Is ACY Securities Reliable? How Is the User Experience?

ACY Securities is an online brokerage company based in Australia. It supports popular trading platforms such as MT4 and MT5, which provide traders with robust chart analysis tools, indicators, and automated trading features.

Introduction to ACY Securities

ACY Securities is one of the fastest-growing multi-asset online trading providers in Australia, headquartered in Sydney. Since its establishment in 2011, the company has leveraged keen market insights, effective demand management, customer-oriented advanced technology, and comprehensive educational resources to help more institutional participants and retail traders engage in the ever-evolving financial derivatives industry.

By providing a high-quality trading environment, precise market analysis, and customizable educational training, ACY Securities helps clients become better traders. It offers fast execution with latency below 30 milliseconds and is a provider of multi-asset CFDs, including stocks, forex, commodities, indices, and ETFs. A variety of trading tools are available, such as daily analyses, trading ideas, and educational resources, supported by deep liquidity quotes from 16 global top banks.

Security of ACY Securities

ACY Securities is a multi-regulated financial derivatives broker, holding financial service licenses in Australia (ASIC: AFSL 403863) and Vanuatu (VFSC: 012868). As a financial service provider, ACY Securities adheres to strict regulatory requirements, including capital management and audits.

- Fund Segregation: All traders' funds are held in fully segregated trust accounts at the Commonwealth Bank. Traders' funds are separate from ACY Securities’ funds, ensuring they are not used to repay creditors in case of bankruptcy.

- Convenient Deposits and Withdrawals: To ensure the safety and proper use of traders' funds, ACY Securities offers various deposit and withdrawal methods, including credit cards, bank transfers, and international transfers.

- Professional Indemnity Insurance: ACY AU and ACY LLC provide professional indemnity insurance for their traders, complying with ASIC's regulatory guidelines.

- Anti-Money Laundering Regulations: In accordance with international anti-money laundering laws, ACY Securities requires all traders to provide complete and accurate identity and address proof when opening a real trading account. Accounts used for deposits and withdrawals must match the account holder’s name, with no third-party transactions allowed.

Account Types at ACY Securities

ACY Securities offers Standard, ProZero, and Bespoke accounts, allowing traders to choose the account that best suits their trading style.

- Standard Account: Supports flexible trading strategies in the global CFD market with quotes from 16 liquidity providers, avoiding conflicts of interest between clients and brokers.

- ProZero Account: The most popular account type, featuring a rich set of functionalities and a stable trading environment, offering zero spread trading. For traders, a single-sided trade costs only $3, reducing investment costs.

- Bespoke Account: Designed for professional traders, offering ultra-low trading costs, high-quality service, and customized pricing. Spreads start from 0, with single-sided trades beginning at AUD 2.5 per lot, benefiting from low-latency execution and tight spreads through ACY’s connection to Equinix NY4 in New York.

The three account pairs are shown in the following figure.

| Standard | ProZero | Bespoke | |

|---|---|---|---|

| Initial Minimum Deposit | $50 | $200 | $10,000 |

| Minimum Trading Lot Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Spreads From | Floating | 0.0 | 0.0 |

| Commission | Zero | $3/lot | $2.5/lot |

| Leverage Up To | 500:1 | 500:1 | 500:1 |

| Global Stocks | MT5 | MT5 | MT5 |

Account Opening Process for ACY Securities

The account opening process at ACY Securities is straightforward. Click "Open an Account Now!" or scan the QR code below for exclusive new user gifts from Hawk Insight!

