BYD's Rever to Open Leasing Business in Thailand

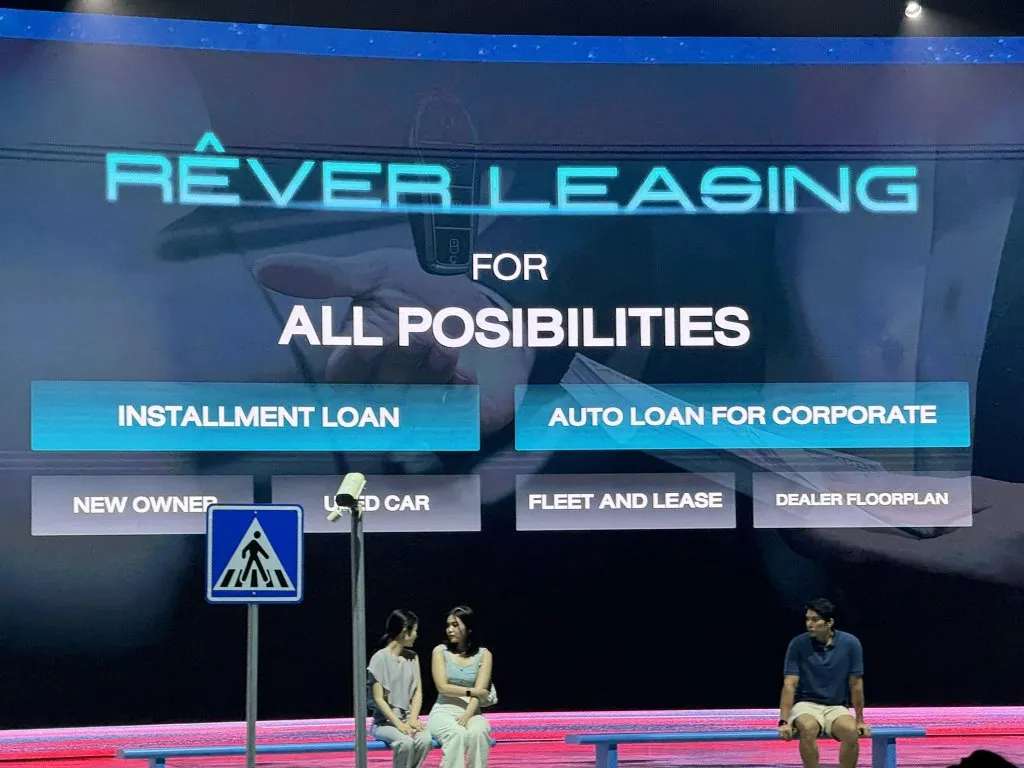

It is reported that Rever Leasing, BYD's only electric car dealer in Thailand, will start operations next month.

According to reports, Rever Leasing, the car rental division under Rever, the sole distributor of BYD electric vehicles in Thailand, will commence operations in May this year. They aim to become one of Thailand's leading electric vehicle leasing companies within the next few years. Rever Leasing has an initial registered capital of 1 billion Thai baht, fully owned by Rever.

Isara Wongrung, CEO of Rever Leasing, expressed confidence and capability in achieving this ambitious goal as the only self-operated electric vehicle leasing company in the Thai market.

He estimates that new car sales in Thailand will remain steady in 2024, at around 780,000 units, consistent with the slow economic recovery and a GDP growth expectation of 3% for the year. This forecast aligns with the delayed disbursement of the 2024 fiscal year budget, which suppressed economic activity and consumer purchasing power in the first quarter, resulting in decreased new car sales. Sales may rebound post-disbursement.

In 2023, new car sales in Thailand dropped from 830,000 units in 2022 to 780,000 units, with electric vehicles accounting for 10%, or 78,000 units, where BYD held a 50% market share. Isara anticipates a surge in electric vehicle sales to 100,000 units this year, with BYD maintaining its leading position with a 50% market share.

Isara also revealed Rever Leasing's future development plans: aiming for a 20% market share of the electric vehicle leasing market in the first year of operation, followed by 10% growth annually over the next two years, reaching a 40% market share by 2026. In terms of loan business, the company hopes to achieve a car loan portfolio of 10 billion Thai baht this year, increasing to 20 billion next year and reaching 30 billion by 2026.

It is reported that three major banks in Thailand, Kasikornbank, Siam Commercial Bank, and Bank of Ayudhya, will collaborate with Rever to provide car loans for BYD buyers. Through selective strategies and robust risk management, the banks effectively controlled non-performing loans (NPLs) related to BYD loans. In the first year of providing loans to BYD buyers in 2023, none of the three cooperating banks incurred any NPLs.

However, due to strict loan standards and concerns about the continuously rising household debt, which accounts for 91% of GDP, the three cooperating banks have reduced the average loan approval rate for purchasing BYD vehicles from 80% to 70-75%. Isara mentioned that Rever Leasing also intends to adopt similar operational strategies. On the other hand, to address the situation of high interest rates, the three cooperating banks have increased the annual interest rate for BYD car loans from 1.88% last month to 1.98% (based on the unified new car rate).

Isara stated that Rever's target customers are primarily high-income individuals, including office workers, government officials, and entrepreneurs, with a minimum monthly income of at least 30,000 Thai baht. Additionally, BYD requires a minimum down payment of 20-25% of the total vehicle value, higher than that of competitors. Through a sound risk management framework, Rever Leasing aims to keep the NPL ratio within 1.5% of the outstanding loan amount this year.

Isara said, "Rever Leasing will commence operations when policy interest rates tend to stabilize. A stable interest rate outlook significantly enhances the ability of car buyers to repay debts, benefiting the entire automotive industry. Furthermore, future interest rate cuts can increase benefits for car buyers."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.