Best Forex Broker in Qatar (2024 Edition)

What to watch out for when looking for a Forex broker in Qatar?How to verify if a Forex broker is regulated in Qatar?

Qatar is a small but wealthy Arab country where nearly two million of its 2.3 million residents are foreign workers and expats, so foreign exchange trading is very common in this country.。Qatar ranks fourth in GDP and the foreign exchange market is highly sought after due to the high average size of deposits and overall portfolio。Our review of Qatar Forex Trading focuses on identifying the most competitive brokers and providing tips for trading Forex in Qatar。Convenient for you to trade with the broker that best meets your trading requirements。

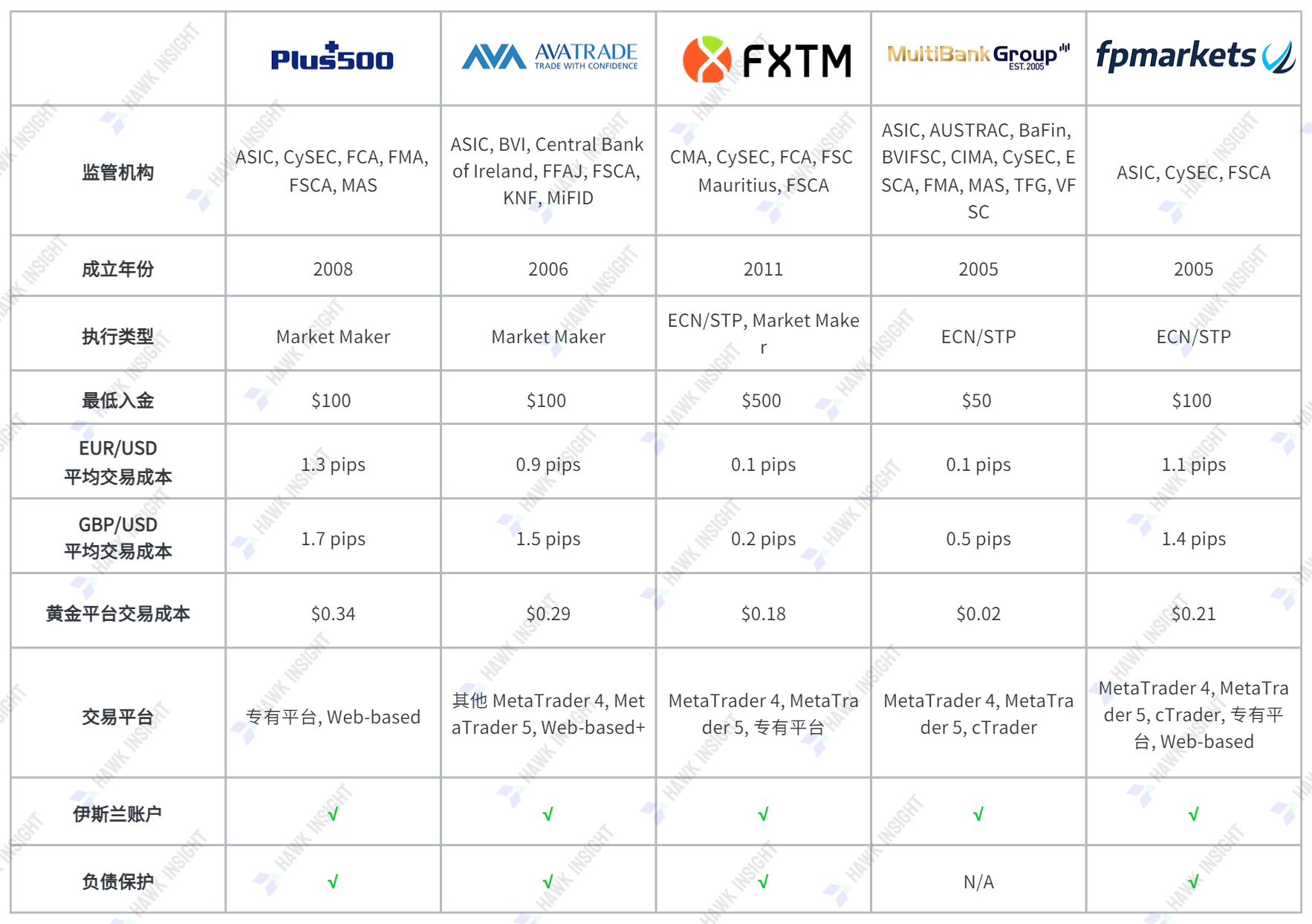

▍ Qatar Best Broker Comparison

○ PLUS500

Plus500 offers a user-friendly online trading platform with multiple investment options including options and cryptocurrency trading。Plus500 also offers an invitation-only premium service for eligible traders.。commission-free pricing environment from 0.6 points or every 1.0 Standard Hand 6.The spread of $00 begins to ensure that traders receive competitive trading fees, thereby increasing profitability。

