Japan's GDP fell into negative growth in the first quarter, and it is still possible to raise interest rates in June.

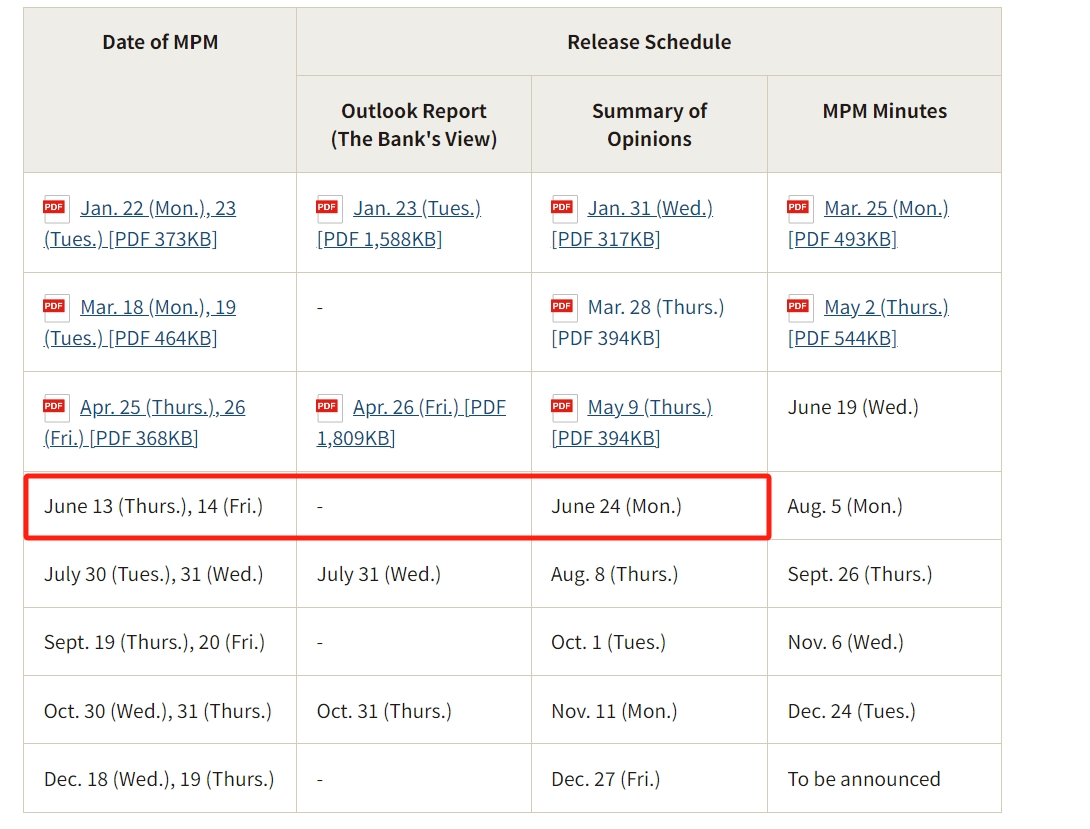

The next interest rate meeting of the Bank of Japan will be held in June, and the market believes that the central bank is likely to raise interest rates three more times this year, and there is still a possibility of raising interest rates in June.

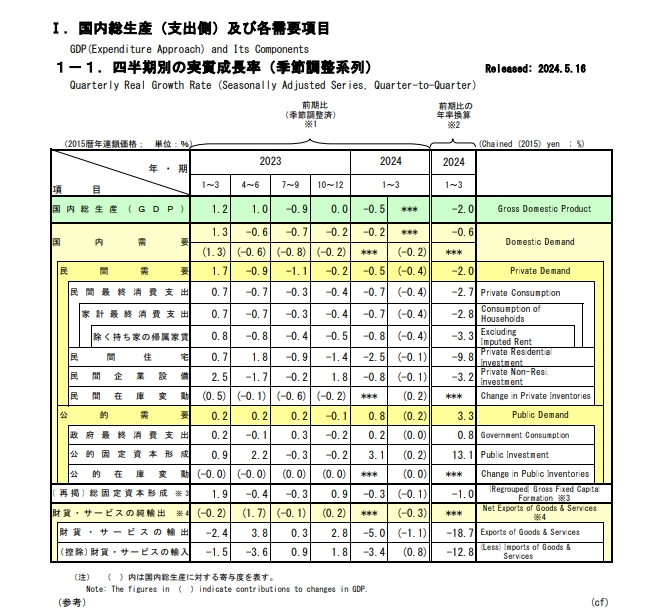

On May 16, preliminary statistics released by the Cabinet Office of Japan showed that in the first quarter of this year, Japan's real Gross Domestic Product (GDP) fell by 0.5% on a quarter-on-quarter basis, and by 2.0% on an annualized basis, exceeding the expectations of the media and institutions.

