US March nonfarm payrolls surge by 300,000; expectations of June rate cut significantly reduced

Under the swap market, the expected rate cut by the Federal Reserve in 2024 has been lowered. US rate futures now price in two rate cuts by the Fed in 2024, reducing the probability of a rate cut in June to 54.5%.

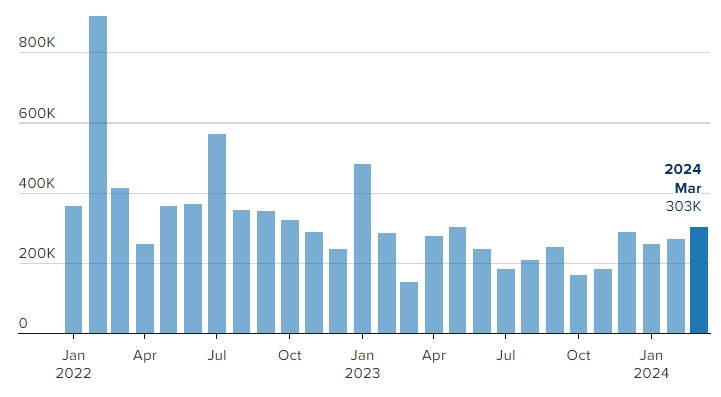

On April 5th, according to data released by the US Department of Labor, non-farm payrolls in the United States surged by 303,000 in March, far exceeding market expectations of around 200,000.

The unemployment rate in March fell to 3.8%, below both the expected and previous value of 3.9%; the US average hourly earnings for March recorded a monthly rate of 0.3%, in line with expectations of 0.3%, but higher than the previous value of 0.10%.

