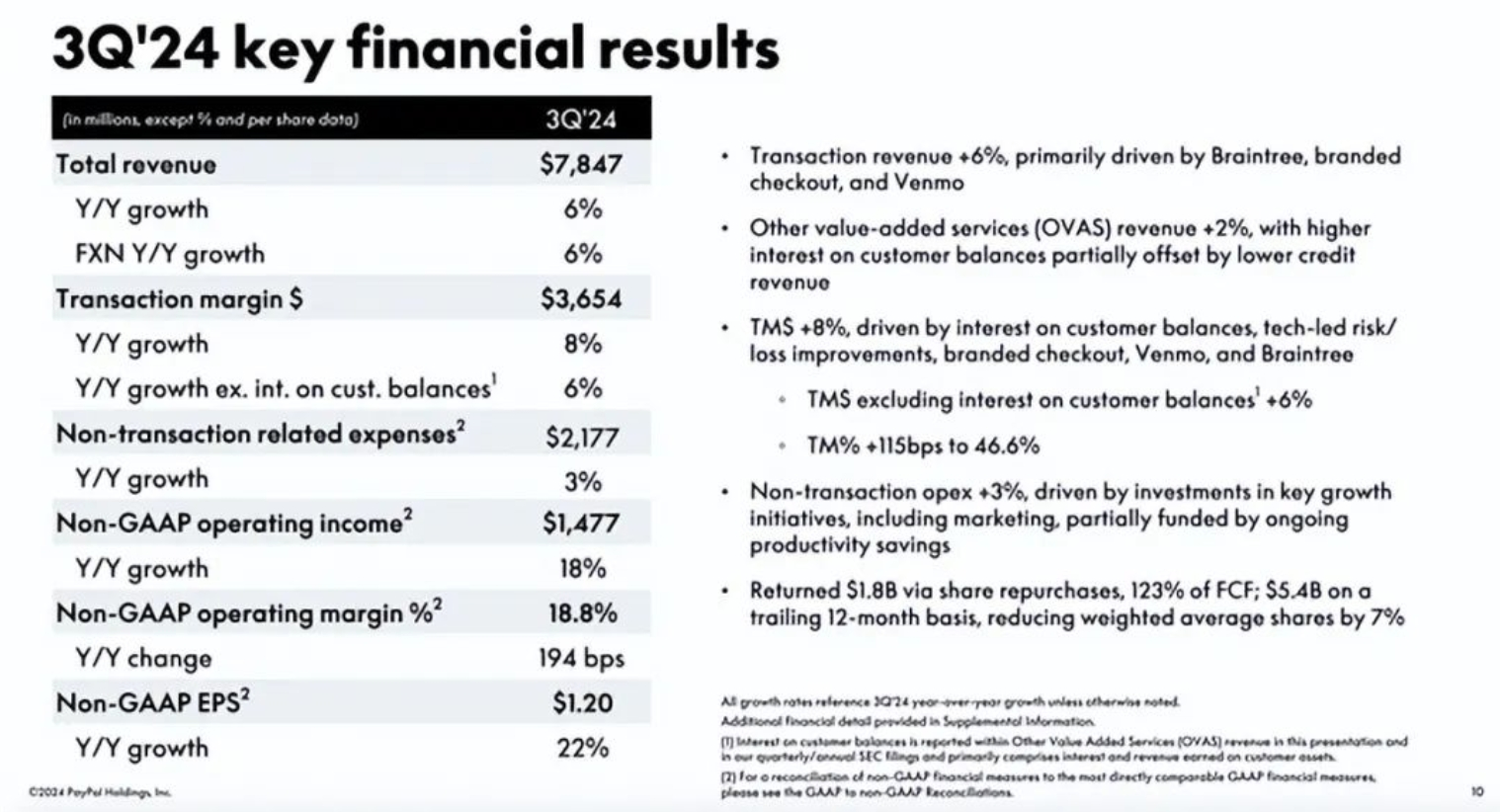

This month, digital payment giant PayPal announced its third-quarter 2024 results, and the report is full of highlights.

