Even ECB hawks believe Thursday's rate cut will not be the last.

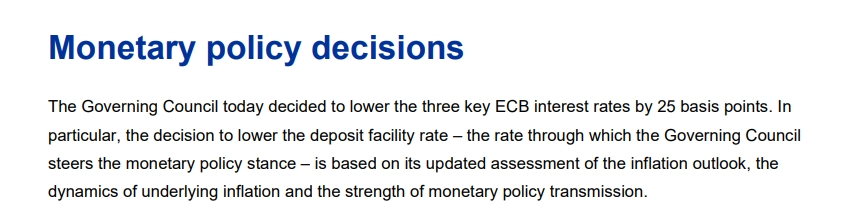

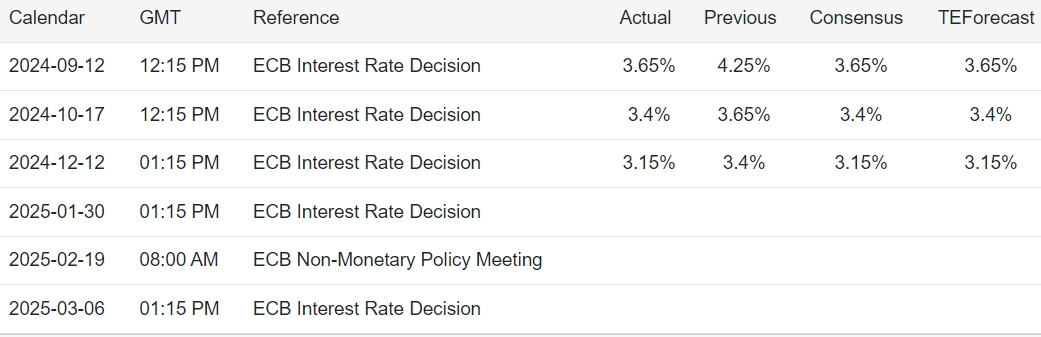

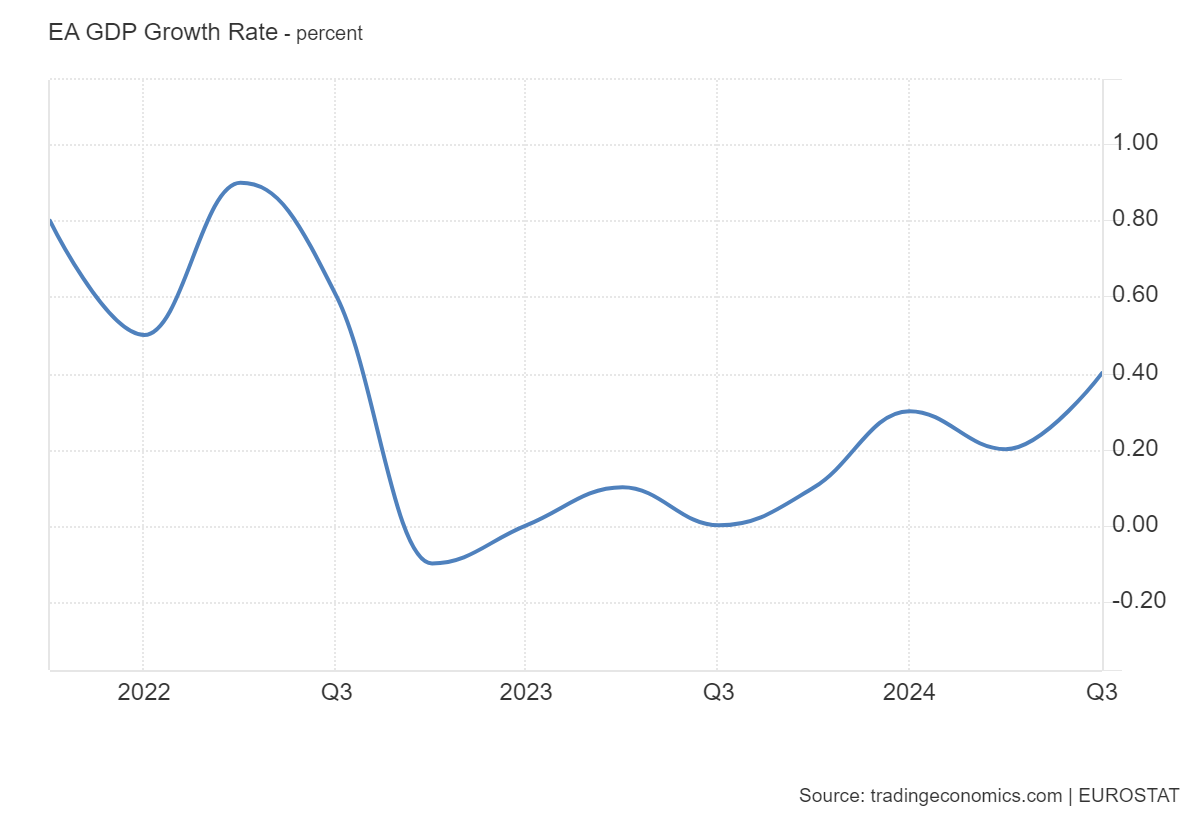

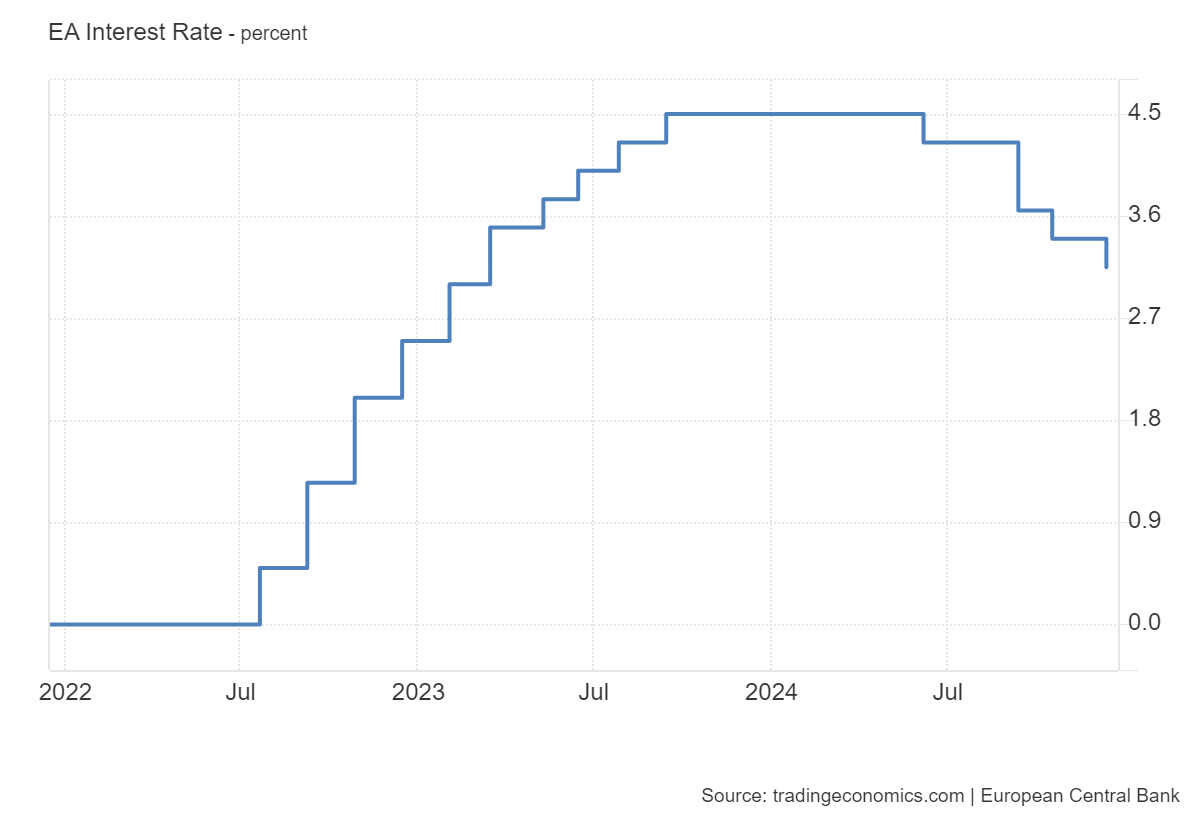

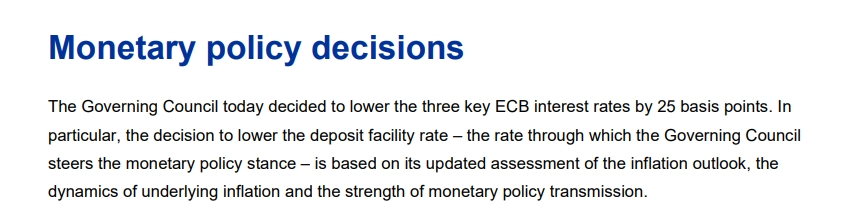

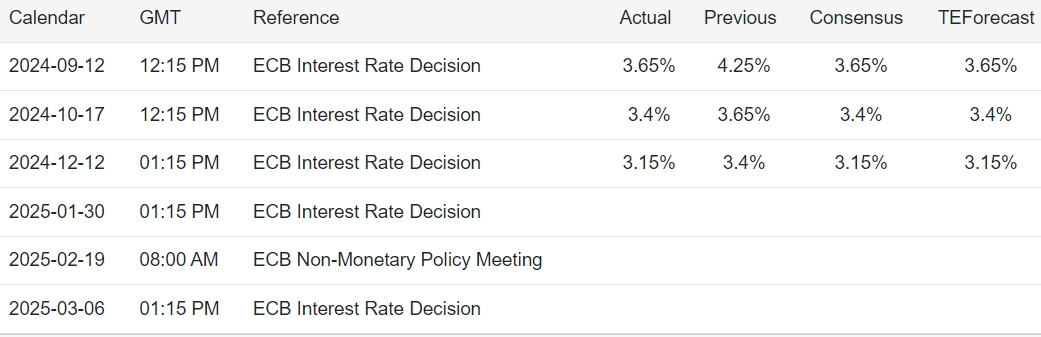

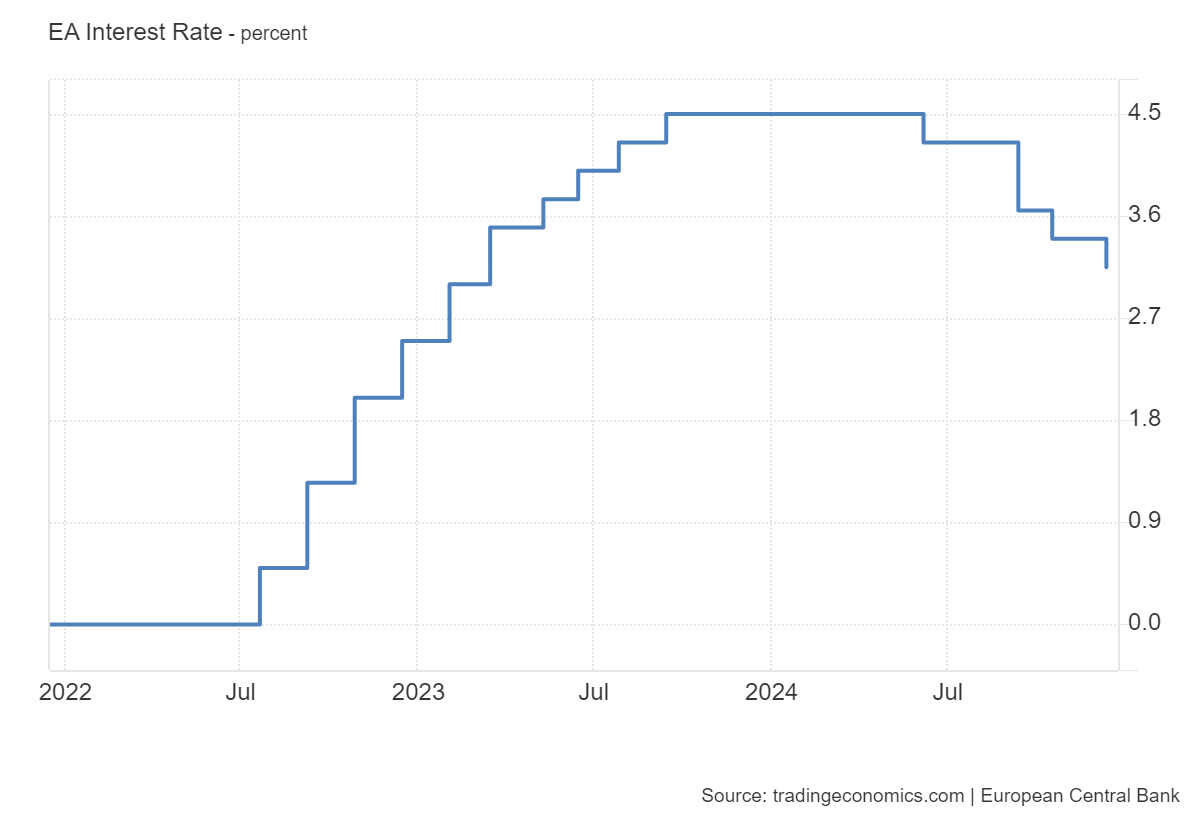

On December 12, the European Central Bank held a monetary policy meeting at its headquarters in Frankfurt, Germany, and decided to cut all three key interest rates by 25 basis points.This is also the fourth time the European Central Bank has cut interest rates this year after announcing interest rates in June this year.

According to the latest interest rate decision announced by the European Central Bank, the deposit mechanism interest rate will be reduced to 3.0%, the main refinancing rate will be reduced to 3.15%, and the marginal borrowing rate will be reduced to 3.40%.

