How is Capital.com? Is it Reliable?

Capital.com is a global CFDs and Forex broker founded in 2016, offering trading on 3,000 of the world’s most popular indices, commodities, cryptocurrencies, stocks and currency pairs.

Introduction to Capital.com

Founded in 2016, Capital.com is one of the fastest-growing trading platforms in Europe, with offices in the UK, Melbourne, Cyprus, and Belarus. Capital.com offers traders opportunities to trade in over 4,000 markets with competitive spreads, zero commissions, and no hidden fees.

Capital.com is a company registered in Cyprus, with registration number HE354252. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 319/17. As a regulated entity within the EU, Capital.com adheres to the requirements of the EU Markets in Financial Instruments Directive (MiFID).

Security at Capital.com

- Capital.com operates under entities authorized and regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Services Authority (FSA), and the Securities Commission of The Bahamas (SCB).

- Capital.com collaborates with two major European financial institutions, RBS and Raiffeisen Bank, to provide traders with secure fund storage and protection. Traders’ funds are kept in segregated accounts, completely separate from the company's operational accounts.

- Security is further assured by safeguarding traders' assets. Under regulatory rules, every deposit made by traders is protected by the Investor Compensation Fund or the UK Financial Services Compensation Scheme.

- Negative balance protection and automatic margin closeout features safeguard traders’ assets from negative balances when the market moves unfavorably.

- Capital.com strictly follows PCI Data Security Standards, ensuring traders' funds are always within the safest data environment. The company also uses Transport Layer Security (TLS) protocols to encrypt and secure real-time backup of traders’ information.

Features of Capital.com Services

- Zero Commission: Traders can trade CFDs online without worrying about hidden fees. They only need to pay the spread. Withdrawals and deposits are also fee-free.

- Robust Risk Management: Manage risk using stop loss, guaranteed stop loss, and take profit orders. Use advanced charting tools to trade on a platform offering post-trade analysis to help clients understand their trading behavior.

- Secure Broker: Trade with a secure, regulated, and reliable CFD provider. Capital.com employs the latest encryption technology to protect traders’ funds fully.

- Chart Trading: Capital.com offers an excellent online CFD trading experience with over 75 technical indicators and instant price alerts.

- Customer Support Service: Capital.com provides 24/7 customer support in 12 languages.

Capital.com Account Types

Capital.com offers multiple account types. When choosing an account, consider factors such as investment goals, risk tolerance, trading frequency, and any associated fees or minimum balance requirements. New traders may prefer a retail account, while experienced traders may opt for a professional account.

Retail Accounts

Capital.com offers three different retail account types for traders, namely Standard Account, Plus Account and Premier Account.

In addition, Capital.com also allows you to open a demo account to test trading strategies, or open a real account to enter the foreign exchange market. The comparison of the three accounts is shown in the figure below:

| Feature | Standard Account | Plus Account | Premier Account |

|---|---|---|---|

| Minimum Deposit | $20 to $3,000 | $3,000+ | $10,000+ |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:30 |

| Advanced Charts & Market Access | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Automatically Applied | Automatically Applied |

| Exclusive Platform Roaming | No | Yes | Yes |

| Custom Analysis Access | No | Yes | Yes |

| Account Manager Service | No | Yes | Yes |

Professional Accounts

When trading as a professional, traders must consider several factors, including leverage limits, negative balance protection, and expected experience.

Professional traders using Capital.com can access the following leverage based on the financial instruments they trade:

- Major Forex pairs - 1:500.

- Major Indices - 1:200.

- Commodities - 1:200.

- Stocks - 1:20.

- Cryptocurrencies - 1:20.

Capital.com offers negative balance protection on the accounts it offers, but it only applies to professional accounts with up to 1:50 leverage.

Capital.com Account Opening Process

The account opening process at Capital.com is straightforward. Click "Open an Account at Capital.com Now!"

Here’s the basic process:

First, visit Capital.com's website and fill out the registration form to apply for an account. The broker needs to review and verify the application, which typically takes around 24 hours.

The following steps usually occur at the end of the application process or after your identity is verified:

- Complete a trading experience questionnaire. Capital.com must ensure that traders possess some basic financial knowledge and are aware of the risks involved in trading.

- Select an account type and a base currency.

- Choose a funding source, enter the deposit amount, and provide any other necessary trading details. Submit your deposit request. You can start trading once the account is funded. The minimum deposit required by Capital.com is $20. The minimum $20 applies to transfers via credit/debit cards, Apple Pay, or PayPal. For bank wire transfers, the minimum deposit is $50.

