Seeing $7bn loss in chipmaking unit, will Intel IFS bounce back?

In 2023, Intel's IFS business losses widened again to $7 billion, with projected peak losses in 2024, but have gradually returned to the right track.

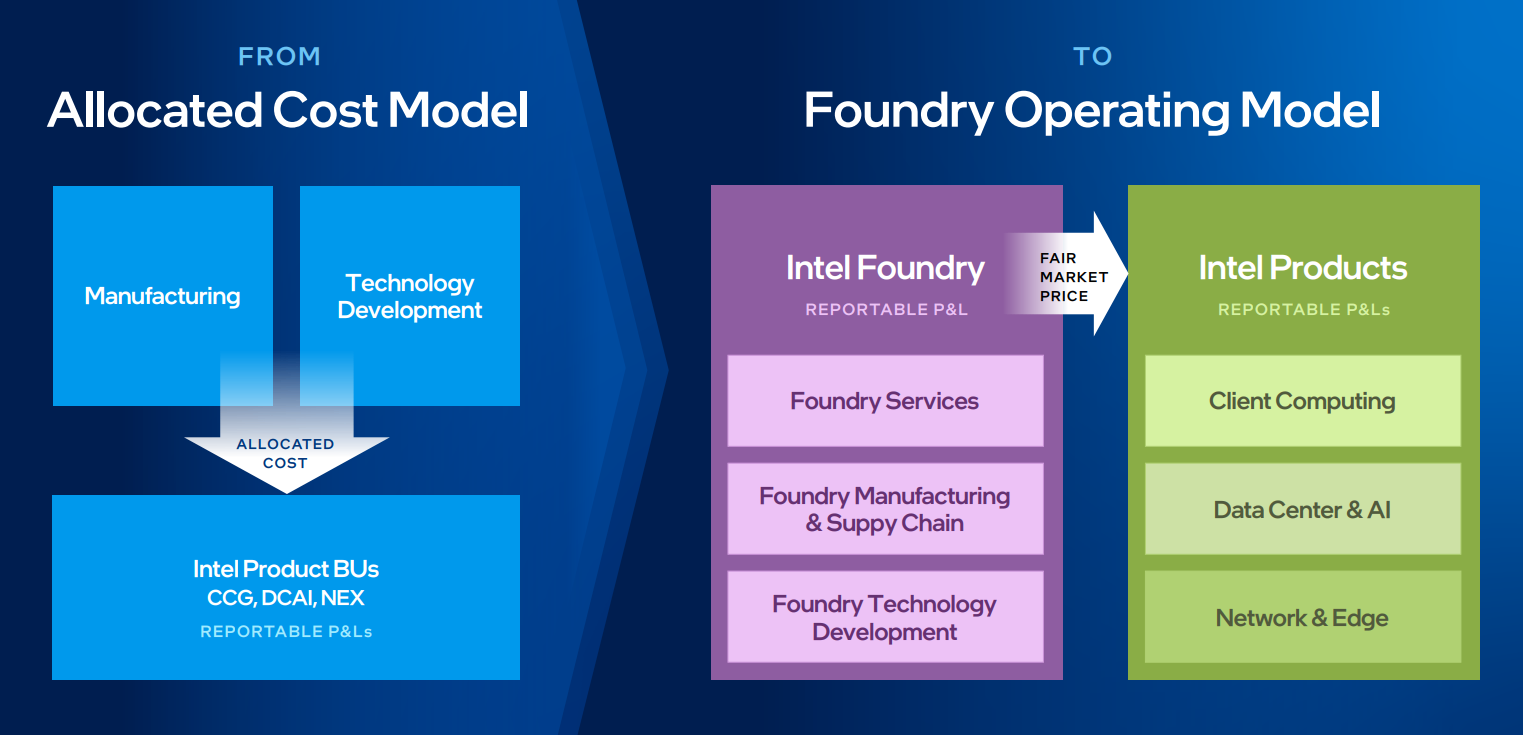

On April 2nd, Intel disclosed the financial report of its Intel Foundry Services (IFS) for the year 2023 in documents submitted to SEC. This marks the first time Intel has separately disclosed the total revenue of its chip manufacturing business.