The ECB cut interest rates this time is within market expectations. All analysts surveyed except one predicted that deposit rates will be cut again by a quarter of a percentage point to 3% on Thursday.Only JPMorgan Chase analysts believe the ECB's cut will be even larger, or half a percentage point, citing recent data showing weak economic growth and inflation.

This interest rate cut indicates that ECB officials are worried about the future trajectory of economic development.Some officials believe that a continued sluggish economy may drag inflation below the target.Officials are also trying to resolve the collapse of governments in Germany and France and try to judge how Trump's tariff policies will affect Europe and the Federal Reserve.

Against this backdrop, officials tend to gradually reduce borrowing costs.The new quarterly forecast could signal a weakening in price increases and GDP in 2025, which will help determine the direction of borrowing costs in the coming months.

Later today, European Central Bank President Christine Lagarde will hold a press conference on monetary policy to further elaborate on this interest rate decision.

Future interest rate path

When the European Central Bank advanced its third interest rate cut to October, the economic situation looked so bad that officials debated whether they had to follow up with the 50 basis point move to avoid falling behind the curve.

As third-quarter GDP was stronger than expected, the discussion ultimately fell apart.Only a handful of policymakers have called for continued discussions on a sharp interest rate cut in December.

Although investors believe such a measure is possible at the next meeting, they almost no longer price the risk.Economists expect deposit rates to fall by a quarter of a percentage point until they reach 2%.