Capital.com Deposits and Withdrawals

Deposit Process

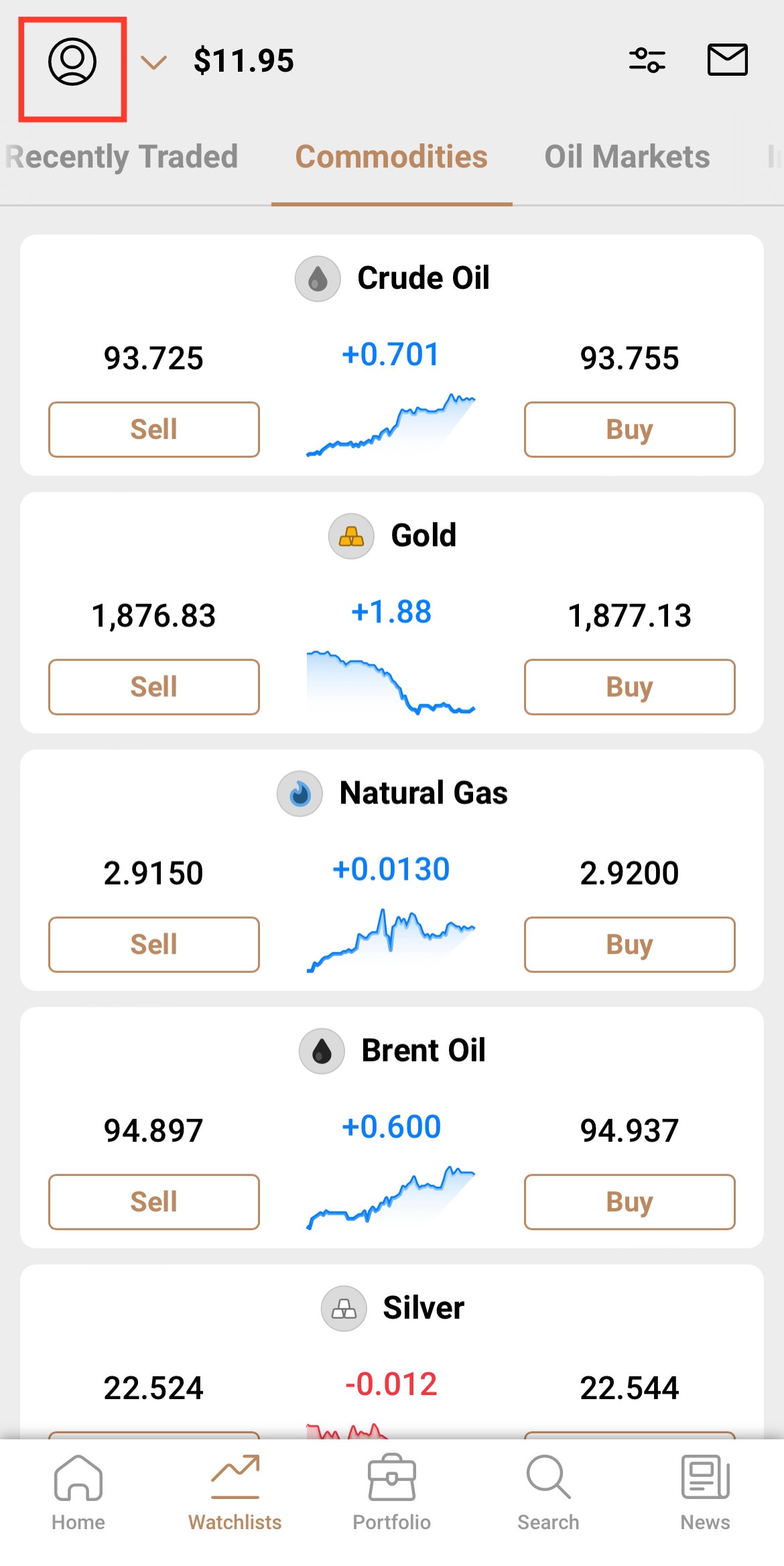

- Via APP

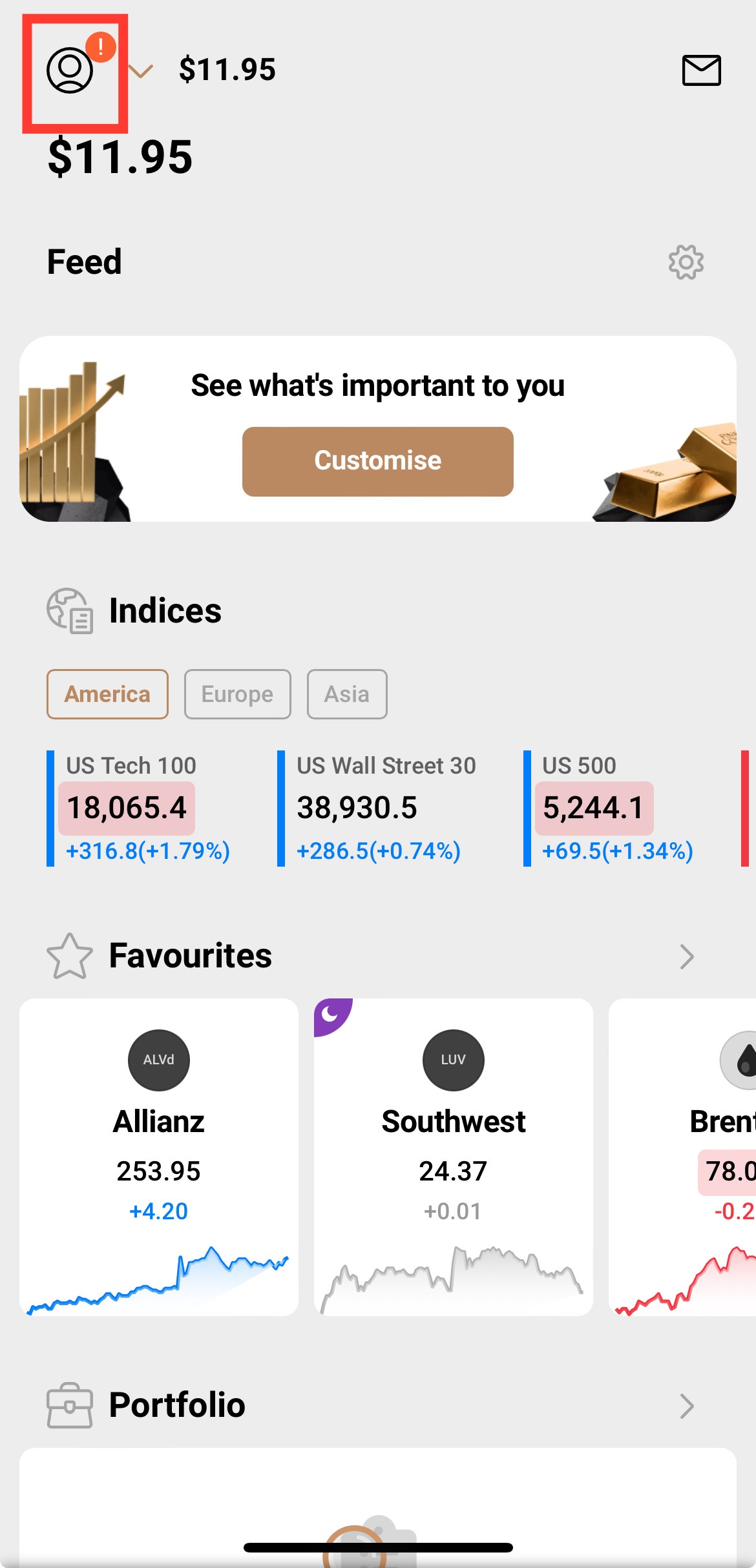

Open the APP homepage and click “Account.”

