Bank of England January interest rate resolution: keep benchmark interest rate unchanged, hawkish language softened

The analysis said that the independent economist Dengera's push to immediately reduce borrowing costs sent a strong signal to financial markets that the central bank was moving closer to taking action.。

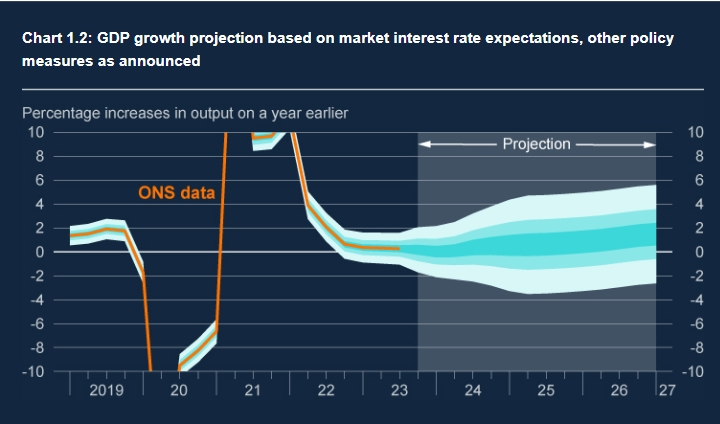

On February 1, local time, the Bank of England announced its January 2024 interest rate resolution。In line with market expectations, the Bank of England announced that it would continue to maintain the current 5.With the benchmark interest rate unchanged at 25%, the Monetary Policy Committee (MPC) voted 6-3。

Of these, two members (Haskell and Mann) voted for a 25 basis point rate hike and one (Dengera) supported a 25 basis point rate cut.。The analysis said that the independent economist Dengera's push to immediately reduce borrowing costs sent a strong signal to financial markets that the central bank was moving closer to taking action.。

Bailey: UK inflation is' moving in the right direction'

In its policy statement, the Bank of England has softened its language on monetary policy, dropping its previous warning that "further tightening" will be needed if more persistent inflationary pressures emerge.。Instead, the central bank claims that the MPC will ensure that bank rates remain restrictive long enough for inflation to sustainably return to its 2% target in the medium term.。It added that monetary policy would be "adjusted based on economic data" and the timing of keeping interest rates unchanged would be assessed.。

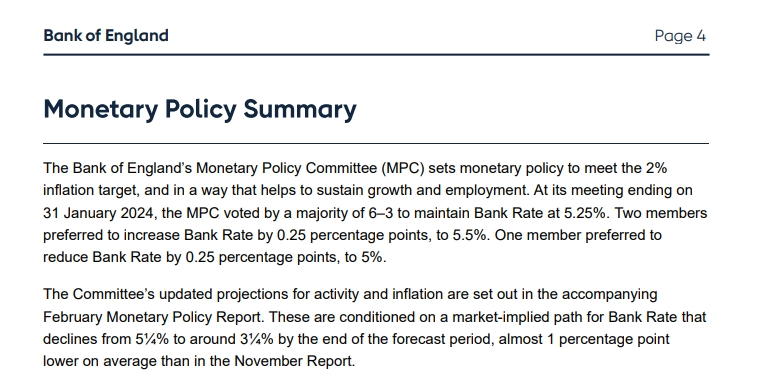

The softening of the Bank of England's language is mainly due to lower inflation in the UK.。The latest data from the Office for National Statistics show that in December last year, the UK consumer price index (CPI) has fallen to 4%, significantly better than the central bank's previous expectations;.1% unchanged, but still on an overall downward trajectory。Meanwhile, the Bank of England's focus on key indicators such as the labour market, wage growth and services inflation are all showing signs of slowing.。

