U.S. April Manufacturing PMI: The Market Finally Awaits Bad News

More seriously, the more challenging business environment at present has prompted companies to start cutting wages, and if not for the pandemic period, the magnitude of this reduction has not been seen since the global financial crisis.

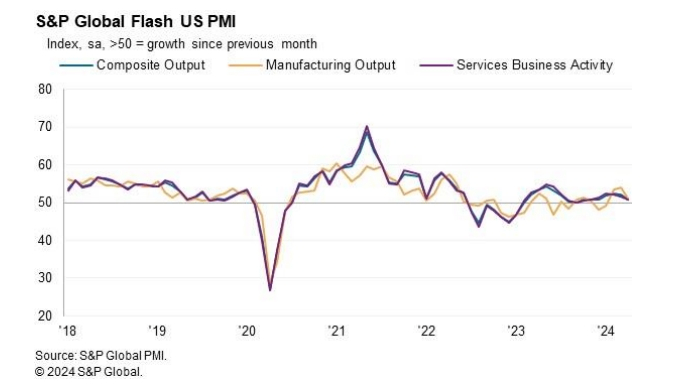

On April 23rd, the United States released the April Manufacturing PMI data, which was a big surprise. The data showed that the preliminary value of the U.S. April Manufacturing PMI was 49.9, significantly lower than the expected value of 52 and the previous value of 51.9 in March, below the boom-bust line, and the worst level since December 2023. The pressure of high interest rates in the U.S. is gradually becoming apparent.

The service sector, which contributes more to the economy, also performed below expectations, with a preliminary value of 50.9. Although still above the boom-bust line, it was clearly inferior to the expected value of 52 and the previous value of 51.7 in March, setting a new low in five months; the Composite PMI also fell by 1.2 points in a single month, with a preliminary value of 50.9, also lower than the expected 52 and the previous value of 52.1, marking the largest drop since August last year.

In terms of secondary data, new orders in the U.S. manufacturing sector decreased comprehensively for the first time in nearly six months; companies' response measures included reducing the number of employees for the first time in nearly four years; and business confidence fell to the lowest level since November last year. The above data also indicates that the U.S. economy is under pressure.

It is worth noting that against the backdrop of widespread slowing inflation in the second quarter, the inflation of input costs in manufacturing has actually reached a new high in nearly a year. Some service providers have frankly stated that the double blow of rising interest rates and increasing prices has severely suppressed economic demand this month. Analysis suggests that this may be a signal that the Federal Reserve no longer needs further interest rate hikes to curb inflation and economic activity.

After the data was released, it severely undermined expectations for the U.S. to maintain high interest rates. U.S. Treasury bonds were very popular, with prices soaring during the trading day, and yields turned downward, with the benchmark ten-year Treasury yield quickly falling below 4.60%, and the two-year Treasury yield, which is sensitive to interest rates, did not continue to hover around 5.0%. The U.S. dollar index fell.

Regarding this data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said that the U.S. economy has lost momentum at the beginning of the second quarter, and the April PMI survey shows that business activity growth is below the trend. There may be more momentum lost in the coming months, as the inflow of new business in April saw a decline for the first time in six months, and due to intensified concerns about the outlook, companies' expectations for future output have fallen to the lowest point in five months.

He also pointed out that more seriously, the more challenging business environment at present has prompted companies to start cutting wages, and if not for the pandemic period, the magnitude of this reduction has not been seen since the global financial crisis.

Williamson believes that the deterioration of demand and the cooling of the labor market have led to a decrease in price pressures: the increase in the prices of goods and services sold in April has shown a welcome slowdown. It is worth noting that the drivers of inflation have changed. The manufacturing sector has seen higher price increases in three of the past four months, and the factory cost pressure in April intensified due to rising prices of raw materials and fuel, which contrasts sharply with the price pressures dominated by wage-related services for most of 2023.

On May 1st, the Federal Reserve will hold a new round of interest rate meetings, and the market believes that the bank will continue to maintain interest rates at 5.25%-5.50%. Last week, several officials avoided signaling at least one interest rate cut this year, and the market interpreted this move as a sign that monetary policy will remain resilient for a longer period.

At present, the Federal Reserve's response has triggered a chain reaction in hedging tools: traders in the U.S. interest rate market have begun to bet that the Federal Reserve will not cut borrowing costs this year. Before the Federal Reserve's decision on May 1st, traders have established option positions related to the Secured Overnight Financing Rate (SOFR), aiming for officials to keep interest rates stable after the December policy meeting. Some more aggressive bets also hedge the possibility of the central bank raising interest rates again in 2024.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.