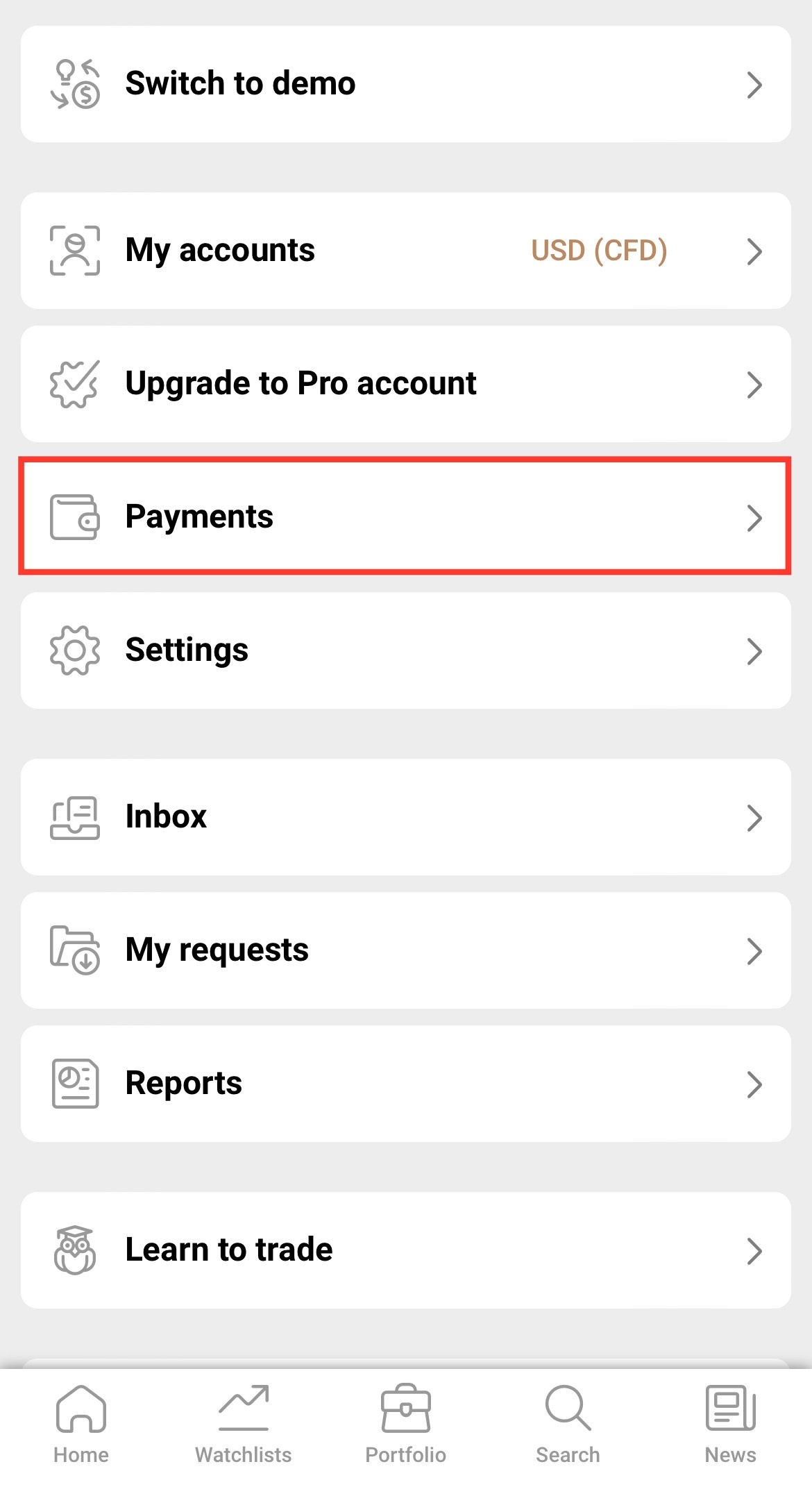

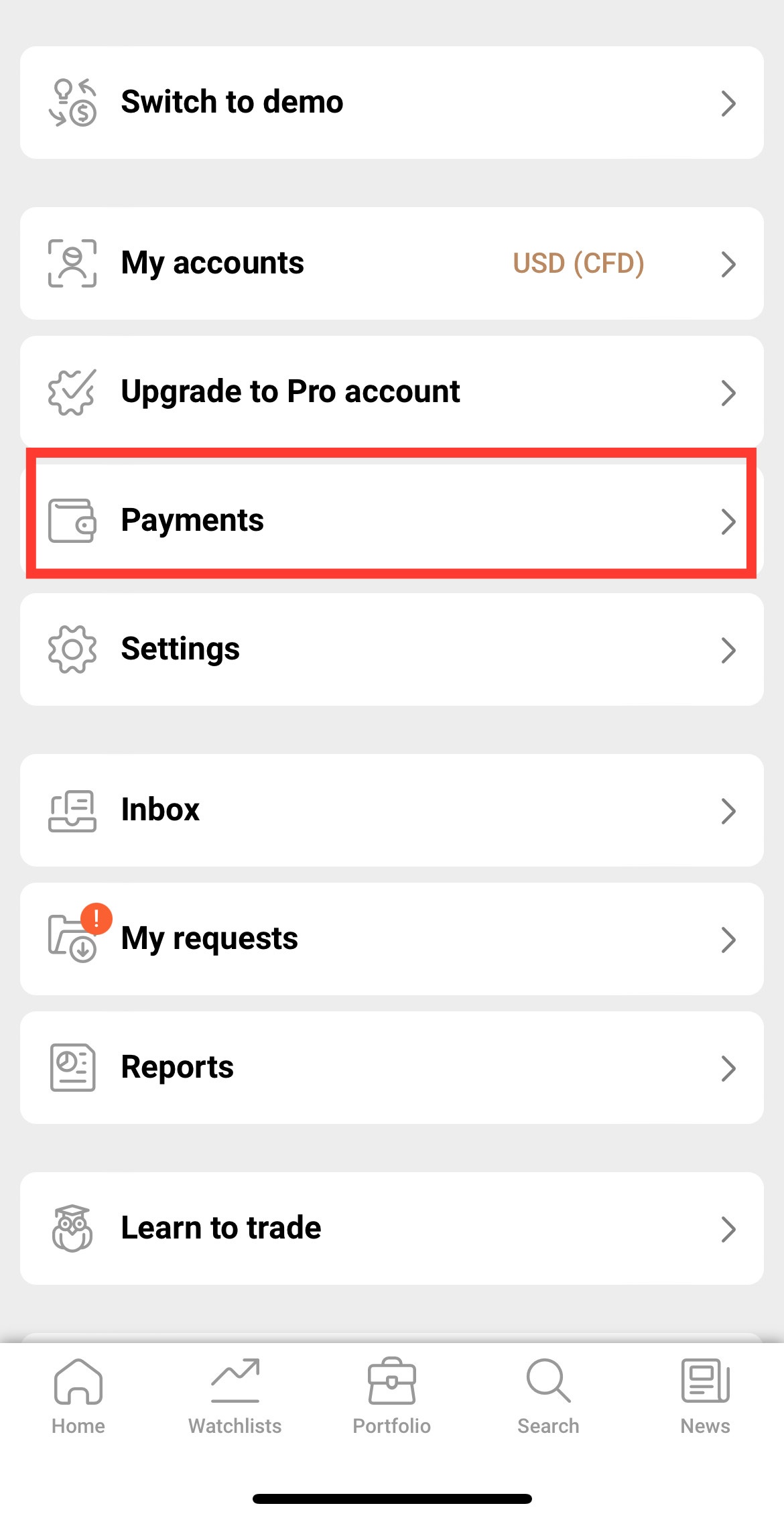

Select “Payments” within