Meituan 2023Q3 earnings report: net profit increased by more than 60% year-on-year distribution single volume soared 23% to 6.2 billion

By the end of the third quarter, the total number of orders for instant delivery reached 6.2 billion, up 23% year-on-year; food and beverage takeaways maintained a strong growth momentum, with a peak of 78 million orders per day, a record high and double that of three years ago.。

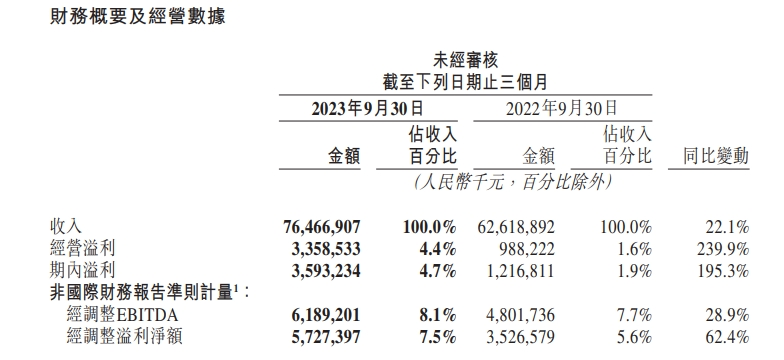

On November 28, Meituan released its third-quarter 2023 earnings for the year ended September.。Data show that Meituan's third-quarter revenue was 764.700 million yuan (RMB, the same below), up 22.1%; adjusted net profit 57.$300 million, up 62% YoY; Adjusted EBITDA 61.900 million yuan, up 29% year-on-year; net profit 35.900 million yuan, up 195.3%; operating profit 33.600 million, estimated 31.600 million yuan。

In addition to the relatively excellent financial data, Meituan has also had a bright business performance this year.。Data show that as of the end of the third quarter, Meituan's annual number of active trading users, annual number of active merchants and user purchase frequency all hit record highs.。In addition, during the reporting period, Meituan's peak daily orders for food and beverage takeaways finally exceeded the 78 million mark, and Meituan's peak daily orders for flash purchases exceeded 13 million, which is another milestone in the history of Meituan's instant delivery development.。

In the face of bright performance, Meituan CEO Wang Xing said that thanks to continued innovation and investment in service retail and merchandise retail, Meituan's business continued to achieve solid growth this quarter.。We will continue to implement the 'retail + technology' corporate strategy, through the digital transformation of technology-enabled life services in various industries, to help the local real economy, to contribute more to the pursuit of a better life for consumers and practitioners.。

Chen Shaohui, CFO of Meituan, said that in this quarter, Meituan continued to adhere to customer-centric, adding richer content and services, enhancing the service quality and efficiency of various categories, bringing more convenient and higher quality lifestyles to consumers, and providing operators with a combination of online and offline digital business methods.。We will continue to be determined to create long-term value for all participants through scientific and technological investment and service innovation.。

