How is BDSwiss? Is it Reliable?

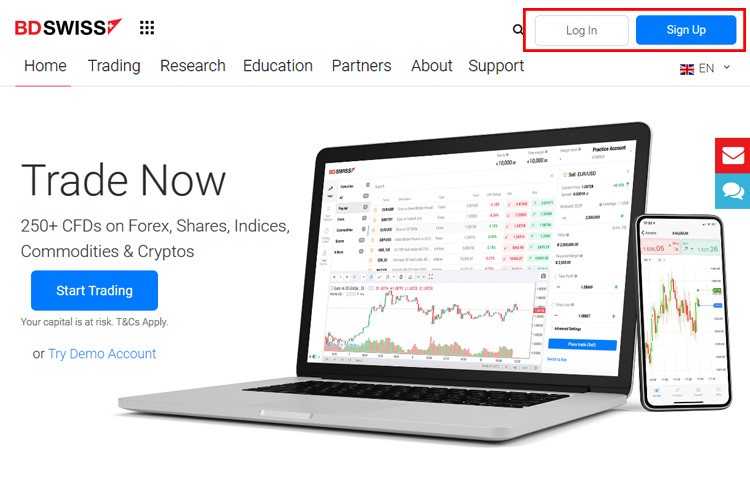

BDSwiss is an international brokerage firm established in 2012, offering a comprehensive and high-quality trading experience in forex and CFDs, providing a wide range of trading products to over 180 countries worldwide.

Introduction to BDSwiss

BDSwiss is a leading financial institution specializing in forex and Contract for Differences (CFD) trading. Established in 2012, BDSwiss has since provided a world-class platform, competitive pricing, and exceptional trade execution for over 250 CFD products. As of the third quarter of 2023, BDSwiss has over 1.7 million registered accounts from clients in more than 180 countries.

BDSwiss offers top-notch forex and CFD investment services, with a monthly trading volume exceeding $84 billion. The company also provides a wealth of educational resources, up-to-date market research, and excellent customer service. Currently, BDSwiss has seven offices worldwide, including locations in the US, Cyprus, Mauritius, and Seychelles, with over 20,000 partners.

BDSwiss Security

BDSwiss employs internationally recognized SSL (Secure Sockets Layer) security systems to encrypt all credit card payments processed online.

BDSwiss is regulated by several authorities:

- Mauritius Financial Services Commission (FSC): C116016172

- Seychelles Financial Services Authority (FSA): SD047

- South African Financial Sector Conduct Authority (FSCA): FSP 49479

- International Services Authority (MISA): T2023244

- Securities and Commodities Authority (SCA) UAE: 20200000188

BDSwiss Account Types

BDSwiss offers Classic, Zero-Spread, Cent, and VIP accounts. Different accounts have varying spreads and minimum deposit requirements. The minimum deposit for Classic and Cent accounts is $10/€10/£10. For Zero-Spread accounts, it is $100/€100/£100, and for VIP accounts, it is $250/€250/£250. Zero-Spread accounts start with a spread of 0.0, while VIP accounts start with a spread of 1, and offer priority support and a personal account manager.

Comparison of the four account types is shown below:

| Account Comparison | Cent | Classic | VIP | Raw |

|---|---|---|---|---|

| Average Spread | 1.6 | 1.3 | 1 | 0.3 |

| Leverage |

Up to 1:2000 default (up to 1:400) dynamic leverage (up to 1:2000) |

Default (up to 1:400) dynamic leverage (up to 1:2000) |

Default (up to 1:400) dynamic leverage (up to 1:2000) |

Default (up to 1:400) dynamic leverage (up to 1:2000) |

| Number of Products | 70+ | 250+ | 250+ | 250+ |

| Tradable CFD Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex CFDs, Stock CFDs, Index CFDs, Commodity CFDs, Cryptocurrency CFDs |

| Commission (Per Round Trip) |

All Currency Pairs: $0 Indices: $2 (200 CUD) Stocks: 0.15% |

All Currency Pairs: $0 Indices: $2 Stocks: 0.15% |

All Currency Pairs: $0 Indices: $0 Stocks: 0.15% |

All Currency Pairs: $5 Commodities: $5 Indices: $2 Stocks: 0.15% |

| Margin Call Level | 50% | 50% | 50% | 50% |

| Stop Out Level | 20% | 20% | 20% | 20% |

| Platforms | WebTrader, APP, MetaTrader 4 | WebTrader, APP, MetaTrader 4 | WebTrader, APP, MetaTrader 4 | WebTrader, APP, MetaTrader 4, MetaTrader 5 |