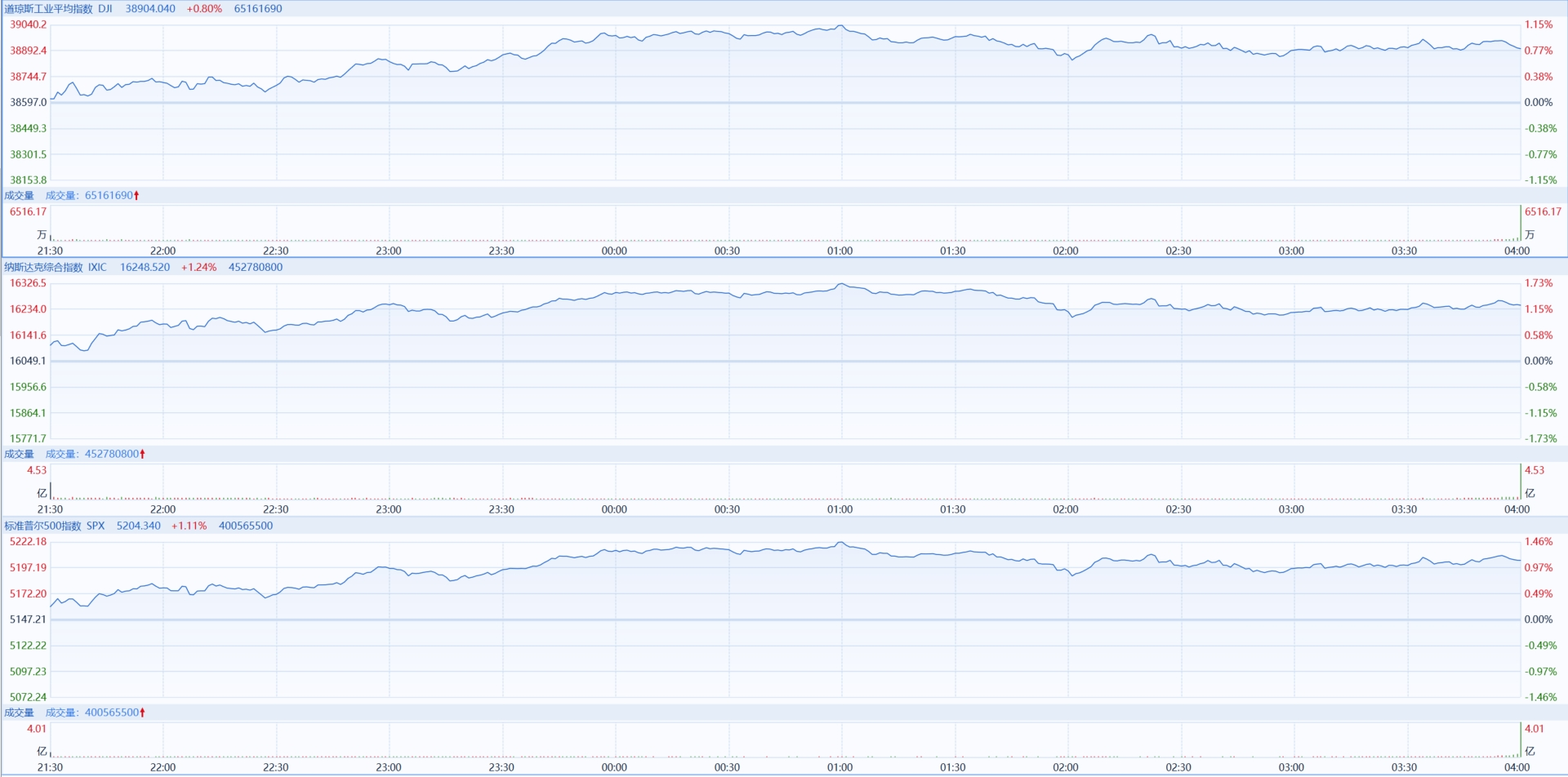

Following the release of the data, the three major US stock indexes collectively rose. At the close, the Dow rose by 0.80%, the Nasdaq rose by 1.24%, and the S&P 500 index rose by 1.11%.

Regarding the outstanding data, the US Bureau of Labor Statistics pointed out that employment growth mainly occurred in healthcare, government, and construction sectors. The data also showed that the labor force participation rate rose to 62.7%, the first increase since November last year. The unemployment rate for workers aged 25-54 fell to 83.4%, still near its highest level in 20 years.

However, the market expressed concerns about the consequences of this data.

Shortly after the data release, relevant market traders reduced their bets on the possibility of a Fed rate cut in June: the swap market lowered its expectations for Fed rate cuts in 2024, with US rate futures pricing in two rate cuts by the Fed in 2024, reducing the probability of a June rate cut to 54.5%, down from 59.8% before the data release. The swap market now fully prices in the Fed's first rate cut from July to September.

This indicates that, guided by strong economic data, the market has weakened its expectations for Fed rate cuts in the first half of the year.

Dallas Fed President Kaplan said on Friday that it was too early to consider rate cuts now, as recent inflation data remained high, and there were signs that the drag on the economy from borrowing costs might not be as significant as previously thought. In addition, Bloomberg's chief US interest rate strategist, Ira Jersey, also said that if the Fed truly relies on data, it would be hard-pressed to justify rate cuts.

Another Fed official, Fed Governor Bowman, expressed concerns about the potential upward risks to inflation on Friday. She reiterated that it was "not yet" time for rate cuts, and raising rates might be necessary to control inflation. Bowman also stated that the most likely outcome is still that "rate cuts will eventually be appropriate," but she pointed out, "we are not there yet" because "I still see some upside risks to inflation."

However, Fed Chair Powell holds the opposite view to the above officials. He no longer seems to believe that a strong labor market implies significant overheating risks for the economy. He stated in a speech last Wednesday that a robust rebound in immigration has led to a better balance between labor supply and demand.

After the non-farm payroll report, investors will turn their attention to the US inflation data for March, set to be released next week. Market expectations suggest that the year-on-year increase in the US Consumer Price Index (CPI) for March may further rise to 3.4%, maintaining its high level. This also implies that the Fed will keep its policy interest rates unchanged at the May 1st meeting.

According to the latest data from the Chicago Mercantile Exchange's FedWatch tool, investors anticipate a 53% probability of a 25-basis-point rate cut by the Fed in June, with a 44.5% chance of no change; the probability of a rate cut in July is 75.1%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.