Federal Reserve's FOMC interest rate meeting agenda, latest interest rates, policy path, meeting review, inflation trend (2025)

What is the path for the Federal Reserve to cut interest rates in 2025? How much will the Federal Reserve cut interest rates in 2025? What should investors pay attention to after interest rate cuts? What did the Fed's policy meeting reveal?

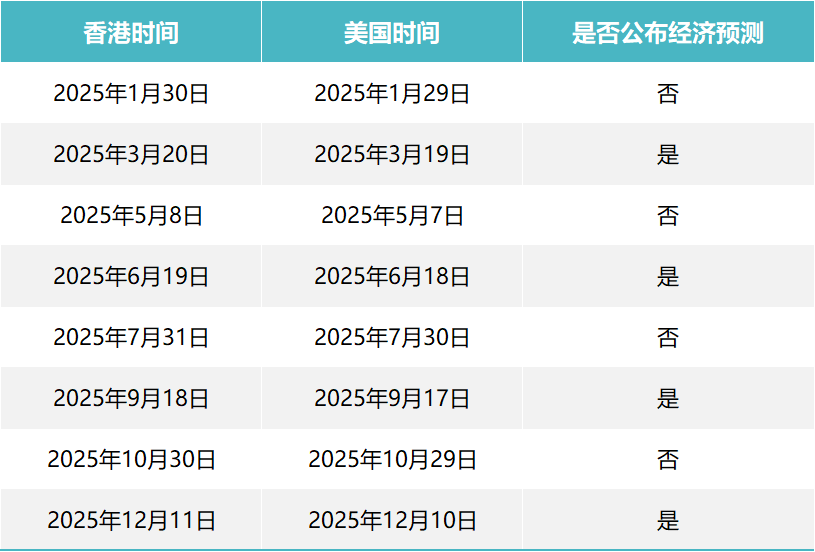

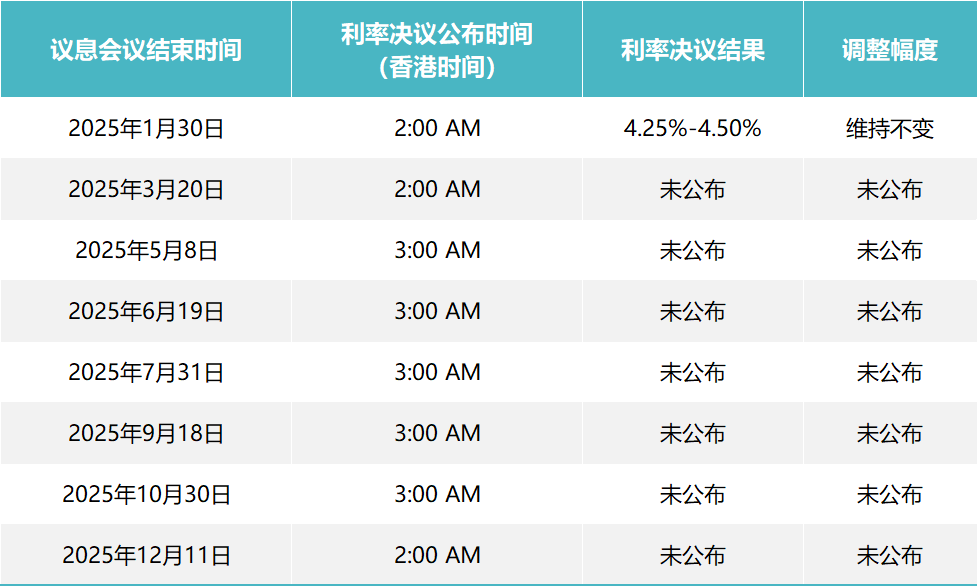

2025FOMC regular meeting schedule:

Data source: Federal Reserve official website

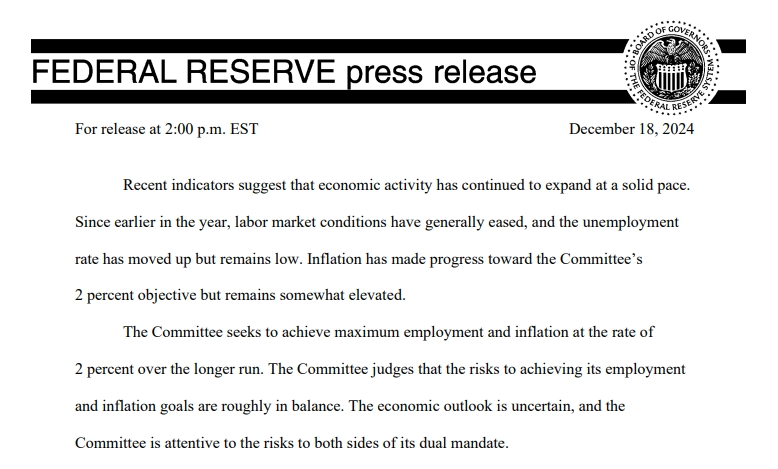

Review of the statement of the Federal Reserve's December 2024 interest-rate meeting

· The US economy continues to expand steadily

--"Since earlier this year, the labor market situation has generally eased, and the unemployment rate has increased, but it is still at a low level.”

· Inflation "still slightly above target"

--"The risks of achieving employment and inflation targets are roughly balanced.There is uncertainty about the economic outlook.”

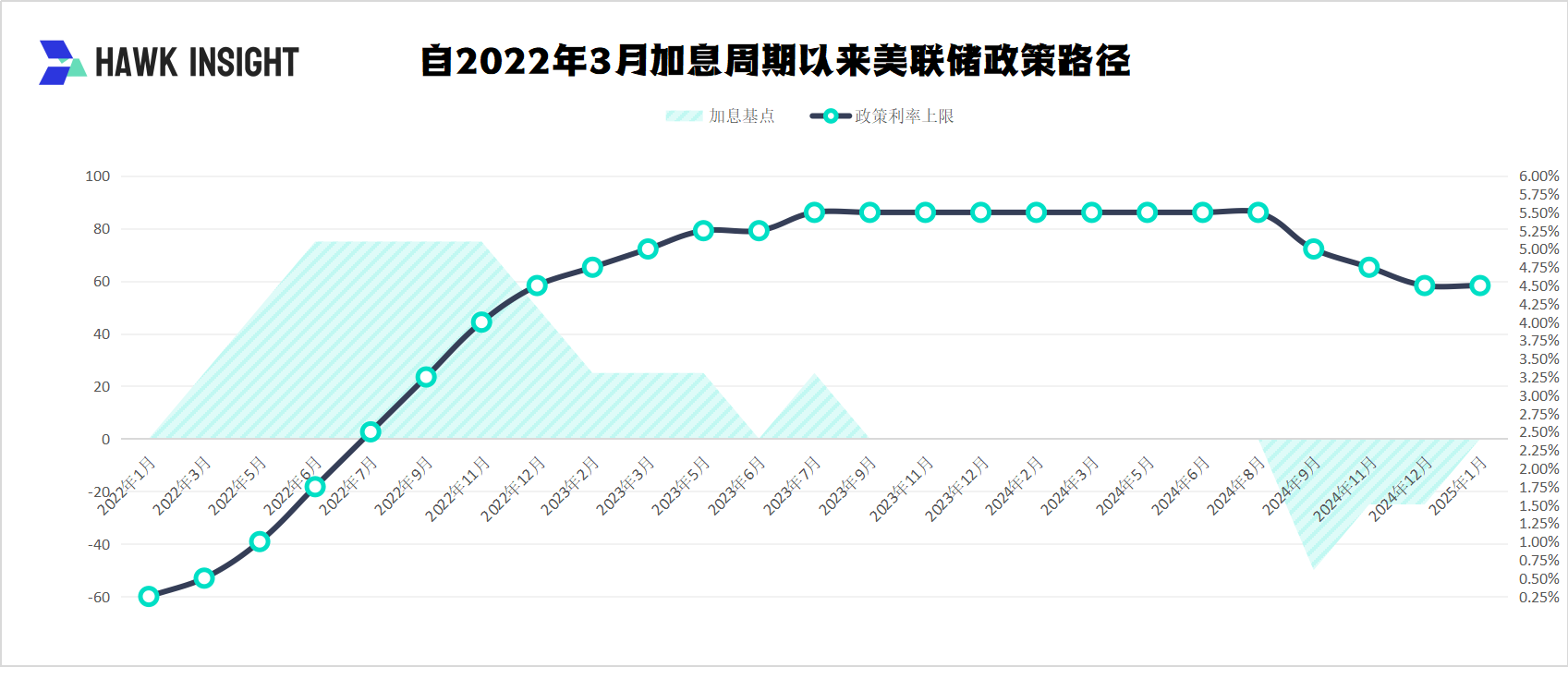

· Reduce the policy interest rate by 25 basis points

· Continue to reduce holdings of national debt

--"The committee will continue to reduce the size of its holdings of U.S. Treasurys, agency debt and agency mortgage-backed securities.”

