This surge in digital payments is mainly due to the convenience digital payments provide compared to traditional payment methods such as cash or cards.

Recently, CDO Trends released a new survey on the digital payment landscape in the Asia-Pacific region.

Digital payment has huge development potential

Through in-depth research on the status of digital payments in six key markets: Australia, the mainland of China, Hong Kong, Singapore, Malaysia and Indonesia, CDO Trends believes that digital payments have huge development potential in both high-growth and mature economies.

CDO Trends mainly discussed five points.

First, the growth momentum of buy first and pay later (BNPL) services is once again strong after a period of strict supervision.Although regulatory measures initially had a dampening effect on its development, BNPL has regained great popularity among Gen Z and millennials.This group particularly appreciates its flexible repayment terms and the advantages of no interest charges.The BNPL market in the Asia Pacific region still has huge growth potential.

According to statistics, the market value of the Buy First Pay Later (BNPL) platform will be approximately US$27.84 billion in 2023 and is expected to grow to US$122 billion by 2030, achieving a compound annual growth rate of 18.6% from 2024 to 2030.

Secondly, the use of cryptocurrencies and stablecoins has increased.In 2024, the use of cryptocurrencies for payments will increase significantly, especially in high-growth economies such as India and Indonesia.Consumers 'growing familiarity with cryptocurrencies and stablecoins will promote increased trust and usage in the next few years.

According to the "Research Report on Digital Payment and the Development of Inclusive Finance in China," digital payment, as an important component of the modern payment system, is an important manifestation of the development of financial technology and is of great significance to promoting the development of the digital economy.

Third, the central bank digital currency (CBDC) is still in its infancy, but it has huge development potential.CBDC is emerging as a promising digital payment method, and multiple countries in the Asia-Pacific region are exploring or implementing these plans.The launch of CBDC is an important step in the adoption of digital currencies and is supported by the security and trust of the central bank.

Fourth, digital payments are popular in both high-growth and mature economies.This surge in digital payments is mainly due to the convenience digital payments provide compared to traditional payment methods such as cash or cards.Consumers also appreciate the convenience of transaction tracking and financial management provided by digital options.

According to data recently released by the People's Bank of China, in 2023, banks handled 185.147 billion mobile payment services, with an amount of 555.33 trillion yuan, a year-on-year increase of 16.81% and 11.15% respectively.During the same period, non-bank payment institutions also achieved rapid growth in processing online payment services, processing a total of 1.23 trillion transactions, with an amount of 340.25 trillion yuan, a year-on-year increase of 17.02% and 11.46% respectively on a comparable basis.

Finally, despite the booming digital payments space, cash remains resilient.During the epidemic, cash's popularity declined due to health concerns and the use of digital payments increased significantly, but new findings show that cash remains a widely used payment method in online and offline transactions.

Buying ETFs is still one of the best options to seize dividends

In this market environment, if investors want to seize the growth dividends of the digital payment market, purchasing a digital payment ETF may be a good choice.

Digital payment ETFs have many advantages.

First, it provides investors with a simple and efficient way to participate in the rapid growth of the digital economy.By purchasing an ETF, investors can effectively diversify their investments among multiple companies related to the digital economy, which helps reduce the risk of investing in a single stock.

Second, digital payment ETFs typically have low fee ratios, which means investors can have low-cost options.In addition, there is no risk of trading or delisting ETF.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

For ordinary investors, mastering cash flow means mastering the ability to resist risks, while ETFs 'low threshold and risk diversification properties undoubtedly provide an additional layer of insurance for novice investors.

