U.S. June CPI data: four major sub-items cooling across the board September rate cut probability rose

With housing inflation accounting for about one-third of the overall CPI statistics, the slowdown in this sub-item is pivotal to the continued downward trend in U.S. inflation.

On July 11th, the US released significant inflation data, with the June CPI's four major components all coming in below expectations.

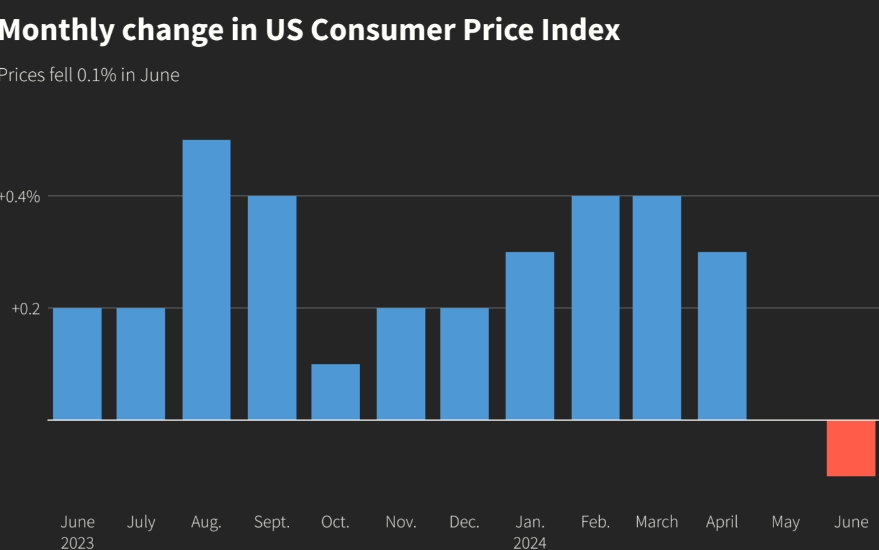

According to a report from the US Department of Labor, the US June CPI year-over-year rate increased by 3.0%, previously forecasted to be 3.1%; the US June CPI month-over-month rate fell by 0.1%, previously expected to rise by 0.1%; the US June core CPI year-over-year rate increased by 3.3%, with a month-over-month increase of 0.1%, previously forecasted to be 3.4% and 0.2% respectively.

The data shows that the good performance of this CPI was mainly affected by the decline in gasoline prices and the fall in the prices of new and used cars, marking the first monthly decline since May 2020. Additionally, looking at the annual comparison, the growth rate of the US June CPI was the slowest since June 2023 and even set the lowest annual growth rate since the beginning of 2021.

Naturally, the better-than-expected inflation report further strengthened the market's confidence in interest rate cuts. Skyler Weinand, Chief Investment Officer at UBS Capital, wrote in a note to clients on Thursday: "With another good CPI data release, the window for the Federal Reserve to cut rates has opened, possibly as early as September, and if inflation data continues to cooperate, possibly again in December."

According to the CME FedWatch, the probability of the Federal Reserve cutting rates at the September 17-18 meeting reached 92%, significantly higher than the 73% on Wednesday and 50% a week ago. Yesterday, Federal Reserve Chairman Powell testified before Congress, stating that the Federal Reserve's assessment of the interest rate cut path has changed, the US labor market has noticeably cooled, the unemployment rate has risen for three consecutive months, and the Federal Reserve does not need to "wait until inflation reaches the 2% target before starting to cut rates."

In addition to the overall CPI data, the core inflation that the Federal Reserve pays close attention to, excluding food and energy, also showed an unexpected slowdown. Especially in housing, the US housing inflation in June only rose by 0.2%, the slowest increase in three years. Calculated annually, housing inflation increased by 5.2% year-over-year, the lowest in more than two years, but still higher than overall inflation.

Since housing inflation accounts for about one-third of the overall CPI statistical caliber, the slowdown in this item has a significant impact on the continued downward trend of US inflation. Greg McBride, Chief Financial Analyst at Bankrate, said: "Housing and service costs have always been a long-standing issue in the inflation reading, but perhaps the trend is beginning to change."

Specifically, lower hotel and motel prices have dragged down housing inflation (down by 2.5% this month), however, the monthly and annual decline in rent and owner-equivalent rent have also slowed. Analysis suggests that this slowdown should continue in the second half of this year.