--"The committee is firmly committed to supporting the goal of maximizing employment and restoring inflation to 2%.”

· Continue camera decision making

--"In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the impact of the latest information on the economic outlook.”

--"Should risks arise that may hinder the achievement of the Committee's goals, the Committee will be prepared to adjust its monetary policy stance as appropriate."”

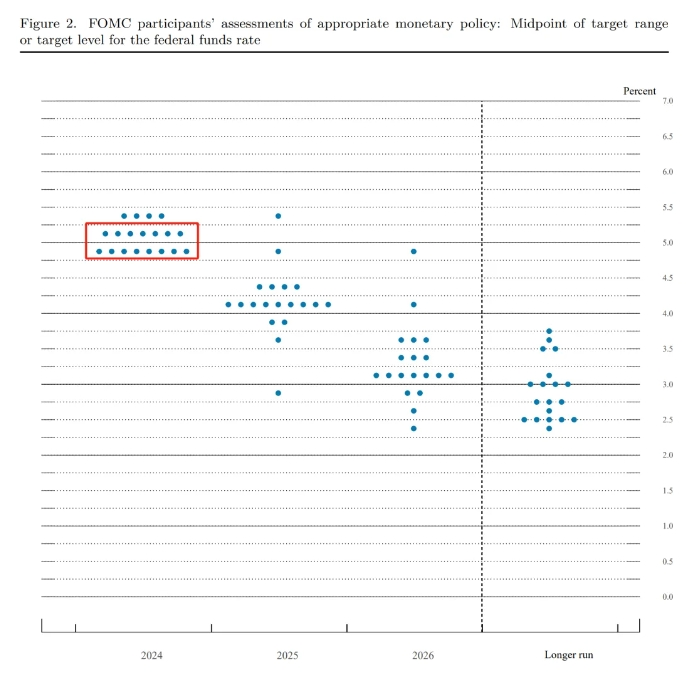

· bitmap

--"Raise the economic forecast for 24/25 years, lower the unemployment rate forecast, and raise the inflation forecast. The inflation forecast for 25 years will be raised by a large margin.”

--"The dot chart only guides interest rates twice throughout next year, showing a strong hawkish tendency.”

For a complete analysis of this meeting, please refer to:

Review of the press conference of the Federal Reserve's December 2024 interest-rate meeting

· Talk about future monetary policy actions

--"After this interest rate cut, the Federal Reserve has lowered its policy rate by a full 100 basis points from its peak. Now that the monetary policy stance is significantly less restrictive than before, policymakers can be more cautious when considering more interest rate adjustments.”

--"Any Fed decision to cut interest rates in 2025 will be based on upcoming data, not current economic conditions."”

--"As the Federal Reserve strives to keep the labor market strong while keeping inflation down to 2%, a rate hike next year seems unlikely.”

· Affirming the performance of the US economy

--"The overall economy is performing strongly; economic growth is faster than expected in the second half of 2024; there is no reason to believe that an economic downturn is more likely than usual; it is clear that the United States has avoided a recession: Very optimistic about the economy.”

--"Policymakers generally expect GDP growth to remain strong.”

· Talking about inflation and the job market

--"Given that year-on-year inflation data is still sticky, we will continue to pay attention to the progress of inflation improvement in 2025.”

--"When considering further interest rate cuts, we will focus on improving inflation, and we have made little significant progress on the 12-month inflation data.”

--"Consumers feel more the impact of high prices than the direct effect of high inflation.”

· Some officials have begun to assess the potential impact of Trump's policies

--"Some members of the Federal Open Market Committee (FOMC) have begun a preliminary assessment of the possible impact of Trump's policies.”

--"As for Trump's tariff plan, it is too early to draw conclusions on how it will affect inflation.”