Even ECB hawks believe Thursday's rate cut will not be the last time, and the ECB may adjust the language in its policy statement-especially the part that currently says it will "maintain adequate policy rate limits for as long as necessary."However, the ECB wants to remain flexible and is unlikely to deviate from its "meet-by-meet-approach.

Policymakers are also beginning to look to the future and take a stand on whether interest rates must fall below neutral levels-a theoretical tipping point that neither constrains nor stimulates the economy, generally believed to be around 2%.

_1080837549_739.png)

Some people, including Francois Villeroy de Galhau of France and Fabio Panetta of Italy, say this should be considered.But executive board member Isabel Schnabel warned against going too far as it could waste valuable policy space at a time when the economy is more hampered by structural problems and monetary policy cannot do anything about it.

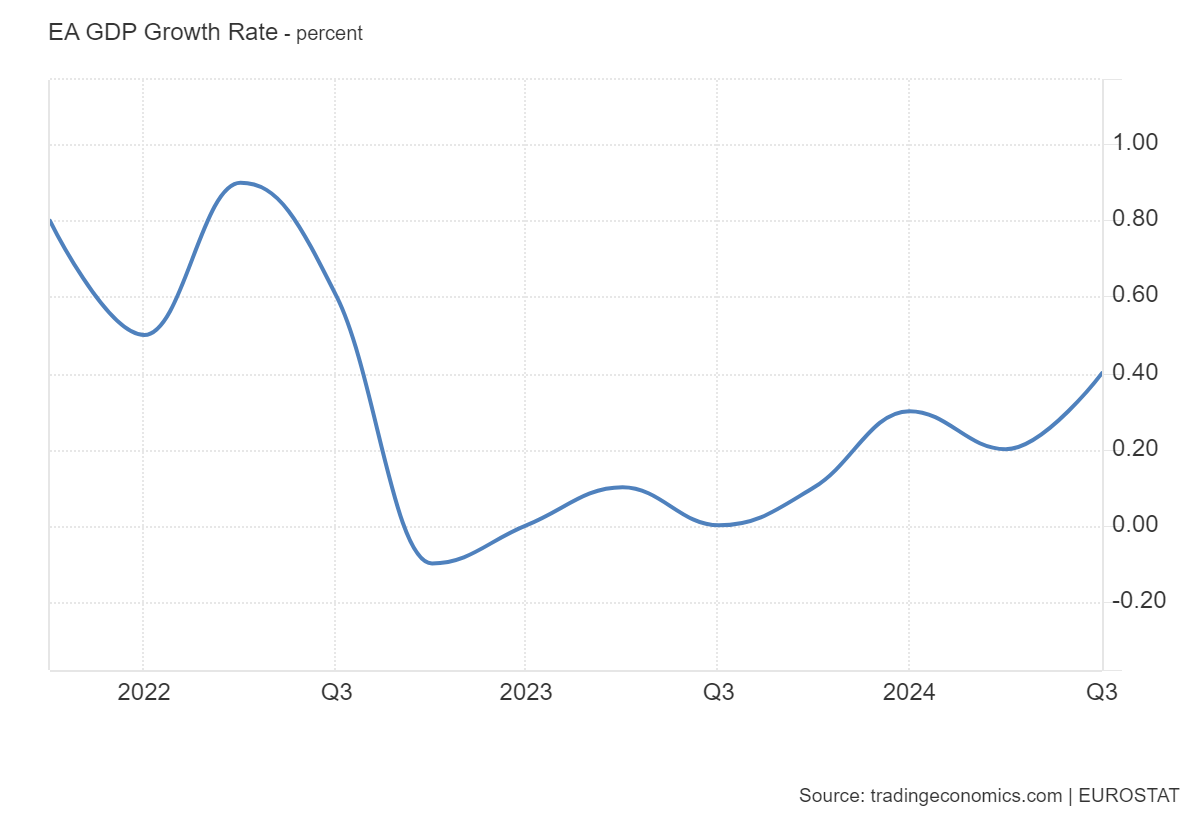

Eurozone Economic Outlook

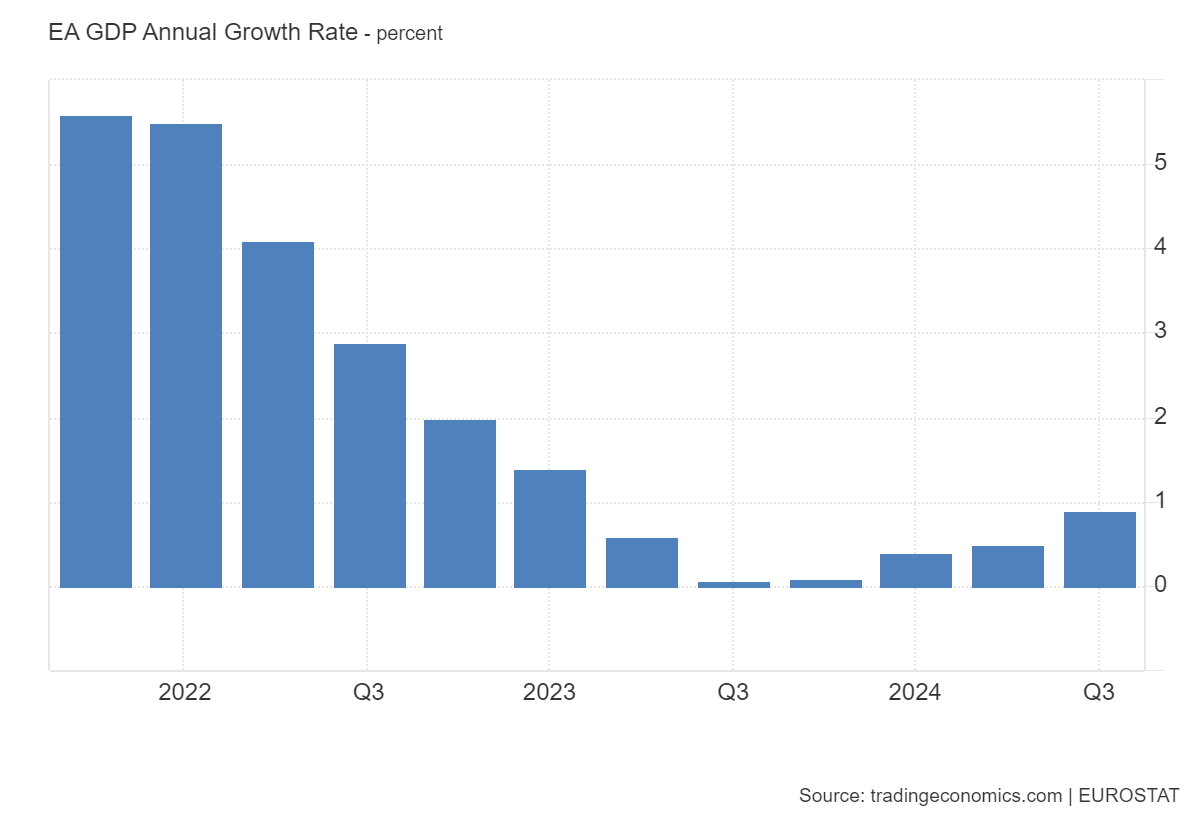

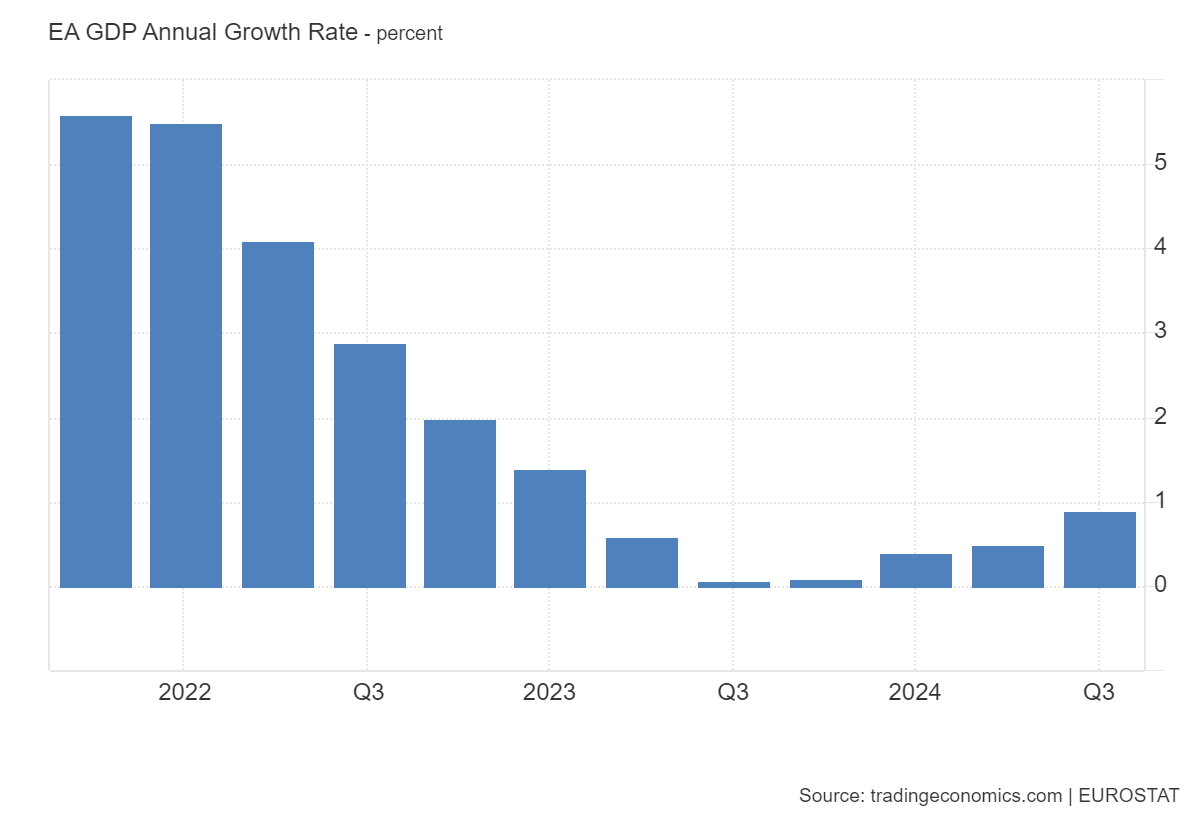

The European Central Bank has long pinned its hopes on wage growth and household spending to drive economic recovery.In September this year, the European Central Bank expected economic growth to rebound from 0.8% this year to 1.3% in 2025 and 1.5% in 2026.

