Japan temporarily out of technical recession as early as March to withdraw from negative interest rate policy

For now, economists and investors have widely expected the Bank of Japan to lift its negative interest rate policy in March or April, with the debate focusing on whether the Bank of Japan's exit will be in March or April.。

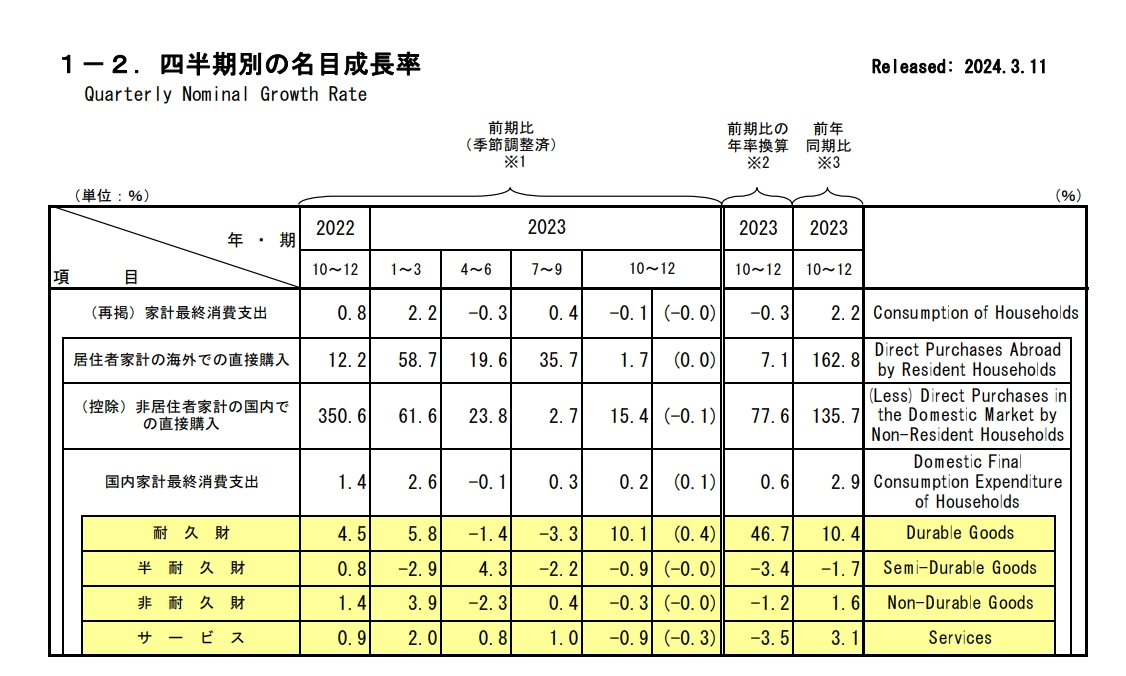

On March 11, the Cabinet Office of Japan announced the final annualized quarterly real GDP for the fourth quarter of 2023, which recorded 0.4%, significantly lower than the expected 1.1%, but compared to the initially announced -0.4% major repairs。Japan has also temporarily emerged from a technical recession with the data.。

Capital spending sharply revised up in the fourth quarter, experts say Japan's economy is still at risk of contraction