Step 1: Visit ACY Securities' Official Website

- On the homepage, find and click the "Open an Account" button.Visit ACY Securities official website

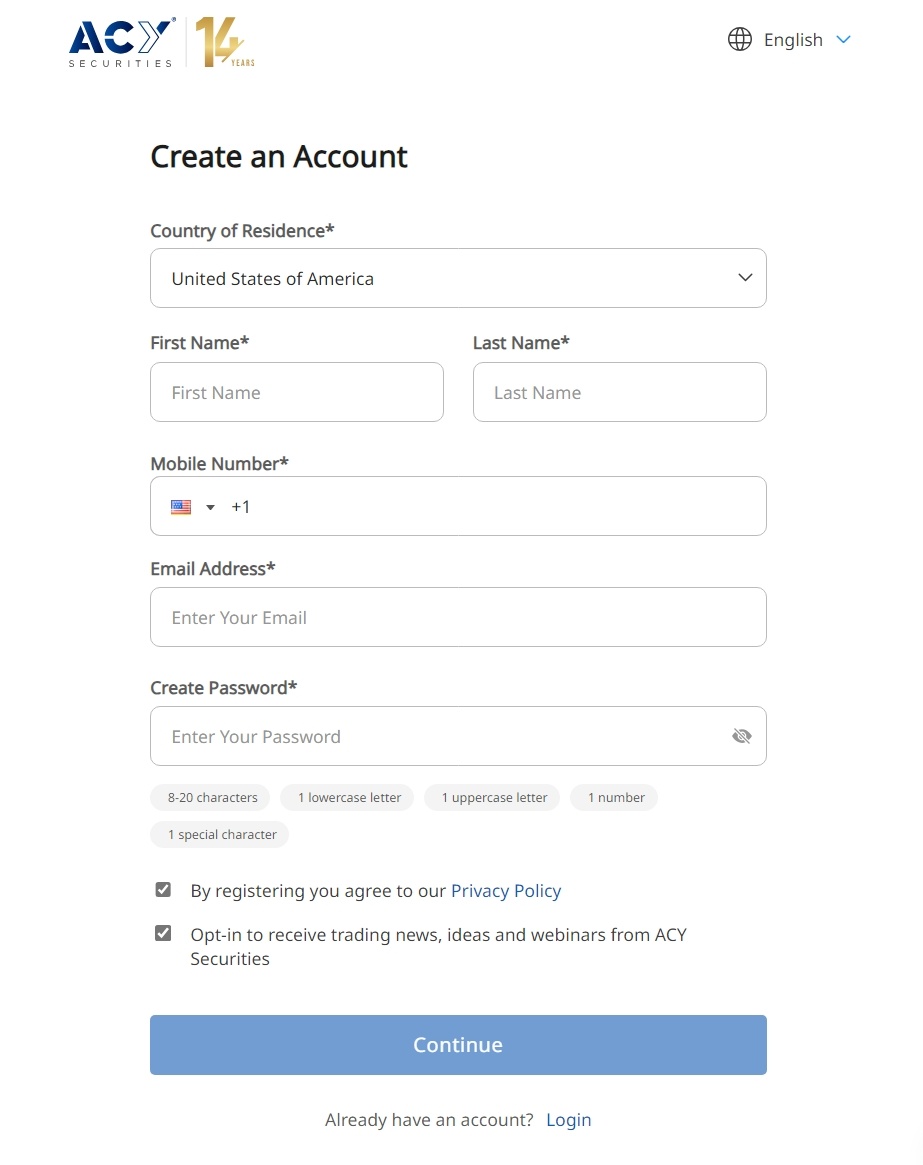

Step 2: Fill in Registration Information

- On the registration page, enter basic information, including your name, email address, phone number, and a strong password (with letters, numbers, and special characters).

- Confirm you are over 18 and agree to the terms and privacy policy before clicking "Continue."

Step 3: Email Verification

- After registration, ACY Securities will send an email containing your trading account and backend management login details.

- You can click on the background management on the left side of the official website to enter the background for operations such as entering and leaving gold.。

Step 4:Login to Your Real Account

- Open the MT4 platform, select ACYFX-Live server, and log in.

Step 5:Backend Operations

- In the backend, you can view fund status, transaction history, and client information.

Notes

- Ensure that the information provided is true and valid, so as not to affect subsequent transactions and withdrawals.

- Personal information fill in the bank statement requirements:. Clear website; Apply for the full name of the bank; Client's full name, gold card number.