Under N-GAAP, revenue and EPS both increased by 20%

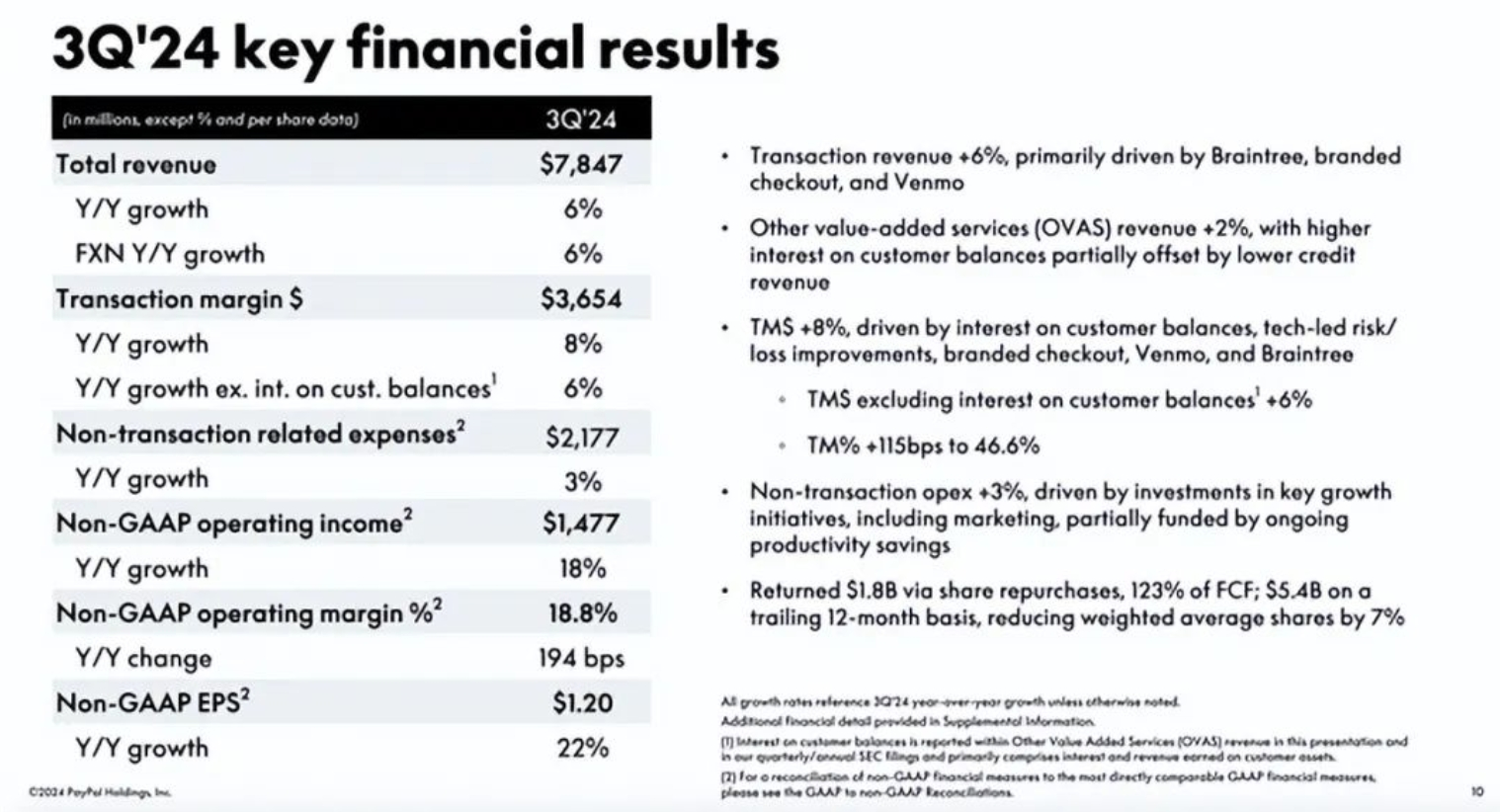

In terms of revenue, under GAAP, PayPal's revenue during the reporting period increased by 5.8% year-on-year to US$78.47; under Non-GAAP, PayPal's revenue in the third quarter increased by 18.8% year-on-year, exceeding market expectations.

The difference between GAAP and Non-GAAP is that although GAAP can ensure the consistency and comparability of a company's financial information, some companies believe that certain GAAP requirements may distort the true situation of their financial performance, so they will provide Non-GAAP financial indicators to better reflect the performance of the company's core business.

In terms of business division, PayPal's report card in the third quarter was also quite outstanding.PayPal's transaction revenue increased from US$6.654 billion in the third quarter of 2023 to US$7.067 billion in the third quarter of 2024 (year-on-year increase of 6.2%), and other value-added services revenue increased from US$764 million in the third quarter of 2023 to US$780 million in the third quarter of 2024 (year-on-year increase of 2.1%).

Diluted net income per share increased from US$0.93 in the third quarter of 2023 to US$0.99 in the third quarter of 2024, a year-on-year increase of 6.5%; free cash flow increased by 31.2% year-on-year, from US$1.101 billion in the third quarter of 2023 to US$1.445 billion in the third quarter of 2024.

