Boeing may suffer expanded probe Red Sea turmoil does not appear to affect tankers

Before the opening of a quick review of yesterday's market trend! U.S. stock navigation sea king, 3 minutes a day to help you analyze the trend of U.S. stocks and big and small things!

U.S. stock news before the market.

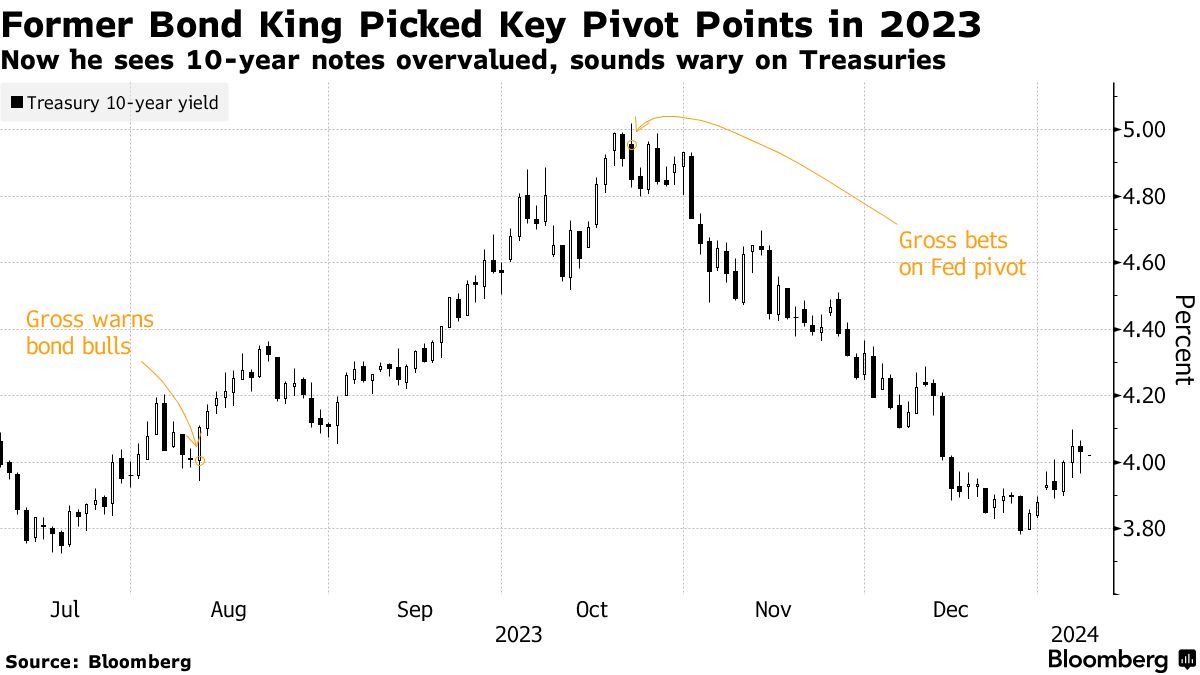

"01" Old Debt King Warns U.S. Debt Is Overvalued

Bill Gross, founder of Pacific Investment Management, known as the "old debt king," said that 10-year U.S. bonds are "overvalued" and that he is now moving away from U.S. bonds, with a yield of 1 if he needs to buy them..8% of U.S. inflation-protected bonds are a better option。In addition, Bill Gross noted that short-term bonds may be more suitable for investors interested in the bond market, and he is confident that the 10-year / 2-year U.S. bond yield spread will return to positive。

"02" regulators do not rule out expanding investigation of other Boeing models

After the Boeing (BA) Max 9 cabin door fell off last week, the Federal Aviation Administration has grounded the Max 9 and ordered airlines to conduct inspections, and a number of airlines, including Alaska Airlines (ALK) and United Airlines (UAL), have found loose bolts, leading the Federal Aviation Administration to consider expanding its investigation beyond the Max 9 model, which could extend the grounding。Boeing, for its part, has issued guidelines to airlines on what inspections are needed to prevent similar accidents from happening again。

"03" A large number of oil tankers still venture through the Red Sea

Many container ships have diverted detours as a result of the Houthi attack, but vessel tracking data show that the number of tankers in the Red Sea remained stable last December, and the impact on oil shipments appears to be smaller than the market feared, even though the attack has pushed up transportation costs and insurance premiums significantly.。The number of tankers passing through the Red Sea fell only briefly in December last year, with an average of 76 tankers still passing through each day, which is only two fewer than the November average and only three lower than the average for the first 11 months of 2023.。

"04" Samsung Q4 preliminary results are not as expected

Samsung Electronics Releases Q4 Preliminary Earnings on Tuesday, Expects Revenue to Decrease -4 Yearly.9% to 67 trillion won, below market expectations of 69.9 trillion, operating profit decreased by -35% to 2.8 trillion won, missing market expectations of 3.6 trillion, but if compared to Q3, revenue is down only -0.6%, while operating profit increased by 15% on a quarterly basis..2%。Samsung blamed the weaker-than-expected results on the slow recovery in demand for smartphones and the lack of recovery in its foundry business, but the memory division improved significantly from the previous quarter thanks to growing demand for higher-order memory chips.。

Alcoa will cut capacity to save costs

Alcoa (AA) announced on Tuesday that it plans to cut production at its alumina refinery in Kwinana, Australia, across the board in 2024, a cost-cutting measure that will begin in Q2 and is expected to produce 1.$8 to $200 million in restructuring costs。Alcoa said the production cut will include phased layoffs, and it expects to reduce the number of employees at the plant from about 800 at the beginning of the year to about 250 in 2024, with further layoffs likely in 2025.。