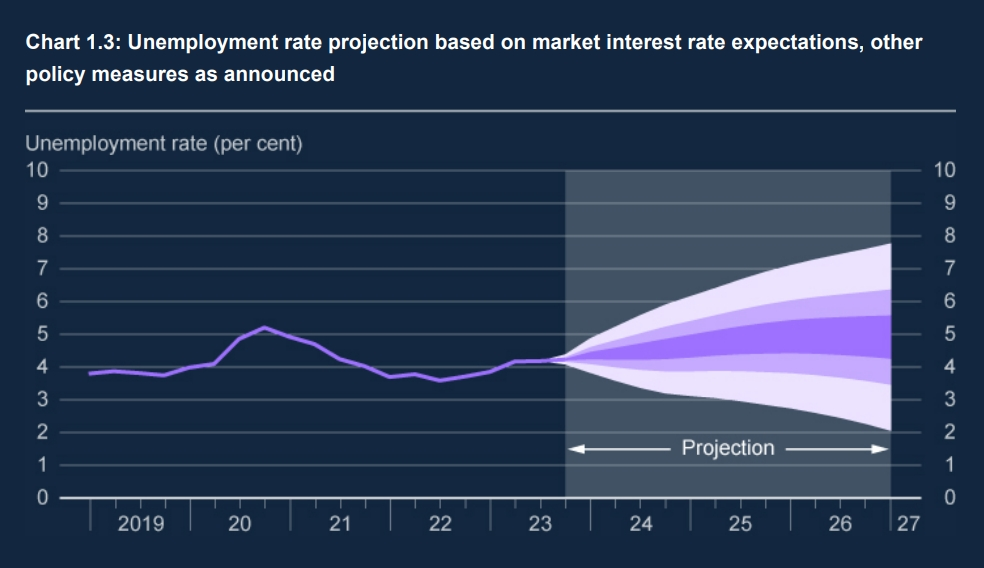

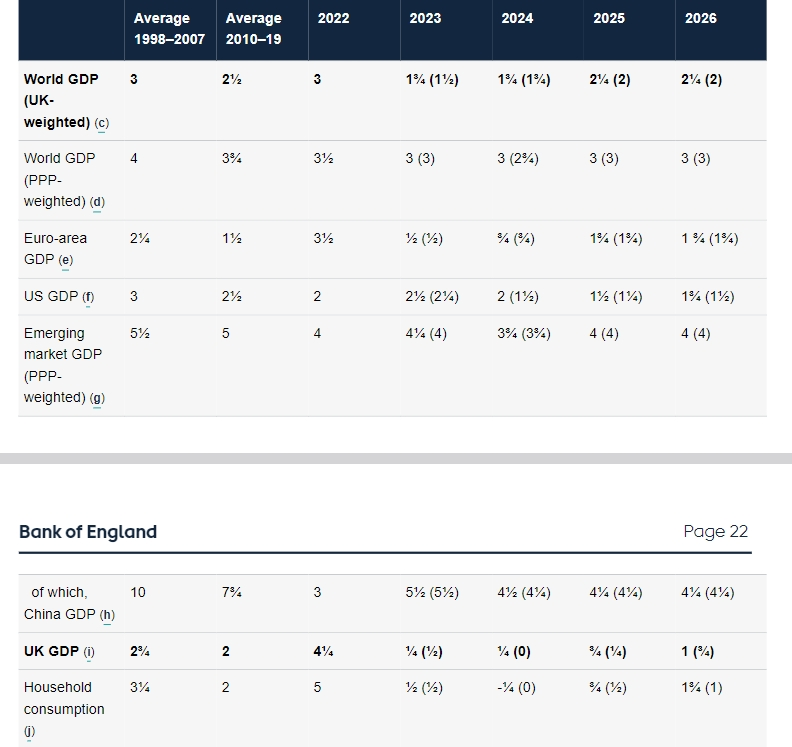

In its interest rate resolution, the Bank of England said that gross domestic product growth is expected to pick up gradually over the forecast period after recent weakness, largely reflecting the weakening drag on economic growth from past bank rate hikes.。Business survey shows improving outlook for near-term economic activity。