Swap-free Islamic accounts are available on request, and Plus500 provides 24 / 7 customer support to quickly handle customer issues。Traders can use a fee-based guaranteed stop order for a specific asset, but this means that the initial spread will widen。

| Advantages | Disadvantages |

| Wide selection of stock and option assets | Sub-standard trading platforms that do not support automated or social trading |

| Free and unlimited demo account | |

| Advanced free analytical trading tool | |

| Regulated Global Fintech Platform |

○ AvaTrade

AvaTrade offers a wide range of available trading platforms and investment options while being commission-free。Traders can choose MT4 or MT5 according to their needs, and MT5 has been upgraded with the Guardian Angel plugin。Both MT4 and MT5 support algorithmic trading, with MT4 being widely used in the industry to support copy trading capabilities。Users who are used to trading on the PC side can use WebTrader, and AvaTradeGO is a great choice for mobile traders.。

Options trading is available using the proprietary AvaOptions platform, with both Ava Social and DupliTrade meeting the needs of replication traders.。It also offers swap-free Islamic accounts, which are important factors in AvaTrade's ranking in Qatar's foreign exchange trading rankings.。

| Advantages | Disadvantages |

| Provide high-quality education services through SharpTrader | Transaction costs are competitive, but nothing special |

| A variety of trading platforms to choose from to meet various trading needs | |

| Broad asset selection and cross-asset diversification opportunities | |

| Trusted Broker Regulated by Central Bank |

○ FXTM

FXTM offers no overnight interest accounts for Muslim traders。The fees that may be incurred if a user holds multiple leveraged positions overnight and exceeds the daily limit without overnight interest are also transparent。As a result, FXTM has become one of the most transparent brokers in Qatar's foreign exchange trading.。

At the same time, FXTM is one of the cheapest forex brokers in the whole industry, with 0 for traders through the "Advantage account" account..Original spread from 0, every 1.0 Trading bill fee commission for standard lots at 0..$80 to $4.Between $00。

Traders can use the MT4 / MT5 trading platform, where FXTM upgrades MT4 via the Pivot Point Strategy plugin, and mobile traders can use the FXTM Trader app。

| Advantages | Disadvantages |

| Excellent commission-based forex pricing environment and transparency | No Cryptocurrencies, Limited Commodity Options |

| Upgraded MT4 / MT5 Trading Platform and Proprietary Mobile Trading App | |

| Quality market research and education content for junior traders | |

| Proprietary replication trading platform and high leverage |

○ MultiBank Group

Residents of some countries, including Qatar, can set up swap-free Islamic accounts in Multibank.。Major and minor foreign exchange currency pairs, commodities and indices are not subject to no-drop restrictions.。All other assets have a grace period of 10 days, except for foreign exchange currency pairs, which have a grace period of only 3 days。This transparency has made Multibank one of the most trusted brokers on our Qatar Forex trading list。

Traders can use the MT4 / MT5 trading platform, and Multibank has a proprietary copy trading service that complements the embedded MT4 / MT5 solution.。Multibank offers 20% deposit rewards of up to $40,000 and cashback programs for high-volume traders。

| Advantages | Disadvantages |

| 20,000 assets with extensive coverage of financial markets | Access to the original spread requires a minimum deposit of $5,000 in the ECN account |

| The original spread is from 0 o'clock and the maximum leverage is 1: 500 | |

| MAM / PAMM account and proprietary copy trading platform | |

| ECN trading with deep liquidity, no need to re-quote |

○ FP Markets

FP Markets traders benefit from 12 plug-in upgrades for MT4 / MT5 as well as Autochartist and Trading Central。FP Markets also offers cTrader, which ensures that traders can choose their preferred algorithmic trading platform, as well as an integrated copy trading service。The MAM / PAMM module supports traditional account management services, and replication traders can try FP Markets' proprietary social trading solution, Myfxbook Autotrade, or the subscription-based Signal Start.。

