Malaysia wants to make Johor a "new engine of economic growth"

Malaysia wants to make Johor a "new engine of economic growth," and the country's economy minister wants to build a special economic zone with Singapore to promote technology and renewable energy。

On January 11, Singapore and Malaysia signed a memorandum of understanding on the planning of the Johor Special Economic Zone, which was signed by Malaysian Minister of Economy Rafizi Ramli and Singaporean Minister of Trade Yan Jinyong, and was witnessed by Prime Minister Anwar Ibrahim and Prime Minister Lee Hsien Loong.。

According to the memorandum, joint initiatives include a two-dimensional code-based passport-free land clearance process, a one-stop business and investment service center, digital cargo clearance at land checkpoints, and renewable energy cooperation.。

Rafizi Ramli said: "The whole idea of building the Johor-Singapore Special Economic Zone is to promote Johor as a new engine of economic growth in Malaysia, beyond the current trajectory of using its own natural resources.。"

"Two-dimensional Code Customs Clearance" Promotes Business Ecology

Singapore and the Malaysian state of Johor face each other across the strait, linked only by a causeway and a bridge, and hundreds of thousands of people cross the border every day.。If the "QR code clearance" is truly implemented, it will promote the cross-border movement of goods and people, strengthen the business ecosystem, and enhance the economic attractiveness of Johor and Singapore.。

Singapore and Malaysia are each other's second largest trading partners.。According to Statistics Malaysia, bilateral trade between January and November 2023 amounted to 335.6 billion ringgit ($72.3 billion).。Singapore was also Johor's second largest foreign investor from January to June 2022, accounting for 70% of the state's total manufacturing FDI.。

In response to the signing of the memorandum, the two countries said that by leveraging Singapore's expertise in services, capital, technology and infrastructure, combined with Johor's cost-effectiveness, rich land and natural resources, the SEZ could create a synergistic economic environment.。

Kwok Ping-shun, CEO of the Singapore Federation of Industry and Commerce, said: "The Johor Special Economic Zone will create greater economic space for global companies to take advantage of the complementary advantages of the two places to promote growth and investment.。"

New energy empowers multi-industry "leapfrog development"

Malaysia's core traditional industries include electronics and car manufacturing, as well as commodities such as natural gas and palm oil.。With the emergence of new technologies, the government last year released a new industrial master plan and energy transition roadmap to promote future growth, focusing on green and high-value industries.。

Moreover, the concentration of technology and heavy industry in Johor and Singapore will drive up demand for renewable energy, which in turn can contribute to the domestic energy transition process.。The Malaysian government will further accelerate its energy transition goals when demand in Johor increases further, the message said.。

On the other hand, given that Johor has a total population of about 4 million, it will largely attract the interest of international investors.。Rafizi said that only by expanding foreign direct investment (FDI) and domestic direct investment (DDI) to the region can the international investment portfolio in the region be truly diversified.。

Political stability leaps "leapfrog development" into government blueprint。In addition to renewable energy, Johor plans to develop industries such as technology, electrical and electronics, medical equipment, food processing and data centers to move into the ranks of high-income countries based on its existing economic and financial focus.。

Diversified investments push up small-cap performance

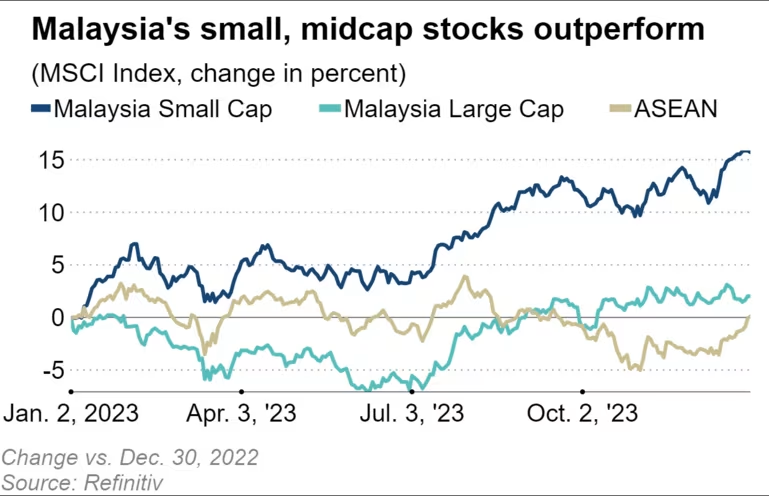

Malaysian small and mid-cap stocks have outperformed some of the country's largest companies, boosted by "digital infrastructure and construction projects" in Johor, boosting developers and tech companies.。

Malaysian companies are said to benefit by providing services, selling properties or becoming co-investors in increased foreign investment in Johor, but policy changes may affect actual investment capital inflows。

MSCI Malaysia mid-small cap index up 15 in 2023, data shows.7%, while the large-cap index rose just 2%。The large-cap index includes the country's more well-known stocks such as Maybank and Malaysia Petrochemical Group (PCG), while the small-cap index tracks the performance of 64 companies with a free-float market capitalization of less than $1 billion, covering about 14% of local stocks.。

In Southeast Asia, Malaysia is the only country where small and medium-cap stocks consistently outperformed large-cap stocks throughout 2023, according to industry insiders.。

As Malaysia looks to bring in high-value, high-growth industries and investment projects from overseas, Prime Minister Anwar Ibrahim has a business-oriented and more liberal economic policy.。Moreover, under the influence of the "medium-term investment catalyst" - the Johor Special Economic Zone -, Malaysia's small and medium-cap stocks are far more diversified in terms of quality and quantity than countries such as Indonesia and the Philippines.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.