the account page.

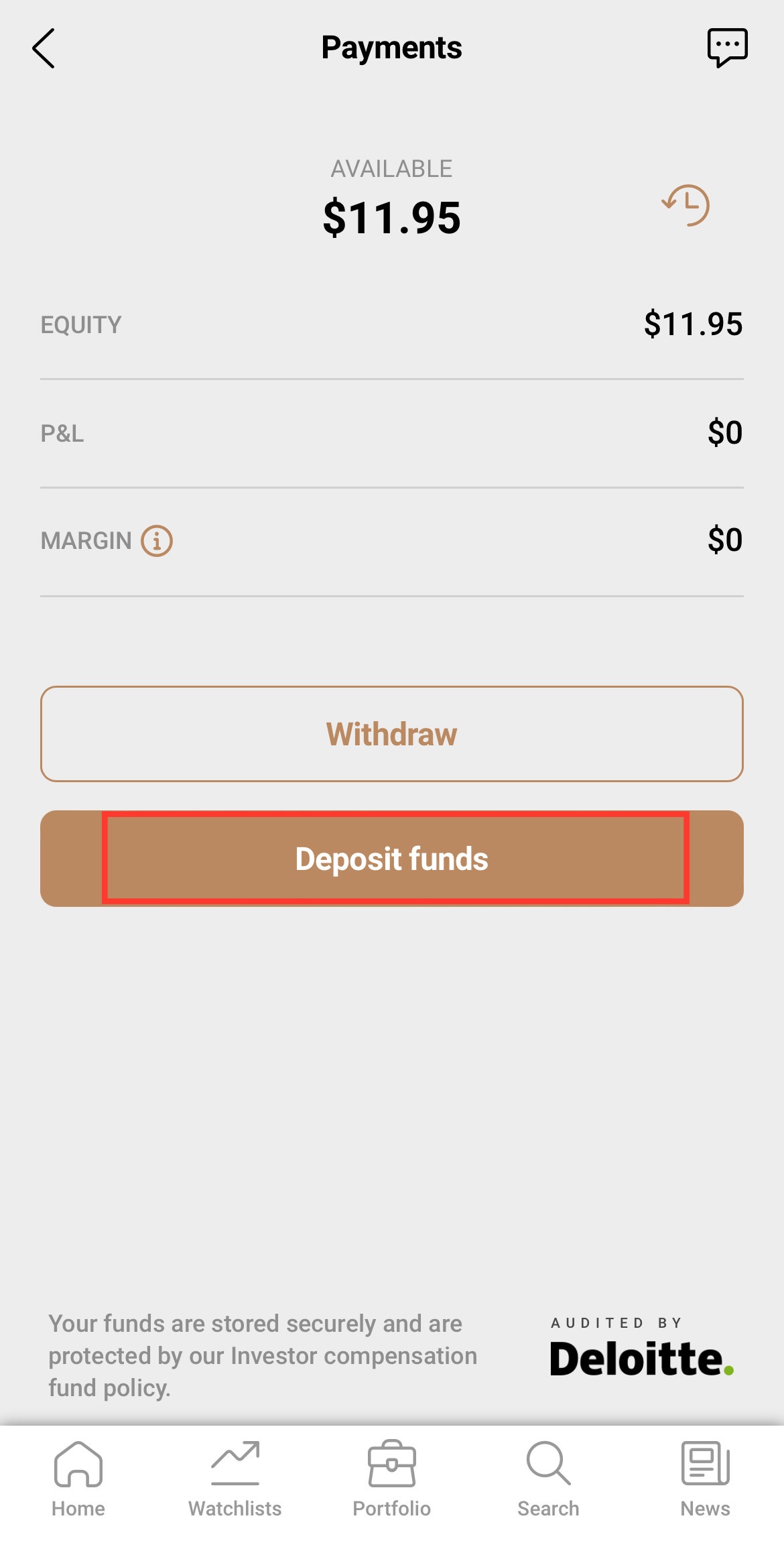

Deposit funds and choose a payment method.

