Fed's March 2024 interest rate resolution: keep interest rates unchanged, slow down, scale down, or cut interest rates three times this year.

The Fed reiterated in its statement that it will wait until it is more confident about inflation before cutting rates。The Fed also hinted that a slowdown in tapering was imminent.。

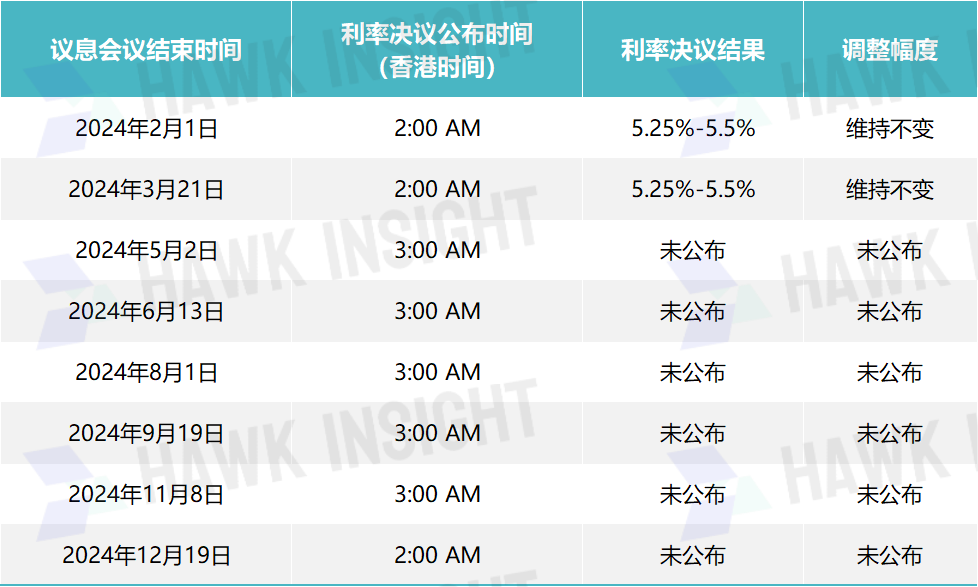

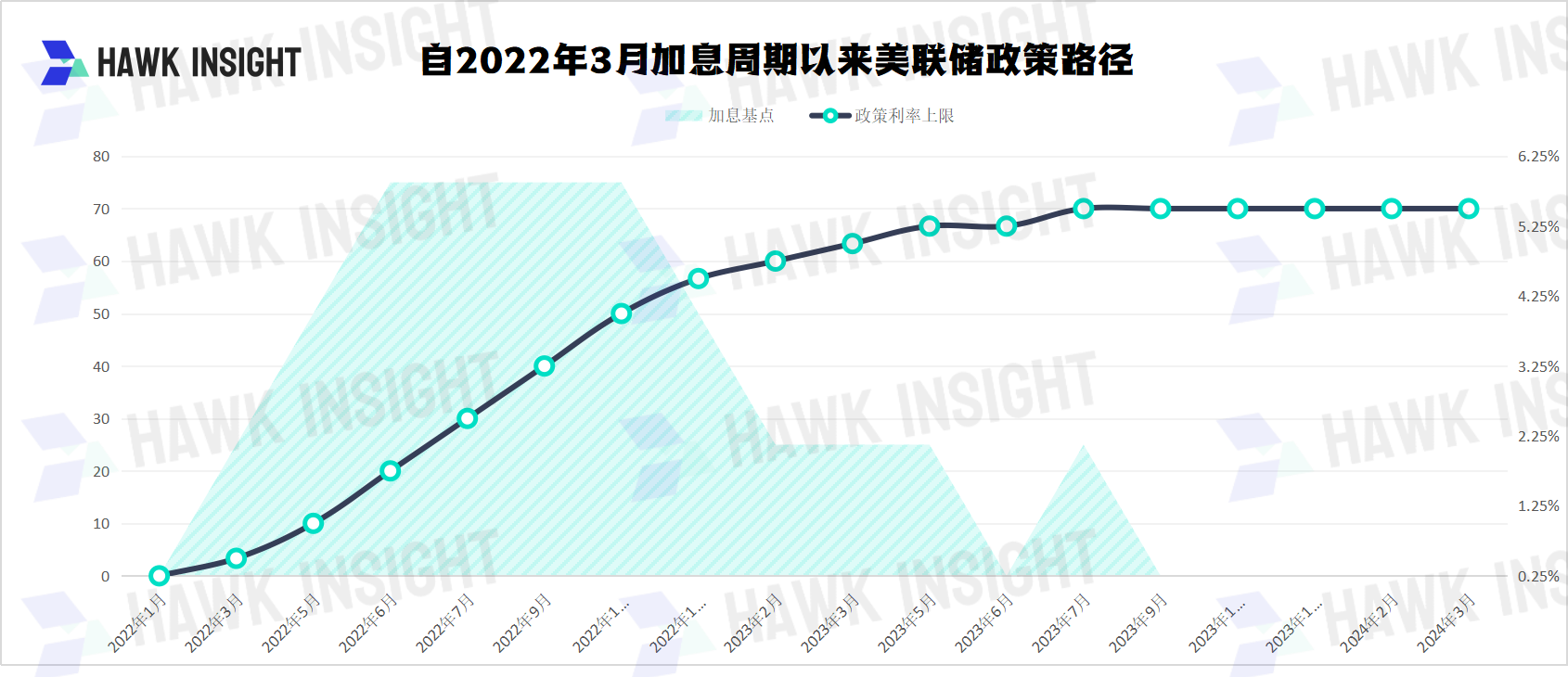

On March 20, local time, the Federal Reserve announced as scheduled that the federal funds rate remained unchanged and remained at 5.25% to 5.Between 5%, in line with market expectations。The Fed reiterated in its statement that it will wait until it is more confident about inflation before cutting rates。The Fed also hinted that a slowdown in tapering was imminent.。

