Divergent views within the Fed Bowman's speech spooked the market gold plunge

In the question-and-answer session after the speech, Bowman's speech was even more shocking.

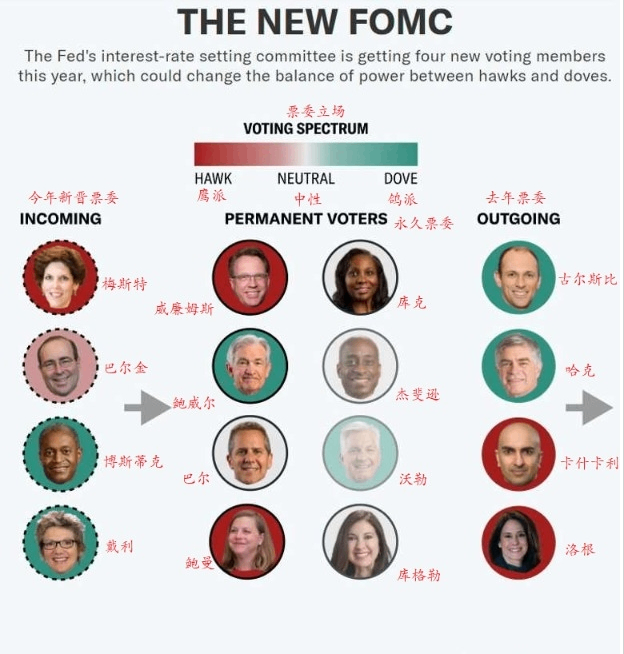

Fed officials are going to "fight."

On June 25, two Fed officials spoke out and gave diametrically opposed predictions of the Fed's rate cut.

First, Fed Governor Cook (who has permanent voting rights and is neutral) gave a moderate view.She said in an unusual event at the Economic Club of New York that with significant progress on inflation issues and a gradual cooling of the labor market, it would be appropriate for (the Fed) to lower the level of policy restrictions at some point to maintain a healthy balance in the economy.

Cook said: "Over the past year, inflation has slowed and labour market tensions have eased, so the risks of meeting our inflation and employment targets have tended to be better balanced.But Cook declined to say when the Fed would be able to act, saying that knowing the exact level of the neutral rate is not an important factor in real-time decision-making.

On hiring, the Fed governor said: "Many indicators suggest that the job market is roughly in its pre-epidemic state - tense but not too hot.Cook also said in his speech that the financial system "has some vulnerabilities, but there are also important resilience factors," and overall, the financial system does not appear to "unusually amplify" any shocks.

Overall, Cook's remarks were neutral to dove.She noted the slowing trend in U.S. inflation and expressed confidence in the U.S. financial system.She said: "Our current policy is ready to respond to any changes in the economic outlook as needed."

Interestingly, then, Fed Governor Bowman (a permanent voting, hawkish) came to the stage and came to a very different conclusion than Cook.

Bowman first reiterated her view that keeping policy rates stable "for a period of time" may be sufficient to control inflation, "but she also reiterated her willingness to raise borrowing costs if necessary.In a prepared speech in London, Bowman said: "US inflation remains high and I still see some upside inflation risks affecting the outlook."

A representative of the Fed's hawks, Bowman made no mention of further rate cuts in his economic forecast statements for most of the year.In her speech in London, Bowman first reiterated her view that keeping policy rates stable "for some time may be sufficient to control inflation," but she also reiterated her willingness to raise borrowing costs if necessary.

Bowman said: "U.S. inflation is still high, I still see some upside inflation risks affecting the outlook," suggesting that the Fed's path to cut interest rates is not smooth, has been quite hawkish.Then, in the question-and-answer session after the speech, Bowman's speech was even more shocking.

Asked to confirm there would be no reduction in borrowing costs for the rest of the year, Bowman agreed.She said: "Yes, that's still my opinion.I did not write about further rate cuts in my economic forecast statement for most of this year.Bowman believes that the Fed will not have any interest rate hike in 2024, and the central bank may postpone the rate cut until 2025.

Bowman's remarks shook the market: spot gold fell 0.63% on Tuesday, hitting a one-week low of 2315.58 during the session, and closed at 2319.36 USD/ounce; the dollar rose 0.2%, closing at 105.63; the 10-year US Treasury yield also edged up.

In response to the comments of the two officials, Jayati Bharadwaj, a global currency strategist at TD Securities in New York, said: "If you listen to Fed officials, they are very taboo to make a big fuss about a weak report, because overall, the data we have been getting since the beginning of the year is still very strong."

He continued: "They sound very reluctant to take a stand, and.Also very data-dependent, as the US inflation outlook is more uncertain than the rest of the world."

At present, from the latest US inflation data in May, the core CPI, which excludes food and energy prices, is up only 0.16%, the smallest gain since August 2021.While core inflation is well above pre-epidemic levels, this does not affect market expectations that the Fed will cut interest rates in September.The analysis said the U.S. is expected to receive weaker economic growth, labor market and inflation data in the future, giving the Fed the opportunity to cut interest rates sharply if necessary, thereby easing downside risks to the economy.

And from recent data, U.S. consumer confidence, job vacancies and inflation data have all been weak to varying degrees, and high interest rate pressures in the U.S. are emerging.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.