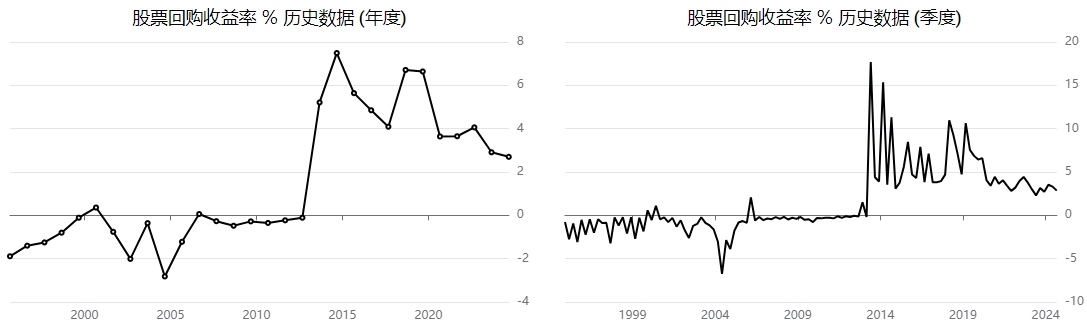

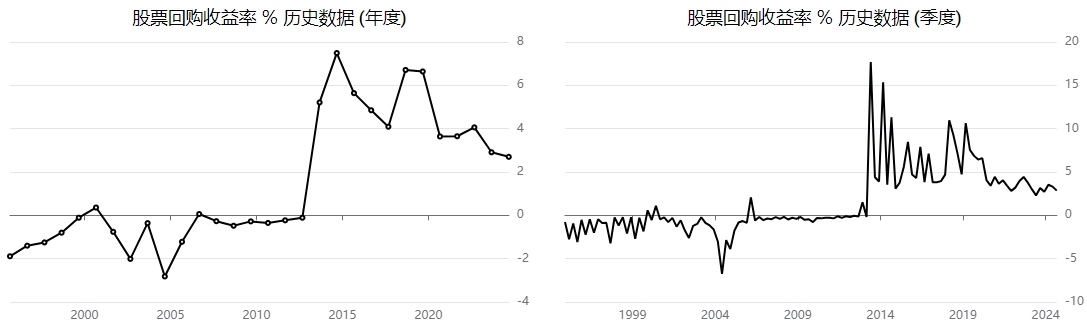

At the same time, in the past 12 months, Paypal has continued to buy back its own shares in large quantities, with a total cost of approximately US$5.4 billion.Generally speaking, only when the stock price is lower than the company's reasonable expectations will the company use large amounts of liquidity to buy back its own shares.Therefore, the company's own share buybacks are often seen as a positive.

During Paypal's repurchase wave, 6.7% of outstanding shares were withdrawn, reducing the company's diluted outstanding shares from 1.098 billion shares in the third quarter of 2023 to 1.024 billion shares in the third quarter of 2024-the result of this project was an increase in earnings per share, and Paypal's Non-GAAP earnings per share increased by 22% in the quarter.

On the one hand, this is due to Paypal bottoming out after an estimated 80% drop; on the other hand, the loss of denominator caused by the decline in the number of outstanding shares also directly raised this indicator.