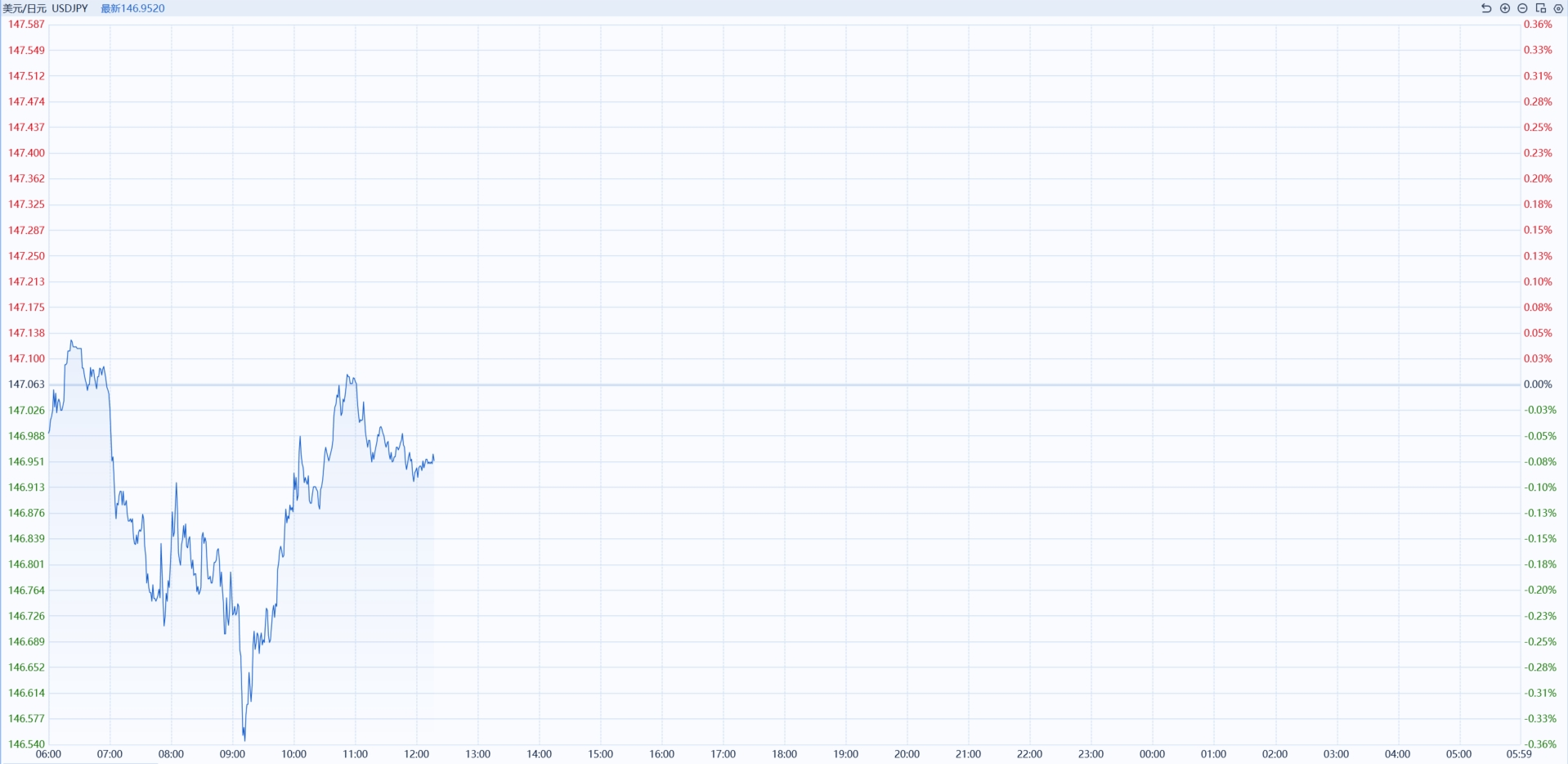

Rising expectations that the Bank of Japan may abandon negative interest rates as early as this month after the data。The yen edged up 7 points against the dollar in the short term; Japan's 10-year bond yield rose to zero at one point..753%; Japanese and Korean stocks opened lower, with the Nikkei 225 index opening down 1.2%, Japan's TSE opened down 1.1%; South Korea's Seoul Composite Index opens down 0.6%。

Specifically, Japan's fourth-quarter capital spending rose 2.0%, laying the groundwork for an upward adjustment in GDP, which is much better than the initial value of -0.1%, but still below market expectations for median growth 2.5 per cent; private consumption, which accounts for about 60 per cent of Japan's economy, fell slightly by 0 per cent..3%, slightly lower than the initial value of the decline of 0.2%, mainly due to the poor performance of aquatic products and household appliances;.2 percentage points, and the initial release data remain unchanged.。

Saisuke Sakai, senior economist at Mizuho Research and Technologies, said that while Japan's GDP figures were generally revised upward, domestic demand remained weak, especially on the consumption side.。In addition, he said Japan's economy could still contract in the first quarter of 2024, given China's economic slowdown and the shutdown of a Toyota unit。

Bank of Japan to exit negative interest rates in March or April?

Last week, foreign media reported that the Bank of Japan may cancel the yield curve control policy (YCC) and end the negative interest rate policy at its policy meeting on March 19.。Analysts say the time is ripe for the Bank of Japan to withdraw from its negative interest rate policy, as the prospect of significant union raises has become increasingly clear during the annual "spring fight" wage negotiations with unions.。

It is understood that Rengo, Japan's largest trade union federation, has demanded a 5-year pay rise in this year's "spring fight.".85%, above 5% for the first time in 30 years。Huatai Securities, on the other hand, expects Japan's "spring bucket" wage growth to rise above expectations to 3 in 2023..A high of 6 per cent, especially with a significant increase in basic wage growth.。The main reasons behind this are the better-than-expected improvement in Japanese corporate earnings in 2023, the sharp rise in residential utility prices at the beginning of the year and high inflation.。

The Bank of Japan has long argued that strong wage growth would be necessary for the bank to exit aggressive monetary policy.。At the Bank of Japan policy meeting in January, central bank governor Ueda Kazuyoshi also released the news, saying that he will focus on the results of the March "spring fight" negotiations, if confirmed to achieve a virtuous cycle of wages - inflation, the Bank of Japan will consider changing the easing policy, including negative interest rates.。

For now, economists and investors have widely expected the Bank of Japan to lift its negative interest rate policy in March or April, with the debate focusing on whether the Bank of Japan's exit will be in March or April.。

SMBC's chief foreign exchange strategist Hirofumi Suzuki believes that Japan's monetary policy is likely to shift in March, because "the yen looks strong in the short term," which may be a signal of market pressure on the central bank.。

On the other hand, the UBS Wealth Management Investment Director's Office (CIO) said in the latest institutional view that the Bank of Japan is more likely to cancel its negative interest rate policy at its monetary policy meeting on April 26 than at its March 19 meeting, as Japan will also release the results of the first quarter 2024 Tankan business survey on April 1, which the Bank of Japan needs to provide it with more valid information.。

In addition, although the first round of "spring fight" wage negotiations for large enterprises will end on March 15, there are still two rounds to come.

Negotiations for small businesses will end on March 22 and April 4, respectively.。This shows that more than half of the companies will be in the second round of "spring fight" to announce the decision to raise wages, which will also have an impact on the central bank's judgment.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.