Boeing Faces First Strike In 16 Years, Credit Rating May Fall To Junk

Recently, Boeing suffered another series of strikes.

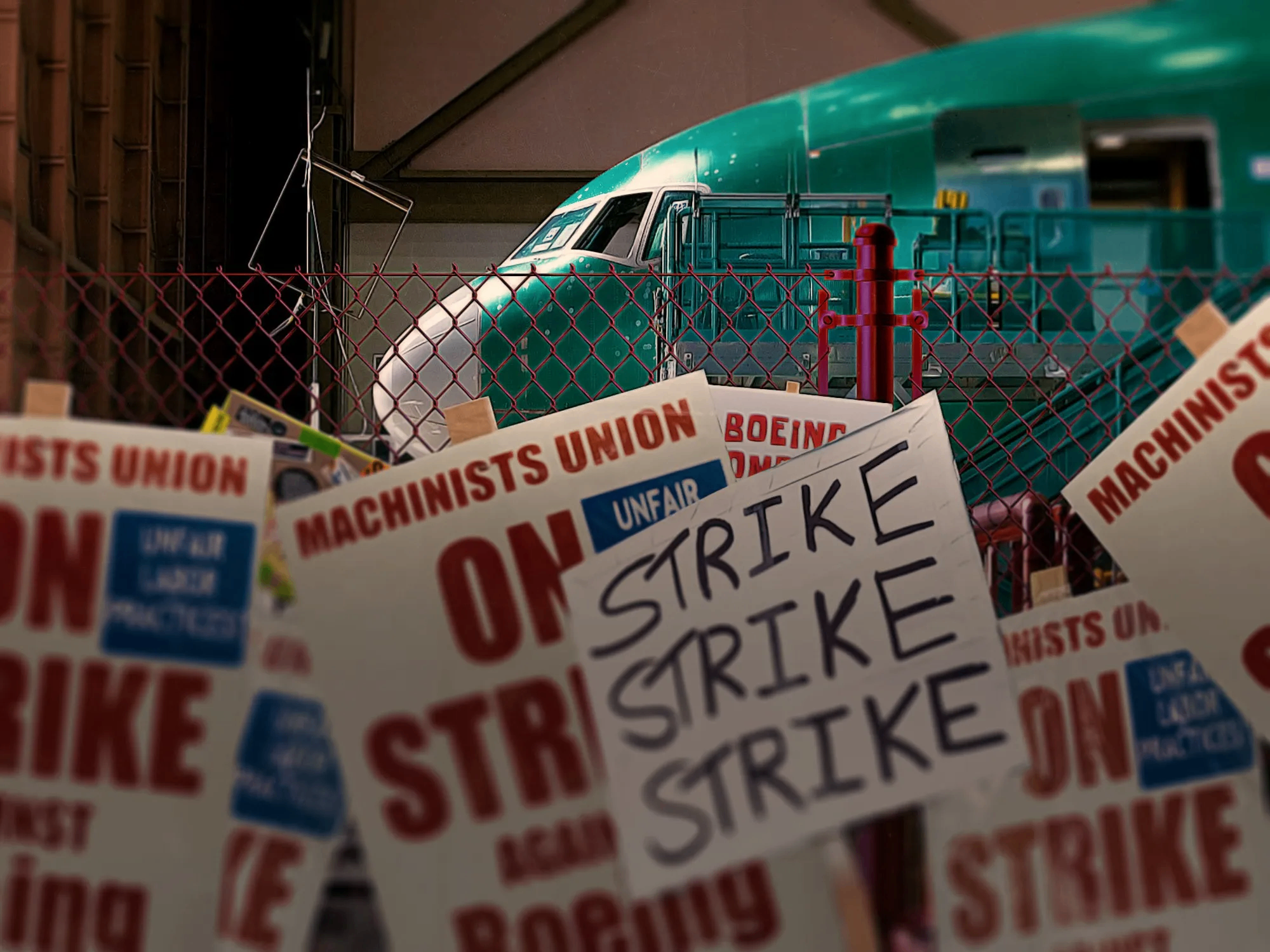

On Friday, about 33,000 workers at Boeing's main plant in the Seattle area announced the start of a strike. This is Boeing's first strike in sixteen years, with the last strike occurring in 2008 and lasting more than eight weeks.

First strike in 16 years

On Friday, approximately 33,000 workers at Boeing's main plant in the Seattle area announced the start of a strike.

The strike comes after Boeing reached a tentative labor agreement with the International Association of Machinists and Aerospace Workers (“IAM”), which sparked discontent among most of the workers.

Boeing offered a 25% wage increase over four years, while the workers wanted a 40% increase over the life of the contract and the reinstatement of a defined-benefit pension plan that had been dropped from discussions a decade earlier. Some 94 percent of IAM members are said to have voted down the contract, and 96 percent voted in favor of a strike. Most said they expected the strike to last several weeks.