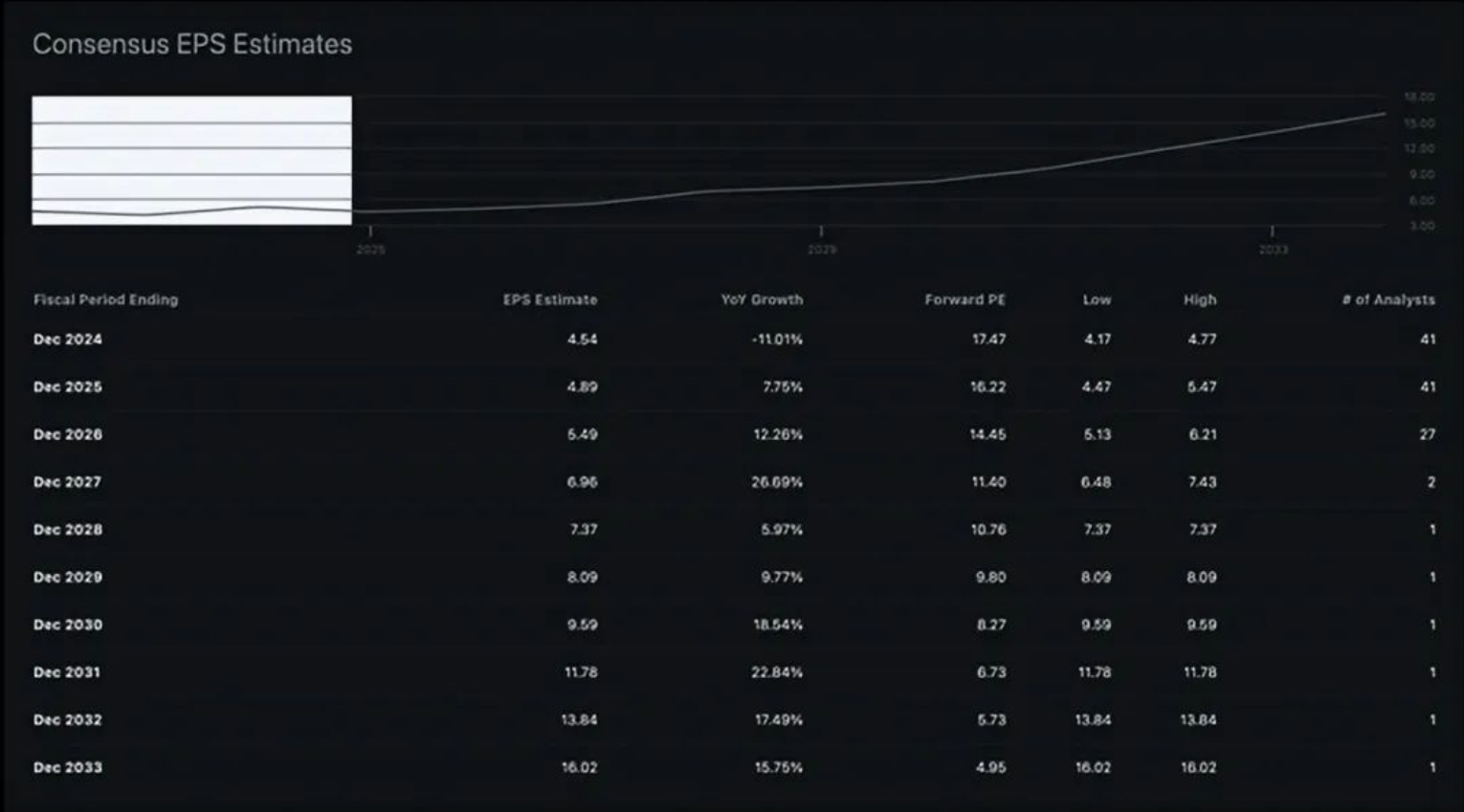

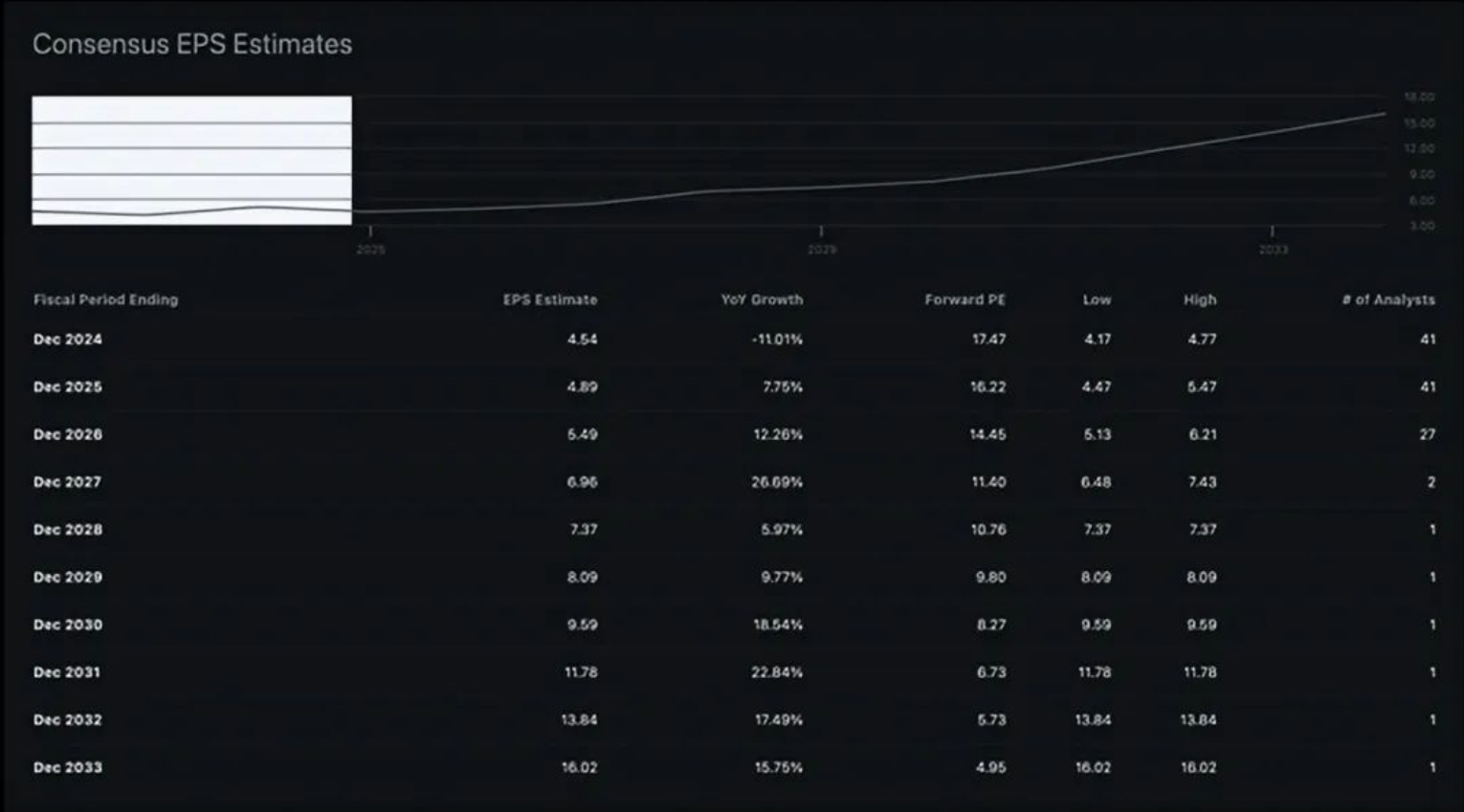

Since EPS is an important indicator observed by Wall Street, analysts raised Paypal's growth forecasts after the earnings report was announced.Analysts expect that Paypal will maintain high growth over the next decade, with a compound annual growth rate expected to reach 12.13%.

Behind the Paypal rebound: The rapid adoption of digital payments

What attracted more market attention is that Paypal's total payments in the third quarter increased by 9.0% year-on-year, from US$387.701 billion to US$422.641 billion.

From a micro perspective, the increase in Paypal's total payment amount represents an increase in user recognition, but from a more macro perspective, as the leading existence