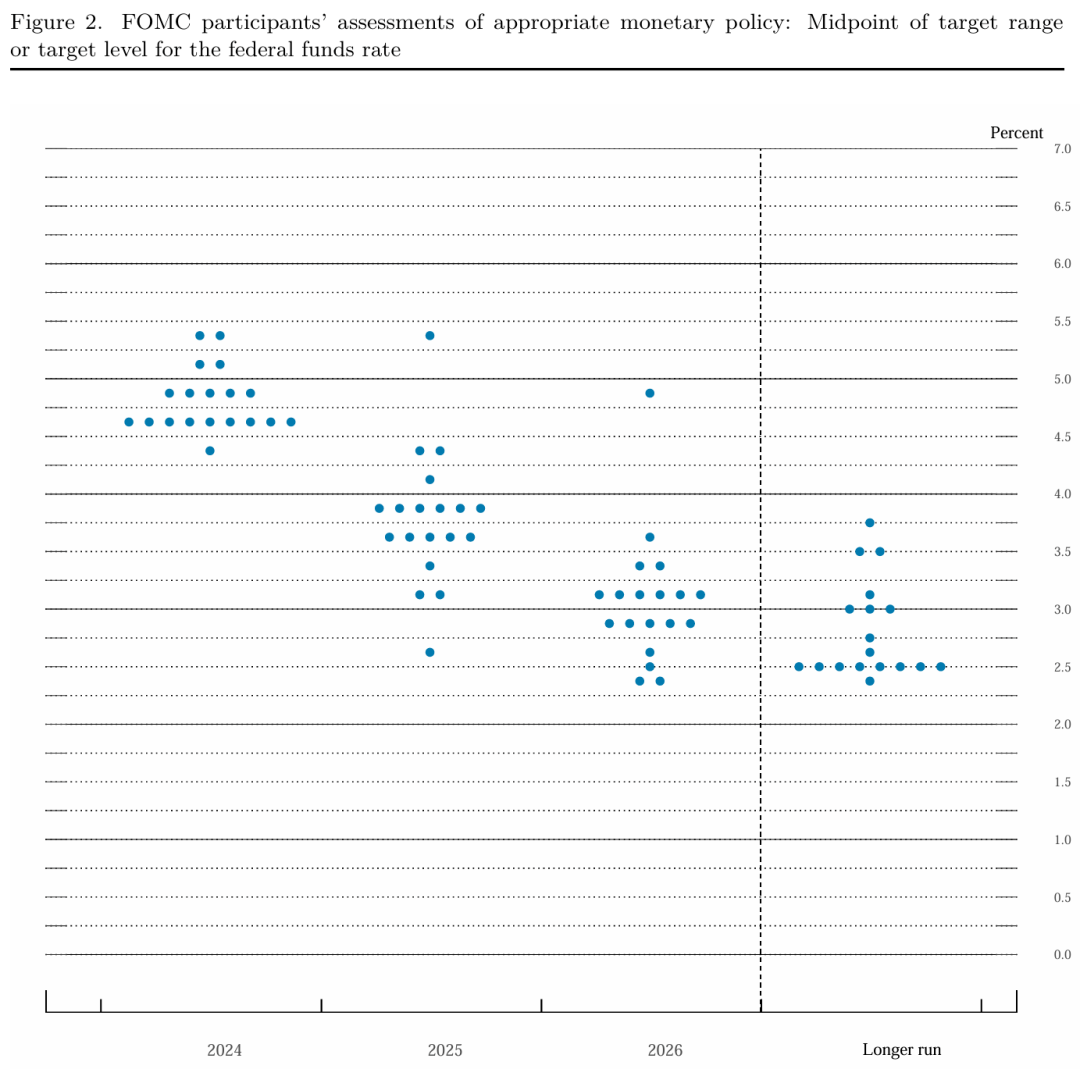

The "dot plot" released after the meeting shows that the median interest rate expected by Fed officials in 2024 is 4.6%。and the current interest rate is 5.25% to 5.Between 50%, which is equivalent to three rate cuts this year if the Fed cuts rates by 25 basis points at a time。Fed has six interest rate meetings left in 2024。