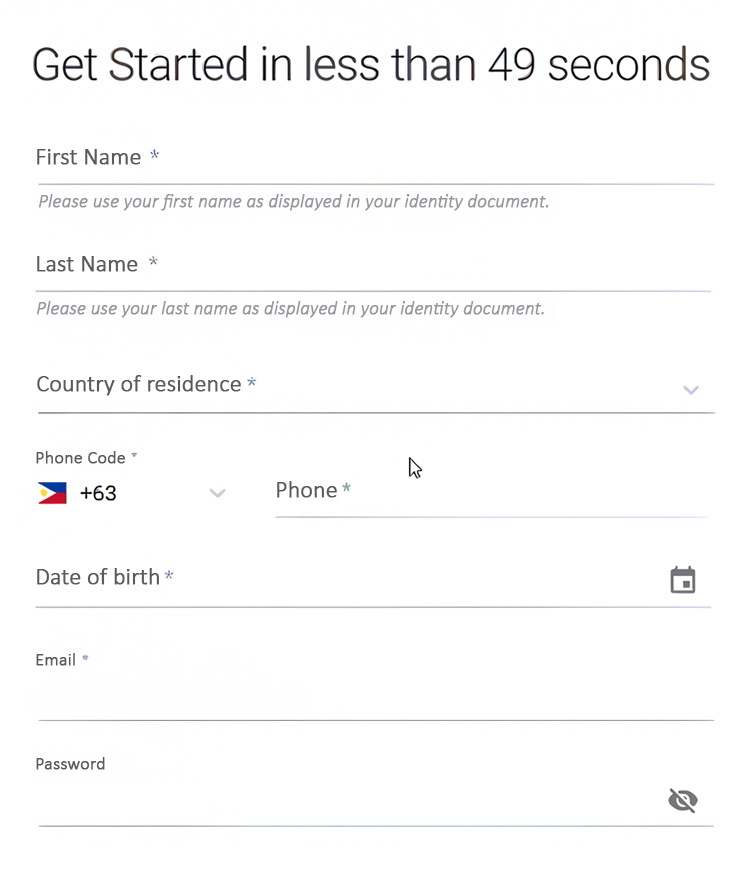

BDSwiss Account Opening Process

The account opening process at BDSwiss is very simple. Click on "Open an Account with BDSwiss Now"!

- Go to the BDSwiss website and click "Sign Up" in the top right corner.

- Enter your personal details (name, email, phone number, etc.).

- Upload documents for account verification. Verification can be done with utility bills, identification documents, or similar items.

- Complete a questionnaire about your trading experience and expectations. Specify the account type you want to open and the base currency you will use.

- Once the account is activated, you can access your account area for trading.

Note:

- You can open up to 5 trading accounts with BDSwiss: 3 Classic accounts, 1 VIP account, and 1 Zero-Spread account.

- Inactive accounts incur a $30 fee per month until the balance reaches zero. This fee covers the maintenance/management of inactive accounts.

- Documents required for account verification:

- Proof of Identity: Scanned copy of an official ID, which can be a passport or ID card. The document must be valid and have more than 3 months of validity remaining.

- Proof of Residence: Scanned copy of a recent utility bill (water, electricity, gas, or fixed-line/broadband bill) or bank statement. The bill must be within the last 3 months.

- KYC and Suitability Test: As a regulated financial institution, BDSwiss requires a full suitability assessment to protect clients.

BDSwiss Deposits and Withdrawals

Deposits

To make a deposit, log in to your BDSwiss account:

- Select the account you want to fund and click "Payments – Deposit."

- Choose the deposit amount.

- Select the deposit method and click "Continue to Payment."

- Confirm the deposit details on the next page. The payment provider may require additional steps.

If using the BDSwiss mobile app, tap "Deposit" at the bottom of the app.

