Fed's November Beige Book on the State of the Economy: Economic Outlook May Worsen, Price Prices Basically Slow Down

The U.S. economy is approaching what most economists previously thought impossible: a return to pre-epidemic normal levels of inflation in the absence of a recession or even significant economic weakness, a so-called soft landing.。

On November 29, the United States released the latest issue of the Brown Book of Economic Conditions, which provides an analysis of the current basic economic situation in the United States.。Since the Beige Book is generally published two weeks before the Fed's meeting on interest rates, the document is an important reference for the Fed's monetary policymaking。

U.S. economic activity slows in November, economic outlook likely to worsen

According to the Beige Book, U.S. economic activity has shown signs of slowing down in November, and the economic outlook for the next six to 12 months is even deteriorating.。The market expects that, in this case, Fed officials may follow the market and end the protracted cycle of rate hikes。

Specifically, overall economic activity, which has slowed in the United States since the previous report。Specifically, four local Fed jurisdictions reported moderate economic growth, two regions had flat or slightly declining indicators of economic activity, and six regions experienced a slight decline in economic activity.。

By sector, retail sales, including automotive, remained mixed; sales of non-essential and durable goods such as furniture and appliances fell on average as consumers were more price-sensitive。general health of tourism activities。Low demand for transportation services。Manufacturing activity mixed, manufacturers' outlook weak。Farming stable or slightly better as farmers report higher selling prices; farm output mixed。Commercial real estate activity continues to slow, the office market remains weak, and activity in the multifamily market is weak.。

The report noted that demand for loans from businesses declined slightly, especially in the real estate sector.。Consumer credit is still fairly healthy, but some banks have noted that delinquency rates for consumers have risen slightly。Multiple regions noted a slight decline in residential sales activity。Residential sales fell slightly in some areas, and the inventory of homes for sale increased.。The report also said the economic outlook for the next six to 12 months weakened.。

In the labor market, labor demand continues to slow, with zero or slight growth in overall employment in most Fed jurisdictions.。Most jurisdictions indicated an increase in job seekers, with some noting improved employee retention.。In addition, employers are cutting headcount through layoffs and attrition, and some are willing to fire underperforming employees。However, some regions still say the labor market is tight and there is a shortage of skilled workers.。

In terms of wage growth, wage increases remained moderate or slight in most regions, with many regions saying wage pressures had eased and several regions saying starting wages had declined.。However, some wage pressures do persist, and there are reports of difficulties in attracting and retaining high-performing employees and skilled workers.。

Good news on the price front, the Fed's focus, reported that while prices remain high, price increases in various Fed jurisdictions have largely slowed。Freight and shipping costs have fallen in several regions, while costs for multiple foods have increased。Some regions point out that the cost of construction inputs such as steel and timber has stabilized or even declined.。Significant increases in utility and insurance costs in all Fed jurisdictions。In terms of pricing power, different industries vary。Service providers are more likely than manufacturers to pass on costs through price increases.。Most Fed jurisdictions expect modest price increases to continue into next year。

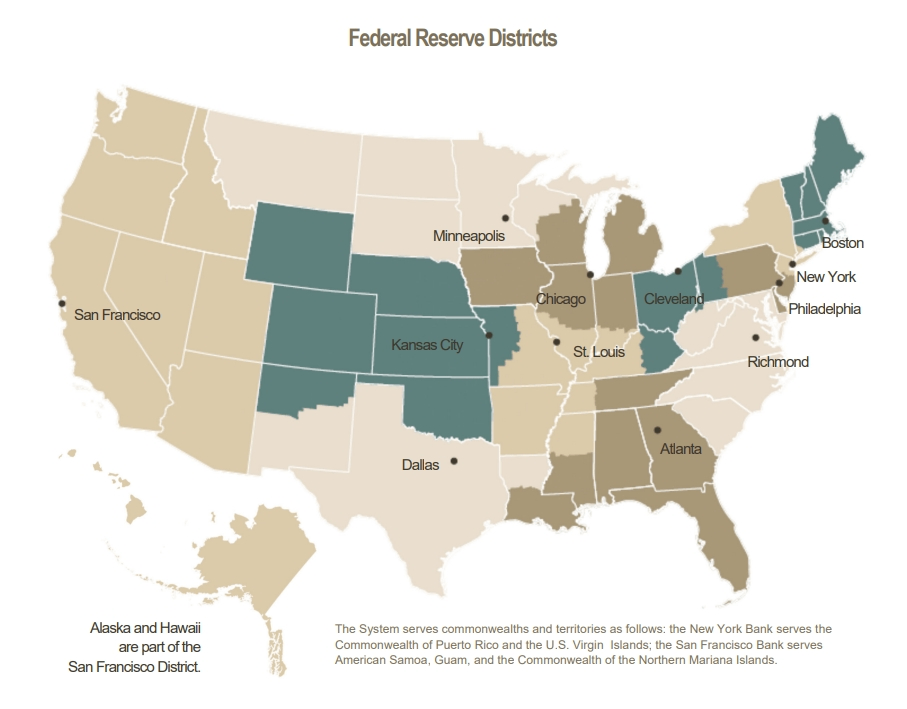

The Beige Book is the Federal Reserve System's publication on current economic conditions in the 12 Federal Reserve Districts.。It describes regional economic conditions and prospects based on most qualitative information, collected directly from information sources in each region, and is published 8 times a year。

The US economy is approaching a soft landing.

According to this Beige Book, the cooling of prices has once again boosted market confidence in the end of the rate hike cycle。The next day, November 30, U.S. Treasury yields fell again。On the same day, the yield on the 10-year U.S. Treasury note fell about 7 basis points to 4.267 per cent, the first time the benchmark interest rate has been below 4 per cent since September last year..3%。2-year Treasury yields last down about 9 basis points to 4.648%, the lowest level since July 18, when yields were as low as 4.660%。

In addition, TD Securities noted today that core PCE is expected to repeat the CPI slowdown in October。U.S. core CPI in October 0.The 2% gain was weaker than expected and bodes well for October's core PCE trend。In fact, we predict a similar performance for the latter, with a month-on-month growth of 0.2%, the annual rate is expected from 3 in September.7% to 3.6%, which would be the lowest YoY growth rate since 2021。

As of press time, according to CME "Fed Watch": the Fed kept interest rates at 5 in December..25% -5.The probability of the 50% interval being constant is 95.8%, the probability of a 25 basis point rate hike is 4.2%。The probability of keeping interest rates unchanged by February next year is 92.0%, with a cumulative probability of a 25 basis point cut of 4.0%, the probability of a cumulative 25 basis point rate hike is 4.0%。

It is worth noting that yesterday, the U.S. Department of Commerce also released the third quarter of this year, the U.S. gross domestic product revision data。U.S. gross domestic product (GDP) grew at an annualised rate of 5 percent in the third quarter of this year, data show..2%, an increase of 0 from the first estimate..3 percentage points。The U.S. Department of Commerce announced that the upward revision in economic growth in the third quarter mainly reflected an increase in non-residential fixed asset investment and private inventory investment。

The U.S. economy is approaching what most economists previously thought impossible: a return to pre-epidemic normal levels of inflation in the absence of a recession or even significant economic weakness, a so-called soft landing.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.