Fed's June 2024 interest rate resolution: even if others cut interest rates, I will not move.

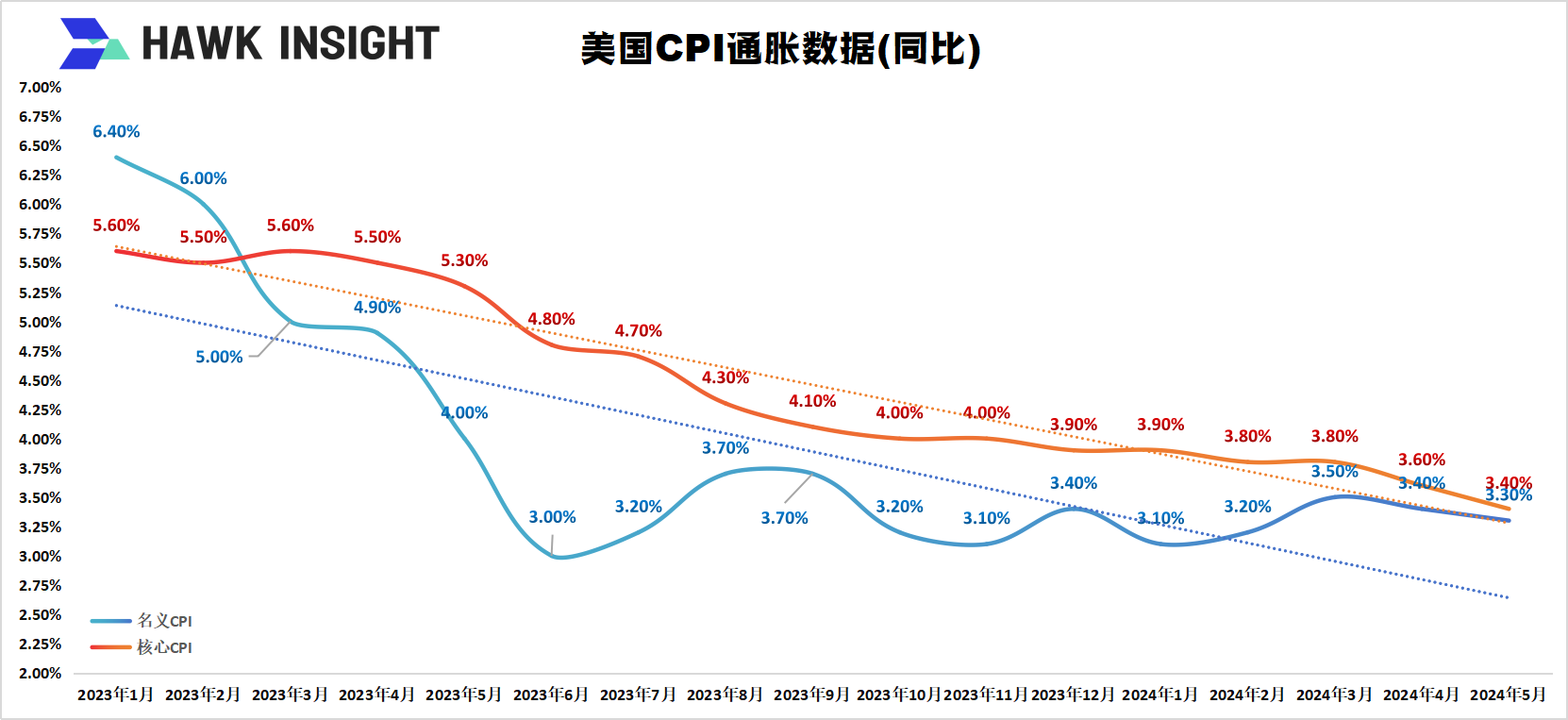

Although the U.S. has made some progress in its fight against inflation, policymakers remain cautious.

Despite the Bank of Canada and the European Central Bank announcing rate cuts within a week, the Federal Reserve remains unchanged.