ACY Securities Deposit and Withdrawal

Deposit Process

Click on "Funds" in the dashboard, then click on "Deposit Funds" on the next page to display options for bank transfers and UnionPay.

The deposit process at ACY Securities is convenient, with multiple currency options and a clear, transparent fee structure. ACY Securities does not charge any fees for deposits made via bank transfer. However, if the deposit is made from outside Australia, the bank may charge international payment fees, which vary by bank. The available deposit methods are shown below:

| Method | Applicable Region | Currency Type | Minimum Deposit | Maximum Deposit |

|---|---|---|---|---|

| China UnionPay 5 | China | RMB | $100 | $7,000 |

| China UnionPay 7 | China | RMB | $300 | $5,300 |

| QR Code Payment | China | RMB | $100 | $1,300 |

| Visa/Master | Global | Various Currencies | $50 | $50,000 |

| Visa/Master - JPY | Japan | JPY | ¥500 | ¥500,000 |

| PayTrust | Indonesia, Vietnam | IDR, VND | $50 | $10,000 |

| FPX Bank Transfer | Malaysia | MYR | $50 | $10,000 |

| DragonPay | Philippines | PHP | $50 | $15,000 |

| THB QR Payment | Thailand | THB | $50 | $50,000 |

| Bank Wire | Global | Various Currencies | $50 | N/A |

| FASA | Indonesia | USD | $50 | N/A |

| Cryptocurrency | Global, excluding Australia | USDT ERC-20, USDT TRC-20, BTC, ETH | $50 | $50,000 |

| USDT | Global, excluding Australia | USDT ERC-20 | $1,000 | $50,000 |

| USDT | Global, excluding Australia | USDT TRC-20 | $200 | $50,000 |

| Skrill | Global | Various Currencies | $50 | $150,000 |

| Perfect Money | Global | USD, EUR | $50 | $50,000 |

| Neteller | Global | USD, EUR | $50 | $50,000 |

| SticPay | Global | USD, EUR | $0 | N/A |

| Bitwallet | Global, excluding Australia | JPY, USD, EUR, AUD | $50 | $50,000 |

Withdrawal Process

Log in to the client portal, go to fund management, click on "Withdraw Funds," and fill out the withdrawal request.

Notes:

- The minimum withdrawal amount is $50. Receiving banks may charge certain fees. Exchange rates fluctuate in real time, and the actual transfer rate will be based on the rate at the time of the transaction.

- Third-party transfers are not accepted; the recipient's name must exactly match the account holder's name.

- UnionPay withdrawals are fee-free for the first 5 transactions each month; thereafter, a fee of $25 per transaction applies. The withdrawal limit for UnionPay is 150,000 RMB per day. Wire transfer withdrawals incur a fee of $25 per transaction.

- Withdrawals will be processed within two business days. Once executed, UnionPay withdrawals may arrive on the same day, while wire transfers may take 2-5 business days.

- If there are open positions, the withdrawal request cannot be executed; please close positions before applying. If you open a position before the withdrawal request is executed, the request will be canceled.

ACY Securities Trading Platform

ACY Securities offers the traditional MetaTrader 4 and MetaTrader 5 platforms, including mobile and web versions, allowing traders to trade anytime, anywhere. ACY Securities also provides the LogixTrader platform, which offers a seamless trading experience without the need for downloads or installations, accessible from any device.

MT4

MT4 provides traders with a wide range of features, including advanced charting, automated trading, and fully customizable dynamic dashboards. Traders can access up to 110 CFD products on ACY Securities' MT4 platform, including forex, indices, commodities, gold, and cryptocurrencies. Available on computers, phones, tablets, etc.

- Real-time Quotes: Get real-time quotes from 16 global banks for trading 40 currency pairs, precious metals, and crude oil CFDs.

- Allow Micro Trading: Minimum trade size of 0.01 standard lots or micro positions allows traders to test strategies or enter the forex market with minimal exposure.