· The Federal Reserve has no intention of holding Bitcoin

--"The Federal Reserve does not intend to add Bitcoin to its balance sheet,"

--"We cannot hold Bitcoin.The Federal Reserve Act sets out what we can have, and we have no intention of seeking to change the law.This is something Congress has to consider, but we are not seeking change at the Fed.”

For a complete analysis of this meeting, please refer to: Minutes of the Federal Reserve's October meeting: Core inflation slowly declines and interest rates continue in December

Review of the statement of the Federal Reserve's November 2024 interest-rate meeting

· The US economy continues to expand steadily

--"The U.S. economic outlook is uncertain, and the Fed will continue to focus on the risks it faces in achieving its goals (employment & inflation).”

· Inflation "still a little high"

· Reduce the policy interest rate by 25 basis points

· Continue to reduce holdings of national debt

Review of the press conference of the Federal Reserve's November 2024 interest-rate meeting

· On the impact of the US election on the Federal Reserve's policy path

· About the rise in bond yields

--"These changes seem to be mainly due to rising inflation expectations, but rather to a perception that growth is stronger and that downside risks are likely to be smaller."”

· What circumstances might lead to a pause in interest rate cuts?

--"As we approach neutral or near neutral levels, it may be appropriate to slow down our pace of reducing restrictions."”

· US finances are unsustainable

--"That is, U.S. finances--the federal government's fiscal policy is on an unsustainable path.Our debt levels are not unsustainable relative to the economy.”

For a complete analysis of this meeting, please refer to:

Review of the statement of the Federal Reserve's September 2024 interest-rate meeting

· Observed a slowdown in employment growth

· Inflation is moving towards set target

· Reduce the policy interest rate by 50 basis points

· Reduce the policy interest rate by 50 basis points

--"Given the progress in inflation and the balance of risks, the committee decided to lower the target range for the federal funds rate by 0.5% to 4.75% to 5%.”

"The Committee will carefully evaluate future data, changing prospects and risk balances as it considers further adjustments to the federal funds rate target range."”

--Delete "The Committee predicts that it is not appropriate to reduce the target range until it is more confident that inflation continues to move towards 2%."

· Add "Support Employment"

--"The committee is firmly committed to supporting full employment and returning inflation to its target of 2%.”

· FOMC voting committee changes

--"Delete" Chicago Fed President Austan D.Goolsbee voted as an alternate member at this meeting.”

--Yes vote: Add Cleveland Fed President Beth M.Hammack

--Voted against a 50 basis point rate cut was Michelle W.Bowman, who preferred to cut the target range of the federal funds rate by just 25 basis points at this meeting

For a complete analysis of this meeting, please refer to: The Federal Reserve's September interest rate decision: The policy of exceeding expectations has seen a major turning point

Review of the press conference of the Federal Reserve's September 2024 interest-rate meeting

--Economic activity continues to expand at a "steady rate" and growth in the second half of this year is expected to be similar to that in the first half."The U.S. economy is in good shape, and our decision today is aimed at keeping it that way.”

--"The U.S. economy currently shows no signs of recession, nor does it believe that a recession is imminent.”

--He did not announce that the Fed had defeated inflation, but expressed his belief that inflation would fall to its target level of 2%.He added: "While people may no longer think about inflation as frequently as before, they may indeed notice higher prices, which is painful.”

· There is no fixed interest rate path in the future, and decisions need to be made based on data cameras.

--Taking into account risk balance, the interest rate will be lowered by 50 basis points today, but no fixed interest rate path has been set, and meetings will be held one by one to make decisions.As usual, Powell reiterated that the next step depends on economic data.

--Powell emphasized that no one should think that a 50 basis point interest rate cut is a new trend, and should not draw such a conclusion based solely on this interest rate cut.In other words, don't bet on a next 50 basis point rate cut.

· Labor market conditions are good

--"The labor market is in good shape, and I hope it can maintain this state; but if the labor market unexpectedly slows down, then the Federal Reserve will accelerate the pace of interest rate cuts."Powell believes that the current unemployment rate of 4.2% is very healthy. The rise in the unemployment rate is partly due to the influx of immigrants. The rise in the unemployment rate is also due to the slowdown in recruitment.