Weak Domestic and External Demands Cause Q1 GDP Decline

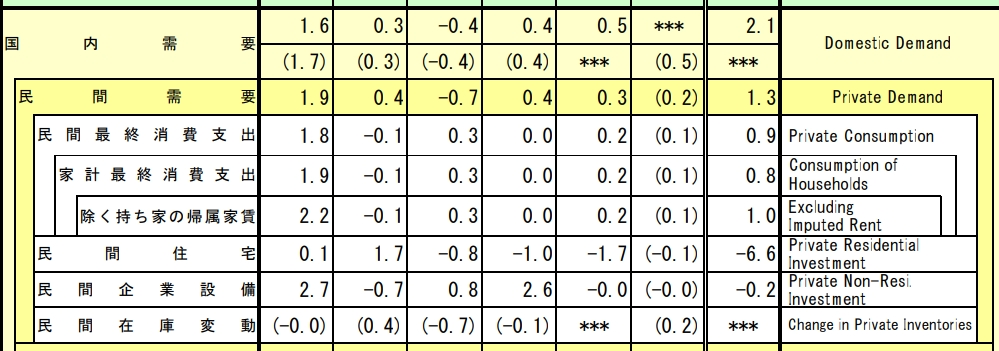

Specifically, in terms of domestic demand, personal consumption, which accounts for more than half of the GDP, fell by 0.7% on a quarter-on-quarter basis in the first quarter, showing a greater deterioration than the previous quarter, and has been in negative growth for four consecutive quarters; corporate equipment investment, also a pillar of domestic demand, fell by 0.8% on a quarter-on-quarter basis; and private residential investment fell by 2.5% on a quarter-on-quarter basis. In terms of external demand, exports fell by 5.0% on a quarter-on-quarter basis, marking the first decline in four quarters; imports also fell by 3.4% on a quarter-on-quarter basis. In that quarter, both domestic and external demands contributed negatively to economic growth, with a quarter-on-quarter decline of 0.2% and 0.3%, respectively.

On the export side, the first quarter also saw a significant decline. On the one hand, it was due to the impact of the data fraud scandal at Daihatsu, which led to the suspension of production at many Toyota factories, affecting exports; on the other hand, it was also related to the high base of the previous quarter. Due to the concentration of income such as Japanese patent fees in the fourth quarter of last year, the export of service trade in that quarter increased significantly, boosting the export data for that quarter. Experts generally believe that as the automobile industry resumes production, external demand will rebound in the second quarter.

Data released by the Ministry of Internal Affairs and Communications show that as of March, Japan's core Consumer Price Index (CPI) excluding fresh food has been rising for 31 consecutive months on a year-on-year basis; the real consumption expenditure of Japanese households with more than two people has been declining for 13 consecutive months on a year-on-year basis, excluding the factors of price changes. In addition, after deducting the factors of price increases, Japan's real wage income in March fell by 2.5% year-on-year, marking a continuous decrease for 24 consecutive months, setting a record for the longest continuous decline in wages since comparable statistics began in 1991.

Policymakers Focus on the Consumption Level of the General Public, Still Possible to Raise Interest Rates in June

Regarding Japan's economic performance in the first quarter, analysts say that weak demand may intensify the pressure on the central bank to raise interest rates, as the continuous depreciation of the yen has increased Japan's import costs, leading to increased spending by Japanese households: "This pressure may prompt the Governor of the Bank of Japan, Haruhiko Kuroda, to continue to send hawkish signals about the policy outlook, but there will also be many considerations to hedge against the possibility that consumption may take longer than expected to rebound." Many experts in Japan have pointed out that against the backdrop of the yen's depreciation, the pressure of stagflation facing the Japanese economy may further increase.

Although in March this year, the Bank of Japan decided to end the negative interest rate policy that has been in place for eight years, it seems that the actual significance of this action is not great. Analysis suggests that due to the huge interest rate differential between the United States and Japan, the yen has depreciated instead of appreciating after exiting negative interest rates, and has depreciated by about 10% relative to the US dollar this year. The depreciation of the yen has increased the cost of living for the Japanese people on the one hand, and on the other hand, the decline in Japanese exports also indicates that the benefits of "cheap yen" for export manufacturers are gradually diminishing.

The market believes that this macroeconomic data is not expected to have a decisive impact on the central bank's decision-making, as policymakers have always focused on the consumption level of the general public in Japan. The Bank of Japan believes that wage increases and consumption increases are linked, so the upcoming consumption data, wage data, and service industry inflation data are particularly important for the Bank of Japan. Analysis suggests that the Bank of Japan will wait for the second quarter GDP data to be released in August to verify the above views.

The next interest rate meeting of the Bank of Japan will be held in June, and the market believes that the central bank is likely to raise interest rates three more times this year, and there is still a possibility of raising interest rates in June. Toshitaka Sekine, former Chief Economist of the Bank of Japan, believes that the Bank of Japan will take the opportunity to gradually reduce its easy monetary policy, even if the real interest rate remains significantly negative. He emphasized that there is no reason to believe that 0.25% is the limit for interest rate hikes, and as long as conditions permit, the Bank of Japan can continue to raise interest rates.

In addition, according to a survey of economists conducted by the media in April, the market generally expects the benchmark interest rate of the Bank of Japan at the end of the year to be 0.25%, and it is expected that there will be one more rate hike after the first rate hike in March. However, institutions such as Vanguard Group and PIMCO expect that the key interest rate of the Bank of Japan may rise to a higher level.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.