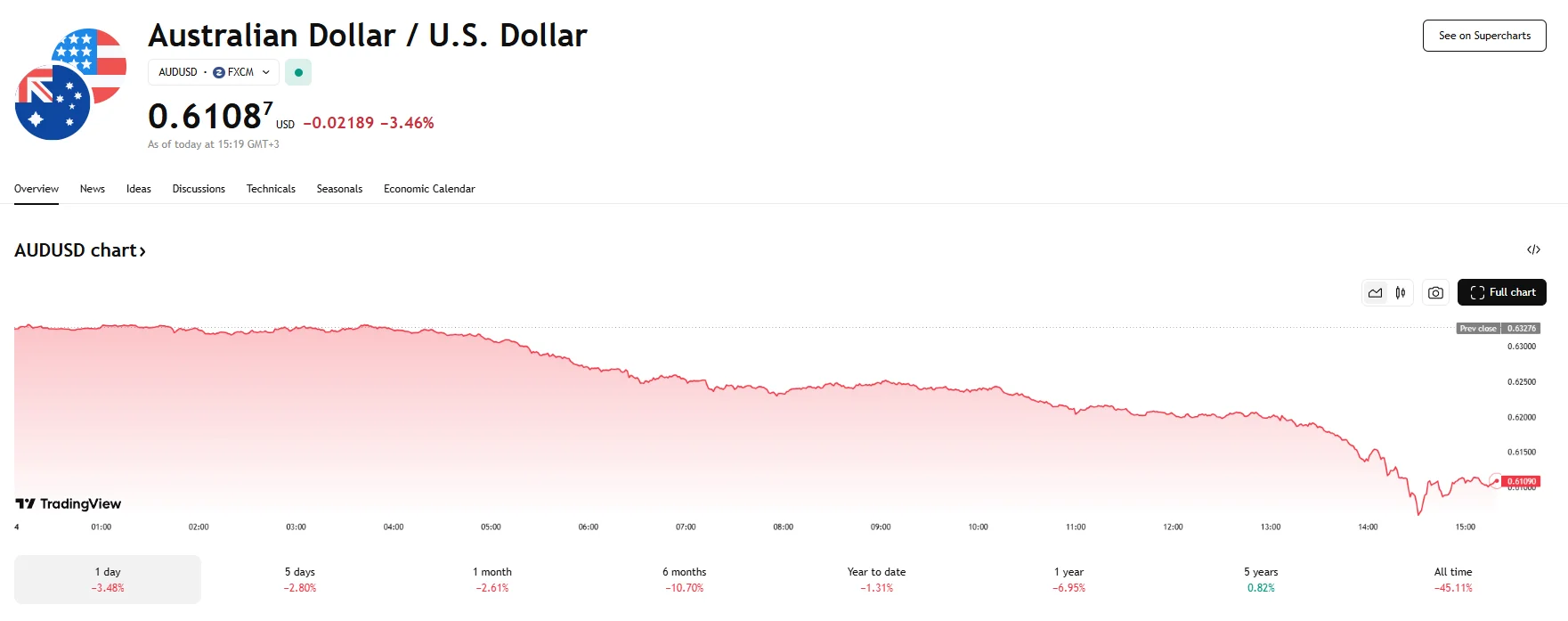

AUD/USD Slides 3.46% as China Announces 34% Tariffs on US Imports AUD/USD Slides 3.46% as China Announces 34% Tariffs on US Imports

Key momentsChinese officials intend to introduce levies of 34% on US imports starting April 10th.The counter-tariffs hit numerous asset classes, with the AUD/USD falling 3.46%.Australia is a major tra

Key moments

- Chinese officials intend to introduce levies of 34% on US imports starting April 10th.

- The counter-tariffs hit numerous asset classes, with the AUD/USD falling 3.46%.

- Australia is a major trade partner of both the US and China, making the Aussie particularly vulnerable to the escalating tariff tensions.

Trade War Fallout Rocks Australian Dollar

On Friday, Beijing announced its plans to implement 34% tariffs on all goods imported from the US, with the deadline set for April 10th. The move, an answer to the Trump administration’s own 54% duties on Chinese imports, ignited concerns about an escalating trade conflict between the two economic powerhouses, triggering widespread risk aversion across various asset classes. Among the currencies most affected by this development was the Australian dollar, which witnessed a sharp decline against the US dollar.

The AUD/USD exchange rate bore the brunt of the market unease, plummeting by 3.46% to reach a level of 0.6108. This marked a significant depreciation for the Aussie, pushing it to its weakest point in nearly five years. According to analysts, there is potential for further declines should the AUD/USD breach crucial support levels.

The ferocity of the sell-off underscored the market’s apprehension regarding the potential ramifications of the heightened trade tensions for Australia. Given Australia’s strong trade links with both the United States and, particularly, China, the imposition of these tariffs raised concerns about future disruptions to its export sector and overall economic growth.

Furthermore, the sharp depreciation of the Australian dollar has led to a recalibration of expectations regarding the Reserve Bank of Australia’s (RBA) future monetary policy. Financial markets have begun to price in a more aggressive easing cycle, anticipating that the central bank will need to lower interest rates more substantially to buffer the domestic economy from the potential negative effects of the trade conflict. This shift in expectations was evident in the Australian bond market, where longer-term bond yields experienced a notable decrease as investors anticipated future rate cuts.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.