· Neutral interest rates are much higher than before the epidemic; there is no plan to stop shrinking the balance sheet in the near future

--Regarding the neutral interest rate, Powell said he did not know where the specific level was, but it should be much higher than in the past (before the epidemic).When asked about the balance sheet, he said that the reserves are stable and sufficient and are expected to remain for some time, and there is no plan to stop shrinking the balance sheet in the near future.

For a complete analysis of this meeting, please refer to: The Federal Reserve's September interest rate decision: The policy of exceeding expectations has seen a major turning point

Review of the statement of the Federal Reserve's July 2024 interest-rate meeting

· Stay put as scheduled, but interest rate cuts may be discussed at the September meeting

Review of the press conference of the Federal Reserve's July 2024 interest-rate meeting

--"The job market is gradually normalized, and that's what we want to see.“

--"If employment data cools faster than expected, we will respond.“

· on economic

--Powell clearly described the economic situation in his opening remarks as "strong but not overheated".

For a complete analysis of this meeting, please refer to: Federal Reserve's July interest rate decision: interest rates remain unchanged, September interest rate cuts are put on the agenda

Review of the statement of the Federal Reserve's June 2024 interest-rate meeting

· Continue to keep policy interest rates unchanged and progress is made in inflation governance

--"In recent months, moderate further progress has been made towards achieving the committee's 2 percent inflation target.”

· Interest rate dot chart cashes upside risks, and differences in the number of interest rate cuts

--"With a slight increase in inflation forecasts, interest rate forecasts have also been raised.After the increase in long-term interest rate forecast in March, this meeting will continue to increase the level of 0.2%.”

--One interest rate cut during the year (7th place) vs two interest rates (8th place)

Review of the press conference of the Federal Reserve's June 2024 interest-rate meeting

· Long-term interest rates may be higher

--"Many officials do believe that interest rates will not return to pre-epidemic levels.“

· Service industry inflation deserves vigilance, American wages are high

For a complete analysis of this meeting, please refer to: Federal Reserve's June 2024 Interest Rate Decision: Even if others cut interest rates, I will remain firm

· Continue to keep policy interest rates unchanged, official announcements slow down and shrink the balance sheet

--"There has been a lack of further progress in meeting the Committee's 2% inflation target in recent months" and "The risks of achieving employment and inflation targets over the past year have become better balanced."”

--"Starting from June, the monthly pace of reducing national debt will be slowed down.In his speech, Powell said that slowing down the balance sheet reduction is not lenient, nor does it mean that the total reduction in the balance sheet will be smaller than expected, but is to ensure a smooth transition more gradually.”

For a complete analysis of this meeting, please refer to: The Federal Reserve's May Interest Rate Decision: Six consecutive times to slow down the pace of shrinking the balance sheet since June

Review of the press conference of the Federal Reserve's May 2024 interest-rate meeting

· It takes longer to gain confidence in inflation

· The labor market remains relatively strong, denying stagflation.

--"The United States is still at a very healthy level of growth and has not seen stagnation.”

· Without considering further interest rate hikes, postponing interest rate cuts is appropriate

· Two paths would allow the Fed to consider cutting interest rates

For a complete analysis of this meeting, please refer to: The Federal Reserve's May Interest Rate Decision: Six consecutive times to slow down the pace of shrinking the balance sheet since June

· Don't consider cutting interest rates until you have "greater confidence" in lower inflation

--"The committee believes that lowering the target range is inappropriate until there is greater confidence that inflation continues to move towards 2%.”

· It is not far off to slow down the scale

· Continue to make discretionary decisions and adjust monetary policy as appropriate based on data

For a complete analysis of this meeting, please refer to: Federal Reserve's March 2024 interest-rate resolution: Keep interest rates unchanged, slow down the balance sheet, shrink the balance sheet soon, or cut interest rates three times this year

Review of the press conference of the Federal Reserve's March 2024 interest-rate meeting

· Interest rate cuts in 2024 are appropriate

--"The first interest rate cut has a significant impact.We can approach this issue carefully and let the data speak.”

--"If there is significant weakness in the labor market, that will be a reason to cut interest rates."”

· Inflation has not changed the overall picture

--"Although recent data has changed, the inflation data has not really changed the overall situation, that is, inflation is gradually declining and the road is a bit bumpy.”