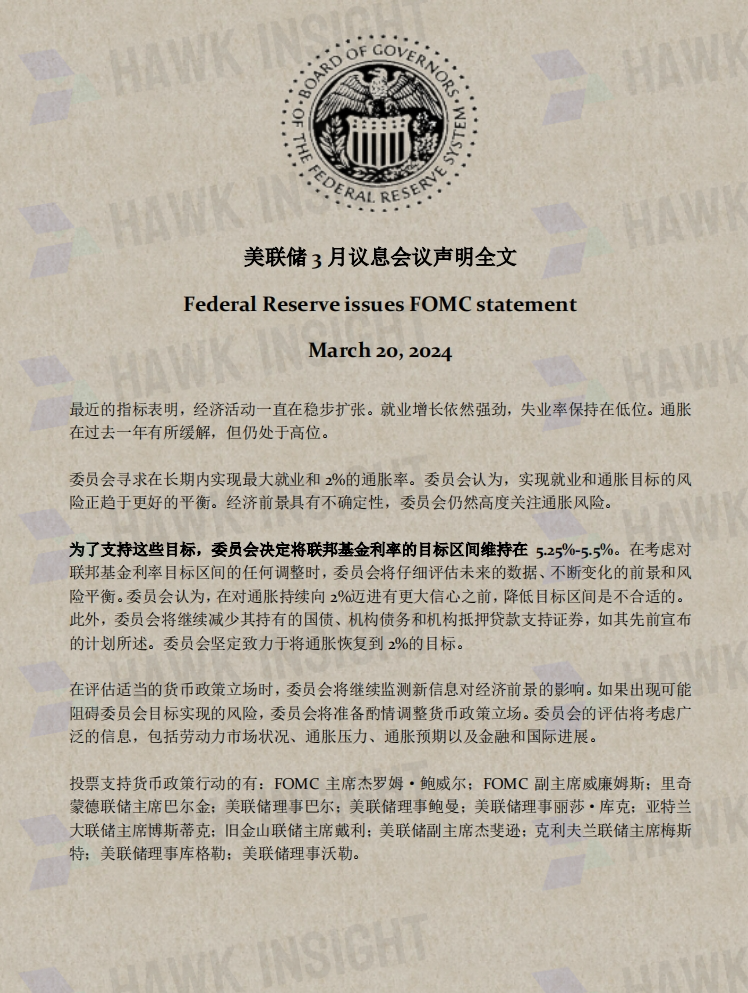

Fed's March statement: The job market is the only change

Specifically, the Fed's March statement was little changed from its January statement, and the risk of essentially continuing the employment and inflation targets is moving further towards a balanced view。The only thing that has changed in this statement is the judgment on the job market, from January's "job gains have moderated" to "new jobs remain strong" (remained strong).。

In its statement, the Fed said recent economic indicators showed that economic activity had been expanding at a solid pace.。Job growth remains strong and unemployment remains low。Inflation has moderated over the past year, but remains high。

For inflation risks, the Fed said the FOMC committee seeks to achieve maximum employment and inflation at a rate of 2% over an extended period of time.。The FOMC Committee judges that the risks of meeting employment and inflation targets are improving the balance.。Economic outlook uncertain, FOMC committee remains highly concerned about inflation risks。

The FOMC Committee does not expect a reduction in the target range to be appropriate until confidence in a sustainable movement of inflation towards 2% increases.。In addition, as stated in its previously announced plan, the FOMC Committee will continue to reduce its holdings of U.S. Treasuries as well as agency debt and agency mortgage-backed securities。FOMC Committee firmly committed to return inflation to 2% target。

In assessing the appropriate stance of monetary policy, the FOMC Committee will continue to monitor the impact of incoming information on the economic outlook.。The FOMC Committee will be prepared to adjust the stance of monetary policy as appropriate in the event of a risk that could impede the achievement of the FOMC Committee's objectives.。The FOMC Committee's assessment will consider a wide range of information, including readings on labor market conditions, inflationary pressures and inflation expectations, and financial and international developments.。

