Unfolded AGI Era Brings Baidu Surprise in 2024Q1

In Q1 2024, Baidu's core operating margins achieved double year-on-year and quarter-on-quarter growth, with its AI-first strategy driving high-quality growth.

On May 16, Baidu released its financial report for the first quarter ending March 31, 2024.

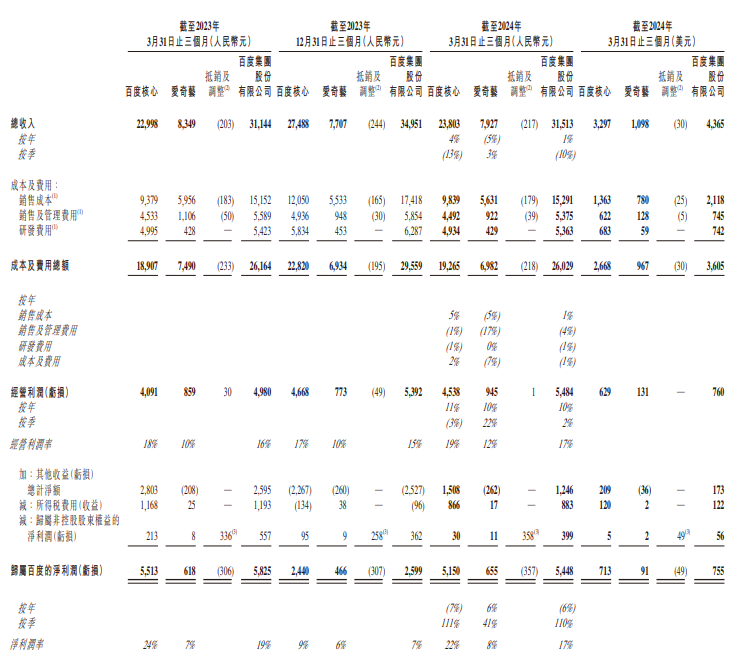

Data shows that Baidu's total revenue for the first quarter was 31.513 billion yuan, a 1% year-on-year increase, exceeding expectations. The net profit attributable to the parent company was 5.448 billion yuan, a 6% year-on-year decrease but a 110% quarter-on-quarter increase. The non-GAAP net profit attributable to the parent company was 7.011 billion yuan, a 22% year-on-year increase, far surpassing expectations.

Specifically, Baidu's core revenue was 23.8 billion yuan, a 4% year-on-year increase. Online marketing revenue was 17 billion yuan, a 3% year-on-year increase, while non-online marketing revenue was 6.8 billion yuan, a 6% year-on-year increase, mainly driven by the intelligent cloud business. Additionally, iQIYI's revenue was 7.9 billion yuan, a 5% year-on-year decrease.

Baidu's Chief Financial Officer Luo Rong stated: "This quarter, the operating profit margin of Baidu Core achieved both year-on-year and quarter-on-quarter growth. We have established a record of continuously improving operational efficiency. In the coming quarters, we will enhance operational efficiency to support AI business and high-quality growth, while maintaining a healthy operating profit margin."

AI Boosts Intelligent Searching

For its mobile ecosystem, in March 2024, Baidu APP's monthly active users reached 676 million, a 3% year-on-year increase. During the period, revenue from managed pages accounted for 50% of core online marketing revenue. Baidu's founder, chairman, and CEO Robin Li pointed out that Baidu Search's AI restructuring is still in its early stages, and overall, "Search is likely to become the killer app in the AI era."

As a domestic search engine giant, search business is the core application of Baidu's ecosystem. By leveraging ERNIE Bot to restructure the search engine and adding an "interaction" section to the search, currently, AI-generated search results account for 11%, meeting users' needs more accurately and directly.

It is understood that Baidu was the first company in China to venture into intelligent search. With this first-mover advantage, Baidu is expected to rapidly expand its market share in the search field, further consolidating its leading position. Meanwhile, the launch of intelligent entities has allowed Baidu to capitalize on the momentum, enriching Baidu's content ecosystem, creating better product experiences for C-end users, and significantly enhancing B-end delivery efficiency and user stickiness.