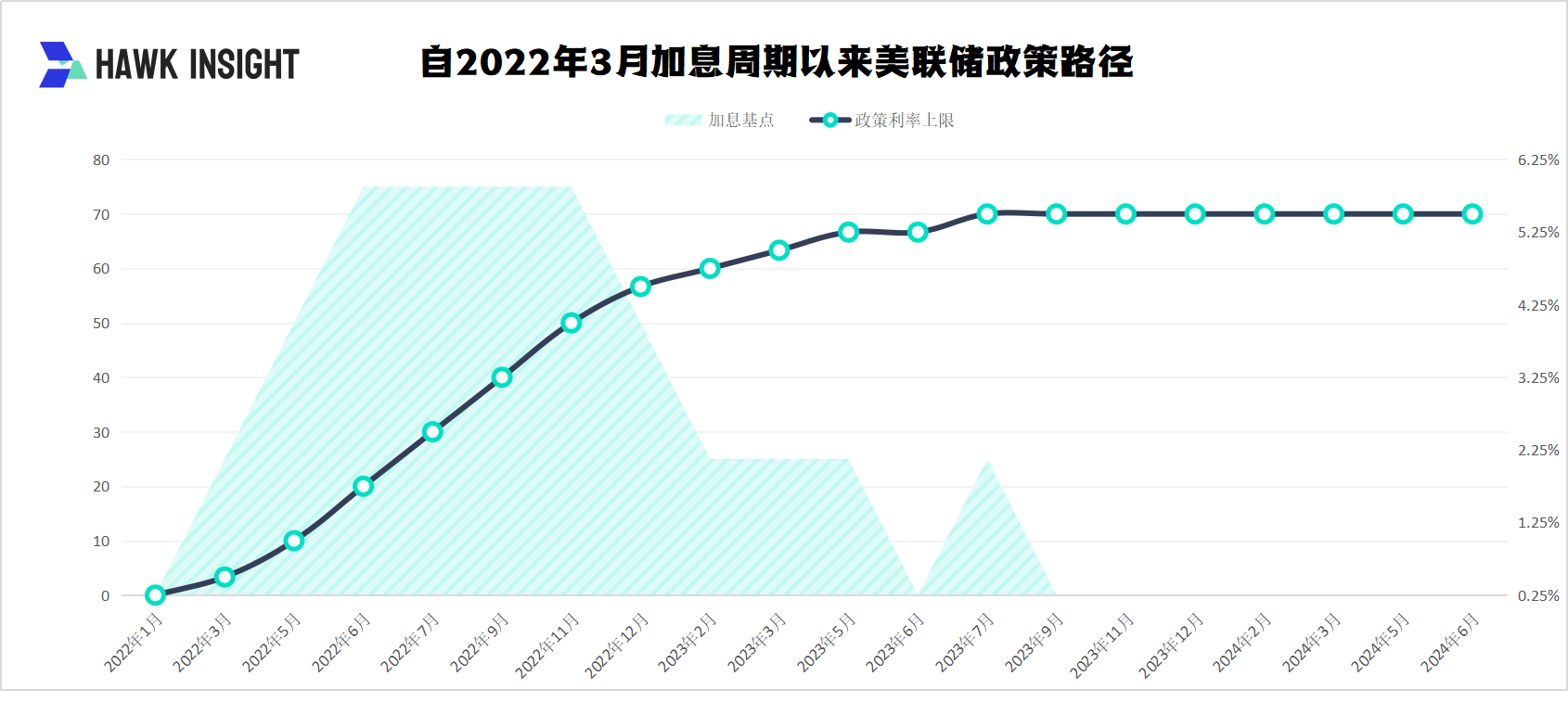

On June 12 local time, the Federal Reserve announced its latest rate decision, maintaining the federal funds rate target range at 5.25% to 5.5%, in line with market expectations, marking the seventh consecutive hold. This indicates that although the U.S. has made some progress in its fight against inflation, policymakers remain cautious.

