IBUSOPT: New options for options trading

IBKR, a US-based online trading firm with operations in Europe and Asia, has announced the launch of IBUSOPT, a new feature designed to boost the strike price of its US options.。

What is IBUSOPT??

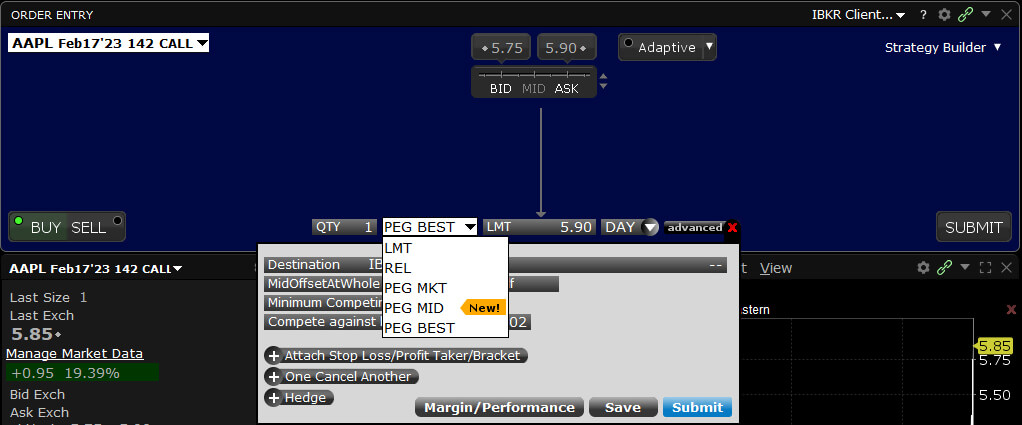

IBUSOPT is actually a new order routing destination or execution venue that will allow option orders to be executed at a price within the U.S. National Best Buy / Ask Price (NBBO) for U.S. stocks and stock index options.。

IBKR leverages its existing intelligent order routing network to allow customers to link an option order to the NBBO midpoint, thereby avoiding bid-ask spreads when executing the order。

Customers can also use the "best linked" order type, which can directly compete with NBBO buy and sell prices, and set the order to keep a tick within the bid or ask price。

IBUSOPT will be available through the company's Trader Workstation platform。Thomas Peterffy, Founder and Chairman of IBKR, said: "We are delighted to launch IBUSOPT, the latest addition to end-trading technology.。"

"With the dramatic increase in retail options trading, this new order destination will help our customers achieve better strike prices in their US options trading and will be a valuable tool for retail traders and institutional investors alike."。"

Options Trading Still Hot in U.S.

JPMorgan Research Released in December Highlights Maintaining Options Volume in 2022。The report shows that despite a slowdown in overall retail trading activity, the use of short-term and daily options is booming, sometimes accounting for 40% of all S & P options trading.。

Some of this growth was led by retail traders, but most of the increased activity may have been due to hedging by options traders (market makers) and the use of systematic trading strategies。

It is also worth noting that the US, UK and European regulators have very different attitudes towards options trading。In the UK and Europe, options are seen as complex instruments that actually discourage retail traders from trading。

However, there are few such doubts or obstacles to opening an options trading account in the US。This may be one of the reasons why IG Group spent $1 billion a few years ago to buy Tastytrade, an options broker and educational institution.。

