Google Q2 Exceeds Expectations, While Advertising Business Growth Slows

Boosted by the demand for cloud computing services and search engine advertising, Google's parent company Alphabet's revenue and profit in the second quarter exceeded market expectations.

On July 23, Eastern Time, Alphabet, the parent company of Google, announced its quarterly financial results for the quarter ending June 30, 2024. Boosted by demand for cloud computing services and search engine advertising, both revenue and profit exceeded market expectations.

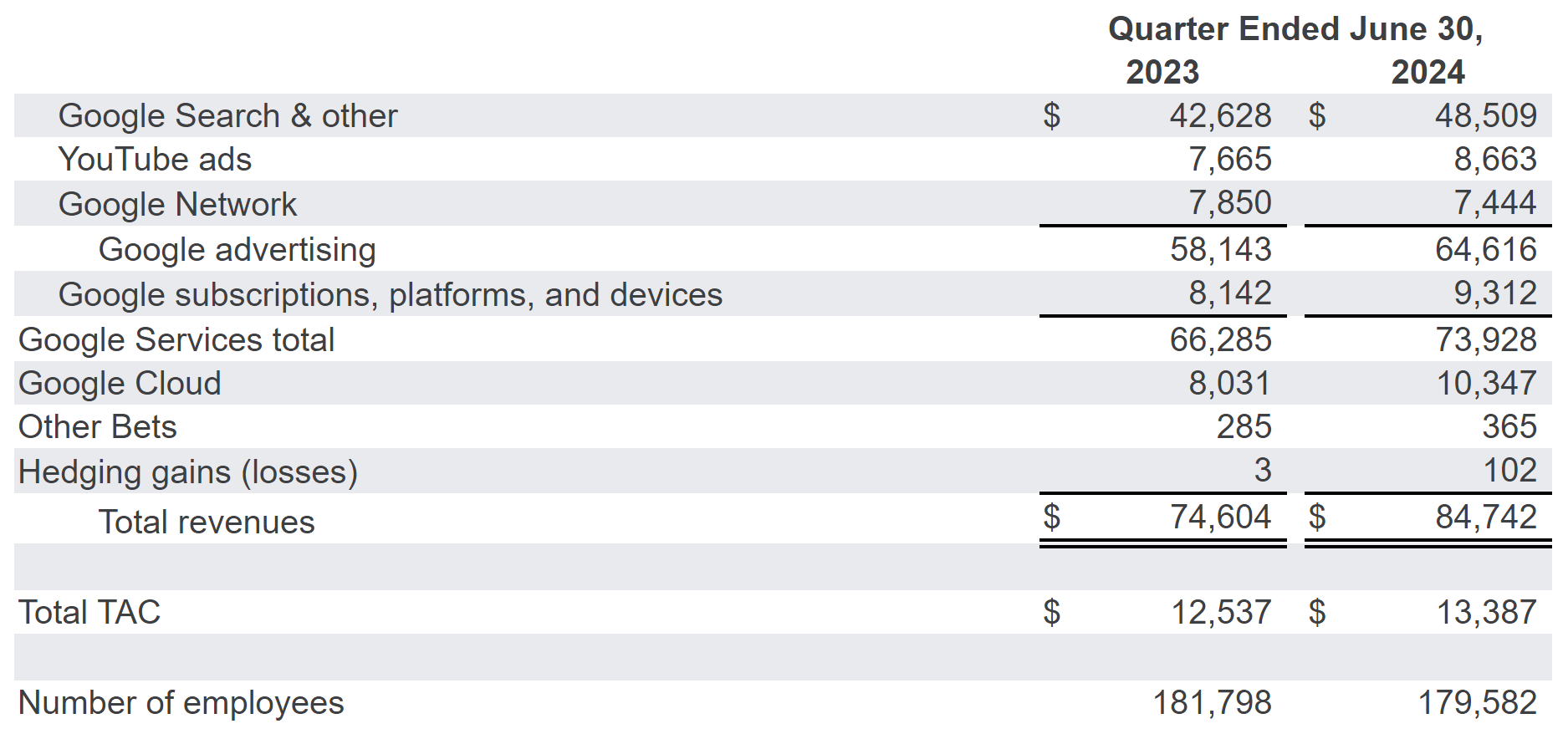

Data shows that Alphabet's Q2 revenue was $84.742 billion, a year-on-year increase of 13.59% from $74.604 billion in the same period last year; Adjusted earnings per share were $1.89, exceeding analysts' expectations of $1.85 per share; The dividend per share is $0.20 and will be paid on September 16.