"Service Retail" Business Grows Rapidly Meituan Preferred Losses Narrow

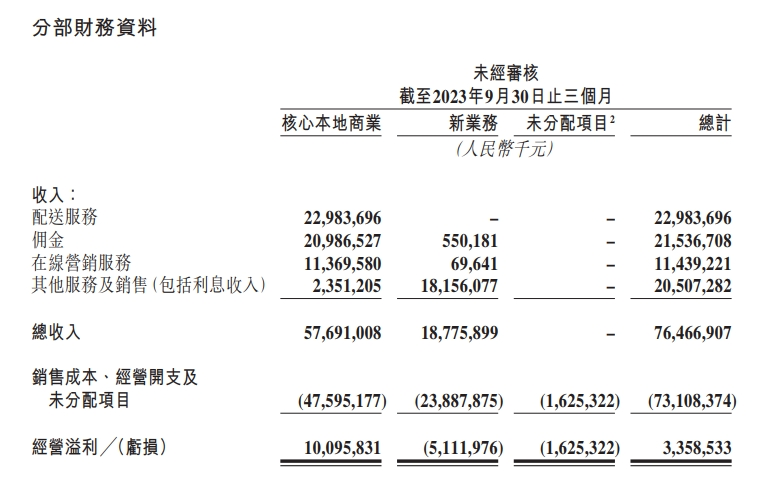

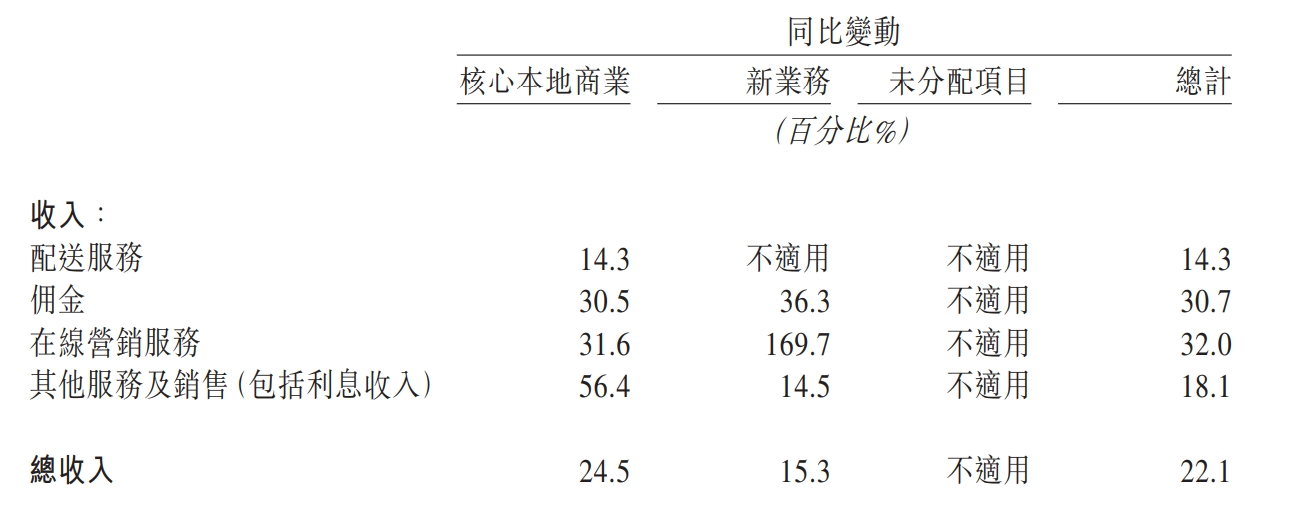

Data show that during the reporting period, Meituan's distribution service revenue reached 229.8.3 billion yuan, up 14.3%; commission income up to 215.3.6 billion yuan, up 30% year-on-year.7%。By the end of the third quarter, the total number of orders for instant delivery reached 6.2 billion, up 23% year-on-year; food and beverage takeaways maintained a strong growth momentum, with a peak of 78 million orders per day, a record high and double that of three years ago.。

By business, the core local business side, driven by Meituan's eye-catching performance in catering, drove the segment's quarterly revenue growth to 576.900 million yuan, up 24.5%。

In terms of instant delivery business, Meituan has deepened its understanding of consumer needs, while enabling businesses to operate digitally and further unleash the consumer potential of the market.。Meituan achieved good results by iterating the membership program and providing membership coupon packages of different specifications to increase the frequency of transactions during the reporting period.。In terms of activities, Meituan actively explored different categories of markets, and achieved good results of 21 million cups per day in milk tea marketing activities, and orders for summer supper also achieved huge growth.。In addition, Meituan also launched activities such as "Spelling Good Meals," "Sharpshooters" and "Time-honored Brands" in the third quarter, providing customers with more high-quality and low-cost supplies, and cultivating consumers' habits of watching live broadcasts and placing orders in Meituan, releasing the growth potential of old brands.。

In terms of Meituan flash purchases, Meituan flash purchases continued to show strong growth in the third quarter, with significant increases in order volume, merchant size and user size.。In August, the peak of the daily order of the flash sale of the US group exceeded 13 million orders.。On the merchant side, Meituan continues to promote the digitization of small and medium-sized merchants, partnering with nearly 400 brands, directly driving a 30% year-on-year increase in the number of annual active merchants in the third quarter.。"Meituan Lightning Warehouse" has exceeded 5,000, effectively supplementing the traditional offline retail supply.。

The store, hotel and travel business also maintained strong growth in the third quarter, with transaction value increasing by more than 90% year-on-year, the number of quarterly active merchants increasing by more than 50% year-on-year, and the number of quarterly transaction users also increased significantly.。

In terms of store-to-store business, Meituan is still reporting good news, with earnings saying that Meituan-to-store transactions grew strongly and hit a new high in August。Meituan continues to empower this business segment through the official live broadcast model.。Meituan said it has expanded the coverage of Meituan's official live broadcast to more than 200 cities to showcase more businesses and merchandise during the holiday season。Considering the use problem, Meituan also provides richer services and artificial intelligence tools to help merchants lower the threshold of live broadcast and expand the scope of live broadcast.。With more merchants participating and providing high-quality and low-cost products, the volume of Meituan's "special group purchase" has continued to grow.。

In terms of hotels and tourism, Meituan's business segment also maintained strong growth momentum in the third quarter, with significant increases in transaction value and volume compared to the same periods in 2022 and 2019.。Thanks to the summer season, Meituan has continuously enriched its portfolio of products and improved its price competitiveness, which has achieved certain results.。In the third quarter, Meituan further enriched the "live + X" package products to provide consumers with diversified products.。In August, Meituan released the latest "Must Stay List," featuring more than 900 hotels, and enhanced its promotion efforts through live broadcasts and joint marketing activities with the Star Hotel Group to help get traffic.。

In terms of new business, the segment's revenue increased by 15% year-on-year during the reporting period..3% to $18.8 billion, with operating losses narrowing by 2.4% year-on-year..5% to $5.1 billion, and the operating loss rate continued to improve to 27.2%。

Meituan preferred, as macro volatility and changes in consumer behavior continued to affect growth, the business generated in the third quarter.