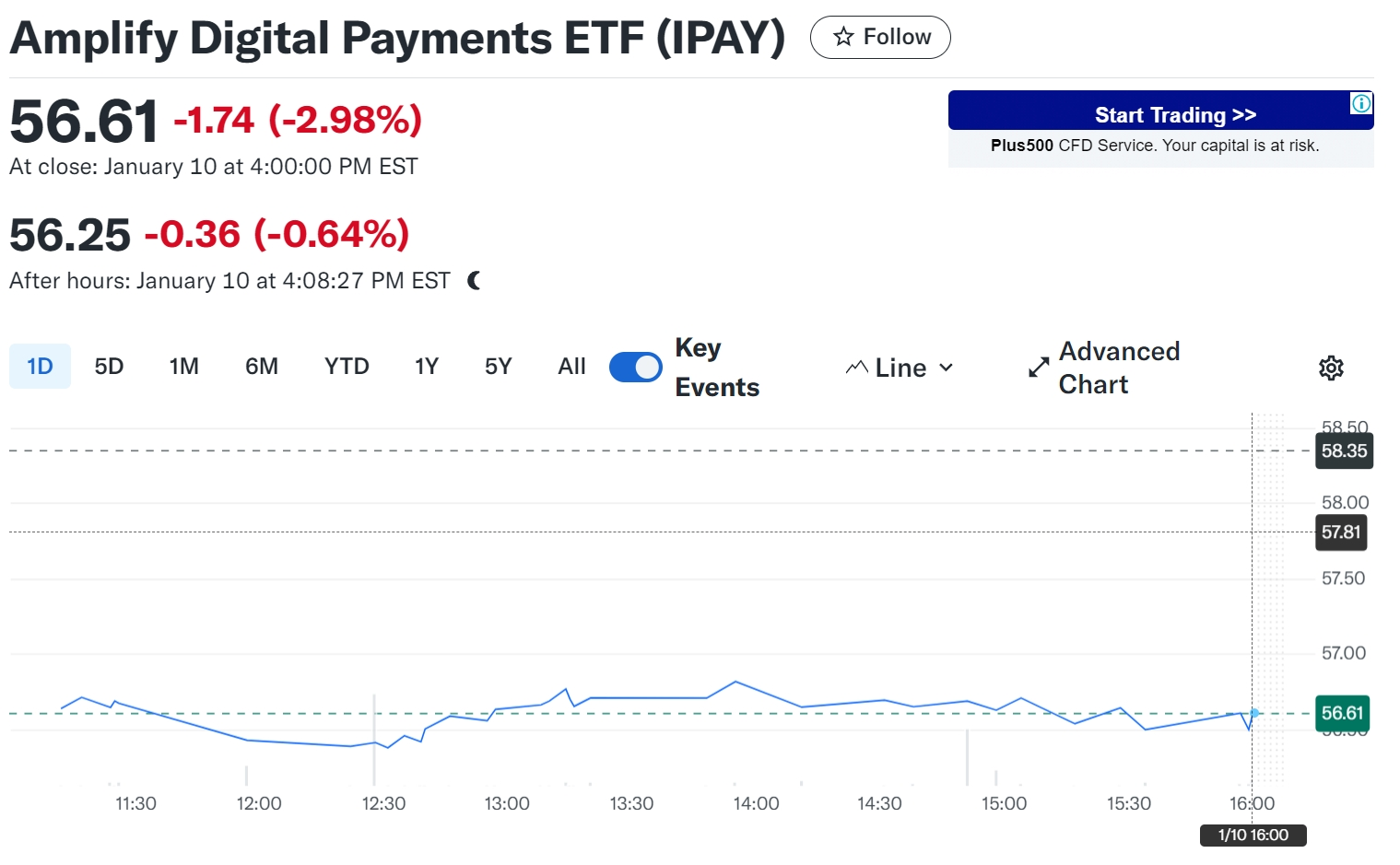

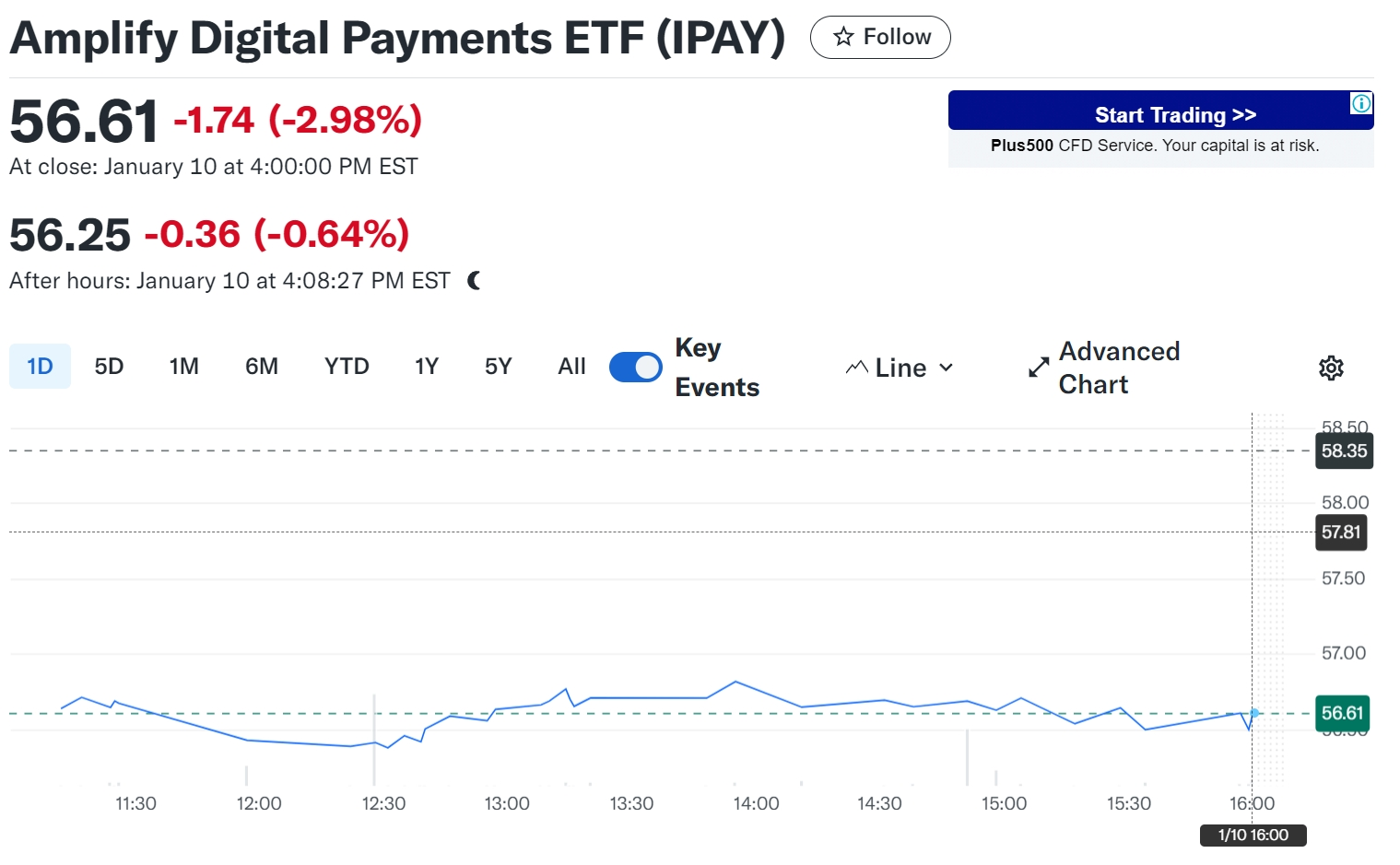

The following are some of the more representative electronic payment ETFs & indexes on the market. They are not recommended for investment but are for reference only.