IC Trading: Evaluation and Analysis

In-depth review of the IC Trading broker. What you can trade, bonus, leverage, platforms, account types, minimum deposit, and spreads.

IC Trading is a forex broker based in Mauritius, regulated by the Financial Services Commission (FSC) of Mauritius. Since 2022, the company has been officially regulated. This article provides an in-depth analysis of all the features of IC Trading to help you determine whether it is the right broker for you.

Introduction to IC Trading

IC Trading offers over 2,000 trading instruments, including forex, stocks, indices, commodities, futures, and cryptocurrencies. With leverage up to 1:500 and spreads starting from 0, it caters to both novice and experienced traders.

Tradable Products

- Forex: Offers 61 forex currency pairs, including major, minor, and exotic pairs.

- Indices: Provides 25 major stock indices such as Nasdaq, S&P 500, Dow Jones, and Germany’s DAX.

- Commodities: Covers over 20 commodities, including gold, silver, platinum, palladium, crude oil, Brent crude oil, natural gas, and agricultural products like sugar, coffee, wheat, and corn.

- Stocks: Offers over 2,100 stocks, mainly from the US (Nasdaq and NYSE) and the Australian Securities Exchange (ASX). Notably, you can receive dividends similar to real stocks.

- Bonds: Provides various popular global bonds, including US Treasury bonds, Euro bonds, UK bonds, Japanese bonds, and Italian bonds.

- Futures: Allows trading of various futures contracts including CBOE VIX index futures, Brent crude oil futures, ICE Dollar Index futures, and WTI crude oil futures.

- Cryptocurrencies: Offers 21 popular cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Minimum Deposit Requirement

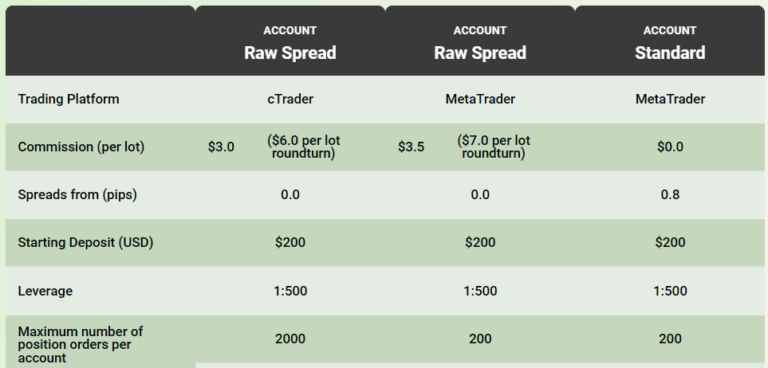

A minimum deposit of $200 or equivalent is required to open a real account. There is no deposit required for a demo account, allowing you to test it freely before committing.

Leverage

IC Trading offers leverage ranging from 1:5 to 1:500 depending on the asset class:

- Forex Pairs: Up to 1:500

- Indices: Up to 1:200

- Commodities (Precious Metals, Energy): Up to 1:500

- Commodities (Agricultural): Up to 1:100

- Stocks: Up to 1:20

- Bonds: Up to 1:200

- Futures: Up to 1:200 (VIX futures), up to 1:100 (other futures)

- Cryptocurrencies: Up to 1:5

Account Types

IC Trading offers three main types of accounts:

- Raw Spread Account (MetaTrader version): Ideal for high-frequency traders and those using Expert Advisors (EAs), with extremely low spreads, but some instruments incur a commission of $3.5 per side.

- Raw Spread Account (cTrader version): Similar to the MetaTrader version but with lower commissions of $3.0 per side, and allows holding up to 2,000 positions simultaneously.

- Standard Account: Commission-free, suitable for discretionary traders, but spreads may be wider. Available on the MetaTrader platform.

All account types can be configured as Islamic accounts (no overnight interest) to comply with religious beliefs.

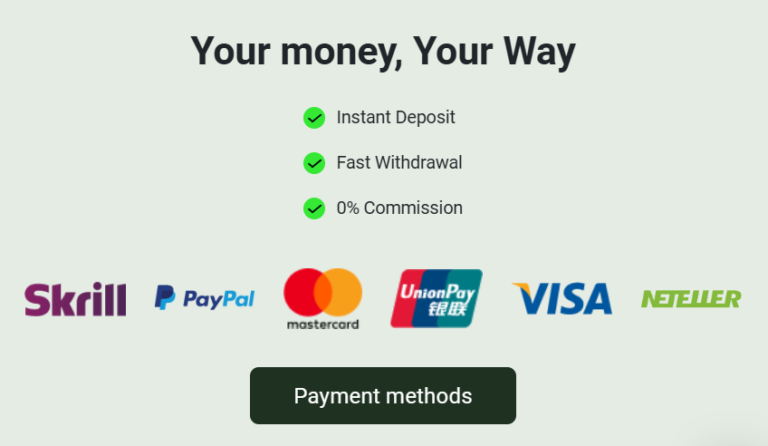

Payment Methods

IC Trading supports a variety of payment methods including:

- Credit/Debit Cards

- PayPal

- Neteller

- Skrill

- Bank Transfers

- UnionPay

- Cryptocurrencies (ETH, BTC, USDC, USDT)

Negative Balances Protection

To avoid a negative balance, traders should be cautious and avoid holding over-leveraged positions overnight, particularly over weekends, when large gaps can occur and cause stop losses to be executed at unintended levels. Additionally, during high volatility periods, such as news releases, excessive leverage should be avoided to reduce risk exposure.

