Cloning fraud is retailers’ biggest threat

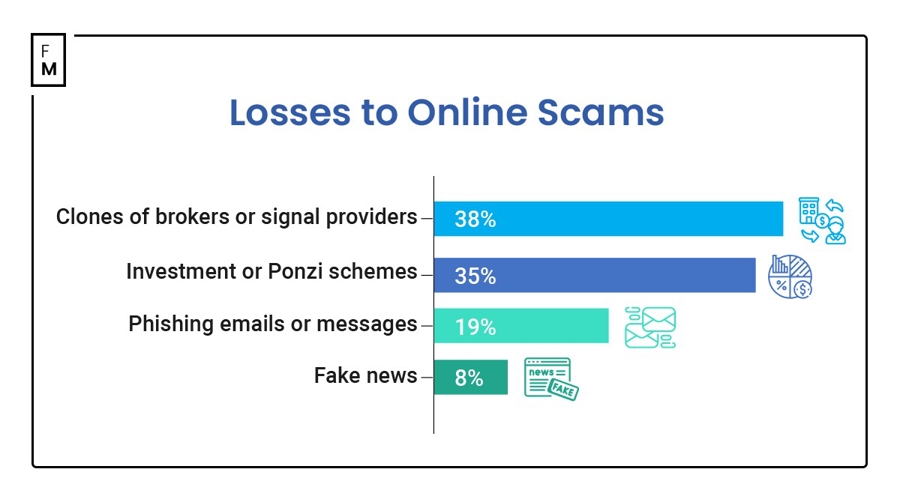

The survey found that 38 per cent of traders who lost money encountered mainly cloned brokers and signal providers.

Survey finds that 38% of traders primarily encounter clone brokers and signal providers when facing financial losses. A total of 631 traders participated in the survey, sharing their experiences of falling victim to online fraud.

Cloned platforms are the main culprits.

Following legitimate clone platforms, investment and Ponzi schemes emerge as the next targets for successful victimization, with about 35% of fund-loss traders encountering such scams. Phishing emails or messages have been encountered by 19.4% of fund-loss traders, while the proportion for fake news is 8%.

Cloning of legitimate brokers and signal providers is also rampant. Regulatory bodies worldwide have been actively issuing warnings against such clones, cautioning against impersonating their official websites and officials. Recently, the financial market regulator in New Zealand issued a warning against a cloned cryptocurrency exchange.

The phenomenon of cloning is rampant, with regulatory agencies marking them almost daily. Even brokers individually issue warnings against their imposters.

Earlier, it was stated that many clones of legitimate brokers and signal providers target traders on Telegram. Despite efforts by companies to shut down these clones through reporting, complete control over them is nearly impossible.

On the other hand, Ponzi schemes generally lure investors by promising substantial and guaranteed returns, then use funds from new investors to pay off old investors. Such scams are rampant across all asset classes, including cryptocurrencies. Official records show that Australians lost AUD 3.1 billion to fraud in 2022, with investment fraud accounting for AUD 1.5 billion.

Telegram is a hotbed for scams.

Telegram and WhatsApp, these two forms of social media, are the top two platforms where victims suffer financial losses due to scams, with 60% of victims experiencing economic losses on these platforms. The respective proportions for Facebook and Instagram are 56% and 52%.

"While we have not taken direct action against Telegram yet, we recognize that false or fraudulent broker platforms and clones of regulated entities pose risks to investors, and we are taking other measures to protect investors," said a representative of CySEC.

"We achieve this by using advanced social media monitoring tools that can identify aggressive marketing strategies in real-time and capture suspicious activities. When we blacklist fake websites through investigations, we report them to law enforcement's cybercrime departments."

Among the surveyed respondents, 17.5% of investment and Ponzi scheme victims incurred no financial losses. For clone brokers and signal providers, this figure stands at 20.7%. Furthermore, 29% of fake news victims did not suffer financial losses, while 28% of phishing email or message victims avoided financial losses.

Interestingly, the survey found that more traders on Facebook become targets of scams compared to other platforms like Telegram or WhatsApp.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.