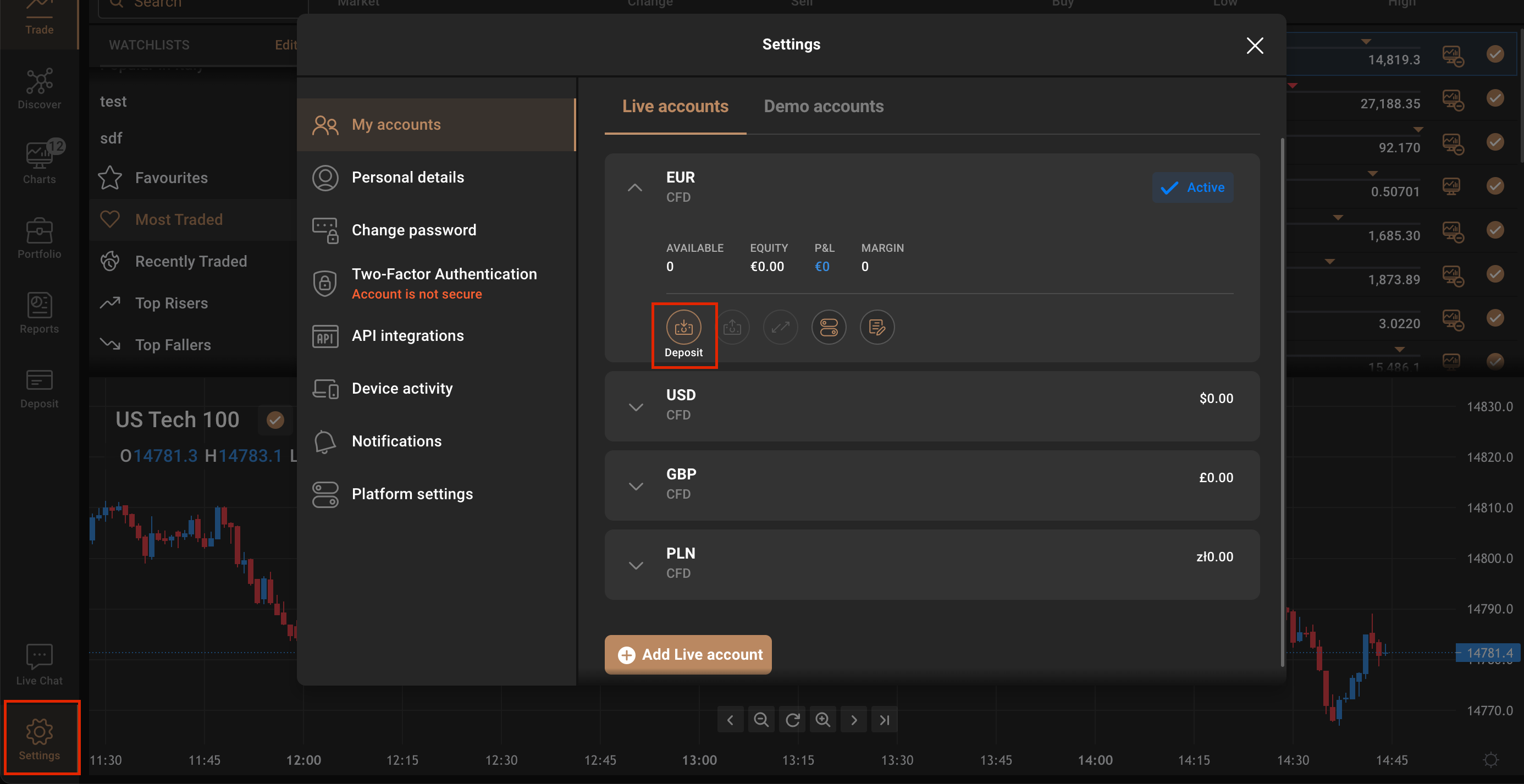

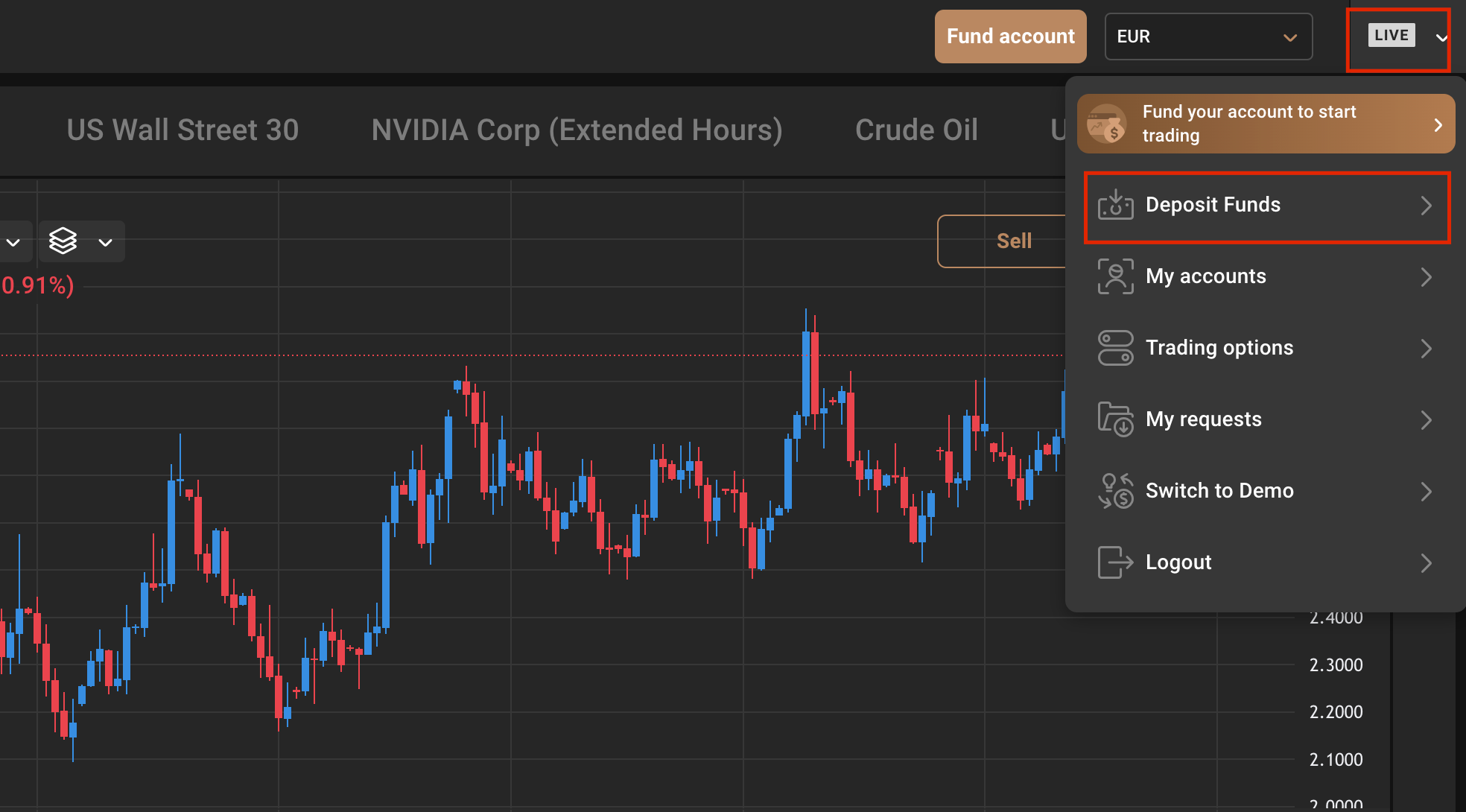

- Via Web Platform

Open the official website, go to settings, enter “My Account,” and select “Deposit.”