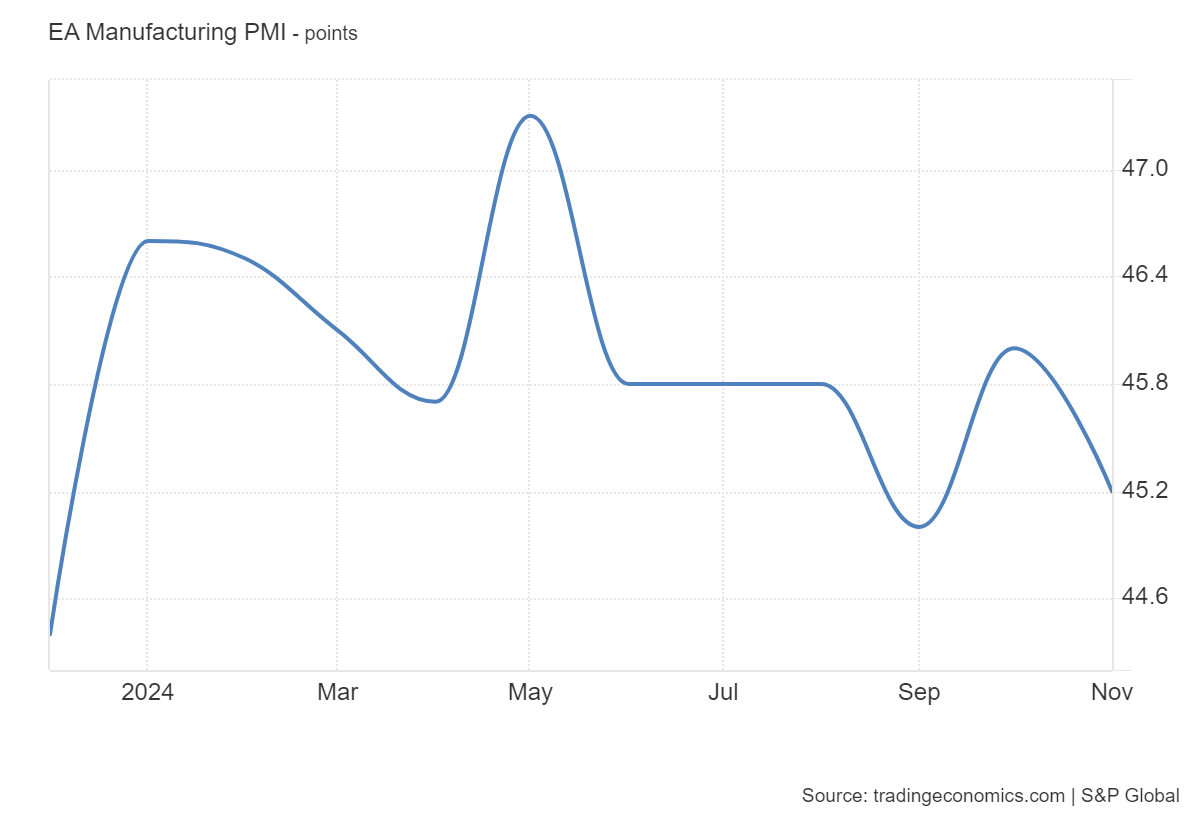

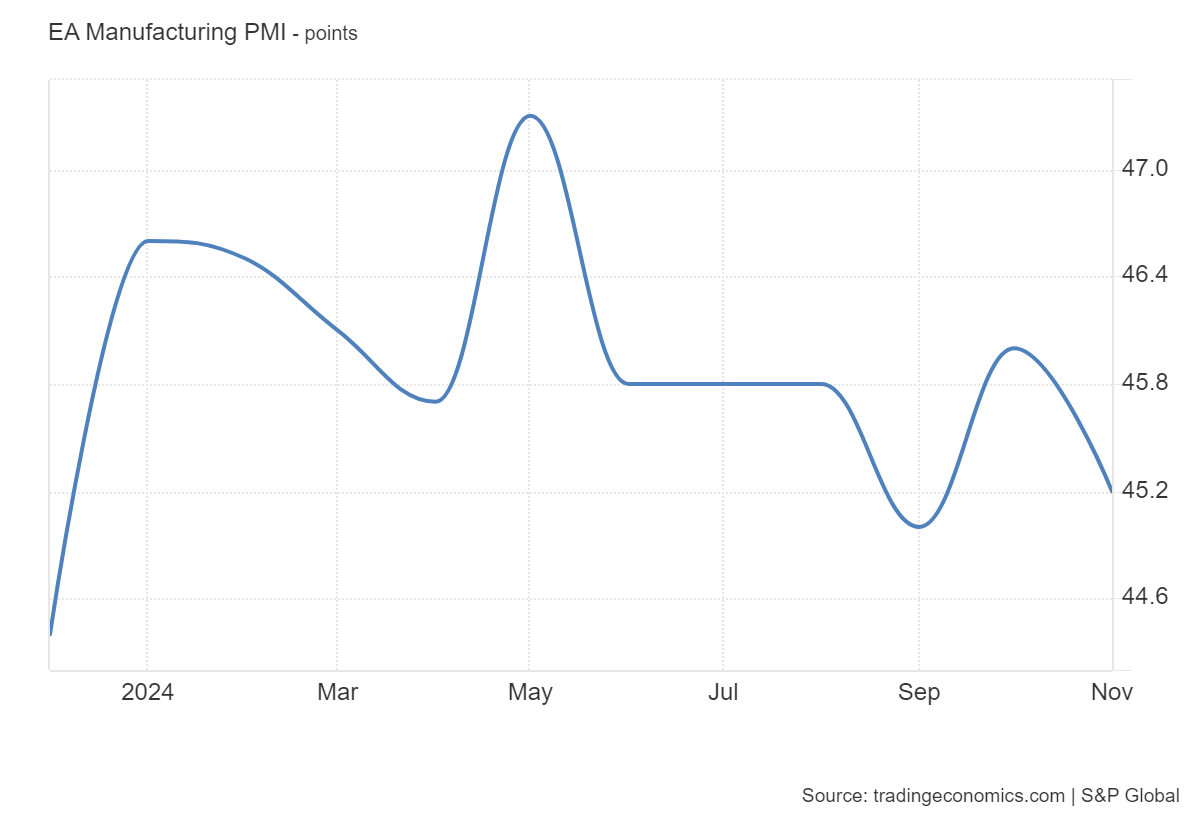

But that assumption seems overly optimistic after the latest monthly survey of purchasing managers showed that the manufacturing malaise is spreading to the services sector.Most analysts expect forecasts for 2025 to be lowered.

Inflation in the euro zone rose to 2.3% last month, and while still largely under control, analysts expect inflation to decline in 2024 and 2025.Forecasts for 2026 may still average 2%.Forecasts for 2027 will also begin to emerge.

A clear shortcoming of this round of forecasts is that it does not include potential trade conflicts with the United States and the fiscal impact of new governments in Germany and France.This can be solved by exploring alternatives-as the ECB has sometimes done in the past.