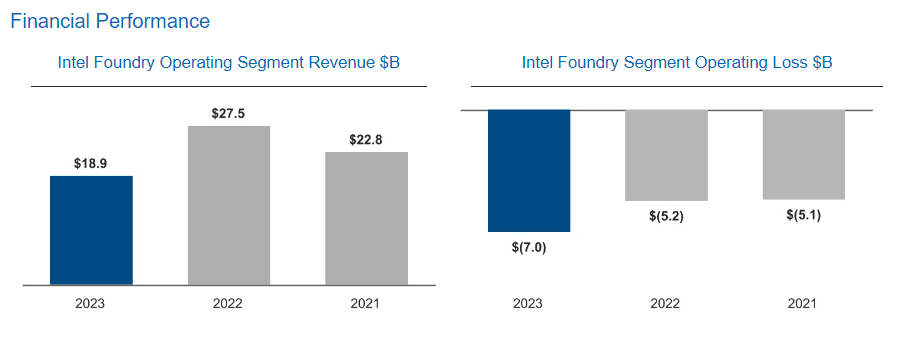

The data shows that in 2023, Intel's IFS business recorded sales of $18.9 billion, a decrease from $27.5 billion in 2022; operating losses widened from $5.2 billion the previous year to $7 billion, with projected losses expected to peak in 2024. Following the release of this report, Intel's stock price fell over 4% after hours.

Undoubtedly, Intel's foray into semiconductor foundry marks the company's largest transformation in its history. IFS business aims to enhance key areas of chip manufacturing such as delivery speed and testing time to improve profit margins and regain orders from competitors, transitioning from the traditional mode of designing and selling proprietary chips to outsourcing.

As support, the company has taken measures such as strengthening financial transparency, increasing business independence, and appointing Lorenzo Flores as the CFO of the IFS business. By clarifying operational departments, enhancing customer service, and increasing technological investments, Intel is committed to compliantly entering the foundry industry and improving its interaction with customers.

However, amidst its proactive transformation, Intel is facing formidable competitors in the semiconductor foundry business such as TSMC, AMD, and Nvidia.

Currently, TSMC is dominating the whole foundry market, boasting a total revenue of $69.4 billion in 2023, with a net profit of $26.9 billion and a gross margin of 54%, far surpassing Intel. It is projected that TSMC's total revenue will grow by 20% in 2024. Meanwhile, AMD is fiercely competing with Intel in traditional business domains. In 2023, AMD reported a total revenue of $22.7 billion, a net profit of $854 million, and a gross margin of 50%. With its unsurpassable AI chips, Nvidia has rapidly emerged as a leading player. Last year, Nvidia's sales doubled, establishing a significant lead in the AI accelerator market.

The deepened losses this time have dealt a significant blow to Intel's ambition to challenge TSMC's chip manufacturing dominance. The company attributes the losses in its IFS business to several erroneous decisions, such as rejecting the use of ASML's extreme ultraviolet (EUV) lithography equipment a year ago. Although the cost of these machines may exceed $150 million, they are more cost-effective compared to earlier chip manufacturing tools. Consequently, Intel has outsourced approximately 30% of its wafer volume to external manufacturers like TSMC, with intentions to reduce it to around 20%.

Despite the current challenges, Intel remains optimistic about improving the long-term profitability of IFS. Before adopting EUV, Intel bore significant manufacturing and research costs, leading to repeated lagging behind. However, in the "post-EUV era", Intel expects to gradually regain competitiveness in terms of price, performance, and cutting-edge manufacturing.

Pat Gelsinger, CEO of Intel, stated that 2024 would be the year with the most severe operational losses for Intel's IFS business, with expectations to achieve operational breakeven around 2027. By 2030, Intel's semiconductor foundries are projected to become the world's second-largest foundry enterprise, trailing only behind TSMC.

As an important step in Intel's turnaround strategy, the company currently plans to invest $100 billion in constructing or expanding chip factories in four states in the United States. The business turnaround plan will depend on marketing its manufacturing services to external companies. According to Pat Gelsinger, five companies in the industry have already committed to using its latest 18A technology, which will see broader applications from next year onwards, with strong momentum.

Intel stated in the document: "IFS is expected to further expand operating profit by developing more Intel products, developing high-margin advanced packaging business, continuing to expand external foundry business, and further focusing on capital utilization, cost efficiency, and continuously expanding scale."

Currently, contracts signed by IFS business amount to a total value of $15 billion. The advantages of the new cost structure and EUV technology will help Intel maintain an operating profit margin of around 40% in the product department over the next decade.

As one of the companies engaged in advanced semiconductor manufacturing in the United States, Intel received nearly $20 billion in funding from CHIPS and Science Act last month.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.