Fed's September interest rate decision: unanticipated rate cut comes at a major inflection point in policy

The central bank's focus has shifted from "anti-inflation" to "job protection," and the logic of the market will change in the future.

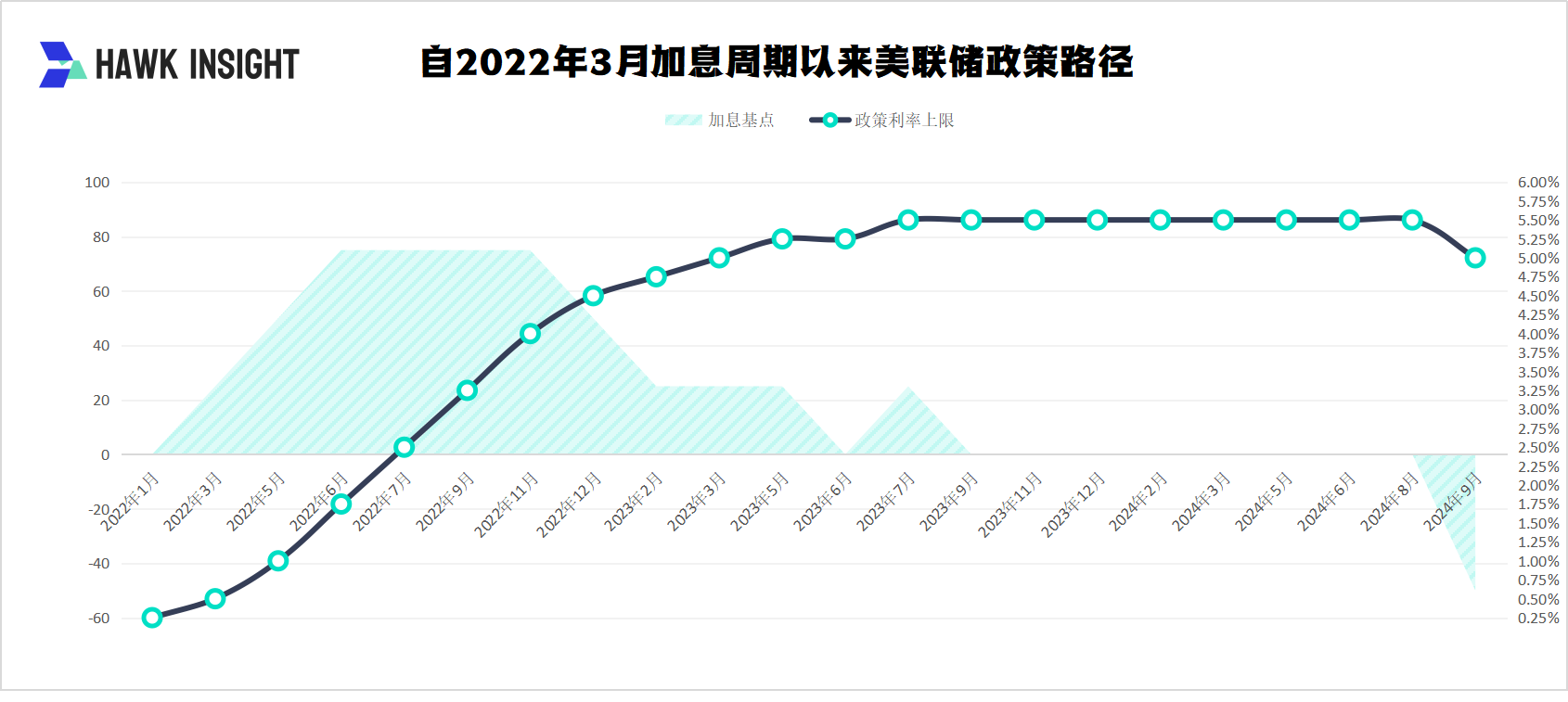

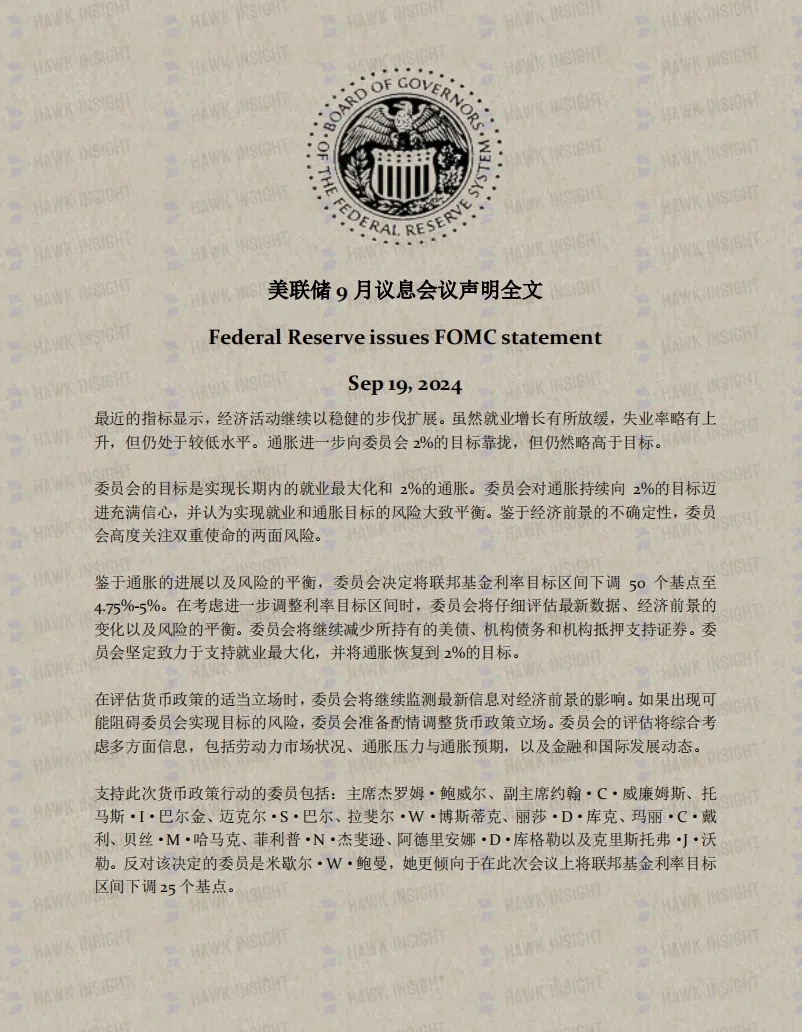

September 18th marked the day when the Federal Reserve officially began its rate-cutting cycle. According to the FOMC's interest rate decision, the Fed cut rates by 50 basis points in one go in September, exceeding market expectations and lowering the policy rate range to 4.75%-5.00%.