of the electronic payment market share cliff, the continuous rise in Paypal's total payment amount is implied by the rapid popularization of the entire digital payment system in the post-epidemic era, and this trend is becoming increasingly irreversible.

According to statista, with the rapid adoption of mobile payments, transaction volume at the track is expected to reach US$19.89 trillion by 2026, with a compound annual growth rate of 24.4% during the forecast period.Worldpay also predicts that by 2027, half of global transactions will be in the form of electronic payments, and total payments will exceed US$25 trillion.

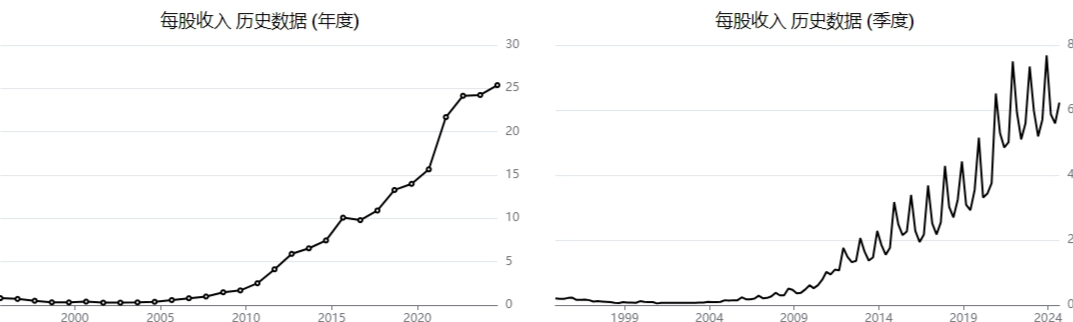

As an unshakable giant in electronic payments, Paypal has received solid dividends in the past five years.

