High interest rates are weighing on the U.S. economy JOLTS job vacancies unexpectedly plummeted in April

The JOLTS data kicked off a series of US labor force data.

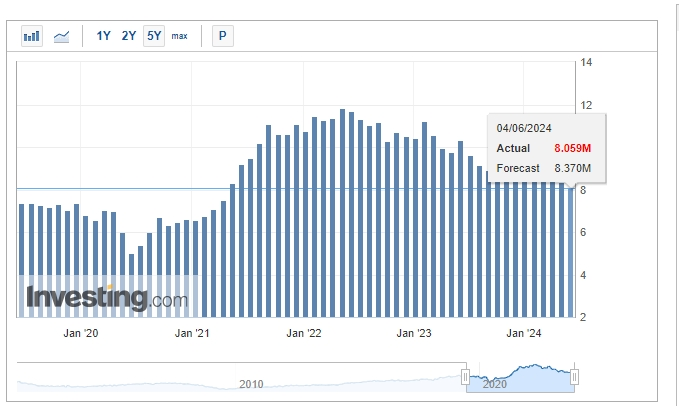

On June 4th, the U.S. Bureau of Labor Statistics reported that the number of job openings in the United States dropped to 8.059 million in April, the lowest level since February 2021. This figure was below the expected 8.35 million and fell short of all economists' estimates in media surveys. The previous value for March was revised down from 8.488 million to 8.36 million, indicating that the U.S. labor market is gradually cooling down.

From an industry perspective, the information technology sector saw the largest decline in job openings, decreasing by 1.3% for the month. Significant declines were also observed in job openings in the healthcare and leisure and hospitality sectors, which are major contributors to employment growth, falling by 0.8% and 0.6%, respectively. Notably, despite the drop in job openings, there was a slight increase in hiring, as well as in quits and resignations, suggesting that workers are confident in their ability to successfully change jobs.

Following the data release, the yield on the U.S. 10-year Treasury note fell by more than 6.6 basis points. The yield on the 2-year Treasury note briefly plummeted by over 2 basis points, hitting a new daily low and approaching 4.75%, with an intraday drop of more than 5.2 basis points. Spot gold maintained a decline of over 1%, stabilizing around $2,325 per ounce, having fallen to a daily low of $2,322.30 three minutes before the job openings data was released.

This JOLTS data marks the beginning of a series of U.S. labor market data releases. On Wednesday, the ADP employment data, often referred to as the "mini non-farm payrolls," will be released. Dow Jones expects the U.S. ADP to record 175,000 jobs in May, down from 192,000 in April. On Thursday, the U.S. will release its weekly initial jobless claims data. On Friday, the highly anticipated U.S. May non-farm payroll data will be released, with the market expecting an increase of 185,000 in non-farm payrolls and a stable unemployment rate.

Currently, Federal Reserve officials are closely monitoring the JOLTS report for signs of labor market weakness while seeking direction for monetary policy. Policymakers are becoming increasingly cautious, stating that they need more convincing evidence that the inflation rate is gradually returning to the central bank's 2% target before considering easing monetary policy.

However, the market is gradually becoming overwhelmed.

According to data released by the U.S. Department of Commerce on May 30th, the real Gross Domestic Product (GDP) of the United States grew at an annual rate of 1.3% in the first quarter of this year, revised down by 0.3 percentage points from the initial estimate. The Department of Commerce stated that the latest data primarily reflects a downward revision in personal consumption expenditures, which account for about 70% of the U.S. economy. Personal consumption expenditures grew by 2% for the quarter, revised down by 0.5 percentage points from the initial estimate, with durable goods consumption revised down by 2.9% to -4.1%.

On the other hand, the latest GDPNow forecast from the Federal Reserve Bank of Atlanta also revised down its prediction for second-quarter GDP growth, now expecting a 2.7% increase, down from the previous estimate of 3.5%.

According to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit, total household debt in the United States rose to a record high of $17.7 trillion. In the first quarter, approximately 6.9% of credit card loans were seriously delinquent (more than 90 days overdue), up from 4.6% a year earlier, marking the highest level since 2012.

Analysts believe that although the U.S. economy still appears resilient, the long-term impact of high-interest rates on businesses and residents presents a dilemma for the Federal Reserve when considering the timing of interest rate cuts.

Current market pricing indicates that the Federal Reserve is expected to make its first rate cut in September.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.