Intel's Stock Avalanche: Where is the Self-Rescue Point?

Recently, Intel's Q2 financial report fell short of market expectations. Additionally, the announcement of large-scale layoffs and the suspension of dividends led to the company's stock price plummeting by over 29%, marking its largest decline in nearly 50 years.

In recent days, chip giant Intel has faced a series of setbacks: a disastrous Q2 earnings report and dismal guidance for the next quarter, a massive layoff of 15,000 employees, and the suspension of dividends for the first time in 32 years.

On the day of the earnings release, Intel's stock price plunged nearly 30%, bringing its market value below the $100 billion mark to $96.7 billion, marking the largest drop since 1982. This year, Intel's stock has already fallen by 42%.

Q2 Earnings Seems Gloomy

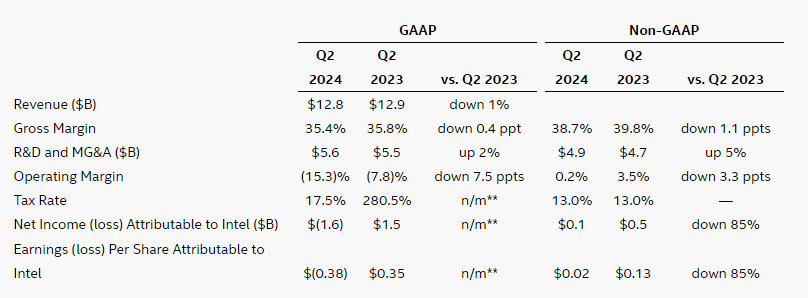

On August 1, after the U.S. stock market closed, Intel released its Q2 2024 earnings report, showing a decline in revenue and profits significantly below market expectations. Additionally, the company's outlook for Q3 also fell short of market expectations.

According to the data, Intel's Q2 revenue was $12.8 billion, down 1% year-over-year, compared to analysts' expectations of $12.94 billion. Net income attributable to shareholders plummeted 85% year-over-year to $83 million. The net loss was $1.6 billion, compared to a profit of $1.5 billion in the same period last year, turning from profit to loss. However, the PC business was a rare bright spot, with revenue of $7.4 billion, up 9% year-over-year, offsetting the adverse impact of declining data center business.

After the performance disclosure, Intel CEO Pat Gelsinger explained, "The earnings this quarter are disappointing, mainly because the company is continuing to advance its product roadmap."

CFO David Zinsner further explained that the main reasons for this situation are the accelerated promotion of AI PC products, unexpected expenses in non-core businesses, and improper utilization of capacity-related costs. Additionally, the tightening of U.S. government trade policies will also lead to a decline in chip sales.

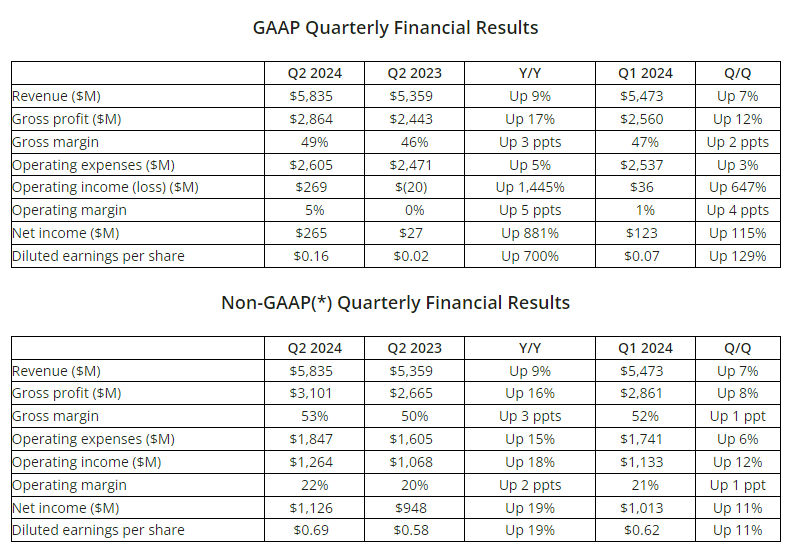

In contrast, competitor AMD benefited from strong demand for data center processors, with Q2 revenue up 9% year-over-year to $5.8 billion and operating profit up 19% year-over-year to $1.1 billion. Despite having half the revenue of Intel, AMD's market value is twice that of Intel.

However, the most shocking aspect was Intel's guidance for Q3.

Intel expects Q3 revenue to be between $12.5 billion and $13.5 billion, compared to market expectations of $14.38 billion. It anticipates a loss of 3 cents per share, while the market expected a profit of 30 cents per share. The profit margin is expected to be 38%, down nearly 8% year-over-year.

Layoffs & Dividend Suspension

Alongside the financial data release, Intel announced plans to cut $10 billion in costs by 2025, including layoffs and halting dividend payments.

In a notification to employees, Pat Gelsinger stated, "Our revenue did not grow as expected, costs are too high, and profit margins are too low. Therefore, we must align our cost structure with the new operating model, fundamentally changing the way we operate."

As a result, Intel will lay off about 15% of its workforce, cutting over 15,000 jobs, and suspend the dividends it has been paying since 1992, marking the first dividend suspension in 32 years. Most measures are expected to be completed by the end of this year.

Intel noted that the company recognizes the importance of prioritizing liquidity to support strategic investments and will resume paying long-term, competitive dividends once cash flow improves to higher levels.

After this series of announcements, Intel's stock price once fell over 29%, the second-largest drop since July 1974's 31%.

The Recovery Path

Currently, Intel is focusing on two main areas: wafer foundry and AI development.

The company is in a critical transition period: on one hand, competition with companies like Samsung and TSMC requires more advanced products; on the other, navigating the AI wave requires effective planning and leveraging domestic manufacturing investments and global demand to reshape core competitiveness.

Analysts suggest that Intel may rely on two products to achieve success within the next 12 months: Lunar/Panther Lake and Gaudi 3.

Lunar Lake and Panther Lake are key products for Intel's client business, with the former expected to be released in the second half of this year. Company executives describe it as a "processor superior to AMD's products in performance and efficiency."

Meanwhile, Gaudi 3, the third generation of Intel's Habana AI accelerator series, represents the company's last hope in revolutionizing the data center AI ecosystem.

Industry insiders indicate that if Intel can develop a cohesive sales and marketing strategy for these two products, they may help the company maintain its customer base, improve profit margins, and better compete with AMD and Qualcomm.

However, during the earnings call, David Zinsner mentioned that the next-generation flagship AI PC chip, Lunar Lake, alone is not enough to turn the tide.

While AI PCs are a major victory, and the product line will continue to be explored next year, Lunar Lake is a highly specialized product requiring a separate memory module, thus only moderately alleviating the company's crisis next year.

"The good news is that the subsequent Panther Lake product will be internally developed on Intel's own 18A process, greatly improving the cost structure, with mass production expected to begin in the second half of 2025, but the corresponding economic benefits won't be seen until 2026," David Zinsner added.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.