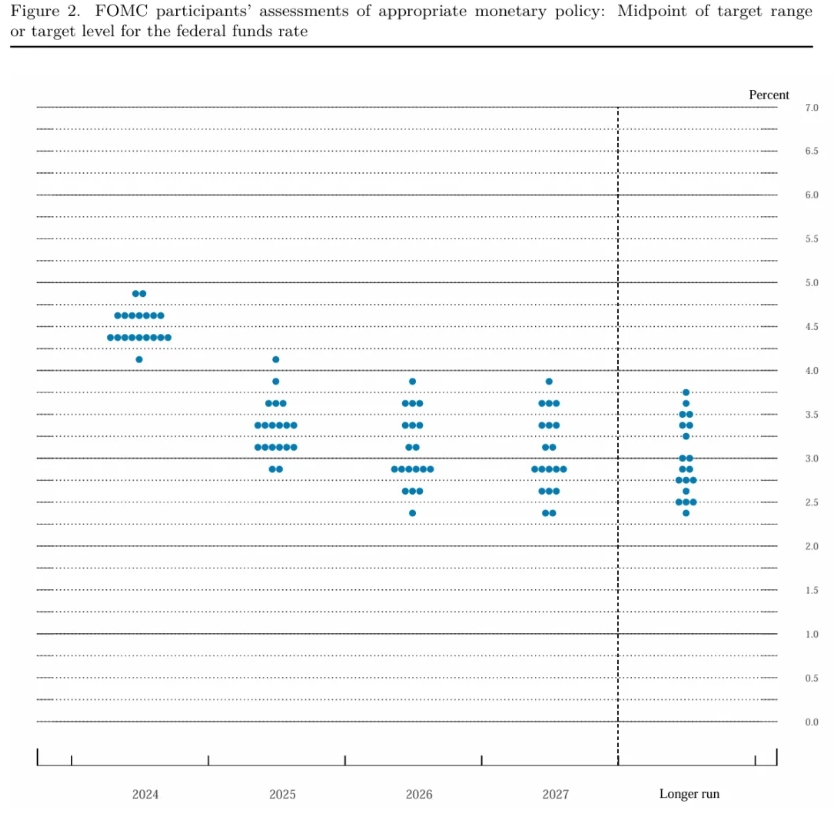

The subsequently released SEP dot plot also indicated that the Fed would make two more rate cuts within the year, each by 25 basis points (or one rate cut of 50 basis points), with the policy rate expected to be around 4.25%-4.5% by the end of the year.

The Fed's policy logic has changed

More fascinating than the outcome of the decision is the content of the decision itself.

This rate cut action has seen a significant change in the Fed's rhetoric, with the central bank's focus shifting from "fighting inflation" to "preserving employment," which will also change the logic of the future market:

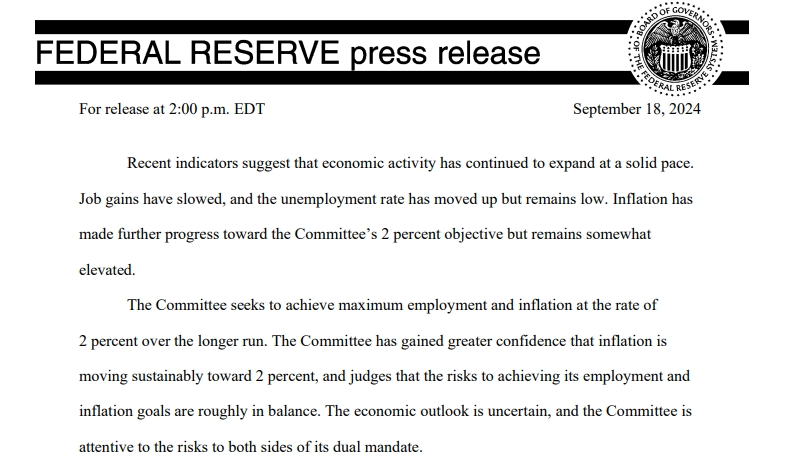

Regarding inflation, the Fed stated: It has gained greater confidence that inflation will continue to decline to 2%.

Regarding employment, the Fed stated that the pace of employment growth "has slowed," with the unemployment rate rising but still remaining low; the "Committee is firmly committed to" adding "supporting maximum employment," which is now on par with "restoring the inflation rate to the 2% target," and has prioritized the employment goal.

The Fed also announced that the risks to achieving the dual goals of employment and inflation are "roughly in balance," representing a change in policy logic and the arrival of an inflection point.

Analysts say that from the perspective of risk management balance, the Fed is clearly leaning towards growth risks, that is, the rise in the unemployment rate is more worrying to the Fed than inflation risks (including the risk of second-round inflation). Although there have been some negative changes in housing and core inflation in the inflation data for August, they are not enough to shake the Fed's current soft landing assumption. Analysts believe there is no need to worry too early before the occurrence of second-round inflation.

The Fed continues to move forward with its dual goals of "maintaining price stability" and "maintaining full employment."

Another highlight of this decision is the intense debate among the voting members.

Firstly, for the first time since September 2005, a voting member voted against the interest rate decision: Federal Reserve Governor Michelle W. Bowman, who preferred a 25 basis point rate cut at this meeting, rather than 50 basis points. It is worth mentioning that Bowman has always been one of the most hawkish spokespeople of the Fed, and she has always called for the existence of multiple upward risks in the inflation outlook, and that cutting the policy rate "too early or too quickly could lead to a rebound in inflation."

Secondly, there is the unusually fierce dot plot. The Fed expects to cut rates by another 50 basis points this year, but the situation is quite tense: 10 officials expect a rate cut of 100 basis points or more in 2024, while 9 officials expect a rate cut of 75 basis points or less in 2024. It is foreseeable that the two sides will continue to tug back and forth with the release of economic data in the future.