· Unemployment is expected to rise

· Slow down and shrink the watch in sight

For a complete analysis of this meeting, please refer to: Federal Reserve's March 2024 interest-rate resolution: Keep interest rates unchanged, slow down the balance sheet, shrink the balance sheet soon, or cut interest rates three times this year

· Don't consider cutting interest rates until it is determined that inflation is lower

--"When considering any adjustment to the federal funds rate target range, the committee will carefully evaluate future data, changing prospects and risk balances."The committee believes that lowering the target range is inappropriate until confidence that inflation continues to move closer to 2%.”

· Economic activity has been expanding steadily

· The Fed's two major goals-promoting employment and controlling inflation-are moving towards balance

· Inflation remains high (consistent with last meeting)

Review of the press conference of the Federal Reserve's January 2024 interest-rate meeting

· Interest rates may have peaked, but March rate cut is not a benchmark scenario

--"The March interest rate cut is not a benchmark scenario.”

--"The balance sheet issue will be discussed in depth at the next meeting. Whether ON RRP is zero will not affect the process of shrinking the balance sheet.”

· Inflation may still rebound

--"There is a risk that inflation will accelerate again.”

· Economic growth will moderate

For a complete analysis of this meeting, please refer to: Federal Reserve's January 2024 Interest Rate Decision: Four consecutive times, interest rate cuts in March are expected to cool down

For a complete analysis of this meeting, please refer to: The Federal Reserve's December Interest Rate Decision: Still not moving on and interest rate cuts have begun to come into view

Review of the press conference of the Federal Reserve's December 2023 interest-rate meeting

· interest rate remains unchanged

· Inflation remains high

· Employment remains strong

· Continue to reduce financial assets

· Continue to monitor financial indicators

Review of the press conference of the Federal Reserve's November 2023 interest-rate meeting

"My colleagues and I remain focused on our dual mission of promoting maximum jobs and stable prices for the American people.We understand the difficulties caused by high inflation, and we remain firmly committed to the goal of reducing inflation to 2%.“

· Powell expressed satisfaction with current economic activity but felt the impact of higher interest rates

--"Recent economic data suggests that economic activity has been growing strongly, well above earlier expectations.Driven by a surge in consumer spending, real GDP grew by 4.9% year-on-year in the third quarter.”

--"After a rebound in the summer, activity in the real estate industry has leveled off and is still well below levels of a year ago, mainly due to rising mortgage rates.Higher interest rates also appear to be putting pressure on corporate fixed asset investment.”

--"In the past three months, an average of 266,000 jobs have been added per month, a strong growth rate that is still lower than earlier this year.

--"Nominal wage growth has shown some signs of easing, and job vacancies have fallen so far this year.Although the gap between employment and workers has narrowed, labor demand still exceeds the supply of available workers.”

--"In the 12 months to September, the overall PCE price index rose 3.4%.Excluding volatile food and energy categories, the core PCE price index rose 3.7%.”

--"Inflation has slowed since the middle of last year, and summer values have been quite favorable.But months of good data are just the beginning of building confidence that inflation is continuing to fall towards our goal.There is still a long way to go to keep inflation down to 2%.”