- Advanced Charts and Technical Indicators: Click a button to access 9 timeframes and 40 technical analysis indicators, providing great flexibility in global market trading.

- One-Click Trading: MT4 offers one-click trading for forex traders and supports EA trading.

- Customizable MT4 Settings: MT4 can be edited and set according to individual trading styles; traders can create trading templates, set files, and orders.

MT5

MT5 is the advanced version of MT4, regarded as the most popular trading platform for global forex traders. MT5 not only operates faster and with more robust features but also offers real-time quotes and trading for all financial products, including stocks, forex, indices, commodities, and cryptocurrencies.

- Flexible Order Volume: Minimum trade size of 0.01 standard lots or micro positions enables strategy testing or entry into the forex market with minimal exposure.

- Market Depth: MT5 allows traders to view complete market depth directly from liquidity quotes.

- Advanced Tools: Traders can hedge current positions, query parts of orders, view complete market depth, and choose from a wider variety of pending order types.

- Free Tools: The MT5 platform offers 21 timeframes, allowing users to trade, analyze, and view history conveniently.

- Automated Trading and EAs: The combination of MT5 with ACY Securities' deep liquidity means it is suitable for all EA trading and high-volume traders. MT5 uses the MQL5 coding language, enabling traders to easily automate systems.

LogixTrader

LogixTrader is an innovative trading platform designed by ACY Securities, offering a seamless cross-device web trading experience.

- Seamless Web Trading Platform: Trade easily anytime, anywhere without installation.

- User-Friendly Interface: Designed for beginners with a clean, easy-to-use interface for quick onboarding.

- Built-in Economic Calendar: Stay updated with real-time economic events and the latest trends.

- Reliable Risk Management: Ensures stop-loss and take-profit orders are executed without slippage and without additional fees.

- Dynamic Margin: Adapts margin based on trading volume to assist small capital trading.

- More Intuitive Trading Units: Trades can be conducted in more intuitive units and points, simplifying the complexity of traditional lots and allowing flexible risk control.

ACY Securities Trading Products

ACY Securities offers over 60 products, including forex, precious metals, stock indices, and commodities. Their main spreads start from 0.1, with maximum leverage of up to 500:1, providing the possibility of high-leverage trading. On the MT4 and MT5 trading platforms of ACY Securities, traders can access and trade popular financial products such as forex (FX), commodities, gold, oil, ETFs, and various precious metals.

Stock CFDs

ACY Securities provides access to over 2,200 stocks for trading, including those listed on the New York Stock Exchange, NASDAQ, and the Australian Securities Exchange. Traders can leverage their positions for short-term or long-term trading, and using stock CFDs can also diversify their portfolios.

-

Leverage Trading: When trading stock CFDs at ACY Securities, traders can utilize leverage, allowing them to trade with less capital.

-

Two-Way Trading: Unlike traditional stock trading, trading stock CFDs allows for both buying (long) and selling (short), providing more market opportunities.

-

Market News-Based Trading: Investments can be made based on the latest market news about companies of interest.

ETF CFDs

ETF funds are financial products that track the performance of top companies within specific industries (such as oil, technology, or energy). Trading ETF CFDs allows traders to open positions with leverage and increase trade sizes. You can start trading ETFs on the ACY MetaTrader5 platform with just $50.

-

Portfolio Diversification: Trading ETF CFDs enables diversification across various asset classes, with multiple ETF products available.

-

Leverage Trading: When trading ETFs at ACY Securities, leverage can be used to trade with less capital.

-

Going Long or Short: Unlike trading regular ETFs, trading ETF CFDs allows for both buying (long) and short selling (benefiting from price declines), providing more market opportunities.

-

Variety of ETF CFDs Available: ACY Securities offers trading services for the most popular ETF products, such as SPDR S&P500 ETF Trust, VanEck Vectors Gold Miners, Proshares UltraPro Dow30, Proshares Ultra S&P500, Vanguard Select Sector, and United States Oil.