ERNIEs‘ Ongoing Expansion

The financial report reveals that Baidu's intelligent cloud business drove the increase in core revenue. As of April this year, Baidu's PaddlePaddle platform has gathered 13 million developers, and enterprise customers' MaaS platform tools have also been improved, with several lightweight large models about to be launched.

As the first company globally to launch a product directly competing with ChatGPT, Baidu's ERNIE Bot received significant attention from the global AI community and capital markets upon its debut in March last year. Robin Li emphasized that this year is Baidu's second year of advancing into AGI, with the company's strategy gradually shifting from "Internet-centered" to "AI-first".

Currently, ERNIE Bot has iterated to version 4.0, processing about 250 billion text tokens daily, with API daily call volume exceeding 200 million, and enterprise customers surpassing 85,000. Partners such as Samsung, Honor, Xiaomi, OPPO, and vivo have all integrated ERNIE's large model API. Furthermore, Baidu has expanded the application of this model from mobile phones to PCs and electric vehicles. This quarter, Baidu will collaborate with Lenovo and NIO, significantly expanding the user base.

At the previous "Qianfan" product launch conference, Baidu released three "ERNIEs" lightweight large models—ERNIE Speed, ERNIE Lite, and ERNIE Tiny. Additionally, three development tools, AgentBuilder, AppBuilder, and ModelBuilder, were launched to help developers and enterprises build intelligent entities, develop AI-native applications, and customize models.

Comparatively, in the AI field, ByteDance recently disclosed data indicating that its Doubao large model currently processes 120 billion text tokens daily, generating 30 million images. In terms of market pricing, this model is priced at only 0.0008 yuan per thousand tokens, 99.3% cheaper than the industry average. OpenAI's GPT-4 is priced at 0.42 yuan per thousand tokens, and Baidu's ERNIE Bot and Alibaba's Tongyi Qianwen are priced at 0.12 yuan per thousand tokens.

Subsequently, Baidu announced that large models should not only be judged by price but also by comprehensive performance. Moreover, the "closed-source large model + public cloud" configuration performs better and costs more than open-source large models. Additionally, Baidu's cloud products have expanded from traditional CPU clouds to high-value AI products and services, so industry CPU cloud pricing adjustments have minimal impact on AI cloud business.

Robin Li stated that the AGI era has now unfolded in China, with foundational models like ERNIE being integrated into various aspects of life as infrastructure. In the future, ERNIE large models will become more affordable and efficient, bringing more opportunities to Baidu.

The Eye-Catching ASD

In the field of autonomous driving, as of April 19, Baidu's Apollo Go had provided over 6 million accumulated ride services. In the first quarter, it offered approximately 826,000 ride services, a 25% year-on-year increase.

On May 15, at "Apollo Day 2024," Baidu Apollo launched the world's first large model supporting L4-level autonomous driving, Apollo ADFM, and introduced the sixth generation of Apollo Go unmanned vehicles. The overall vehicle cost is 60% lower than the fifth generation, priced at only 200,000 yuan. This model will further enhance the safety and generalization of Apollo Go, expanding its operational area and extending operation hours, benefiting more users.

Currently, Apollo Go's service area in Wuhan exceeds 3,000 square kilometers, covering 7.7 million people. Chen Zhuo, General Manager of Baidu's Autonomous Driving Business Unit, stated: "With the gradual deployment of the sixth generation of unmanned vehicles, Apollo Go's revenue growth rate will be faster and is now very close to the breakeven point. The goal is to achieve breakeven in Wuhan by the end of this year and to fully enter the profitability phase in 2025."

It is known that Baidu ASD is the only core technology that can compete with Tesla's FSD. Wang Yunpeng, Vice President of Baidu Group and President of the Intelligent Driving Business Group, stated that it would take Tesla 3 to 5 years to achieve Baidu's current level of fully unmanned operation in Wuhan.

On April 6, Elon Musk, founder and CEO of Tesla, announced on X that Tesla would launch its autonomous taxi Robotaxi on August 8. This announcement sparked public speculation about the introduction of FSD in China, with claims that Tesla would use Baidu's high-precision maps as an aid.

In response to the potential collaboration, Baidu stated that it would consider possible cooperation opportunities based on Tesla's specific application mode and its pace of entering the Chinese market.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.