Thai PM again presses central bank to call for 25 basis points rate cut

Thai Prime Minister Srettha Thavisin again urged the central bank to cut interest rates by 25 basis points to improve people's daily lives, but disagreements between the two sides left the baht underperforming.。

On February 19, local time, Thai Prime Minister Srettha Thavisin again called on the Central Bank (BOT) to cut interest rates, saying that people are being hurt by the current high interest rates.。

According to the latest data, the National Economic and Social Development Board (NESDB) announced that the Thai economy is in crisis.。Secretary-General Danucha Pitchayanan stressed the need for financial measures to boost the Thai economy, particularly through interest rate adjustments to ease the burden on individuals and SMEs.。

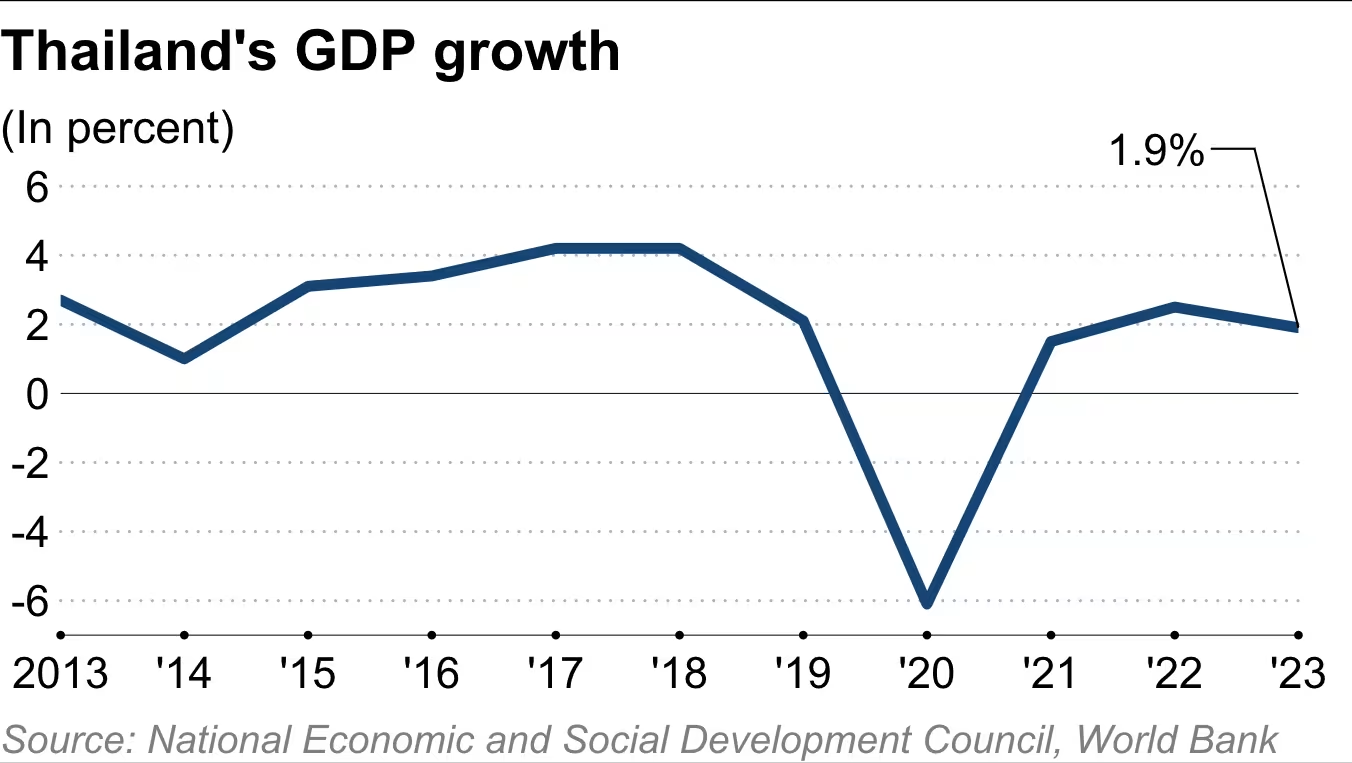

Thailand's fourth-quarter GDP boosted by tourism, up 1 year on year, data show.7%, compared with the previous quarter 1.4% growth has accelerated; however, for all of 2023, Thailand's GDP grew by 1.9%, compared to 2022 2.5% growth slowed and fell short of expectations。As a result, the Committee revised its forecast for 2024 GDP from 3.2% down to 2.7%。

Thailand is currently in deflation, with factory output shrinking for 15 consecutive months and the consumer price index (CPI) negative for four consecutive months since October 2023, as low demand for automobiles, electronics and other products has frustrated exports.。

As a result, Srettha distributed $14 billion worth of cash to the public the other day to stimulate consumption。However, the BOT believes that the deflation is due to excessive state subsidies, not insufficient demand, and the two sides have argued over the issue。

Thailand's current interest rate level is 2.50%, the highest level in the country in a decade。Srettha said: "Domestic inflation has been negative today, falling below the central bank's target range.。move the key rate from 2.50% down to 2.25%, which will not only significantly reduce the burden on the population, but will not exacerbate deflation.。"

On February 7, Thailand's Monetary Policy Committee (MPC) voted 5: 2 in favor of keeping interest rates at 2..50% unchanged。Srettha has since posted on X: "I implore the committee to meet urgently to consider lowering interest rates without waiting for the scheduled meeting.。"

It is reported that the MPC plans to hold a regular meeting before April 10.。However, the BOT is unlikely to cut interest rates this time, as Governor Sethaput Suthiwartnarueput recently said that the current interest rate policy is "roughly neutral" and the economy is not in crisis, unless structural problems are resolved, the interest rate cut will not help the economy much.。

After this disagreement between the Prime Minister and the central bank, investor jitters, foreign investors continue to deliberately avoid Thai assets, causing the baht to fall from Asia's best performing currency at the end of 2023 to the second worst currency this year, down as much as 0.5%。

Moh Siong Sim, currency strategist at Bank of Singapore (Bank of Singapore), said: "Given the apparent escalation of pressure on the central bank to cut interest rates before its next meeting in April, the baht may be subject to increasing resistance, while the baht will remain under pressure in the short term against the backdrop of a strong dollar.。"

As of press time, the BOT had not yet responded to the matter, but an assistant governor had previously indicated that the authorities were willing to consider reducing borrowing costs if the economic weakness was sustainable rather than temporary.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.