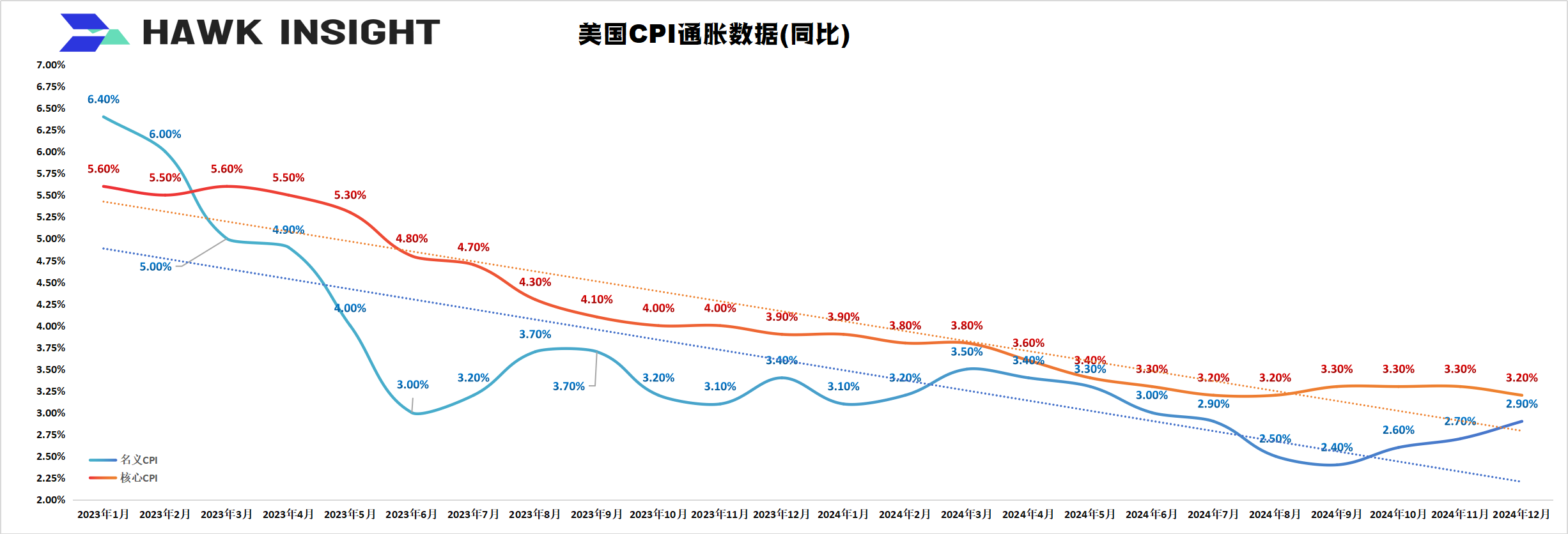

U.S. CPI inflation data (year-on-year):

Data source: U.S. Bureau of Labor Statistics

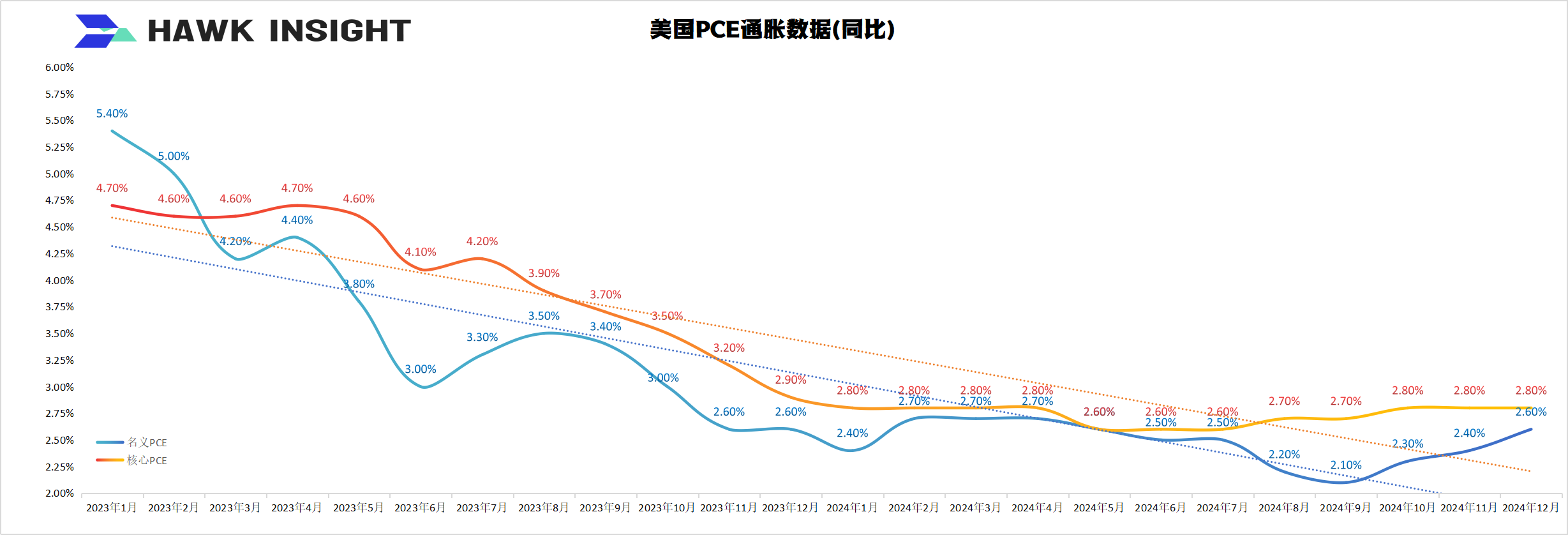

U.S. PCE inflation data (year-on-year):