FP Markets can offer swap-free Islamic accounts on request, which requires onboarding team checks to ensure non-Muslim traders do not abuse swap-free offers。

| Advantages | Disadvantages |

| Optional trading platform and auxiliary trading tools | Providing Iress is subject to geographical restrictions |

| Competitive cost structure and superior asset selection | |

| Low minimum deposit requirements and leverage of up to 1: 500 | |

| Perfect supervision, trustworthy |

Qatar Forex Trading

In Qatar, Forex Trading Is Growing Popular in Retail。Since more than 85 per cent of the population is foreign and tourism is a strategically important pillar of the economy, most Qatari residents engage in foreign exchange transactions out of necessity.。The local currency, Qatari Riyal QAR, has a fixed exchange rate of 3 to the dollar.64。Our review of Qatar Forex trading believes that traditional asset management services are the core strategy of Forex trading, followed by automated trading and copy trading using mobile apps, with many Qatari Forex traders becoming signal providers.。

Is Forex Trading Legal in Qatar??

Legal。Qatar has three financial regulators that take a relaxed approach to offshore brokers。Qatar does not require international forex brokers to obtain a licence in Qatar if they are regulated within their own jurisdiction, and there are no restrictions on Qatari forex traders opening and funding offshore forex accounts.。

What to watch out for when looking for a Forex broker in Qatar?

The personal requirements of Qatari forex traders will vary and the strategies they need to implement will vary, but all forex brokers should have common core characteristics。

Our comments on Qatari forex trading believe that Qatari forex traders should ensure that their forex broker can provide the following services:

◇ Good trading environment, more than 10 years of flawless operating record

◇ No-swap Islamic accounts with no hidden fees

The Arabic website

Low transaction costs and fast order execution.

◇ Trading platform supporting algorithmic trading and copy trading

◇ Optional payment processor

How to verify that a Forex broker is regulated in Qatar?

Qatar adopts easing policy on offshore forex brokers, no online retail margin broker in country。Banks oversee most forex trading volumes, but the Qatar Financial Markets Authority (QFMA) oversees brokers.。Qatari FX traders can query the Qatari Financial Markets Authority database for the licence numbers of FX brokers claiming to be regulated by the Qatari Financial Markets Authority。Qatari FX traders can check each license with the appropriate regulator to confirm its validity.。All brokers on this Forex trading list are regulated and have a good operating record。

Is Qatar taxing foreign exchange transactions??

The author's review of foreign exchange trading in Qatar shows that personal foreign exchange trading income is still tax-free, but Qatari resident foreign exchange traders are better off consulting a licensed legal professional to clarify the tax issue, as personal circumstances may vary.。Qatar imposes a capital gains tax of 10% on all net income, which applies only to legal entities and is levied together with corporate tax。Qatar does not have an income tax, and overall, Qatar is a small, tax-efficient and efficient economy that is particularly attractive to high-income earners.。Despite the obvious tax rules, Qatari FX traders get a clear answer after speaking to tax and legal professionals in Qatar。

▍ FAQs

What is the best trading platform in Qatar??

MT4 is still the best trading platform in Qatar。This desktop client is the most full-featured off-the-shelf trading platform, supporting algorithmic trading, embedded copy trading services, and more than 25,000 custom indicators, plug-ins, and EAs。

Which is the best broker in Qatar??

The answer depends on the individual's trading needs, but the best brokers will offer swap-free Islamic accounts with no hidden fees。They should also include trading platforms that support algorithmic trading solutions, low transaction fees, and a well-regulated and well-established trading environment.。

Can you use US $10 or US $100 to trade foreign exchange in Qatar??

While it is possible to trade Forex in Qatar for $10 or $100, traders should consider the profit potential of a small account versus the effort required to achieve profitability.。Therefore, it is a more effective small deposit strategy to use multiple deposits of more than $100 before the trader reaches a sufficient account balance。

Is there a Forex broker that offers Islamic accounts??

Yes, many Forex brokers offer Islamic accounts without overnight interest, and all brokers in our Forex Trading Qatar Rankings offer Islamic accounts。Islamic traders should read the terms and conditions of Islamic accounts carefully, as many brokers put higher sticker prices on spreads or charge hidden fees to supplement the loss of income from the absence of swap rates。

▍ Summary

Foreign exchange trading in Qatar continues to expand. For offshore brokers, Qatar is a high-growth market driven by above-average deposits and relatively large investment portfolios。Our analysis of Qatari forex trading shows that traditional account management, algorithmic trading and copy trading are the main forex trading strategies most popular with local traders。Qatari Forex traders are well educated and seek innovative trading solutions and products。Despite the presence of three financial regulators in Qatar, international forex brokers cater to the needs of most domestic retail traders because of their competitive advantages compared to the services of major domestic banks.。Many offshore brokers offer services in Arabic, including customer support and no-swap Islamic accounts。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.