Significant operating loss, but the operating loss rate narrowed further year-on-year and month-on-month。Meituan said that during the reporting period, the company maintained its market share, strengthened its product selection and pricing capabilities, and provided consumers with more cost-effective choices。In addition, the company also improves logistics efficiency by optimizing the fulfillment network and adding high-quality self-lifting points.。As of the end of September, Meituan Preferred had accumulated 4.900 million trading users。

Meituan's grocery shopping also recorded strong growth this season and has become the first choice for many consumers。During the reporting period, the number of users, purchase frequency and unit price of Meituan's food purchases increased steadily.。Meituan said that in the future, it will continue to consolidate its price advantage, optimize its logistics network, improve supply chain efficiency, and provide a diversified product portfolio and use holiday promotions to meet the broader needs of consumers.。

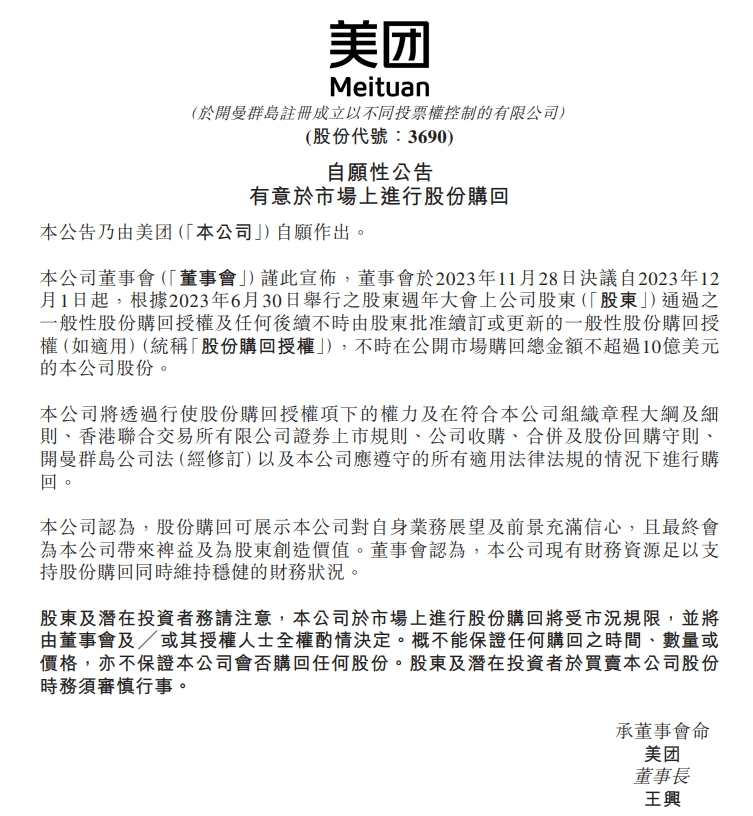

Wang Xing: Is considering pushing ahead with a $1 billion buyback program

In the post-performance conference call, Wang Xing said that management has full confidence in the company's long-term growth potential, the current share price of Meituan in the secondary market only reflects the valuation of the takeaway single business, is not in line with the intrinsic value of the company, is considering promoting a $1 billion repurchase plan, "the company will make a prudent decision based on a comprehensive consideration of business investment, cash position and market conditions。"

In addition, Wang Xing also analyzed the current loss of new business in more detail.。He said that he is still optimistic about the huge potential of the grocery retail market, the current operating losses of Meituan Preferred are narrowing, which is a good signal, in addition, Meituan will optimize operations, focus on high-quality growth.。

Turning to the future forecast for the outbound business, Chen said the two-year compound growth rate of the takeaway business in the fourth quarter is forecast to be in line with the growth level of the previous nine months。He mentioned that factors including the macroeconomic situation and climate affect the growth of orders, while more people return to offline consumption, which also affects the order volume of takeaway consumption.。

For the U.S. group flash purchase, Chen Shaohui said the future will continue to optimize supply, the business is expected to reach a two-year compound growth rate of 45% in the fourth quarter, higher than the growth rate of the broad e-commerce industry.。

However, he also mentioned that the unit price of takeaways may decline, "due to the epidemic, the high unit price of customers and long-distance orders in the fourth quarter of last year accounted for a much higher proportion of the overall order volume, and this year's resumption of business of small and medium-sized businesses and changes in consumer behavior will also lead to year-on-year changes in unit prices in the fourth quarter.。"

The next day, November 29, Meituan issued a voluntary announcement in Hong Kong that it "intends to buy back its shares in the market."。Meituan said it will repurchase the company's shares in the open market from time to time in a total amount not exceeding $1 billion in accordance with the relevant authorization.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.