Ali to Lazada at the time of Southeast Asian e-commerce competition.$3.4 billion

Recently, Southeast Asian e-commerce Lazada received another 6.$3.4 billion in capital。Since 2023, Ali's total capital injection into Lazada has exceeded $1.8 billion.。

Recently, Southeast Asian e-commerce giant Lazada received another 6 from its parent company Alibaba Group (hereinafter referred to as "Ali")..$3.4 billion in capital。It is understood that the funds were provided by Ali at the time of the evaluation and adjustment of the group's strategy.。

1.8 billion a year, why does Lazada "suck money" Ali?

Founded in 2012, Lazada is headquartered in Singapore and has significant operations in six countries in Southeast Asia (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam).。

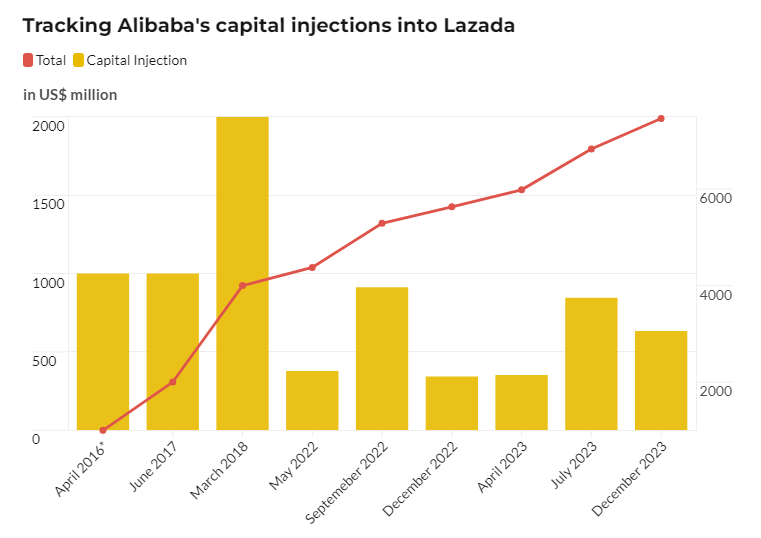

In 2016, Ali spent $1 billion to take a controlling stake in Lazada, and since its acquisition, Lazada has continued to receive capital injections from Ali, making it its main e-commerce platform in Southeast Asia.。

Looking back at Ali's capital injection into Lazada, in 2017, Ali spent $1 billion to increase its stake in Lazada from 51% to 83%; in 2018, it again increased its stake in Lazada by $2 billion.。In the following three years, 2019, 2020 and 2021, that is, during the tenure of the three CEOs of Peng Lei, Pierre Poignant and Li Chun, Ali did not inject any more capital into Lazada.。

Until 2022, Ali injected a total of $1.6 billion into Lazada in three installments, including 3 in May 2022..US $782.5 billion, September 2022.US $12.5 billion, 3 in December 2022.$42.5 billion。This year, Ali has injected more than $1.8 billion into Lazada.。So far, Ali has injected more than $7.4 billion into Lazada over the years.。

Heat climbs, can Ali stand out?

The capital injection coincides with the fierce competition in the e-commerce industry in Southeast Asia, the major cross-border e-commerce platforms have poured into the market, in addition to the mainstream platforms in Southeast Asia Lazada, Shopee (belonging to SEA), TikTok (belonging to ByteDance), Temu (belonging to Duoduo) and other rookies are also eyeing the market.。Earlier, TikTok invested $1.5 billion in Indonesia's GoTo's Tokopedia (e-commerce division) to revive its online shopping business.。SEA also announced plans to increase investment in its live e-commerce business.。

Industry insiders said that with more and more new cross-border e-commerce into the market, Lazada is facing increasingly fierce competition in Southeast Asia, coupled with the economic slowdown in Southeast Asia and inflation and other adverse factors, it is also facing increasing challenges.。