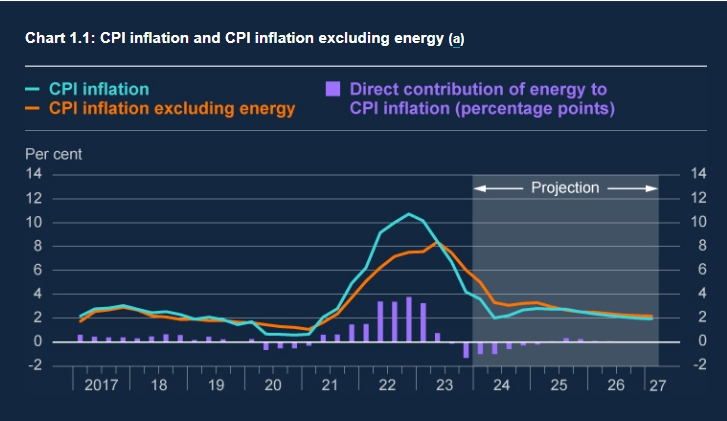

For the labor market, the Bank of England said the labor market continues to be loose, but still tight compared to historical standards。In the February report's forecast, demand remained relatively weak despite subdued supply growth.。By historical standards, there will be a degree of slack in the economy during the first half of the forecast period。Unemployment expected to rise further。

For inflation, the Bank of England said it expects CPI to temporarily fall to its 2% target in the second quarter of 2024 before rising again in the third and fourth quarters.。The bank went on to say that by the end of this year, CPI is expected to be reduced to 2.75 per cent, and then inflation is expected to be above the 2 per cent target for the remainder of the forecast period。This reflects the fact that, despite the increasingly depressed economy, domestic inflationary pressures remain。The Bank of England expects the UK CPI index to gradually reduce to 2 over a two-year period..3%, reduced to 1 after three years.9% (reach target level)。

At a press conference on the same day, Bank of England Governor Andrew Bailey also said that UK inflation was "moving in the right direction."。According to Bailey, staff estimates that the peak impact of interest rate hikes on gross domestic product (GDP) levels is now showing about two-thirds。In addition, excess demand is turning into excess supply。"While we expect underlying supply growth to remain subdued, a modest pickup in productivity and labor supply growth is sufficient to allow supply to outpace demand over the forecast period."。"

Bailey added that the second round of domestic price and wage increases in the UK will take longer to undo, explaining why inflation is expected to be above the 2 per cent target in the central bank's benchmark forecast despite an oversupply.。

Cut interest rates to avoid haste

Although in this interest rate meeting, the Bank of England "eagle" track significantly weakened, but did not publicly say that interest rate cuts are planned。

Lindsay James, an investment strategist at Quilter Investors, believes that with the road to a sustainable 2% inflation rate not expected to be smooth, policymakers will be keen to avoid haste and premature rate cuts。James said that given the fragility of the current economic environment and the geopolitical risks, Bailey and others would take a cautious approach rather than risk another spike in inflation.。

For his part, Raj Badiani, chief economist at Standard & Poor's Global, said that with eight of the nine members of the Monetary Policy Committee still advocating keeping interest rates at current or even higher levels, discussions within the Monetary Policy Committee about monetary policy deregulation may remain distant.。

Badiani revealed in an email: "We expect four rate cuts this year, the first of which will be in June.。However, the exact timing of the rate cut remains uncertain as earnings growth is unsustainable as services and core inflation remain strong。In addition, millions of British households face a further deterioration in the tight cost of living as highly restrictive monetary policy is destined to close to flat economic activity in the coming quarters。"

Falling interest rates and inflation, as expected by financial markets, will also provide a boost to UK economic growth。In its current forecast, the Bank of England raised its forecast for UK economic growth next year。The bank said it expects GDP growth of 0 in 2024 based on market interest rates..25%, 0 growth in 2025.75%, 1% growth in 2026。

However, the Bank of England also warned that inflation would only "temporarily" fall below 2 per cent this spring and then recover to 2 per cent by the end of the year due to "persistent domestic inflationary pressures" in the services and labour markets..75% or so and remain above the target for the remainder of the three-year forecast。

The Bank of England believes that in the coming months, the Israeli-Gaza war will pose a risk of disruption to Red Sea shipping, which could further push up consumer prices in the UK.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.