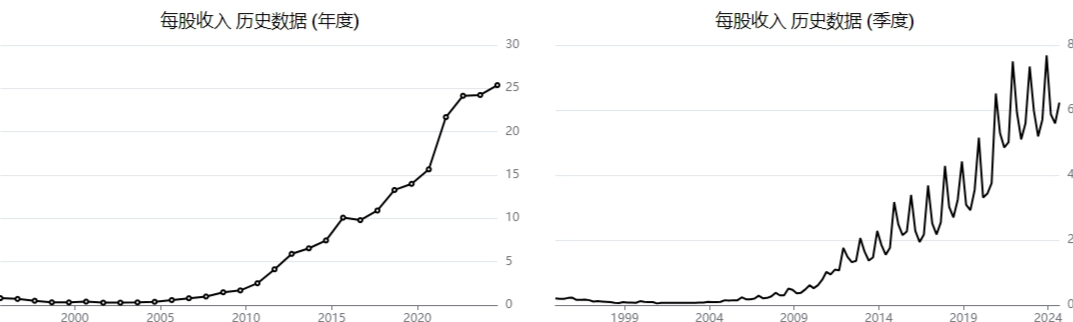

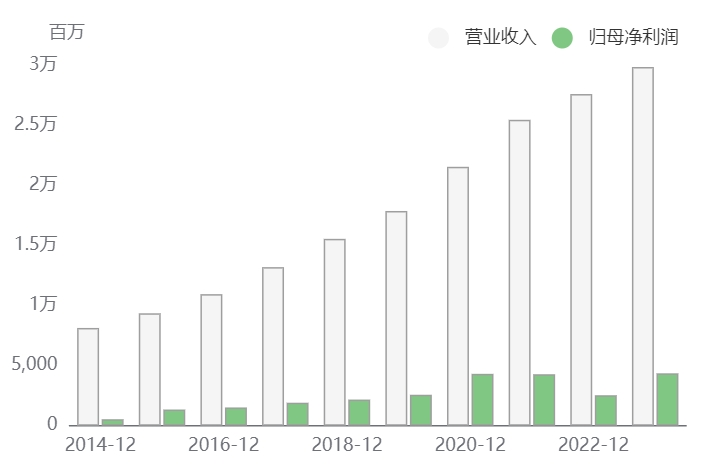

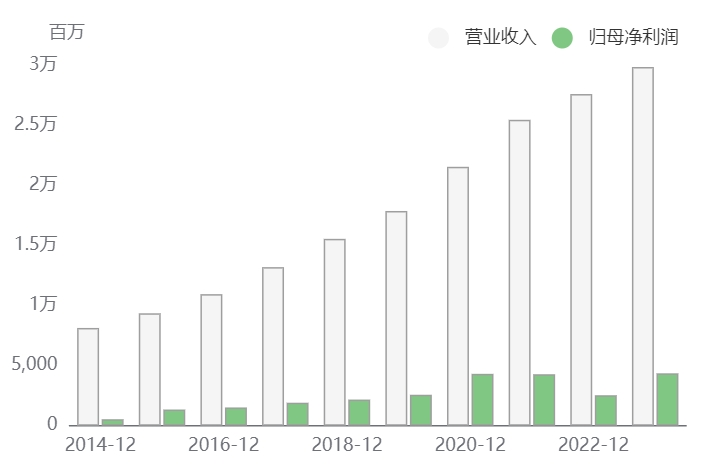

--From 2019 to 2023, PayPal's revenue continues to grow.Revenue in 2019 was US$17.77 billion and will increase to US$29.77 billion by 2023.Revenue in 2024 is expected to be US$31.03 billion, a year-on-year increase of 8.66%.

--In 2019 alone, the number of active accounts in PayPal increased by 37.3 million to 305 million, a year-on-year increase of 14%.The volume of payment transactions reached 12.4 billion, a year-on-year increase of 25%, and the total payment volume reached US$712 billion, a year-on-year increase of 23%.

Now, as the earnings report bottomed out, we have reason to hope that Paypal is about to usher in its own spring.

How do ordinary people grasp dividends?

Now, not only is Paypal actively expanding its payment boundaries, but even e-commerce brands closely related to payments are also gathering together to enter this track.For example, China e-commerce company Alibaba created Alipay to promote payment services between sellers and customers, thereby enhancing its operations and increasing customer engagement.

In addition, Meikeduo in Latin America, Amazon in the United States, Lotte in Japan, and Shrimp Pi in Singapore have all launched their own electronic payment solutions.

As ordinary people, how should we grasp electronic payment dividends in the post-epidemic era?

If you know how to pick stocks, you can do it according to your own judgment, but remember to control your positions and master basic investment discipline.

But for a novice Xiaobai who can't pick stocks, buying an ETF may be a safer choice.