Or go to LIVE and choose “Deposit Funds.”

Common deposit methods include:

- Bank Transfer;

- Bank Cards (Visa/MasterCard) – All countries except the following: Afghanistan, Algeria, Argentina, Bahamas, Bangladesh, Bolivia, Botswana, Canada, China, Colombia, Democratic Republic of Congo, Cuba, Ecuador, Egypt, Ghana, Guam, Guinea-Bissau, Haiti, India, Iceland, Indonesia, Israel, Iraq, Japan, Kyrgyzstan, Lebanon, Libya, Mongolia, Morocco, Nepal, Nigeria, Pakistan, Panama, Samoa, South Sudan, Somalia, Sudan, Syrian Arab Republic, Trinidad and Tobago, Venezuela, Yemen, Zimbabwe (payments may sometimes be successful, but Capital.com cannot guarantee the stable use of bank cards in the above-mentioned countries);

- ApplePay;

- SOFORT (for Switzerland);

- SPEI (for Mexico).

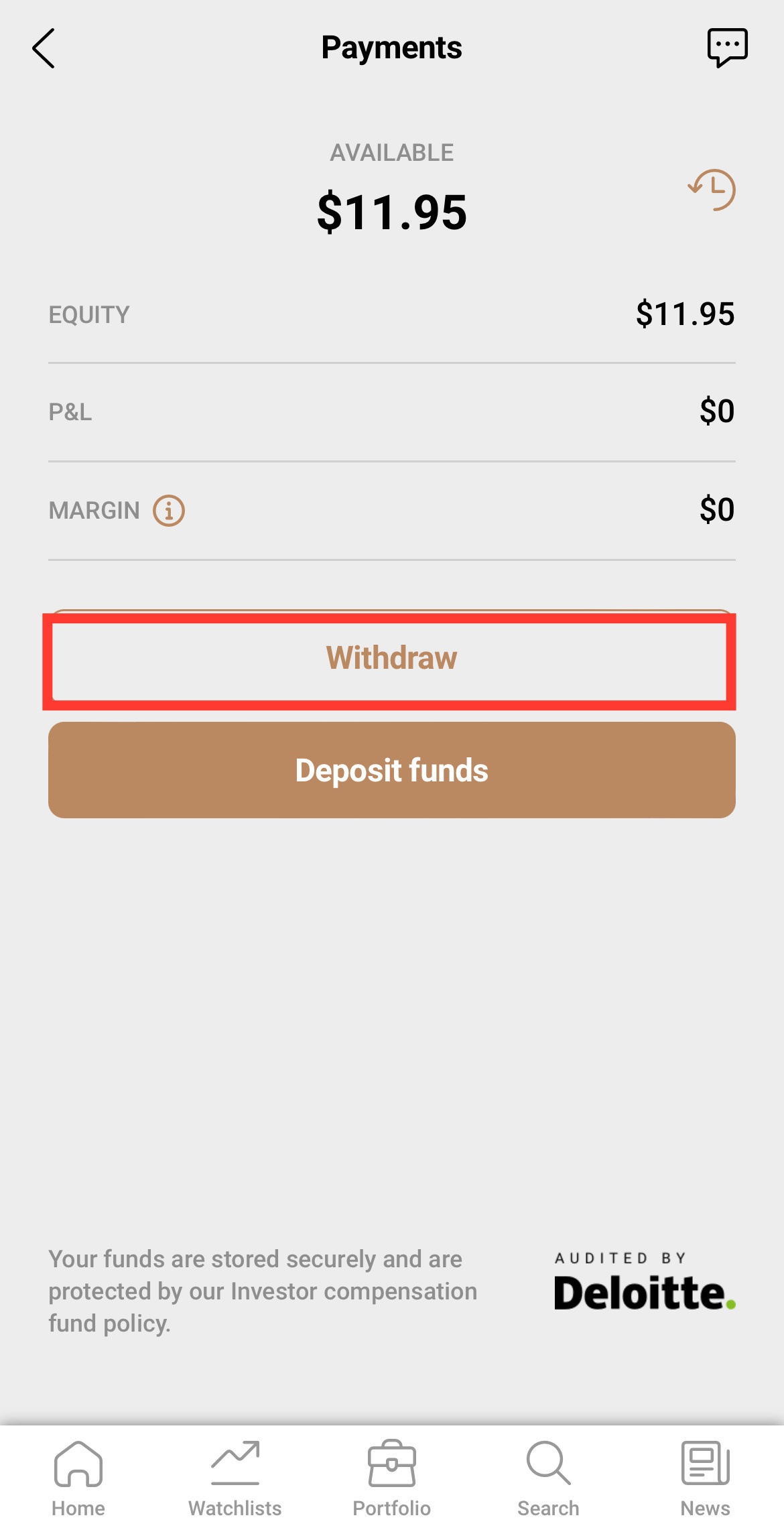

Withdrawal Process

To withdraw your funds, go to Account -> Payment -> Withdrawal within our application. Choose the same payment method used for deposits, enter the amount, and confirm.

- Via APP

Open the APP homepage and click “Account.”

Select “Payments” within the account page.

Withdraw funds and choose a payment method.