Data source: US Department of Commerce

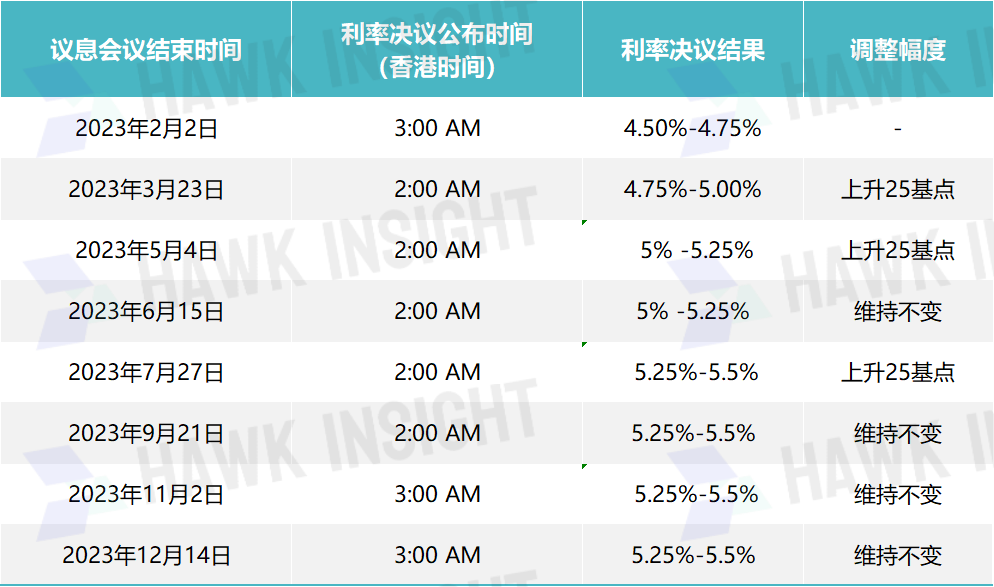

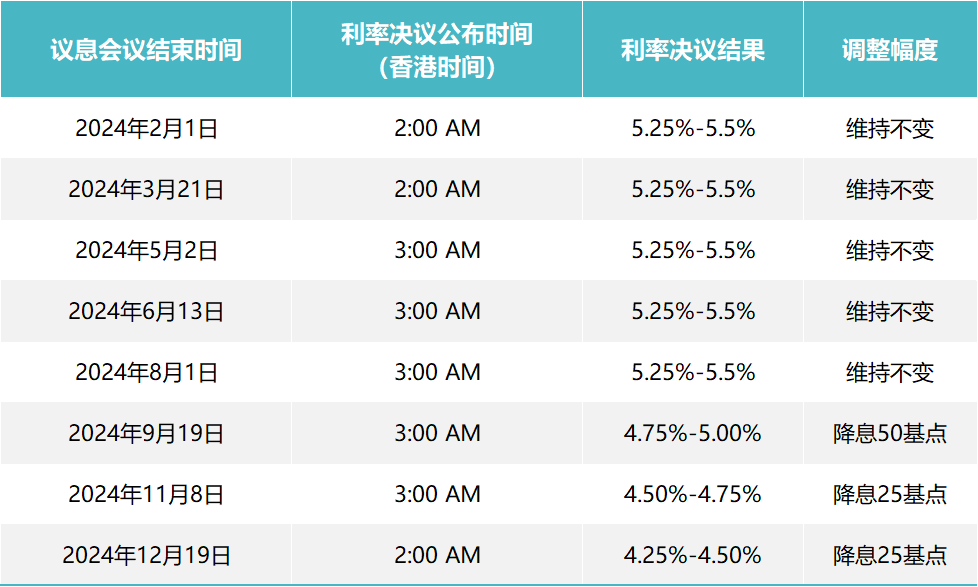

Results of the 2024FOMC Interest Rate Negotiation Meeting and Interest Rate Trend (Completed):

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.