IBKR GlobalTrader and IMPACT New Features

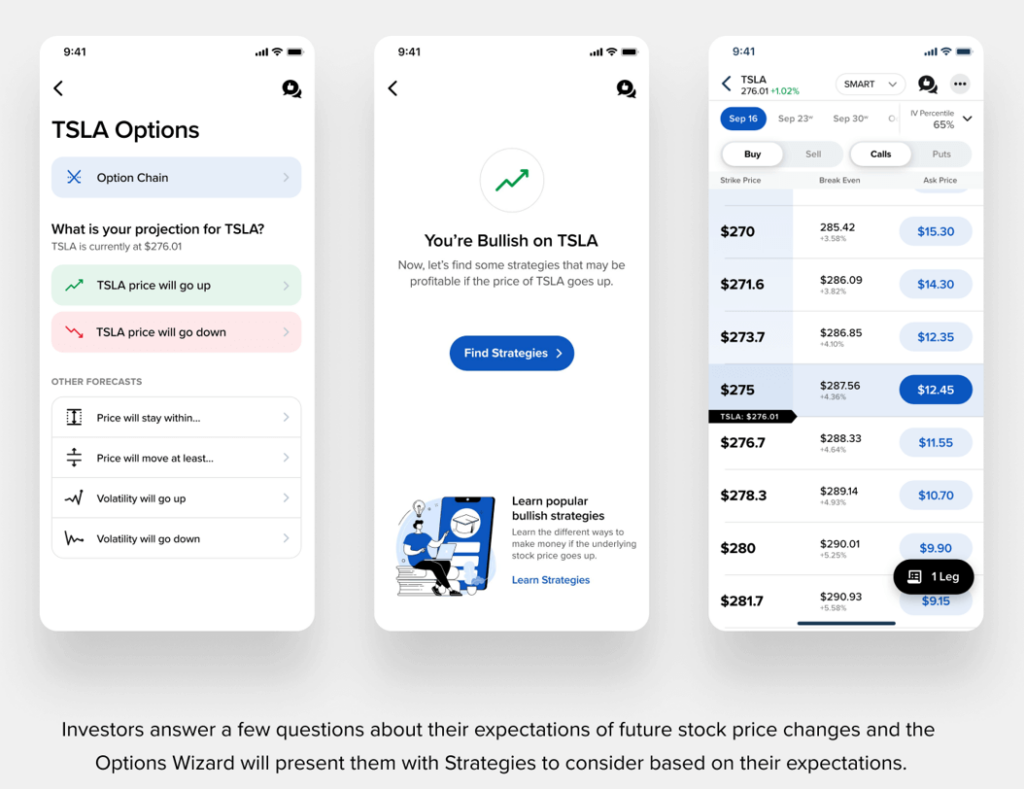

The new tool, designed to help retail traders negotiate in the options world, includes an options wizard and an options chain tool that will help them understand how options work and how they are priced.。

Options are derivatives that are invented to spread risk and facilitate hedging, but they also allow traders to speculate on the rise and fall of the price of a security。

Options have two forms: put options and call options.。A put option gives the buyer the right, but not the obligation, to sell a fixed number of securities at a given price within a specified time frame。A call option gives the buyer the right to purchase a fixed number of securities at a given price within a specific time frame, with no obligation。

Options are traded in so-called series, such as weekly, monthly or quarterly, each series will contain multiple strike prices, these are just the levels at which the option owner has the right to buy or sell securities。

The option price is calculated based on a variety of factors, including the strike price of the option relative to the price of the underlying security, the time remaining on the option expiration date, and the degree of market volatility。

IBKR reasons for innovation

Options are increasingly popular with retail traders, particularly in the US, where private clients have far fewer regulatory hurdles to overcome before trading products deemed complex by UK regulators.。

Investors and traders can deploy multiple strategies using options, and both the IBKR Options Wizard and the Options Chain tool can help retail traders determine the strategy and strike price that best meets their needs.。

Users should answer their view of the security to determine whether they are bullish or bearish, and once determined, they will see a series of potential trades and strategies, as well as an indication of the likely cost of the trade or strategy, and a trading break-even point based on the price of the underlying security。

should be usedIBKR The new tool to trade options??

For those interested in learning about options trading, these new tools from IBKR are a great starting point。However, its own research is irreplaceable, especially since there is asymmetric risk in options trading。

The risk position of the option buyer is limited and the loss is limited to the purchase price or premium of the option, however, the option short is exposed to potential open-ended risk。

With this in mind, we recommend that you fully understand how options work and how they are priced before trying to trade options。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.