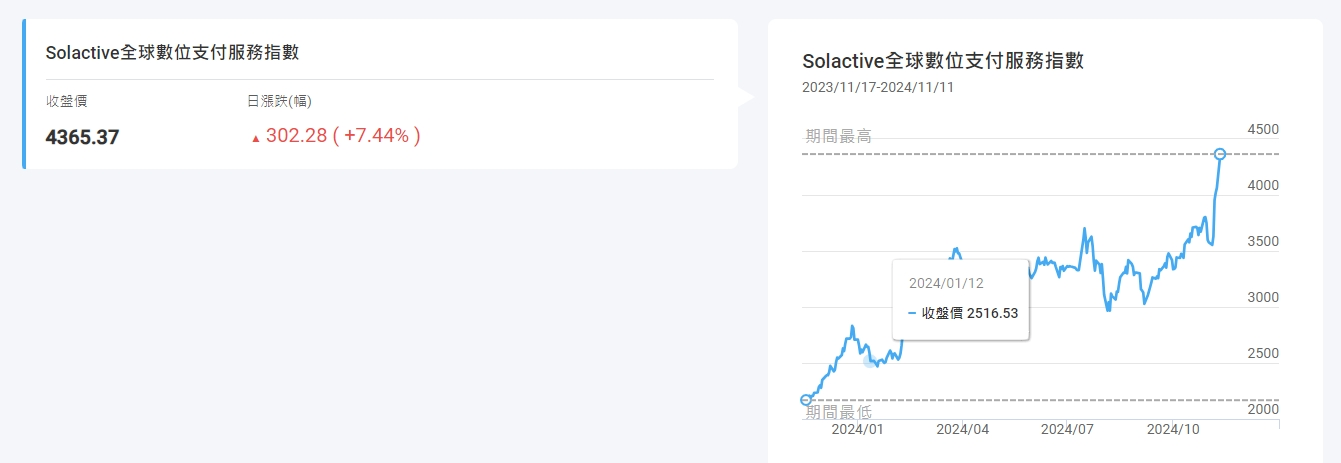

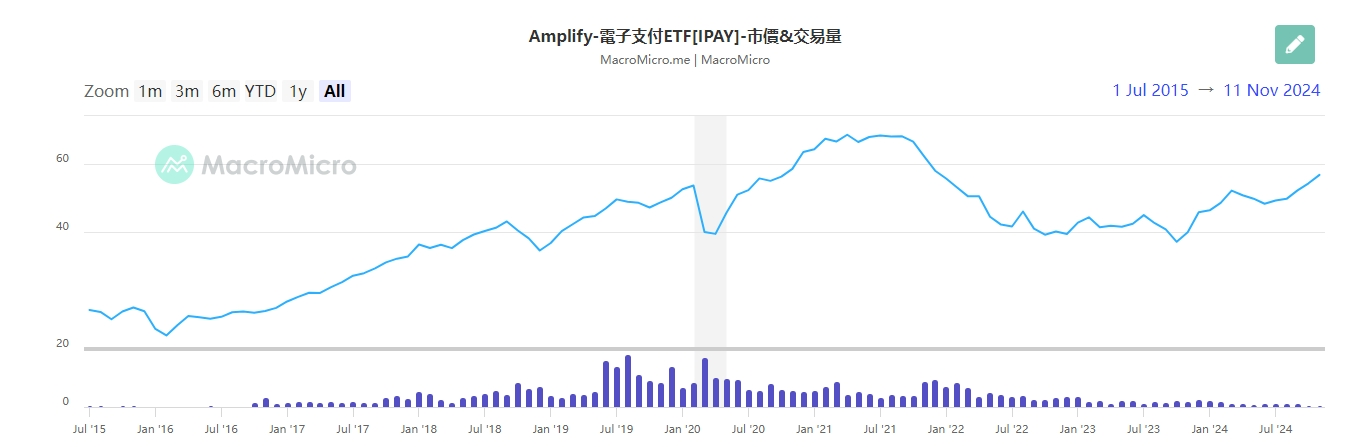

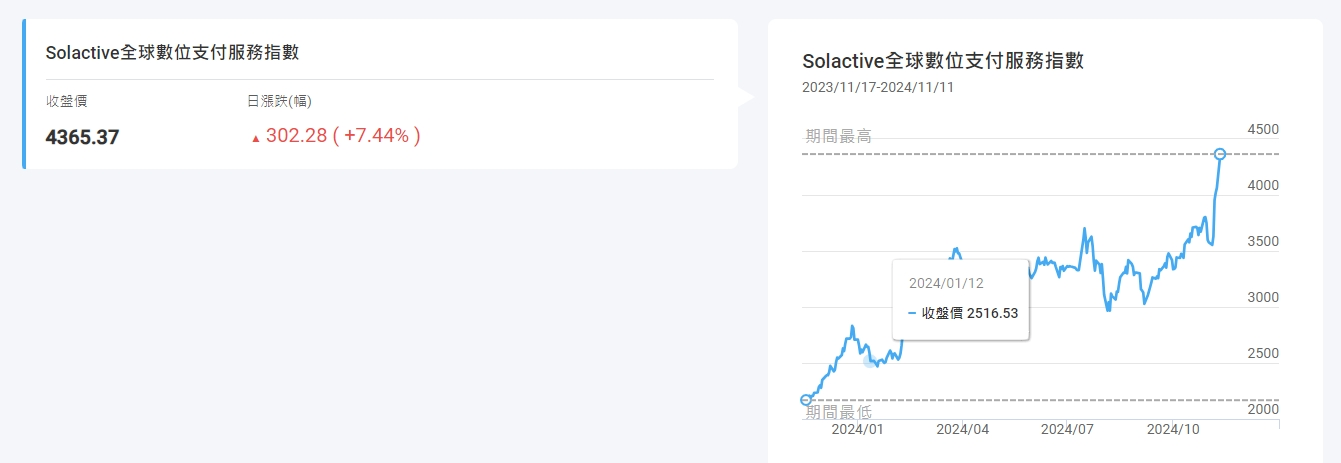

The following are some of the more representative electronic payment ETFs & indexes on the market. They are not recommended for investment but are for reference only.