- Via Web Platform

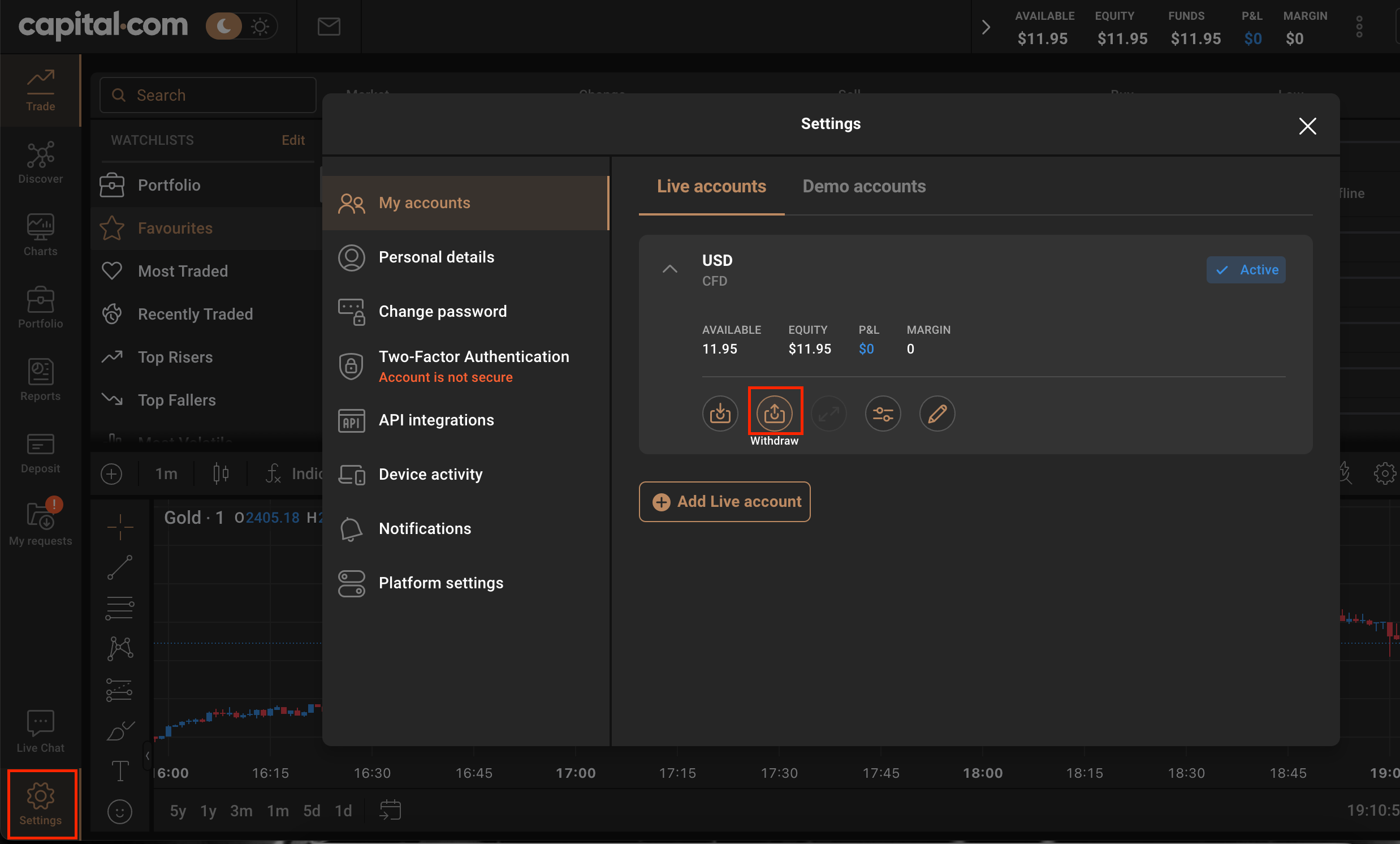

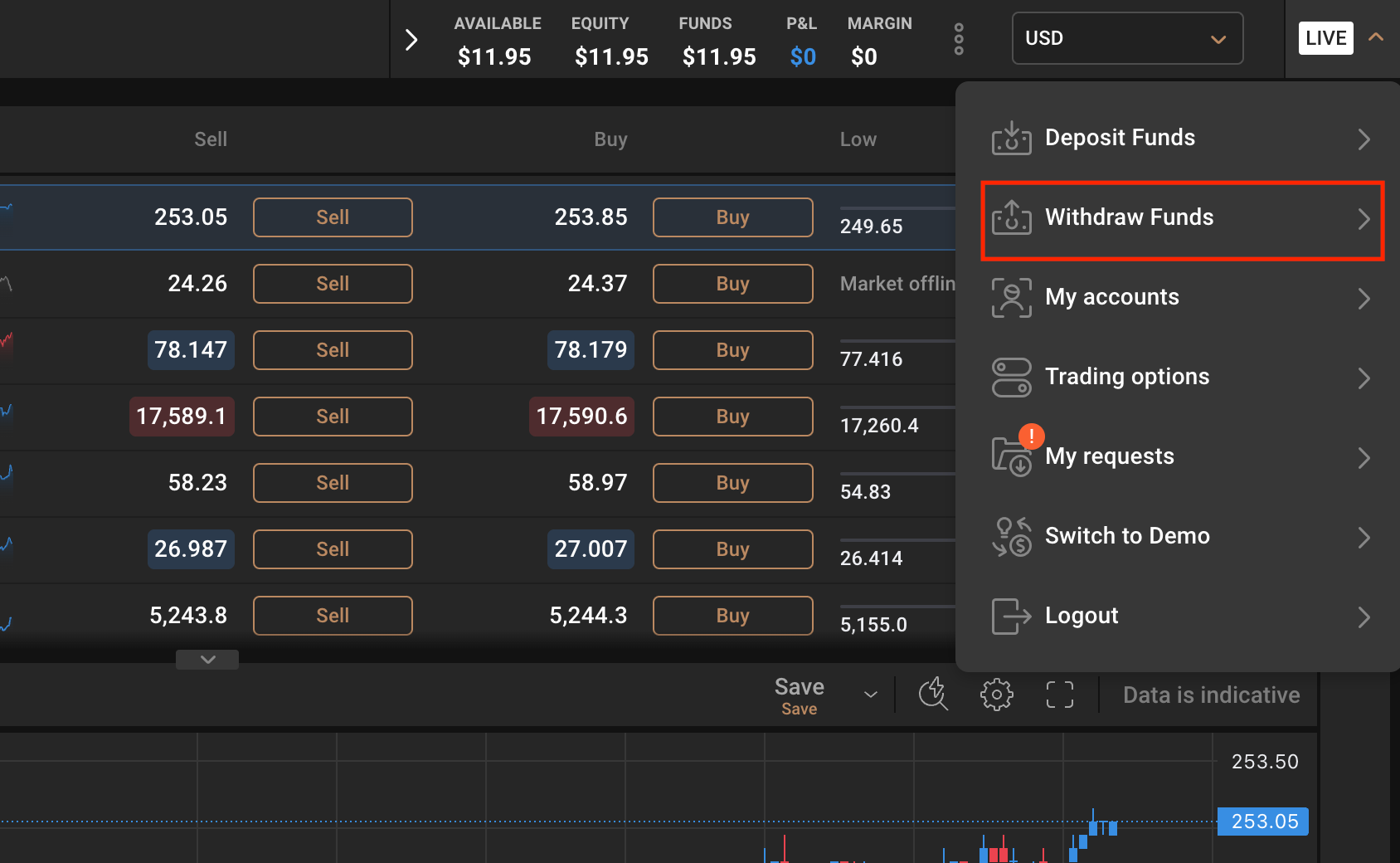

Open the official website, go to settings, enter “My Account,” and select “Withdraw.”

Or go to LIVE and choose “Withdraw.”

Important Notes

- Capital.com typically processes all withdrawal requests within 24 hours, but funds may take up to 5 business days to reach your bank account.

- If the balance in the trading account is below $50/€50/£50, you can only withdraw the entire balance. If the balance exceeds $50/€50/£50, the minimum withdrawal amount is $50/€50/£50.

- The minimum deposit is 20 EUR/USD/CHF/GBP, 80 AED, or 400 MXN.

- Capital.com only accepts payments in fiat currency. Traders can deposit in either the trading account currency or the local currency. In such cases, funds will be automatically converted into the trading account currency.

Capital.com Trading Platforms

Capital.com offers various platforms, including an online trading platform, an APP, TradingView, and the popular MT4 platform. Note that the MT4 platform is not available for Australian clients.

Online Trading

Use modern, easy-to-read charts, more accurate technical indicators, and indicator editors to help traders spot trends and identify optimal entry or exit points.

- Actionable Trading Ideas: Capital.com offers over 70 technical analysis indicators (from Bollinger Bands to Ichimoku Cloud) and a wide range of drawing tools to better calculate potential trading opportunities.

- Perfect Multi-Chart Switching: Easily zoom in and out of up to six tabs to keep a close eye on all charts and tools within your trading device.

- Personalized Watchlists: Set up multiple watchlists to track selected markets, with dynamic price alerts updating every second.

- Hedging and Risk Management Tools: Stay flexible, hedge positions, go long or short on the same market. Ensure traders’ profits and manage risks effectively using stop-loss and take-profit orders.

APP Trading

Capital.com features an intuitive, easy-to-use interface with a fast and convenient registration process.

- Access to 3,000+ Markets: Capital.com allows access to over 3,000 of the most traded international markets, including stocks, indices, commodities, forex, and cryptocurrencies.

- In-depth Financial Analysis: Use the most reliable technical analysis tools and high-level charts to spot additional trading opportunities and accurately identify market trends.

- Smart Risk Management: A full suite of effective risk management tools.

- Set desired price levels and receive instant push notifications from Capital.com.

TradingView

Link your Capital.com account to TradingView to trade using various charting tools.

- Discover opportunities with over 12 customizable chart types, including Renko, Kagi, and Point & Figure, and view up to 8 charts on a single tab.

- Stay synchronized with the market using 12 price, indicator, and strategy alerts.

