U.S. May inflation data cooled across the board, igniting hopes of a rate cut

According to the dot plot released by the Federal Reserve yesterday, seven members support one rate cut this year, and eight members support two rate cuts this year.

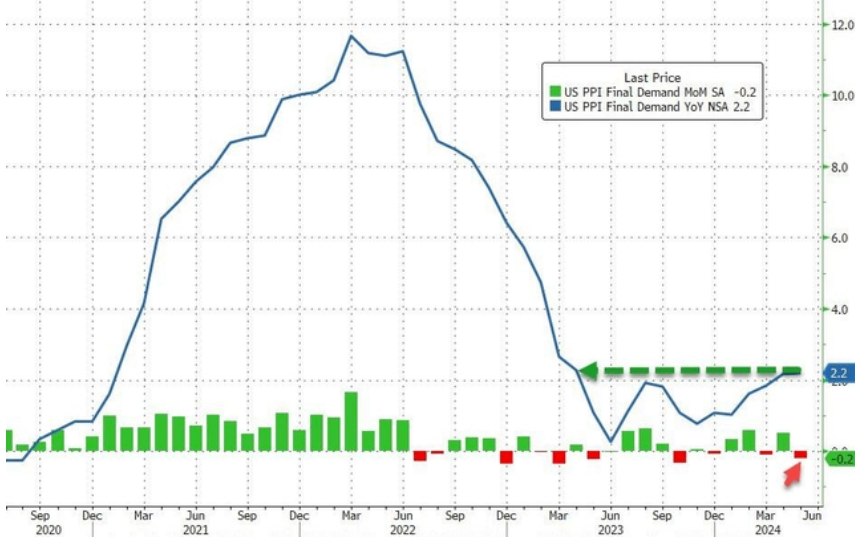

On June 13, the United States released the May PPI data. Due to a decrease in energy costs, the May PPI increased by 2.2% year-on-year, lower than the expected 2.5%, and decreased by 0.2% month-on-month, below the expected increase of 0.1%.

Excluding the volatile food and energy categories, the core PPI for May rose by 2.3% year-on-year, lower than the expected 2.4%, and showed zero growth month-on-month, below the expected 0.3%.

The unexpected drop in the May PPI data significantly boosted market confidence in a rate cut by the Federal Reserve. The previous day, the May CPI data also exceeded expectations, indicating an overall decline in May inflation data. Now, only the core PCE data, which is most important to the Federal Reserve, remains to be released. Experts predict that this data will record the smallest month-on-month increase since November last year.

According to Trading Economics' econometric model forecasts, combining global macro models with analysts' general expectations, the annual year-on-year change rate of the U.S. core PCE price index is expected to reach 2.60% by the end of this quarter. The core PCE year-on-year increase in December is expected to fall to 2.3%, better than the Federal Reserve's official forecast of 2.8%.

Swap market pricing shows that after the CPI and PPI data exceeded expectations, traders' bets on a 25-basis point rate cut in September increased to 65%, and the probability of a rate cut in December rose significantly to around 80%.

Alongside the U.S. PPI data, the initial jobless claims for last week were also released yesterday. The data showed that 242,000 people applied for unemployment benefits last week, the highest level since August last year. The elevated initial claims, combined with the not-so-good unemployment rate in May, suggest that the long-troubled job market is gradually cooling. The Federal Reserve may gain more confidence to cut rates this year.

After the data release, the market reignited enthusiasm for a rate cut. Spot gold surged $10 in the short term, the U.S. dollar index fell nearly 30 points in the short term, and the S&P 500 index futures and Nasdaq 100 index futures also saw further gains.

Regarding the recent economic data, Nationwide Mutual Insurance Co.'s Chief Economist Kathy Bostjancic said, "There is still a possibility of two rate cuts this year, expected to start as early as September, but Federal Reserve officials need data to comply with and enhance their confidence in rate cuts."

She continued, "Caution is understandable. They lean towards conservatism, but I believe the door to rate cuts is still open."

Pantheon Macroeconomics' Chief Economist Ian Shepherdson said, "Our comparison of the PPI and CPI data shows that the core PCE deflator in May only increased by 0.11%, far below the average month-on-month increase of 0.32% in the first four months of this year. Our forecast shows a significant downside potential for inflation."

Other Wall Street analysts also expressed that after the cooling of the CPI and PPI data, the core PCE index, which the Federal Reserve focuses on, will also perform well. According to Capital Economics' Chief North American Economist Paul Ashworth, the core PCE in May is expected to increase by only 0.11% month-on-month, lower than the 0.15% expected by Citi economists.

According to the dot plot released by the Federal Reserve yesterday, seven members support one rate cut this year, and eight members support two rate cuts this year. Federal Reserve officials will hold four more meetings this year, in July, September, November, and December. Analysts say that barring any surprises, the Federal Reserve will announce two rate cuts in September and December this year, each by 25 basis points, setting the year-end interest rate in the range of 4.75%-5.00%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.