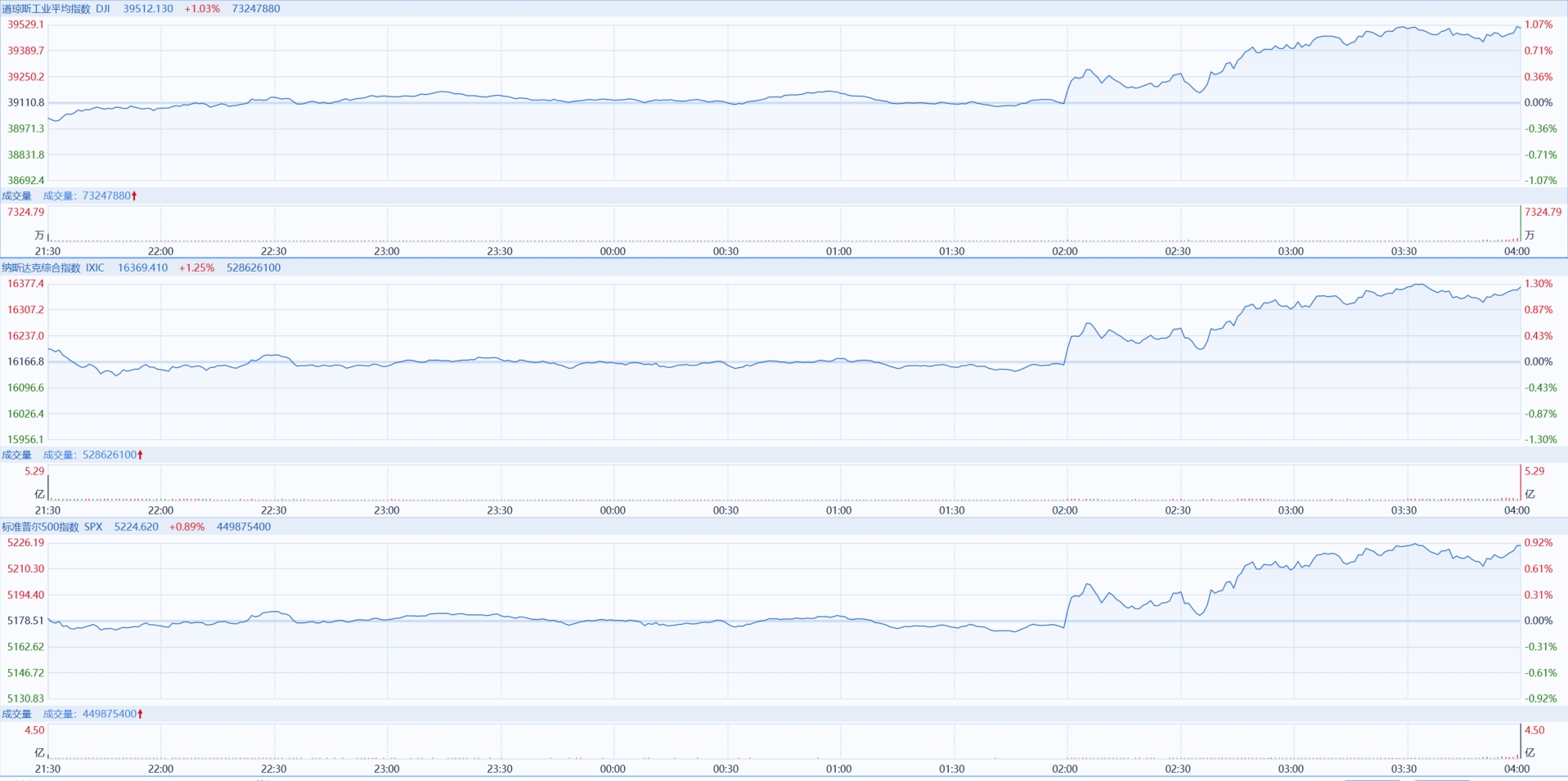

Three major U.S. stock indexes rise in response to interest rate decision。By the close, the Dow was up 1.03%, at 39512.13 points, S & P 500 up 0.89% at 5224.62 points。Nasdaq up 1.25%, at 16,369.41 points。All three major U.S. stock indexes hit record closing highs。

On March 21, according to CME "Fed Watch," the probability that the Fed will keep interest rates unchanged in May is 92.3%, with a cumulative probability of a 25 basis point rate cut of 7.7%。The probability that the Fed will keep interest rates unchanged by June is 23..4%, with a cumulative probability of a 25 basis point cut of 70.8%, with a cumulative probability of a 50 basis point rate cut of 5.8%。

