BoJ Hawkish Signal Leads to Rate-Raising?

Amidst the weakness in the yen exchange rate, speculation about BoJ's raising interest rates intensified after its hawkish signal.

Recently, there have been various speculations in the market regarding the possibility of the Bank of Japan raising interest rates. Amidst the weakness in the yen exchange rate, some analysts believe that the central bank may resort to adjusting bond yields to prevent further depreciation of the yen.

In March of this year, the Bank of Japan ended its long-standing negative interest rate policy globally and announced its intention to maintain an accommodative financial environment while gradually increasing interest rates. Last week, the Bank of Japan reduced its purchases of government bonds with remaining maturities of 5 to 10 years by ¥50 billion (approximately $320 million), to ¥4.25 trillion (approximately $27 billion). However, the yield on 10-year Japanese government bonds remained relatively stable.

Despite the Japanese government's intervention attempts twice to boost the currency and reduced purchases of government bonds, the yen remains at historically low levels in the market. Meanwhile, Federal Reserve officials believe that the number of rate cuts this year will be far fewer than the market's expected six, with expectations for only three cuts.

At present, with the yen's weakness driving inflation and influenced by various factors, the likelihood of Japan raising interest rates ahead of schedule has increased.

On May 8, Bank of Japan Governor Kazuo Ueda stated at an event in Tokyo that if inflation exceeds expectations, the central bank will adjust interest rates earlier, a sentiment consistent with statements made by central bank officials at the April monetary policy meeting.

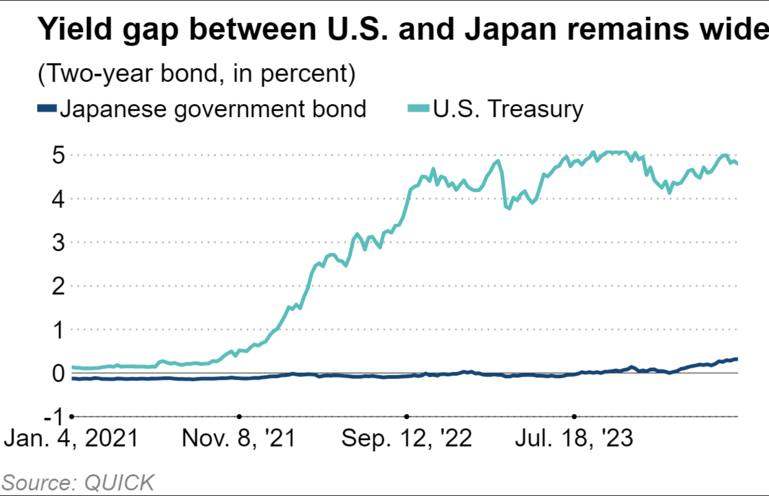

According to FactSet data, the yield on two-year Japanese government bonds is 0.32%, making them highly sensitive to interest rate adjustments by the central bank. This also implies that the policy rate is expected to reach 0.25% in the second half of 2024 and 0.5% the following year.

Masamichi Adachi, Chief Japan Economist at UBS Securities and former Bank of Japan official, noted that remarks by Governor Ueda and other officials during the April 25 to 26 monetary policy meeting hinted at a hawkish stance from the government, emphasizing that yen depreciation is likely to push up core inflation.

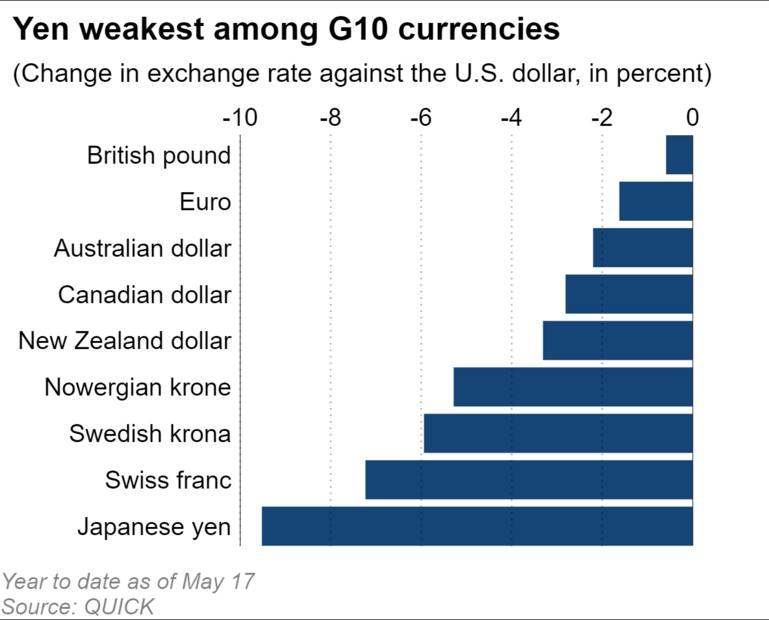

According to government data, Japan's core consumer price index rose by 2.6%, slightly lower than the previous month's figures. On May 17, the yen's exchange rate against the dollar remained at the 155 level, down nearly 10% since the beginning of the year, making it the worst-performing currency among G10 countries.

Preliminary data released last week showed that consumer spending fell in the first quarter of this year due to inflation outpacing wage growth, marking the fourth consecutive quarter of decline. Economists at JPMorgan Securities stated, "With capital outflows and increasing inflation risks, the Bank of Japan may face pressure to adjust interest rates."

Economists at Bank of America Securities believe that unless the yen falls below 165, the Bank of Japan will need more data to consider raising rates, allowing policymakers to cite accelerated base inflation as a reason rather than just focusing on foreign exchange factors. A previous report indicated that Bank of America Securities has moved up its expectation for the next rate hike to 0.25% from September to July and expects a hike to 0.5% in January next year and to 0.75% in the second quarter.

Last week, the Bank of Japan announced a personnel change, appointing an executive director with experience in formulating monetary policy, further solidifying market expectations for a rate hike by the central bank.

However, Naka Matsuzawa, Chief Strategist at Nomura Securities, and others predict that the Bank of Japan will continue to maintain rate stability and gradually move towards a neutral rate. Matsuzawa stated, "Given declining real wages and weakening economic confidence, predictions of a rate hike by the central bank are uncertain. In fact, people are more inclined to see an increase in long-term bond yields to steepen the yield curve and prevent further depreciation of the yen."

In reality, the weakness of the yen stems from the significant interest rate differential between the U.S. and Japan, indicating its sensitivity to U.S. economic data.

On May 16, despite Japan's first-quarter economic growth falling below expectations and the economy not being in an ideal state for rate hikes, the yen rose to the 153 level as U.S. consumer inflation and retail sales data for April showed a cooling economy.

UBS Securities' Adachi mentioned, "The key reason for the yen's depreciation lies not in Japan but in the U.S." This is because U.S. interest rates have reached their highest levels in 23 years, ranging from 5.25% to 5.50%. He stated, "In our view, the Bank of Japan may not raise rates above 0.5% before the end of this year, meaning that if the Federal Reserve does not cut rates, the interest rate differential will not significantly narrow."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.