BDSwiss works closely with leading and secure payment providers. The minimum deposit requirement for Classic and Raw STP accounts is $200. Clients can manage deposits and withdrawals flexibly through the terminal. Available deposit methods are listed below:

| Payment Option | Currency | Fees/Charges | Processing Time |

|---|---|---|---|

| VISA | EUR, GBP, USD | Covered by BDSwiss | Instant |

| MASTERCARD | EUR, GBP, USD | Covered by BDSwiss | Instant |

| SKRILL | EUR, GBP, USD | Covered by BDSwiss | Instant |

| NETELLER | EUR, GBP, USD | Covered by BDSwiss | Instant |

| PAYO | ZAR | Covered by BDSwiss | Instant |

| KORAPAY | NGN | Covered by BDSwiss | Instant |

| OZOW, MPESA, airtel, vodafone, MTN, airtel tigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Covered by BDSwiss | Instant |

| PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Covered by BDSwiss | Instant |

| Pix | BRL | Covered by BDSwiss | Instant |

| Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Covered by BDSwiss | Instant |

| LetKnow, SpeedlightPay, ChipPay | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Network fee | Instant |

| Bank Wire | ZAR, AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZMW | Covered by BDSwiss | 1-5 Business Days |

Processing times may vary depending on the speed of different banks or payment providers.

Withdrawal

First, ensure that your BDSwiss account is fully verified before withdrawing funds from your account.

The available withdrawal methods are as follows:

| Method | Currency | Processing Time |

|---|---|---|

| VISA | EUR, GBP, USD | Processed within 24 hours |

| MASTERCARD | EUR, GBP, USD | Processed within 24 hours |

| SKRILL | EUR, GBP, USD | Processed within 24 hours |

| NETELLER | EUR, GBP, USD | Processed within 24 hours |

| PAYO | ZAR | Processed within 24 hours |

| KORAPAY | NGN | Processed within 24 hours |

| OZOW, MPESA, airtel, vodafone, MTN, airtel tigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Processed within 24 hours |

| PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Processed within 24 hours |

| Pix | BRL | Processed within 24 hours |

| Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Processed within 24 hours |

| LetKnow, SpeedlightPay and ChipPay | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Processed within 24 hours |

| Bank Wire | ZAR, AED, AUD, BBD, BGN, BHD, CAD, CHF, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, ILS, JPY, KES, MWK, MXN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, SAR, SEK, SGD, THB, TND, TRY, TTD, UGX, USD, ZMW | Processed within 24 hours |

For all methods except for bank wire transfers, the minimum withdrawal amount is $2. Any amounts less than $2 cannot be processed as they are below the fee incurred by BDSwiss for processing such withdrawals.

For international bank wire transfers, the minimum withdrawal amount is $60/€60, with a $10/€10 fee deducted as withdrawal costs. For SEPA transfers, the minimum withdrawal amount is $15/€15, with a $10/€10 fee deducted as withdrawal costs.

Notes:

- To prevent fraud, traders can only withdraw funds after their account has been fully verified with appropriate KYC documentation.

- The withdrawal method should be the same as the method used for the initial deposit, meaning the withdrawn funds must go to the source of the original deposit.

- All withdrawal requests received during business hours (9 AM to 6 PM) will be processed on the same day. Requests received outside business hours will be processed on the next business day.

- Please note that card providers may also charge additional transaction or banking fees.

BDSwiss Trading Platform

BDSwiss offers excellent trading platforms and tools, including MetaTrader 4, MetaTrader 5, and the BDSwiss mobile app.

MT4

- BDSwiss’s Forex MT4 platform is derived from the MetaTrader MT4 platform and optimized by BDSwiss technology. Its user-friendly trading interface supports traders of all levels.

- The platform provides all the necessary tools and resources for analyzing the price trends of financial products, executing and editing trades, and creating and using automated trading programs (Expert Advisors). Through this highly customizable platform, traders can tailor their trading environment based on their preferences and strategies.

- MT4 platform services include:

- Timely news updates pushed directly to the platform

- Free pre-written analysis tools

- Overlaid analysis tools

- Multiple chart and analysis options

- Daily account statements

- Real-time client account summaries, including net asset value, floating profits, and losses

MT5

- BDSwiss MT5 is the latest and most advanced MetaTrader platform, offering all the cutting-edge technology of MT4 with more advanced trading tools and indicators. Traders can more easily manage trades and make more informed decisions using advanced analytical tools.

- The platform provides many new analysis tools and features, enhances trading support, and improves the trading experience.

- MT5 platform services include:

- Daily account statements

- Multilingual capabilities

- Automated trading using Expert Advisors

- The ability to overlay analysis studies

- Superior built-in MQL5 development environment

- Over 80 technical indicators and more than 40 analytical objects

BDSwiss Mobile App

- BDSwiss has developed its mobile app, allowing trading and trade management anytime, anywhere, with the same tools and features available on the desktop platform.