"06" HP Enterprise is about to acquire Juniper Networks

The Wall Street Journal reports that HP Enterprise (HPE) is close to acquiring Juniper Networks (Juniper Networks, JNPR), a $130 deal that could be announced as soon as this week。Juniper Networks mainly sells communication equipment such as routers and switches, and also owns Mist AI business to improve the user's network experience through AI technology.。Juniper Networks surged more than + 20% premarket, while HP Enterprise fell about -9%。

《 More 》

* NVIDIA (NVDA) unveils NVIDIA Avatar Cloud Engine (ACE) service at Consumer Electronics Show (CES), allowing game developers to use state-of-the-art generative AI models to create in-game virtual characters that can be customized with multilingual voice and simulated facial animation

* Microsoft (MSFT) has established a close partnership with OpenAI after the OpenAI "palace fight" ended, and EU regulators said on Tuesday that they were studying whether Microsoft should be reviewed under the EU's merger norms (merger standards).

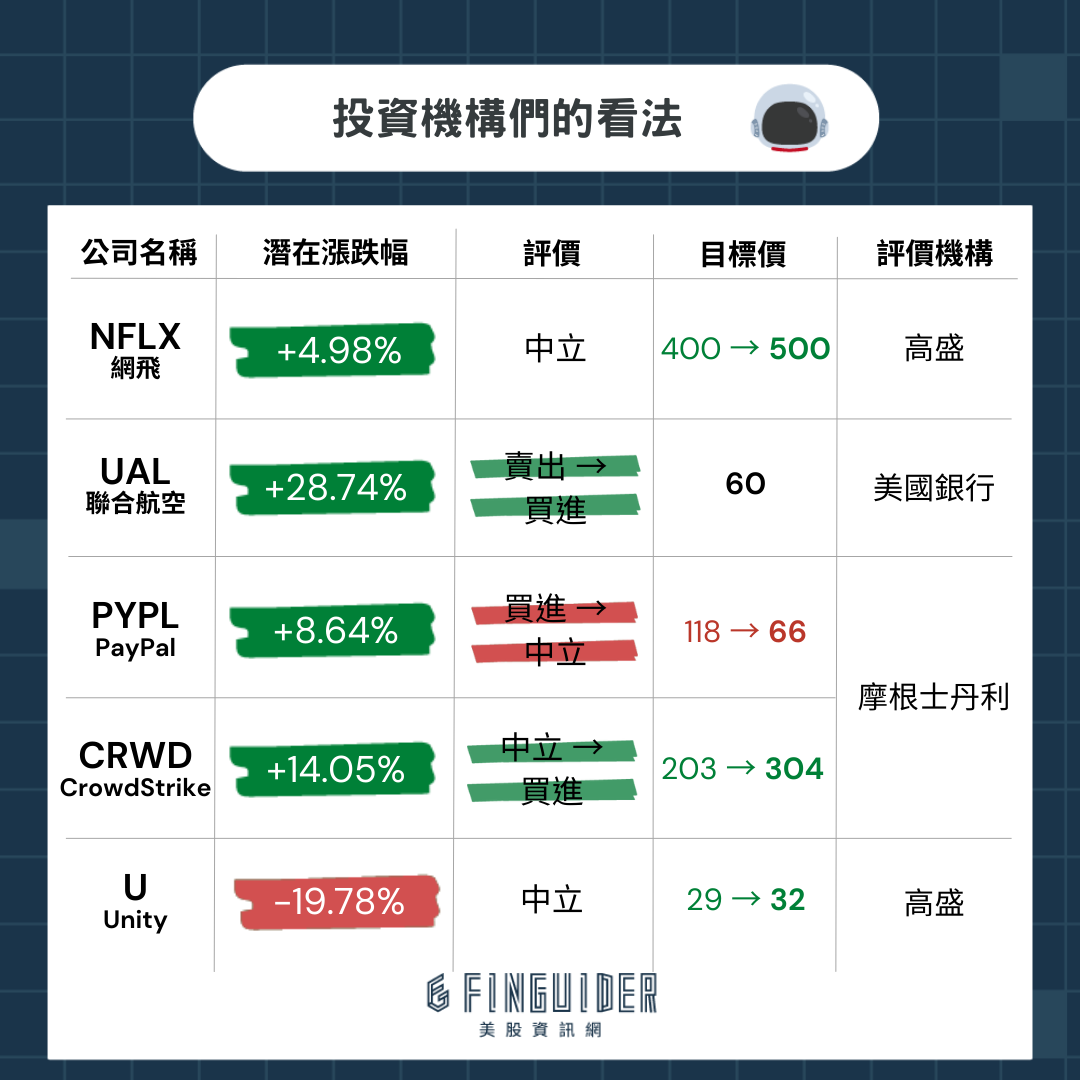

* Morgan Stanley raised its CrowdStrike (CRWD) to "buy" from "neutral" and raised its price target to $304 from $203, implying a potential increase of + 14%.

* Thanks to the surge in demand for high-bandwidth memory (HBM) driven by the AI wave, SK Hynix CEO believes that the company's market capitalization is expected to double over the next three years, and as demand picks up, SK Hynix is considering whether to increase DRAM capacity in Q1

* Wood sister Cathie Wood remains optimistic that the SEC will approve the Bitcoin spot ETF, which is expected to attract a lot of investment from the institutional sector, and will not happen "buy in expectations, sell in reality" situation.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.