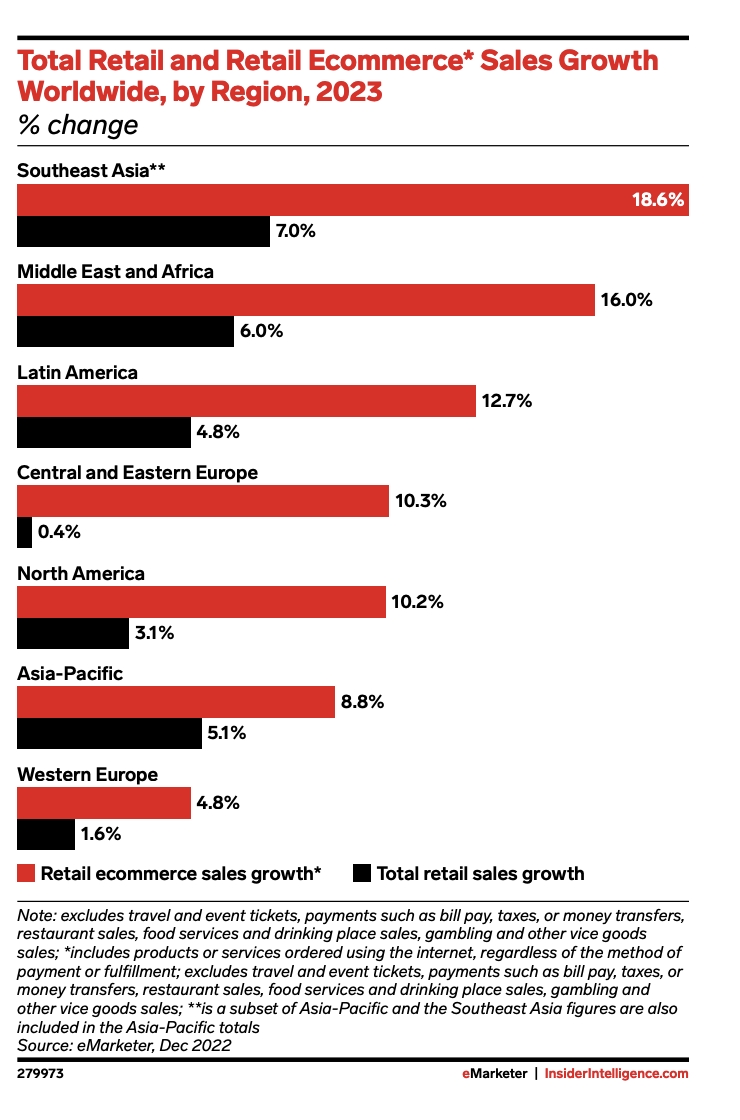

Southeast Asia is one of the most potential e-commerce markets in the world。According to the "2023 Global Retail E-commerce Forecast Report" released by market research firm Insider Intelligence, the Southeast Asian e-commerce market is expected to reach $113.9 billion in revenue by 2023 and its e-commerce sales will grow by 18% in 2023..6%, far more than the global electricity supplier 8.9% average growth rate。

In March this year, Ali announced organizational changes and established Ali International Digital Business Group, which is responsible for overseeing overseas markets including Lazada.。It is not difficult to see that Ali is betting heavily on cross-border e-commerce business in Southeast Asia and attaches great importance to Lazada。

Ali's third-quarter results show that Ali's revenue from the international commercial retail business was 189.7.8 billion yuan, up 73% year-on-year。During the period, Ali's overseas retail revenue hit a record high, mainly due to the strong performance of major retail platforms such as AliExpress, Lazada and Trendyol, which led to an overall increase of about 28% in orders for Ali International Digital Business Group's retail business year-on-year.。

As one of the largest e-commerce platforms in Southeast Asia, Lazada has a strong market share and user base in the region.。By continuing to invest in Lazada, Ali hopes to further consolidate its position in the region and expand its presence in this market.。Lazada has also revealed that the company's goal is to achieve GMV (total goods traded) of $100 billion and serve 300 million consumers by 2030.。In the context of the continued growth of the Southeast Asian market, continued investment is a wise choice.。

It is worth mentioning that through this investment, Ali can also use Lazada's localization experience and resources to improve its own e-commerce ecology, including the establishment of a broader logistics network in Southeast Asia, the promotion of payment tools such as Alipay, and the expansion of cloud computing and other business.。Whether as part of Ali or as a business group that operates independently or will be listed independently in the future, the current priority of Ali's overseas business is still expansion and growth, and profitability will be relatively secondary.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.