The "last negative interest rate samurai" continues to hold back the Nikkei index hit a new high in nearly 34 years.

On January 23, the world's "last negative interest rate samurai," the Bank of Japan, concluded a two-day monetary policy meeting.。The bank decided to maintain ultra-loose monetary policy and cut its inflation forecast for the next fiscal year.。

On January 23, the world's "last negative interest rate samurai," the Bank of Japan, concluded a two-day monetary policy meeting.。The bank decided to maintain ultra-loose monetary policy and cut its inflation forecast for the next fiscal year.。

Bank of Japan: will not hesitate to take additional easing measures Nikkei up

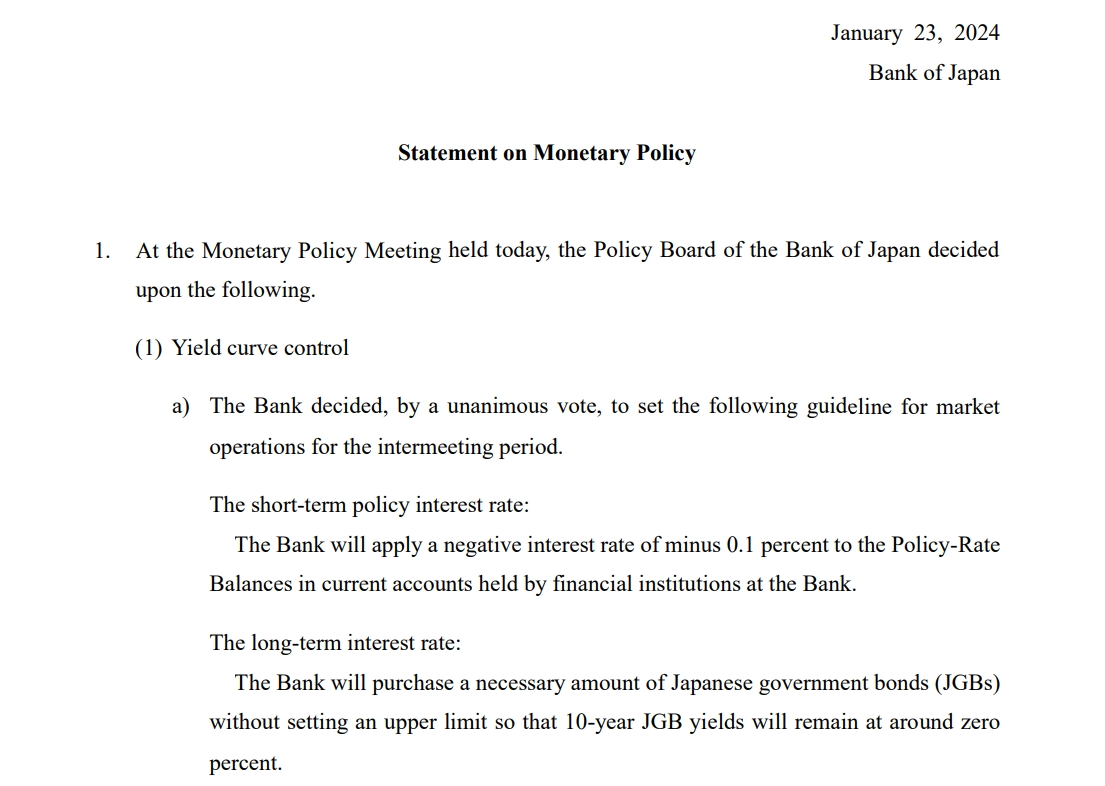

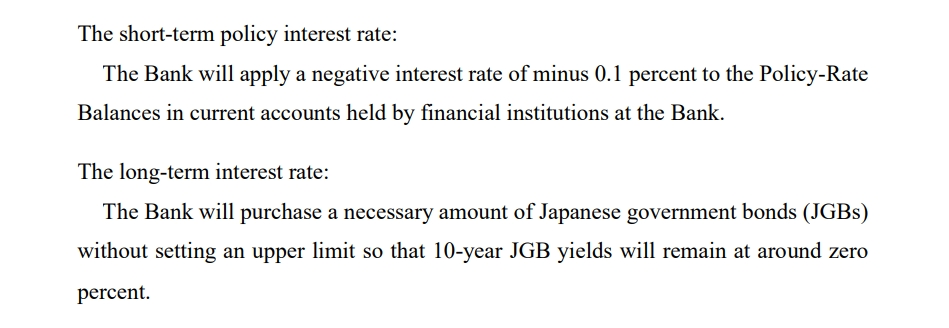

In the statement, the Bank of Japan retained language indicating its dovish leanings, vowing to steer short-term interest rates to minus zero..1%, the 10-year rate fell to 0%, while maintaining the 10-year government bond yield allowed to rise to 1..Yield Curve Control (YCC) policy of around 0%。

Spurred by the news, the Nikkei rose 1% to its highest level since February 1990, bringing its year-to-date gain to 10.3%。Hang Seng up 1 in Hong Kong.The Morgan Stanley Capital International Index (MSCI), the broadest Asia-Pacific stock index outside Japan, rose 0%, led by 8%..5%。

The dollar pulled up more than 30 points against the yen in the short term, extending its intraday gains to 0.3%, continuing to hover at 2-month lows; 10-year Japanese government bond futures also pulled up 20 points in the short term。

The Bank of Japan said it would not hesitate to take additional easing measures if necessary, adding: "As long as it is necessary to maintain a stable inflation rate of 2%, the central bank will continue to implement the YCC policy."。Going forward, any initiatives launched by the central bank will be based on economic data, including Japan's annual wage negotiations in 2024.。

On the inflation front, Japan's core consumer inflation (excluding fresh food) continued to decelerate, reaching 2 in December..3%, an 18-month low, reflecting lower energy prices。Consumer inflation excluding food and energy is 3.7%, highlighting the spread of price increases from goods to services。

