How to trade with Admiral Markets Sentiment Monitor

Market sentiment can affect short-term price movements, so Admiral Markets provides sentiment monitoring tools to help you interpret the market and generate higher profits。

Market sentiment can affect short-term price movements, so Admiral Markets provides sentiment monitoring tools to help you interpret the market and generate higher profits。

When trading, there are many important factors that can be used to analyze the market。One of the most popular among traders is market sentiment, which basically refers to the general outlook or attitude of investors towards a certain trading instrument or the financial market as a whole, showing a general optimism or pessimism of market participants, which drives demand and supply, thus affecting price movements。

Many traders often combine market sentiment indicators with other forms of analysis to identify reliable entry and exit signals; in addition, traders can use Admiral Markets' sentiment tools to check which assets are dominated by bullish / bearish sentiment to confirm their trading positions。But before that, let's take a closer look at market sentiment in forex trading。

The Importance of Market Sentiment

Market sentiment is an important indicator of the trading world and is a term used to describe the psychological attitude of market participants towards a particular asset or security。Demand and supply in markets are often driven by market sentiment and are not always rational。This is often seen as the result of "animal spirit" behavior and is a group psychology in which people suddenly have the urge to buy or sell assets, causing the market to fluctuate wildly.。

Understanding market sentiment is not easy because there are many factors involved, the most important of which is market psychology。Emotions such as fear and greed can easily influence market movements, especially after major news headlines or geopolitical events.。When the market is dominated by fear, it can lead to massive selling and rapid price declines in instruments such as forex, stocks and indices。At the same time, when greed prevails, we will see the market rise。

Now, in order to understand why market participants behave in a certain way, we should be able to observe and analyze market sentiment indicators, such as.

- Volatility Index (VIX): An indicator of market demand for insurance。VIX rises when volatility is high, indicating increased risk。

High and Low Index: Compare the number of stocks that make up the 52-week high and the number of stocks that make up the 52-week low.。When the index is high, it is bullish market sentiment and vice versa。

Bullish Percent Index (BPI): This indicator measures the total number of stocks in a given index that show a bullish pattern over a period of time based on a point chart。A high BPI score (about 80% or more) indicates optimistic market sentiment and vice versa。

Moving averages in technical analysis: simple moving averages can give the overall price movement of a given asset over a specific period of time。For example, a 50-day or 200-day moving average is a very common indicator of market sentiment; when the 50-day moving average breaks through the 200-day moving average (often referred to as a golden cross), it indicates bullish sentiment; when the 50-day moving average falls below the 200-day moving average (also known as a death cross), it indicates bearish market sentiment。

Trading with Admiral Market's Sentiment Tools

In addition to the above tools, Admiral Markets also provides sentiment widgets to help clients see the correlation between long and short positions held by other traders in the market.。The tool basically shows "bull and bear" signals that can be used to identify overall market sentiment。

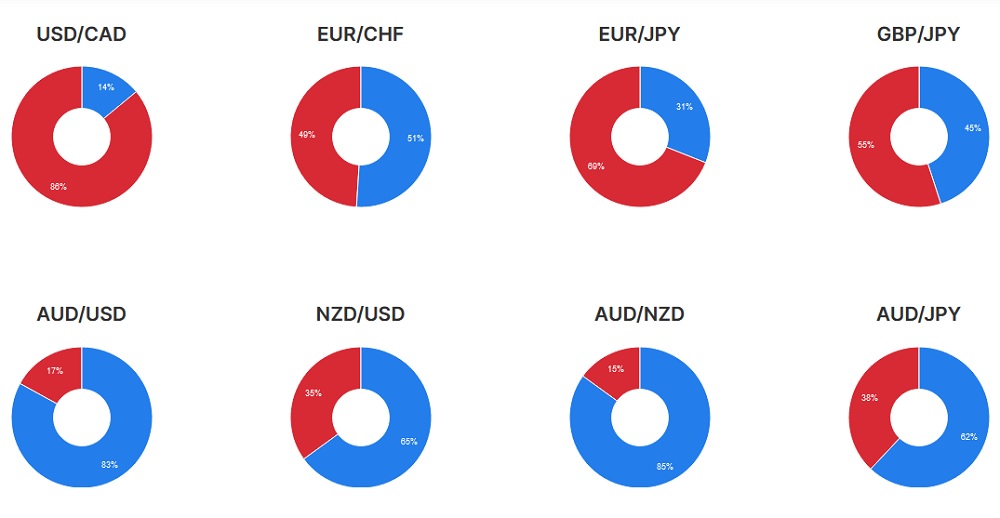

Market sentiment tools track gold, major forex currency pairs, and other other currency pairs in real time by showing other traders' long and short positions in the market。The following is an example from the Admiral Markets website:

The sentiment is based on real-time data collected from multiple trading service providers.。The data above shows market sentiment data for individual currency pairs, with the blue section representing bullish and the red area representing bearish。Thus, if the sentiment for EUR / CHF is 49% in red and 51% in blue, it means that the market is inclined to be bullish on the pair。The small difference in percentages indicates that the long and short are nearly equal in strength.。The greater the percentage difference, which usually means that the stronger the signal, the greater the chance of profiting from sentiment。

The widget updates in real time, making it easier for traders to get accurate analysis。Please note, however, that the volume data in the Admiral Markets Sentiment tool may change significantly during market volatility or when traders open / close positions in large numbers。

Conclusion

Market sentiment is one of the most important indicators of financial market trading profitability, which is used to identify trading opportunities for short-term price movements due to investors' attitudes towards an asset.。Market sentiment is often described as bullish or bearish, and when the market is bullish, asset prices usually rise and vice versa。

Sentiment tends to drive price movements, so market sentiment can sometimes be irrational。In this case, you can easily view the overall market sentiment in real time using the sentiment tool provided by Admiral Markets。As can be seen from the example above, the data is very easy to read even for beginners。Overall, it is a very useful tool that can help you see bullish / bearish signals in order to execute trades at the right time and generate profits。

Admiral Markets is a Forex and CFD brokerage firm,Since 2001, it has been committed to providing smart financial solutions for global traders.。The main services revolve around three key activities: learning, trade and investment。To this end, it has a number of registered subsidiaries, including Admiral Markets UK Ltd, Admiral Markets Pty Ltd (Australia), Admiral Markets AS Jordan Ltd, Admiral Markets Cyprus Ltd, Admirals SA (Pty) Ltd (South Africa) and Aglobe Investments Ltd (Seychelles), for global markets。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.