Sundar Pichai, CEO of Alphabet, said, "The strong performance this quarter indicates that the search business continues to maintain strong momentum, the cloud computing business has made tremendous progress, and we are innovating at every level of the AI stack. Our long-term infrastructure leadership and internal research team enable us to have a strong grasp on technological development and pursue future opportunities

Ruth Porat, President, Chief Investment Officer, and Chief Financial Officer of Alphabet, stated that the company will continue to restructure its cost base to enhance its investment capabilities and meet the pursuit of high growth opportunities in the future

After the release of the financial report, Google's stock price rose by over 2% at one point, and then fell by over 2% again. Since the beginning of this year, Google's stock price has risen by over 30%. As of Tuesday's close, Alphabet's market value is close to $2.3 trillion, making it the fourth largest company in the world after Apple, Microsoft, and Nvidia.

Divisional Performances

From a business perspective, advertising and cloud services are the two core businesses of Google. Driven by this, Google's operating profit in Q2 exceeded $1 billion for the first time.

During Q2, Google's advertising revenue was $64.616 billion, a year-on-year increase of 11.13%, accounting for about three-quarters of the revenue in Q2. Among them, Google's search and other business revenue was 48.509 billion US dollars, a year-on-year increase of 13.80%; However, YouTube's advertising revenue was $8.663 billion, a year-on-year increase of 13.02%, but lower than the market expectation of $8.93 billion.

In terms of cloud business, Google Cloud's quarterly revenue exceeded $10 billion for the first time, growing from $8.031 billion in the same period last year to $10.347 billion, a year-on-year increase of 28.84 percentage points.

Capital Expenditure Grabs High Attention

In Q2, Alphabet's capital expenditures reached $13.19 billion, almost double the $6.9 billion spent in the same period last year. In Q1, capital expenditures also surged by 91% year-on-year, and the sustained huge capital expenditures have attracted investors' attention to operating profit margins.

Among them, Google has invested a total of $2.2 billion in its DeepMind and Google Research departments, dedicated to the construction of AI models, much higher than the $1.1 billion in the same period last year. The Google Research AI model development team, which was previously under Google Services, will also be merged into DeepMind.

Moreover, Alphabet has issued a warning that capital expenditures will remain high this year and expects quarterly capital expenditures for the remaining two quarters of the year to exceed $12 billion.

However, Sundar Pichai stated during the earnings call that the company's Gemini big model tool has been used by over 1.5 million developers. However, it is still unknown when AI will start generating revenue for Google's cloud or advertising businesses.

Jeffrey's analysis of Brent Thill suggests that it is too early to expect the benefits of AI, as most companies are still in pilot mode and substantial AI revenue is more likely to be realized by 2025-2026

It is reported that in order to achieve a healthy balance between revenue and expenditure, Alphabet is increasing its investment in AI while also cutting expenses in other areas. After several waves of layoffs, Google's workforce has decreased from 181798 in the same period last year to 179582.

Waymo Obtains Long-term Invsetment

For Alphabet's non core business unit (Other Bets), while achieving revenue of $365 million, it also incurred an operating loss of $1.13 billion.

During Q2, Alphabet underwent a series of expansions. According to Sundar Pichai, Waymo provides 50000 paid trips per week, mainly in San Francisco and Phoenix, and has completed 2 million trips so far. In June of this year, Waymo opened its service to all San Francisco users, marking the second comprehensive city wide promotion since Phoenix in 2020.

However, Ruth Porat announced that Alphabet would continue to invest $5 billion in Waymo, its autonomous vehicle division, to build a world leading autonomous company.

Waymo CEO Tekedra Mawakana stated on X, "Alphabet has committed up to $5 billion in funding to Waymo. We are very grateful for their great trust in our team and acknowledge the significant progress we have made in technology, products, and commercialization

Other News

Cookies Options Remained

On July 22nd local time, Google decided not to cancel or replace third-party cookies, and users will decide whether to accept third-party cookies. In addition, they will continue to invest in technologies that enhance privacy protection.

Subsequently, the UK Information Commissioner's Office (ICO) issued a statement expressing disappointment with Google's change of plans and considering taking action, while the UK antitrust agency, the Competition and Markets Authority (CMA), accepted the commitment.

In 2020, Google announced that it would gradually phase out support for third-party cookies starting from 2022, but the plan has been delayed multiple times due to opposition from advertisers and regulatory pressure.

Wiz Refuses $23bn Acquisition

On July 23rd local time, Wiz, a cybersecurity startup, announced that it has rejected Google's up to $23 billion acquisition offer and insisted on going public as originally planned, with the goal of achieving $1 billion in annual recurring revenue.

Wedbush analyst Dan Ives released a report stating, "For Microsoft, Google, and Amazon, the global disruption caused by CrowdStrike technology failures further highlights the interconnectedness between cybersecurity software and cloud ecosystems

In addition, there are voices in the industry stating that due to the scrutiny surrounding mergers and acquisitions of large tech companies in recent years, board members of Wiz and Alphabet are concerned that this transaction may not pass the scrutiny of antitrust regulators.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.