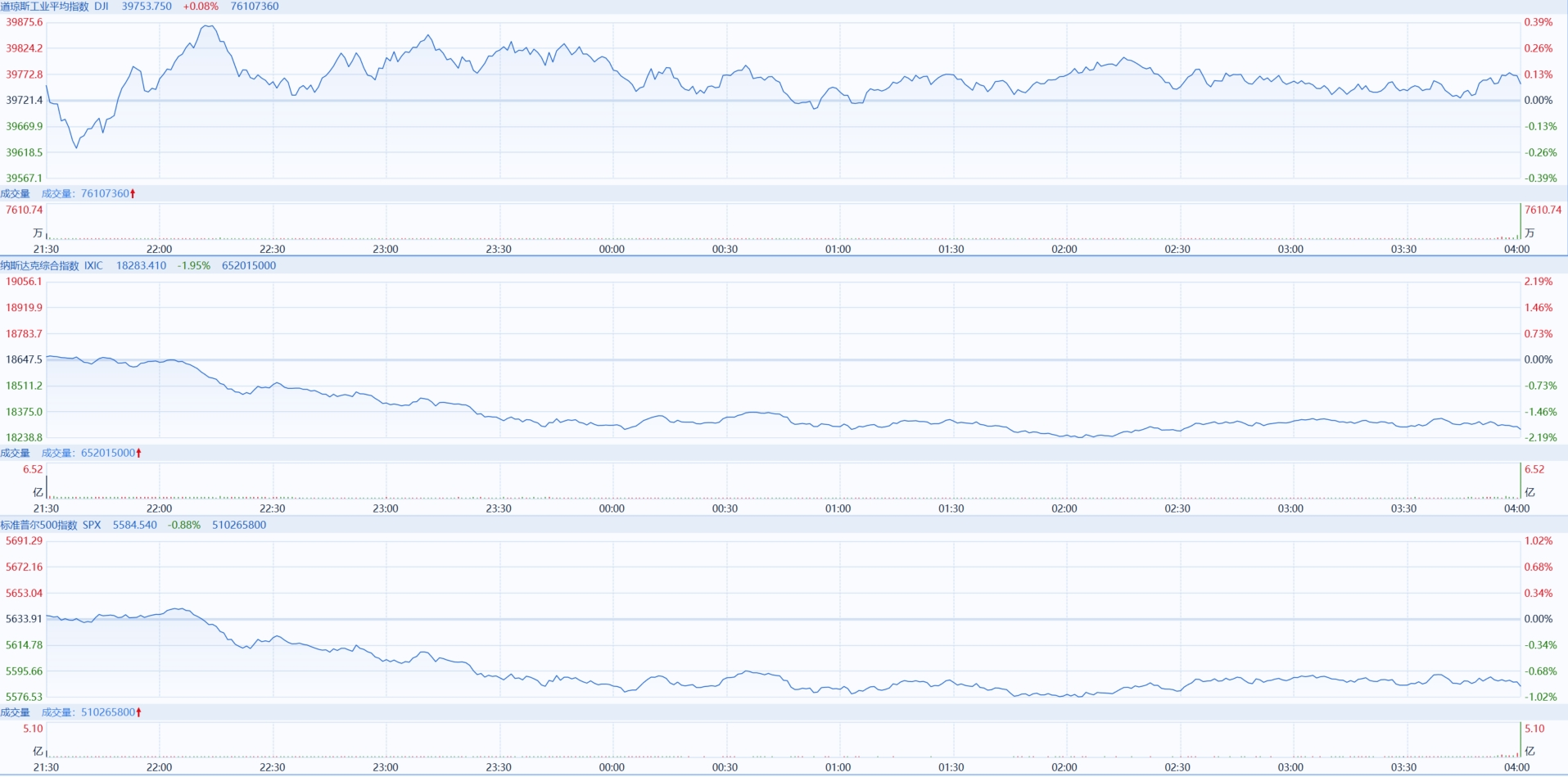

Affected by this, the US stock market jumped upon hearing the news, but soon gave back the initial gains and closed lower.

As of Thursday's closing, the Dow Jones Industrial Average rose by 32.39 points compared to the previous trading day, closing at 39,753.75 points, an increase of 0.08%; the S&P 500 stock index fell by 49.37 points, closing at 5,584.54 points, a decrease of 0.88%; the Nasdaq Composite Index fell by 364.04 points, closing at 18,283.41 points, a decrease of 1.95%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.