This is Boeing's first strike in sixteen years; the last one occurred in 2008, when it lasted more than eight weeks.

In announcing the vote, IAM senior negotiator Jon Holden said, “This is a fight for our future. Given the opportunity, we will return to the bargaining table and push the issues our members believe are important.”

Boeing, for its part, said that when seniority increases are factored in, the wage increase would far exceed the 25 percent base pay increase. Boeing executives also said the company has done its best because its operations are burning through a lot of cash and the company is struggling with mounting debt following the Alaska Airlines closed hatch dislodgement accident in January.

Boeing's chief executive, Kelly Ortberg, sent a message to employees before the vote saying, “It's no secret that our business is going through difficult times, in part because of the mistakes we've made in the past. A strike would jeopardize our shared recovery.”

In response to workers still choosing to strike, Boeing said in a statement, “The message is clear, the tentative agreement we reached with IAM leadership is not acceptable to the membership. We remain committed to rebuilding our relationship with our employees and the union, and we are prepared to return to the bargaining table to reach a new agreement.”

Brian West, Boeing's chief financial officer, said the company's top priority is to stabilize its supply chain, but “it's becoming increasingly difficult to achieve that goal.” The workers' strike could spell trouble for Boeing's nearly 10,000 suppliers, West said, adding that Boeing will stop purchasing parts from some suppliers for programs affected by the strike, saying Boeing has ample inventory on those programs.

Boeing shares fell 3.7 percent to $156.77 on Friday, and the stock has fallen about 40 percent so far this year.

Difficulties abound

The massive strike has added to an already struggling Boeing.

Boeing hasn't been profitable since 2019, and two 737 Max crashes in October 2018 and March 2019 that killed a total of 346 people were ultimately investigated as a result of defective airplane design. In response, Boeing began making changes to the design and the construction of the airplane suffered. According to statistics, Boeing lost more than $20 billion as a result.

In the second quarter of this year, Boeing reported a net loss of $1.44 billion, or $2.33 per share. The adjusted loss per share widened to $2.90, significantly higher than the expected $1.97. The company's revenue fell 15 percent to $16.87 billion, missing estimates of $17.23 billion.

Boeing's results were impacted by the ongoing impact of the Alaska Airlines accident in January, which led to increased regulatory scrutiny and slowed deliveries of new airplanes. Production rates for the company's 737 Max airplanes remained at 20 per month, well below the target of 38.

And Boeing's problems are not limited to aircraft issues; the company's defense business is also facing significant challenges. In the second quarter of this year, the company's defense, space and security division lost $913 million, almost double the $527 million it lost in the same period last year.

Boeing's Starliner spacecraft made its first manned flight this quarter, but problems after docking at the International Space Station left two astronauts stranded at the station, with no known return date.

Rating may be downgraded to “junk”

On the same day as the workers' strike, Moody's, one of the three major international rating agencies, announced that it had placed all of Boeing's ratings on its downgrade review list, including its Baa3 senior unsecured rating and P-3 commercial paper rating.

In the review, Moody's said it would assess the duration and impact of the strike on cash flow, as well as potential equity financing Boeing may undertake to enhance liquidity.

Moody's noted that a prolonged strike would undermine the recovery of the commercial airplane business. Moody's expects production of Boeing 737 MAX airplanes to increase to nearly 30 per month in July and August. By way of comparison, a 57-day strike by IAM members in 2008 cost Boeing about $1.5 billion per month, or $50 million per day, when 737 production was about 34 aircraft per month.

Moody's also warned that it would consider downgrading Boeing's rating if the situation worsened. And Boeing's current rating is Baa3, the lowest level of investment grade. If Moody's chooses to downgrade Boeing, the company's rating will fall to speculative grade, known as “junk”.

In addition to Moody's, Fitch Ratings said Friday that Boeing's investment-grade rating has “limited room for downgrade. Like Moody's, Fitch set Boeing's rating at the lowest level above speculative. S&P did the same, rating Boeing at BBB-.

A “junk” rating would be a major blow to Boeing, as it would increase its borrowing costs. As the company continues to lose money in its business, it will likely need to increase its debt, and a “junk” rating will discourage many investors from raising external financing.

Moreover, Boeing itself has other debts coming due in the next two years. Moody's said Boeing has $4 billion of debt due in 2025 and another $8 billion due in 2026.

However, it takes two credit rating agencies to downgrade a company's debt to speculative grade before the company's debt rating “falls out” of the investment grade category.

Chief Financial Officer West told analysts at a Morgan Stanley conference Friday that the company would consider the steps necessary to strengthen its balance sheet. He said Boeing is evaluating its capital structure to ensure it can repay upcoming debt over the next 18 months.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.