Powell: Rate cut appropriate this year; expected to slow down soon

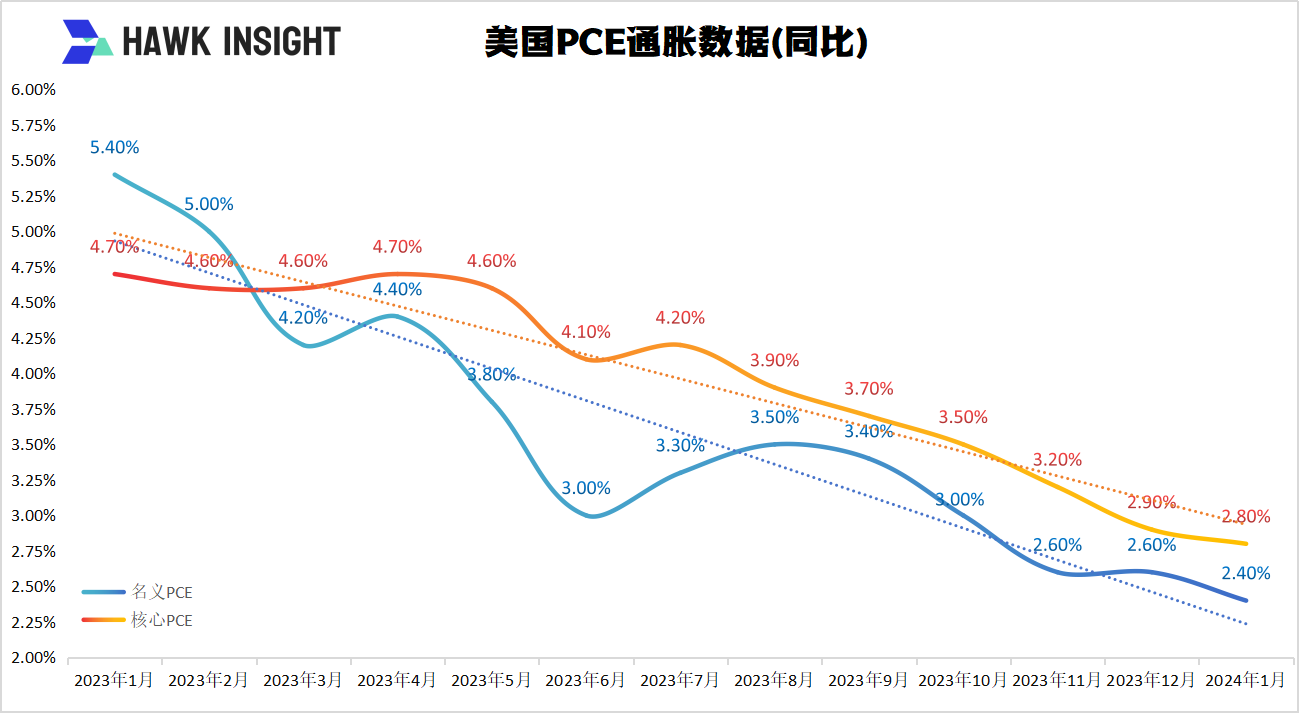

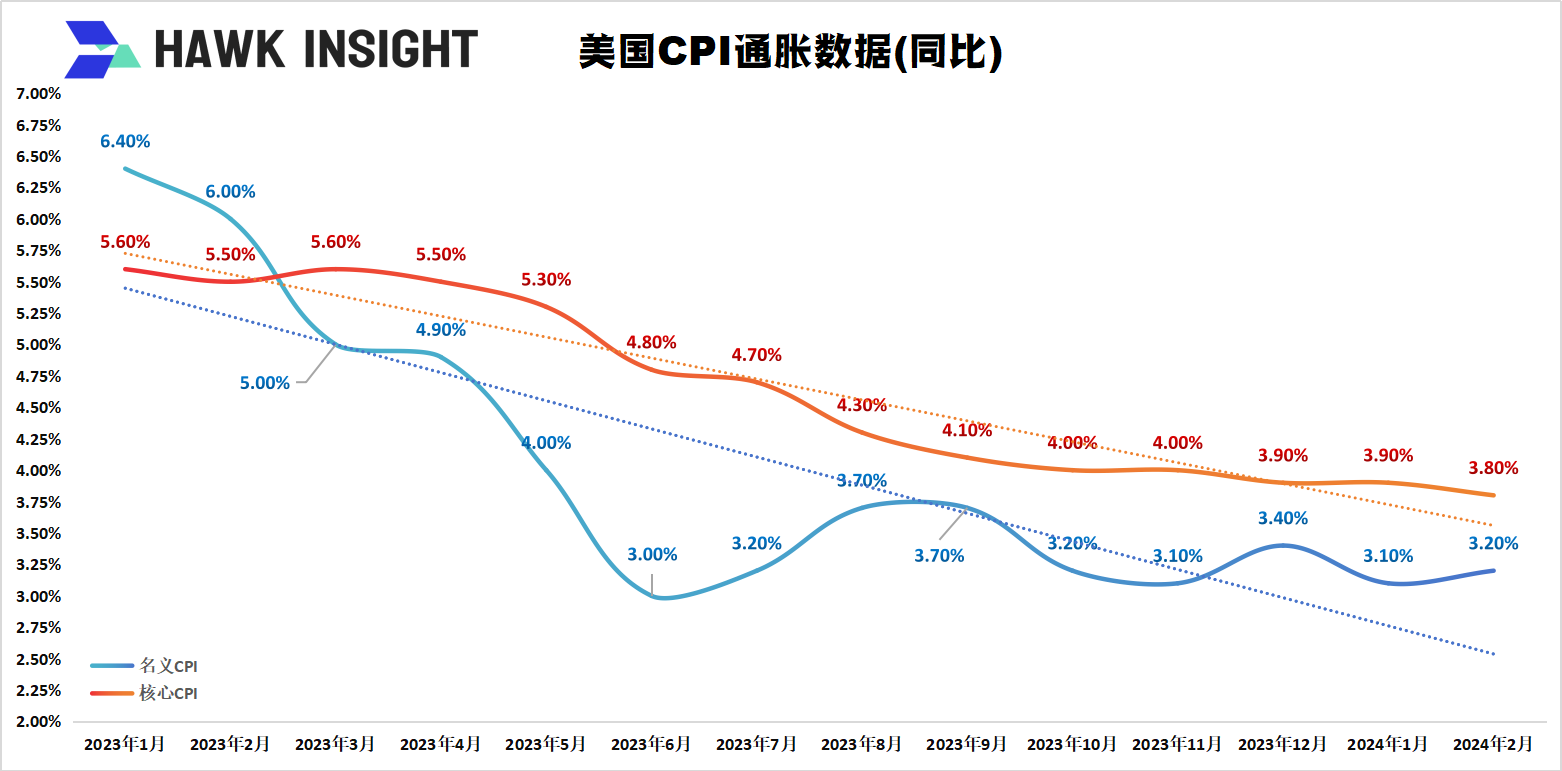

At a post-meeting press conference, Fed Chairman Powell said it would be appropriate to start cutting rates at some point this year。In addition, while the January-February inflation data was repeated, Powell did not see a material impact on the future path of monetary policy。Powell believes that January inflation data exceeded expectations there are seasonal factors, although the absolute value of inflation in February is still high, but PCE to maintain a downward trend。In particular, he believes that strong employment is mainly due to the easing of supply-side factors, so it will not constrain the rate cut plan.。

On inflation, Powell mentioned that the Fed remains highly concerned about inflation data and that the Fed is confident that inflation will continue to move closer to target levels。

Asked if there would be a rate cut in May, Powell did not rule it out, arguing that an unanticipated market could occur between each meeting and therefore would not rule out the possibility of risk, especially if the job market weakens, and that a rate cut would be appropriate.。In contrast, Powell at the January conference thought the May rate cut was too early。

At the press conference, Powell also said that the Fed will soon ("fairly soon") slow down the pace of monthly reductions in U.S. debt and MBS cuts, but does not mean that the Fed's balance sheet will not continue to contract, but will reduce money market liquidity pressures to some extent.。In addition, while the Fed is discussing details about slowing tapering, it still hasn't made a specific decision。

Attached: Full text of the Fed's March rate statement

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.