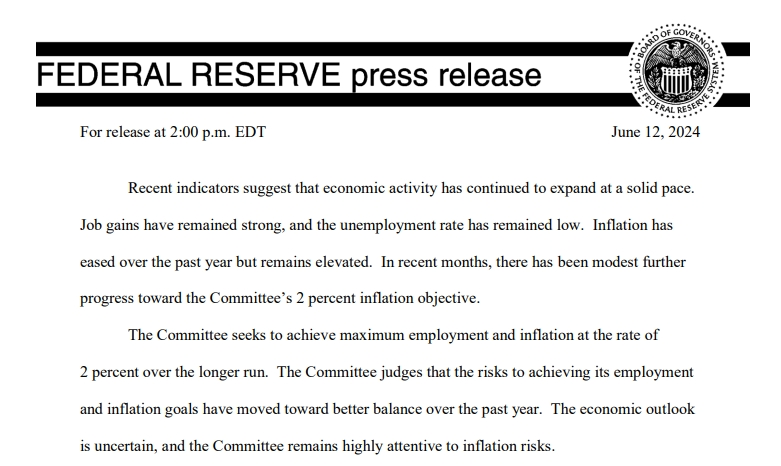

In the meeting statement, the Fed introduced a significant change, shifting from “a lack of further progress” in the previous meeting to “modest further progress” in inflation, reflecting the unexpected drop in the U.S. May CPI data to 3.3%. However, the statement noted that the economic outlook remains uncertain, and the committee continues to closely monitor inflation risks.

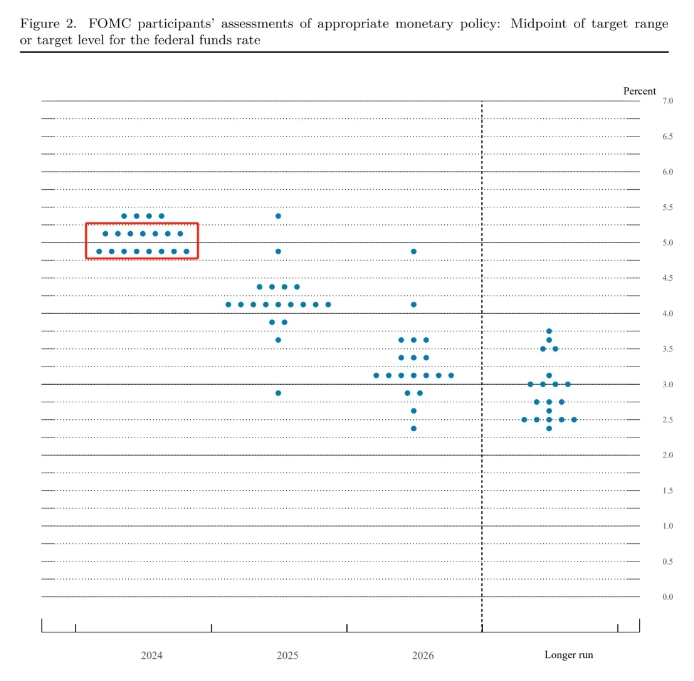

The meeting also revealed the dot plot. There are two key points: First, there is a division among members on the number of rate cuts this year (seven members support one cut, eight members support two cuts), with some members wanting to delay the timing of rate cuts (from September to December). The current dot plot predicts only one rate cut in 2024, down from two cuts predicted in March. More rate cuts are expected in 2025, with four cuts anticipated, up from three previously predicted.

Second, the Fed raised its long-term rate forecast in the dot plot from 2.6% in March to 2.8% in June, and slightly increased the inflation forecast. Powell stated at the post-meeting press conference, "People are coming to the view that rates are not going to come down to pre-pandemic levels." It is now an open secret that the Fed's long-term rates will be higher than pre-pandemic levels.

Additionally, the Fed expects the U.S. economic growth rate (GDP) for 2024 to be 2.0%, slightly lower than the March forecast of 2.1%. The unemployment rate for 2024 is expected to remain at 4.0%, unchanged from the March forecast. The committee noted that the risks to achieving employment and inflation goals have become more balanced over the past year.

At the press conference, Powell stated that the Fed expects the U.S. economic growth rate (GDP) for 2024 to be 2.0%, slightly lower than the March forecast of 2.1%. Meanwhile, the core personal consumption expenditures (PCE) inflation forecast has been raised to 2.8%, up from 2.6% in March. The unemployment rate for 2024 is expected to remain at 4.0%, unchanged from the March forecast. The committee noted that the risks to achieving employment and inflation goals have become more balanced over the past year.

Notably, during Powell's press conference, gold and U.S. stocks' gains narrowed, while the dollar strengthened. This indicates that despite the Fed's hawkish dot plot, Wall Street's expectation of at least two rate cuts this year remains largely unchanged. U.S. stocks were also boosted, with the S&P 500 index rising, U.S. Treasury yields continuing to fall, and the Nasdaq index surging over 2% at one point, hitting a new all-time high.

Appendix: Full text of the Fed's June rate decision:

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.