- The BDSwiss mobile app is fully developed in-house, enabling traders to open positions on every CFD asset available on the desktop MT4, monitor Forex market activity, access the account dashboard, and deposit and withdraw funds anytime, anywhere.

- BDSwiss mobile app services include:

- Real-time quotes

- Interactive charts

- Clean, user-friendly interface

- Full trading and trade history

- Deposit and withdrawal functions

- Account settings and KYC verification

- 24/7 cryptocurrency pair trading

BDSwiss Trading Products

- Forex: BDSwiss offers over 50 major, minor, and exotic currency pairs with spreads as low as 0.0 pips. By opening an account on the BDSwiss platform, traders can buy or sell Forex CFDs, such as EUR/USD, from as low as 0.01 lots in 0.01 seconds. Traders can utilize flexible leverage, leading research, and advanced analysis tools.

- Commodities: BDSwiss allows traders to speculate on the price movements of the world's most popular commodities, including oil and precious metals, against major currencies. Traders can take long or short positions on commodity price movements with BDSwiss’s flexible leverage, ultra-low commissions, and superior execution speeds.

- Stocks: BDSwiss offers hundreds of leading stock CFDs from the world's largest exchanges, including Amazon, Meta Platforms, Inc., Apple, Microsoft, and Alphabet. Traders can take long or short positions on stock price movements with ultra-low commissions and superior execution speeds.

- Indices: BDSwiss offers CFDs on leading global indices, including the S&P 500, FTSE, and Dow Jones indices. Traders can buy or sell index CFDs with ultra-low commissions and superior execution speeds.

- Cryptocurrencies: BDSwiss allows trading CFDs on the price movements of the world’s most popular cryptocurrencies, including Bitcoin, Litecoin, Ripple, and Ethereum.

BDSwiss Trading Tools

- Real-time Forex Heat Map: The real-time Forex heat map provides traders with a quick overview of the most popular trading currency pairs on the platform and the real-time price movements of these pairs in a color-coded, concise chart. With the real-time Forex heat map, traders can quickly identify the largest upward and downward trends in the Forex market and confirm potential trading opportunities.

- Economic Calendar: BDSwiss’s economic calendar is a one-stop source for the latest financial data. Updated automatically after each announcement, it provides the scheduled release times and estimated figures of world-class financial announcements. Traders can filter results by date, country, and/or importance.

- Trend Analysis: An exclusive built-in tool for BDSwiss’s web platform, developed in partnership with AutoChartist, is available to BDSwiss traders. It monitors hundreds of charts 24/7, taking major data releases and news into account, helping to identify and trade the most likely trends.

- Trading Central: Strengthen your decision-making with Trading Central’s range of leading market monitoring tools. Activate your BDSwiss trading account to access Trading Central’s technical analysis, expert forecasts, analyst views, and market trends. All of these are available under the “Tools” tab of your dashboard.

- Autochartist: Autochartist is the world’s first market-scanning plugin, tracking over 250 CFDs 24/7 and alerting traders to the trading opportunities most likely to reach predicted prices and trends in formation. Save valuable time without constantly monitoring the charts; use volatility analysis to optimize stop-loss and take-profit prices, and perform real-time market data analysis on various timeframes.

- Trading Alerts: Exclusive to VIP and Raw Spread account holders, BDSwiss’s analysts continuously research the markets and send real-time trading alerts to VIP clients through the official Telegram channel after considering various factors that might affect key assets.

FAQ

How do I change my personal/ account information? (e.g., address/email address/phone number)

- To change or update your residential address, you can access your account from the BDSwiss dashboard, click on “Settings,” and select the “Profile” option. Upon receiving and accepting new proof of residence, the details will be updated.

- To change your email address or phone number, access your account from the BDSwiss dashboard, click on “Settings,” and select the “Profile” option. After changing your email address here, you will receive an automatically sent email notification to confirm the new email address. Follow the instructions within the email.

Can I open multiple accounts with BDSwiss?

- BDSwiss allows up to 5 different trading accounts to be opened: 3 Classic accounts, 1 VIP account, and 1 Raw Spread account. If you already have a Classic account and wish to open a VIP or Raw Spread account, you must open a new account, as account upgrades are not available.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.