The SEP economic forecast summary also stated that the unemployment rate in 2024 is expected to be 4.4%, compared to 4.0% expected in June; the GDP growth rate in the United States in 2024 is expected to be 2.0%, compared to 2.1% expected in June; the core PCE inflation in 2024 is expected to be 2.6%, compared to 2.8% expected in June; the PCE inflation in 2024 is expected to be 2.3%, compared to 2.6% expected in June.

Dollar-denominated assets fluctuated sharply, and U.S. stocks fell from high levels

After the interest rate decision was announced, U.S. stocks, U.S. bonds, and gold rose in response to the unexpected rate cut.

The S&P 500 index once rose by about 1% during the session, the Dow Jones Industrial Average rose by about 375 points, and the Nasdaq 100 rose by more than 1.1%; the yield on 10-year U.S. Treasury bonds dived from above 3.69% to below 3.64%, turning negative for the day. The yield on two-year U.S. Treasury bonds dived from above 3.64% to below 3.54%; the gold price rose by about $20 in the short term, reporting $2,587.57 per ounce, approaching the historical highest level of $2,589.70 set on September 16. Spot gold continued to rise, breaking through the $2,590 per ounce mark, setting a new historical high, and rising by more than 0.7% for the day.

The dollar fell for a while: the U.S. Dollar Index fell by 40 points. The British pound rose to 1.3287 against the U.S. dollar, setting a new high since March 2022.

However, with Powell's hawkish expectations at the press conference, coupled with the unexpected rate cut causing concerns about the U.S. economic outlook, about 13 minutes after the statement was announced, U.S. stocks almost gave up all the gains that had just been announced after the rate statement, and U.S. Treasury yields also narrowed significantly.

Powell stated that the SEP economic forecast is just a process of "recalibration" of officials' policy positions, and he hopes that everyone will not overinterpret it. There is no sign in the SEP that the committee is in a hurry. The process of adjustment will evolve over time. We can speed up, we can slow down, and we can also pause, depending on the situation, but that is what we need to consider.

Powell also said that no one should think that today's 50 basis point rate cut is a new speed; the Fed will not stop shrinking its balance sheet, and balance sheet reduction can be carried out at the same time as rate cuts. He continued to say, "My personal view is that we will not return to the previous low-level neutral interest rates."

As of the close (about 40 minutes after the press conference), the three major U.S. stock indexes all ended in a decline; spot gold fell after rising, and after the press conference, it refreshed the daily low to $2,553.50, significantly lower than the historical high of $2,600.16 refreshed after the press conference began; the ICE U.S. Dollar Index returned to above 100.8.

The current actual federal funds rate is not real

Regarding the pros and cons of the market after a 50 basis point rate cut, Yardeni Research analysts said that it can bring benefits, including stimulating the needed economic fields, boosting consumer and business confidence, and benefiting the labor market. Both residential and commercial real estate (CRE) will be boosted, and CRE loans will be easier to refinance, thereby reducing the risk of a financial crisis in the industry. At the same time, loose monetary policy helps to increase job opportunities, thereby controlling the unemployment rate.

However, a 50 basis point rate cut will also bring disadvantages, as the stickiness of service industry inflation in the CPI is still strong, and there is still an upward risk of inflation. Excluding housing, the service industry inflation in August rose by 4.3% year-on-year. In particular, the proportion of rent inflation is relatively large, which indicates that it is too early for the Fed to declare the anti-inflation "mission accomplished."

On the other hand, there may be a shortage of skilled labor. Adolescents who have not received high school education are the reason for the continuous increase in the number of unemployed people. If the Fed cuts interest rates too quickly, it may lead to two results: increased demand for goods and services, and increased job vacancies.

Most importantly, the current actual federal funds rate is not real. Yardeni Research believes that the Fed stopped raising interest rates 14 months ago, representing its belief that interest rates are sufficient to reduce inflation to the 2.0% target. Powell often says that this goal can be achieved without causing a recession.

As inflation declines, the actual federal funds rate is rising, so the Fed's monetary policy will automatically become more restrictive, which may to some extent offset the effect of the rate cut.

Hawk Insight includes the full text of the Federal Reserve's September interest rate decision statement:

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.