Margin Call and Margin Stop Out

Margin calls and margin stop-outs are measures to protect your account from significant losses or negative balances. On IC Trading, the margin stop-out level is 50%. When the margin level drops to 50% of the required margin, the broker will attempt to close positions automatically to protect the account, although a negative balance may still occur.

A margin call happens when the margin level falls to 100% of the required margin. At this point, you will receive a margin call, and your positions will turn yellow on your MetaTrader platform. You can either reduce your risk by closing positions or hedging them (though hedging is not ideal) or deposit additional funds to increase your available margin.

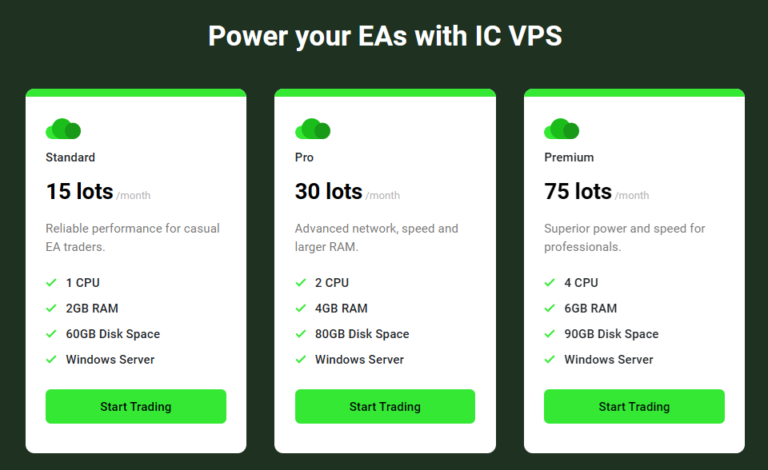

IC Trading Free VPS

IC Trading provides a free Virtual Private Server (VPS) for users who employ EAs (automated trading systems) or wish to host their platform on a server. There are three performance levels of VPS available, with better performance for higher trading volumes. To qualify for a free VPS, you must trade a minimum number of lots per month; higher trading volumes yield better VPS performance.

Copy Trading and Social Trading

IC Trading supports both copy trading and social trading. You can obtain trading signals from sources like the MQL5 website, Myfxbook, or trusted traders. Additionally, IC Trading provides access to ZuluTrade, a social trading platform allowing you to copy trades from over 100,000 traders globally.

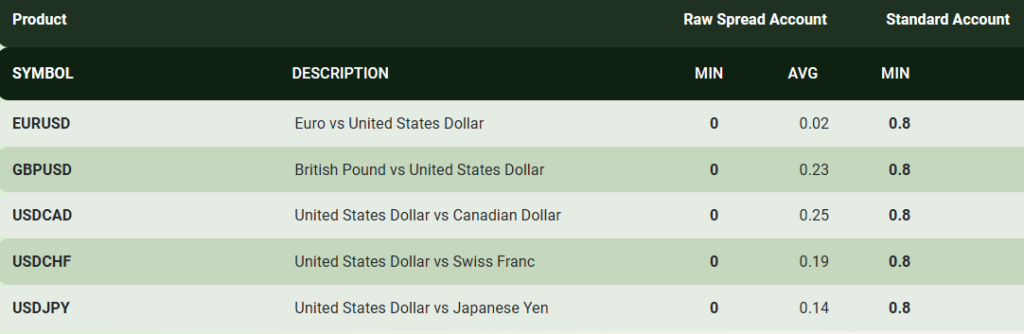

Maximum Lot Size and Spreads

On IC Trading, the minimum lot size for forex currency pairs is 0.01, with a maximum of 200 lots. For other instruments like indices or metals, maximum lot sizes may vary. IC Trading offers very low spreads, starting from 0 pips on some accounts. The Raw Spread accounts have spreads from 0 pips, while the Standard account offers spreads starting at 0.8 pips.

Minimum Withdrawal Amount

IC Trading allows withdrawals of any amount with no minimum withdrawal requirement. Withdrawals are subject to having available funds in the account, excluding those used as margin. Most withdrawal methods are fee-free, but third parties may impose fees, such as for international bank transfers.

Account-Related Notes

- Micro Accounts: Micro accounts allow trading with micro lots, where each micro lot equals 1,000 units of the base currency, or 0.01 standard lots. All account types at IC Trading support micro lot trading.

- Inactivity Fees: There are no inactivity fees if you need to pause trading for an extended period, and your funds will remain in your trading account.

- Hedging and Net Accounts: IC Trading allows hedging, meaning you can open long and short positions on the same symbol simultaneously. Alternatively, you can choose Net accounts, where only one position in one direction is allowed per symbol, suitable for quick position adjustments.

- Account Opening Restrictions: Most countries can open an IC Trading account, but residents of the US, Canada, Israel, New Zealand, Japan, Iran, and North Korea may face restrictions. Additionally, accounts from OFAC-sanctioned countries are also restricted.

Summary

IC Trading is an emerging broker offering a wide range of financial products and high leverage options suitable for various types of traders. Although user reviews are limited, customer feedback is generally positive. Its regulation by the Mauritius FSC ensures operational legitimacy and safety. If you are looking for a comprehensive forex and CFD broker, IC Trading might be a worthy consideration.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.