US$3050/ounce, reflecting traders 'pricing of "loose expectations."However, this optimism may be too fragile-if the implementation of equivalent tariffs in the second quarter and OPEC increases production, the pressure on asset valuation in emerging markets will be highlighted again, and whether U.S. corporate profits can absorb rising costs still needs to be tested.

At the subsequent press conference, Federal Reserve Chairman Powell used 16 "uncertainties" to outline the true state of mind of policymakers.Although he repeatedly emphasized that "the U.S. economy remains strong," he acknowledged that economic growth expectations have been lowered to 1.7% from 2.1% in December last year, and core PCE inflation expectations have been raised to 2.8% from 2.5%.This combination of "slowing growth and stubborn inflation" is like a miniature model of "stagflation" in the 1970s, forcing the Fed to walk a tight wire between curbing inflation and caring for the economy.The comprehensive tariff policy implemented by the new government is like a boulder thrown into a calm lake. A University of Michigan survey shows that consumers 'inflation expectations for the next five years have jumped to 3.1%, a record high since 2008.

The technical operation of slowing down balance sheet reduction is actually a buffer space reserved by the Federal Reserve to deal with policy uncertainty.Halving the reduction of national debt to US$5 billion per month not only avoids repeating the "money shortage" of 2019, but also provides liquidity support for the Ministry of Finance to deal with the US$4.5 trillion debt ceiling deadlock.It is worth noting that this adjustment is only for the national debt component, and MBS's monthly reduction limit of US$35 billion remains unchanged.This "structural brake" suggests that the Fed is trying to curb real estate overheating by keeping the mortgage market tight, while releasing liquidity into the treasury bond market to stabilize government financing costs.

When asked about the possibility of a rate cut in May, Powell made it clear that "there will be no rush to act," which forms a subtle tension with the expectation of two rate cuts during the year shown in the dot chart.This strategy of "exchanging time for space" is essentially a defensive stance against the impact of new policies.The comprehensive tariff policy launched by the Trump administration not only directly affects the price of approximately US$800 billion in imported goods, but also drives up local production costs through supply chain restructuring.Internal simulations of the Federal Reserve show that if trading partners implement reciprocal retaliation, core inflation may rise by another 0.3-0.5 percentage points.In this context, slowing down the balance sheet reduction can not only avoid a "policy collision" with the Ministry of Finance's debt operations, but also reserve ammunition for possible future interest rate adjustments.

The market gave a split reaction to this combination of "doves shrinking the balance sheet + hawkish interest rates".The three major U.S. stock indexes closed up collectively, with the Dow soaring 383 points in a single day in parallel with the anxiety that the two-year U.S. bond yield fell below 4%.

The divergence of global central bank camps exacerbates this uncertainty.Hours before the Federal Reserve announced its decision, the Bank of Japan left its 0.5% policy rate unchanged, while the Swiss National Bank unexpectedly cut interest rates by 25 basis points.This monetary policy pattern of "retreating from the west and advancing from the east" is in sharp contrast to the global coordinated easing scene in 2015.What is even more alarming is that the US dollar liquidity released by the Federal Reserve's slowdown in its balance sheet contraction may flood into emerging markets through carry trades, creating the illusion of short-term prosperity while laying a hidden mine of debt risk.When Powell emphasized that "reserves are still sufficient," he may have deliberately downplayed another fact: the scale of overnight reverse repos has dropped sharply from a peak of $5.8 trillion to $1.2 trillion, and the margin of safety for banks 'reserves is narrowing.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.