Forex

ACY Securities provides over 60 forex products, covering the world's largest financial markets, with a daily trading volume of up to $7.5 trillion.

-

Low-Cost Trading: The ProZero account offers deep liquidity with spreads starting from 0 pips, while the commission for each side of the trade is as low as $2.50.

-

Over 60 Currency Pairs: Trading services include more than 60 currency pairs, covering major pairs, cross-currency pairs, and emerging market currencies.

-

Global Trading: The forex market is a truly global market, where economic, political, and regulatory trends can affect currency movements. With ACY Securities, traders can trade all major currencies worldwide.

-

24-Hour Market: The market is open for trading 24 hours a day, five days a week, allowing investors to participate in market fluctuations at any time.

Commodities

Commodity CFDs are one of the most liquid and actively traded asset classes globally, with products like WTI, Brent oil, copper, and aluminum available for trading at ACY Securities.

-

Low Trading Costs: You can start trading with just $50, with a minimum trade size of 0.01 lots, allowing entry into the global market with a small amount of capital.

-

Ultra-Low Spreads: Spreads are low, with fast execution; WTI oil spreads start as low as $0.034.

-

No Physical Delivery: Trading commodity CFDs allows you to take positions reflecting the underlying futures market without worrying about physical transactions.

Index CFDs

Index trading remains one of the most frequently traded products worldwide. At ACY Securities, you can trade indices such as the S&P 500, Dow Jones, NASDAQ, German DAX, FTSE 100, Euro Stoxx 50, Hang Seng 50, Nikkei, China A50, and ASX 200.

-

Continuous Trading: Most global indices remain open for trading outside normal market hours. Due to different time zones, there are almost 24-hour trading opportunities.

-

Leverage Trading: Index CFDs are traded on margin, allowing traders to open positions with only a small portion of the trade size, with leverage of 100:1 available for major index trades.

-

Two-Way Trading: The ability to trade index CFDs in both directions is appealing to all traders. Regardless of whether prices rise or fall, profits can be made, allowing for hedging with index products or following market trends.

Futures

With ACY Securities' futures CFDs, you can trade across forex, energy, and commodity futures products.

-

Quarterly Contracts Without Automatic Rollovers: Futures CFDs have specific expiration dates, allowing traders to adjust strategies based on market dynamics. Futures CFDs do not automatically roll over and settle on the specified expiration date.

-

No Overnight Fees Advantage: Futures CFDs are only available on standard accounts, providing the advantage of not having to pay overnight fees, suitable for those wishing to avoid such costs. Additionally, futures spreads are consistent with standard accounts, ensuring consistency and transparency for each trade.

-

Hedging Market Volatility: Managing risk by offsetting one position's profit against another's loss, establishing a more resilient balanced trading strategy.

-

Ultra-Low Spread Cost Advantage: Ultra-low spreads offer a cost advantage, with ACY Securities providing transparent pricing that minimizes cost impacts and maximizes trading returns.

Precious Metals

Precious metals are among the most volatile trading products in the global financial market. At ACY Securities, traders can invest in precious metal CFDs (such as gold, silver, and platinum) using their trading insights and strategies.

-

Strong Liquidity: Strong liquidity connects to international markets, allowing for risk diversification or market fluctuation following to achieve value preservation and appreciation.

-

Leverage Trading: Self-adjustable leverage allows traders to control their risk levels.

Frequently Asked Questions

Can I trade futures CFDs with a Standard Account or ProZero Account?

- Traders can only trade futures CFDs with a Standard Account.

Does ACY Securities provide negative balance protection?

- Yes. If an account balance goes negative, ACY Securities offers negative balance protection, ensuring that the maximum loss does not exceed the total deposit amount.

When will I receive a margin call notification?

- The trading platform automatically sends alert notifications when a trader's margin level reaches 100 per cent or lower. The margin percentage is the last number on the balance bar at the bottom of the platform, and if it drops below 50 per cent, the platform will trigger an automatic close-out feature.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.