French Parliament is in turmoil

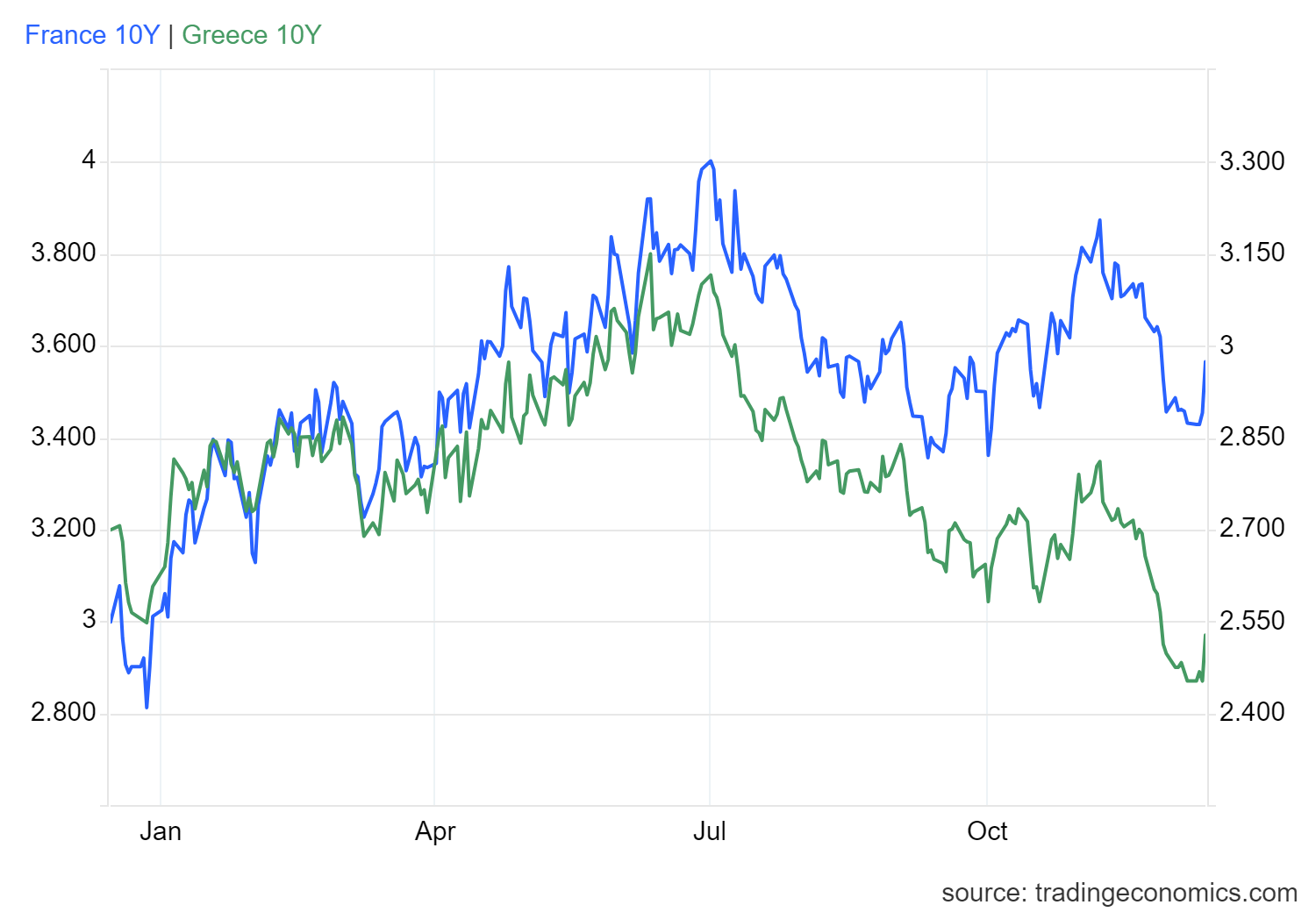

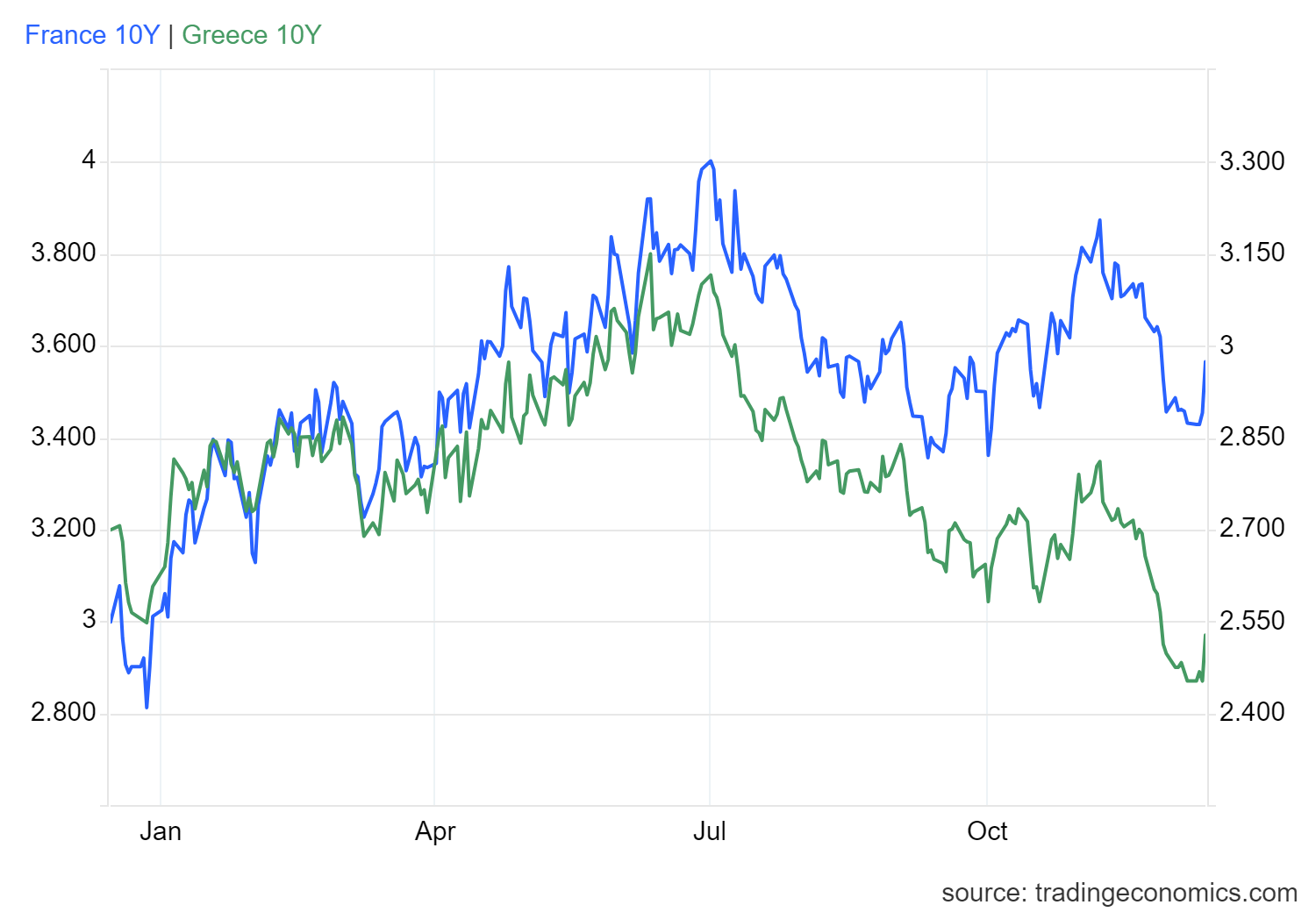

The failure of the French parliament to agree on a budget has caused new turmoil in the country's bond market, with yields once rising to Greece's levels.This has sparked speculation that the European Central Bank may use the emergency bond-buying facility it created in 2022.

Asked about the prospect, Bundesbank President Joachim Nagel said the tool was not designed to contain fluctuations that reflect political developments.If Lagarde raised the topic at a press conference, she might make similar points.

_1080837549_739.png)