- Enhance your analysis with over 100 preset indicators, countless community-built indicators, smart charting analysis tools, volume profile indicators, and candlestick pattern recognition.

- Utilize over 100 fundamental metrics and ratios, financial statements, valuation analysis, and historical company data.

MetaTrader 4

MT4 enhances your trading experience with real-time charts, live quotes, deep analysis, and a range of order management tools, indicators, and Expert Advisors (EAs). The platform is user-friendly, easy to navigate, and packed with professional features.

- 85 pre-installed custom indicators for deeper market insights.

- Expert Advisors (EAs) for automated trading strategies.

- Analytical tools to help traders make more informed decisions.

- Additional trading tools, including 30 popular technical indicators and 24 analysis objects.

- Automated trading 24/7, allowing for uninterrupted trading.

- Various chart settings to quickly and effectively manage trading positions.

Capital.com Trading Products

The broker mainly offers CFDs on stocks and cryptocurrencies, and provides real stock trading for the UK, Denmark, and France.

- Forex: Trade major forex pairs with competitive spreads. Traders can use Capital.com to research real-time forex prices and charts and trade forex CFDs.

- Indices: Trade CFDs on major global indices like the S&P 500, FTSE 100, and DAX 30. Capital.com offers a wide range of global indices CFDs, from flagship indices like NASDAQ 100, Dow Jones, and FTSE 100 to more specific indices such as WIG 20 or IBEX 35.

- Commodities: Trade popular commodities like oil, metals, and natural gas with tight spreads. Capital.com allows trading CFDs on commodities with higher liquidity and leverage, which can amplify profits but also potential losses.

- Stocks: Trade popular stocks of global companies such as Apple, Tesla, GameStop, AMC, and Robinhood without holding the underlying stock. Trade price movements anytime and anywhere.

- Cryptocurrencies: Capital.com offers various cryptocurrencies that can be traded against many different currencies. We provide pairs with cryptocurrencies like Bitcoin, Litecoin, Ripple, TRON, Ethereum, and more. Use Capital.com to study cryptocurrency price charts.

FAQs

-

Can I change the currency of my account?

Traders cannot change the currency of an existing live account but can open a new account in a different currency. Please go to Account (or Settings on the desktop version) → My Account → Open New Live Account.

-

What types of documents can I provide to verify my address?

One of the following documents:

- Utility bills: Water/Gas/Electricity/TV services/Landline/Fixed-line bills.

- Bank statements (including mobile/online banking screenshots and bank letters).

- Proof of residence.

- Credit card/debit card statements.

- Tax statements or local authority tax bills.

- Rental agreements.

- Government-issued documents (notices/election invitations, etc.).

- Letter from landlord or employer.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.