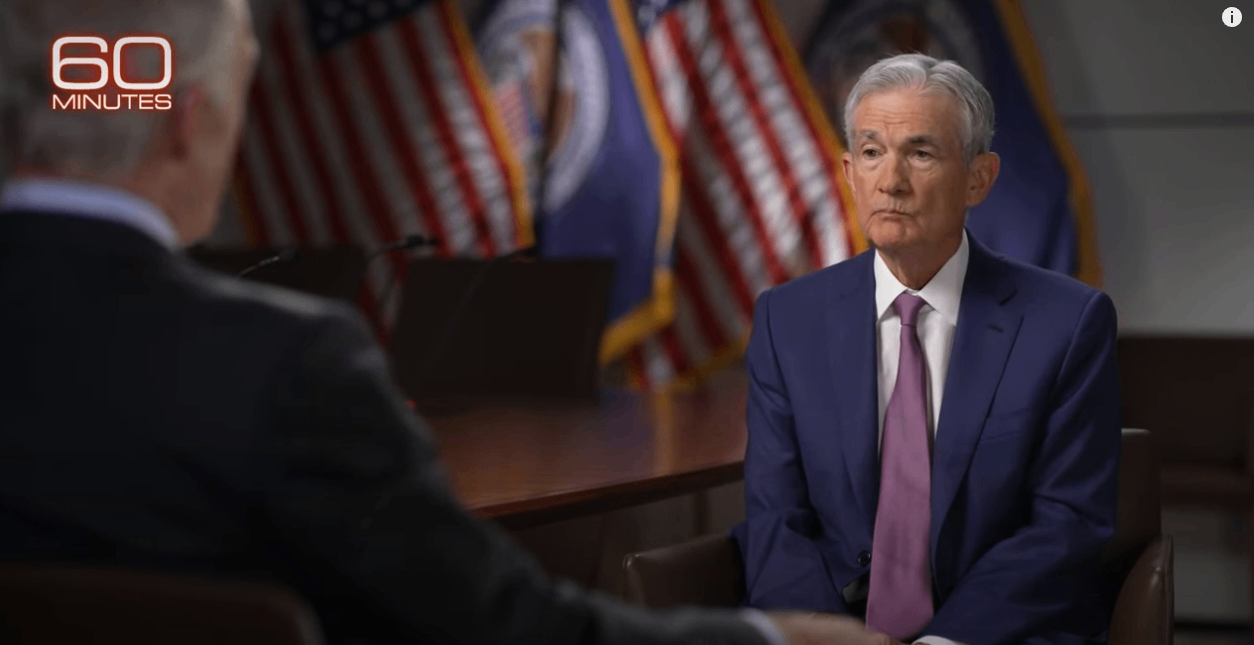

Fed Chairman Powell: March rate cut unlikely, Fed decision not taking politics into account

Powell said: "We have said that we want to be more confident that inflation will fall to 2%, and I don't think the committee is likely to have that level of confidence at its March meeting in seven weeks' time.。All but two participants agreed that it would be appropriate for us to begin easing the restrictive stance this year by cutting interest rates。"

In an interview with the media on Feb. 4, local time, Fed Chairman Jerome Powell (Jerome Powell) reiterated that Fed officials want to see more data to ensure that inflation continues to move towards the 2% target.。

In the interview, Powell said, "The danger of acting prematurely is that the job is not quite done, and the very good readings that we've had over the last six months have somehow turned out not to be a true indicator of where inflation is headed.".It would be prudent to give it some time to see if the data continues to confirm that inflation is falling to 2% in a sustainable way. "。

About the Fed's rate cut

Powell said: "The overall situation is that the economy is strong, the labor market is strong, and inflation is falling.。My colleagues and I are trying to pick the right moment to start reducing our restrictive policy positions。This moment is coming。We've said that we want to be more confident that inflation will come down to 2 percent, and I don't think the committee is likely to have that level of confidence at its March meeting in seven weeks' time.。All but two participants agreed that it would be appropriate for us to begin easing the restrictive stance this year by cutting interest rates。So, this is the base case, we're just trying to find the right moment。"

Powell says policymakers may wait until after March to cut rates。"If we see a weak labor market or a 'really convincing decline" in inflation, there could be earlier action. "。And Powell hinted that the FOMC is still predicting three rate cuts this year.。The central bank governor also said he did not expect policymakers to "significantly" change their forecasts for interest rates next year, with the December forecast showing they expected the benchmark lending rate in the U.S. to fall to 4 percent by the end of 2024..6 per cent, suggesting that at least three rate cuts will occur by then。

Commenting on the forecast, Powell said: "These forecasts were made in December.。These are the participants' personal predictions。It's not the committee's plan。We don't update these forecasts at every meeting。We will update it at the March meeting.。I will say, though, that nothing has happened in the interim that makes me think that people are going to dramatically change their projections。"

Powell also revealed that almost all of the Fed's policymakers (19 participants) believe that it is appropriate for us to cut the federal funds rate this year if, under the right conditions。

On whether politics will affect Fed decision-making

The Fed faces unique challenges in 2024 due to the relative sensitivity of the timing of the Fed's monetary shift。Previously, the approval ratings of current U.S. President Joe Biden (Joe Biden) were affected due to high inflation in the United States。At this juncture, the Fed's choice to cut interest rates this year has led it to Republican accusations that the central bank is trying to cheer Democrats up with economic aid before the election.。Last week, former US President Donald Trump already said he would not re-appoint Powell to head the central bank if elected.。

In response, Powell denied that the November election had anything to do with the Fed's sharp turn on rate cuts。Powell says we don't take politics into account in our decision。We never think about politics, and we never will.。I think the historical record -- fortunately, the historical record does prove it。People looked back。This is my fourth presidential election at the Fed and there is no politics in our thinking and I will tell you why。

There are two reasons。First, we are a non-political organization that serves all Americans.。If we start thinking about politics, it's a big mistake.。Secondly, despite this, it is not easy to get this problem right economically in the first place。You know, these are complex risk balancing decisions。If we try to add a whole set of political factors to these decisions, it will only lead to worse economic outcomes。So we're not going to do it at all and we're not going to do it。We didn't do it in the past and we won't do it now。

Powell stressed: "You know, I just want to say this.。Integrity is priceless。"

About the banking crisis

On the fallout from the banking crisis, Powell said the problem appeared manageable。

Powell said we looked at the balance sheets of the big banks and found that the problems seemed manageable。Some smaller regional banks have concentrated exposures in these areas and they face challenges。We are working with them。We have been aware of this for a long time and we are working with them to ensure that they have the resources and plans to deal with the expected loss.。There will be expected losses。

Powell argued that while the banking crisis problem could take years, he did not believe the crisis had the rudiments of a global financial crisis。Powell said, "I don't think there's much risk of a repeat of 2008.。I also think that we need to be careful about predicting the future。A lot of things took us by surprise。But, on this issue, I do think it's a manageable issue。I think we're doing a lot to deal with this。"

As to why banking runs are happening faster than they were 20 years ago, Powell argues that it is the rapid development of modern social media that has led to the rapid transmission of information and accelerated the run.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.