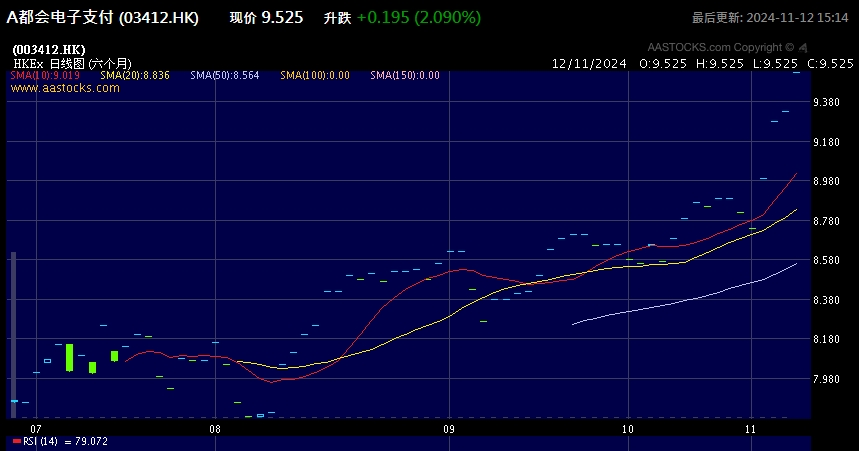

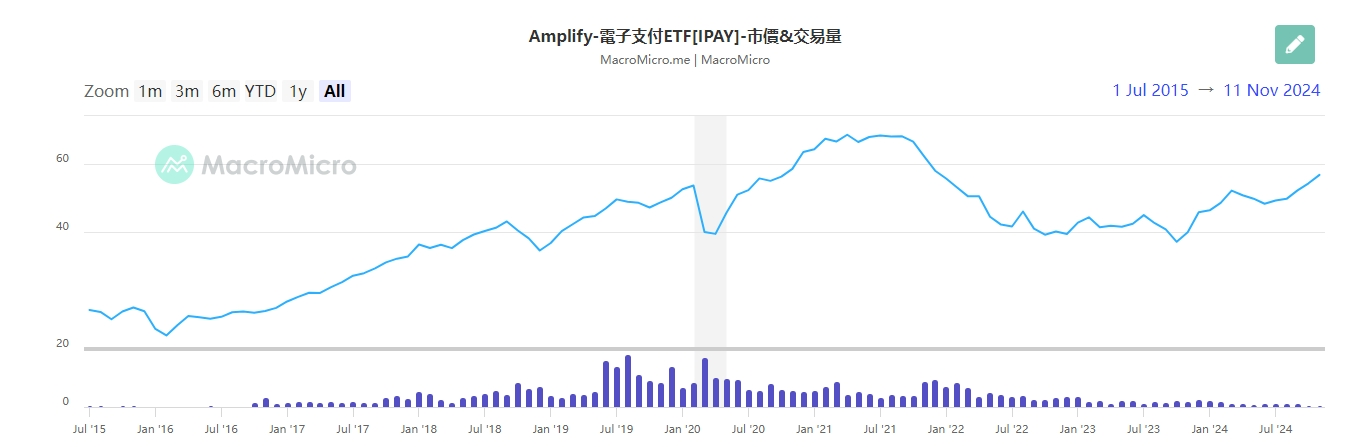

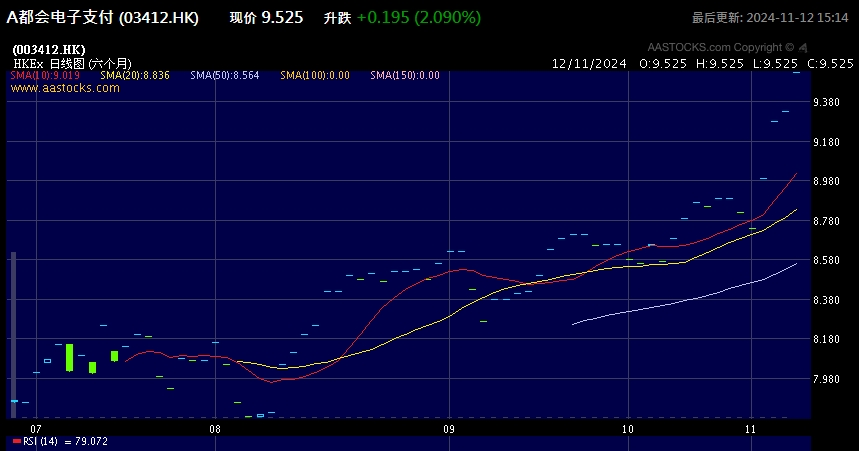

It can be seen that as the industry bottomed out, many targets have recently emerged from a wave of market.Due to the advantage of ETF's "even rain and dew", investors can avoid the trouble of stock selection,"package" all the stocks in the concept, and receive dividends from a basket of stocks.

On the other hand, the selling price of ETFs is also cheaper than buying individual stocks alone, which can also greatly lower the threshold for investing and participating in the digital payment market, and is relatively friendly to investors.

Moreover, ETFs do not face the risk of suspension or delisting.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

For ordinary investors, mastering cash flow means mastering the ability to resist risks, while ETFs 'low threshold and risk diversification attributes are undoubtedly very suitable for novice investors.