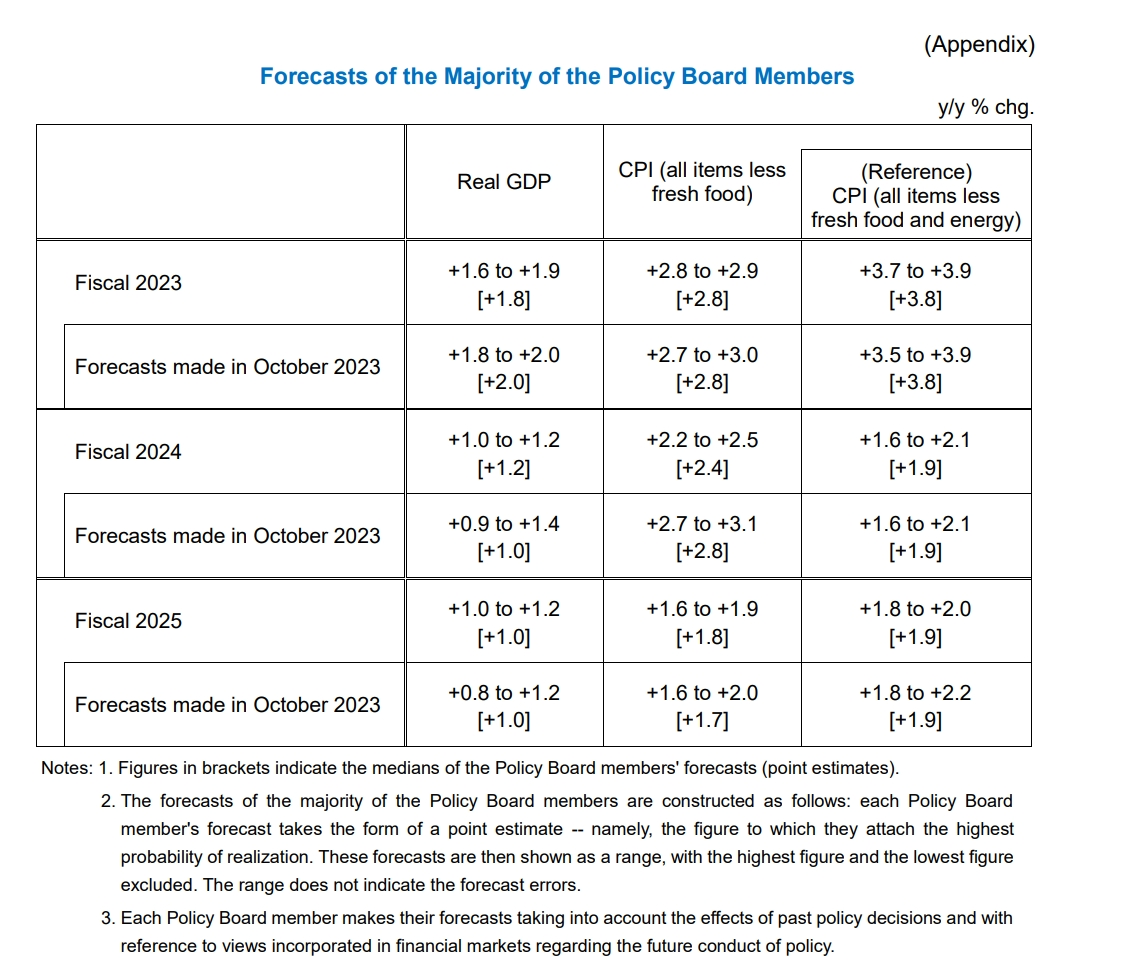

In a separately released quarterly economic forecast, the BoJ dropped its forecast for consumer inflation, excluding fresh food, for the fiscal year beginning in April, from 2..8% down to 2.4%, while shifting the FY 2025 forecast from 1.7% up to 1.8%。

When will the Bank of Japan raise interest rates??Market unanimously bullish April-June

The market was not surprised by the Bank of Japan's decision.。Of the 28 economists surveyed by Nikkei affiliate QUICK, all but one predicted no change from the January meeting.。7 on the west coast of central Japan during New Year's Day.6 earthquake, relief operations are still ongoing, so economists believe the Bank of Japan will avoid making major policy adjustments in an emergency。

For now, more economists believe the Bank of Japan will end its negative interest rate policy in April-June。A former executive director of the Bank of Japan, who once set monetary policy, said the Bank of Japan will likely be encouraged by the outcome of annual salary negotiations, which could pave the way for an end to negative interest rate policy this spring。In addition, 18 out of 23 economists surveyed by QUICK predicted that the Bank of Japan would end its negative interest rate policy in April-June.。

Standard Chartered believes the BoJ will only consider policy normalization if growth trends are stronger and inflation is driven by wage growth and demand-driven factors。The normalization of negative interest rates and the adjustment of the YCC may also depend on tangible signs of wage growth, with a possible timetable of April 2024 after the spring wage negotiations.。

Kenny Fisher, an institutional analyst at MarketPulse, said inflation has been easing and the economy remains fragile.。The recent earthquake caused the market to lower expectations for a policy shift at the conference.。In addition, national wage negotiations will be held in March, and the Bank of Japan prefers to analyze the outcome of wage negotiations before making any policy adjustments.。This will indicate that the time is ripe for a major announcement at the April meeting.。

For his part, IG Australia Pty market analyst Tony Sycamore stressed: "We expect the Bank of Japan to take the next step in April towards policy normalization and away from negative interest rate policy.。However, as Ueda and Kazuo have said that any policy changes will be 'carefully assessed, "we expect the upcoming adjustments to be carefully managed.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.