Throwing for two months?Zuckerberg cashes out Meta over $400 million!

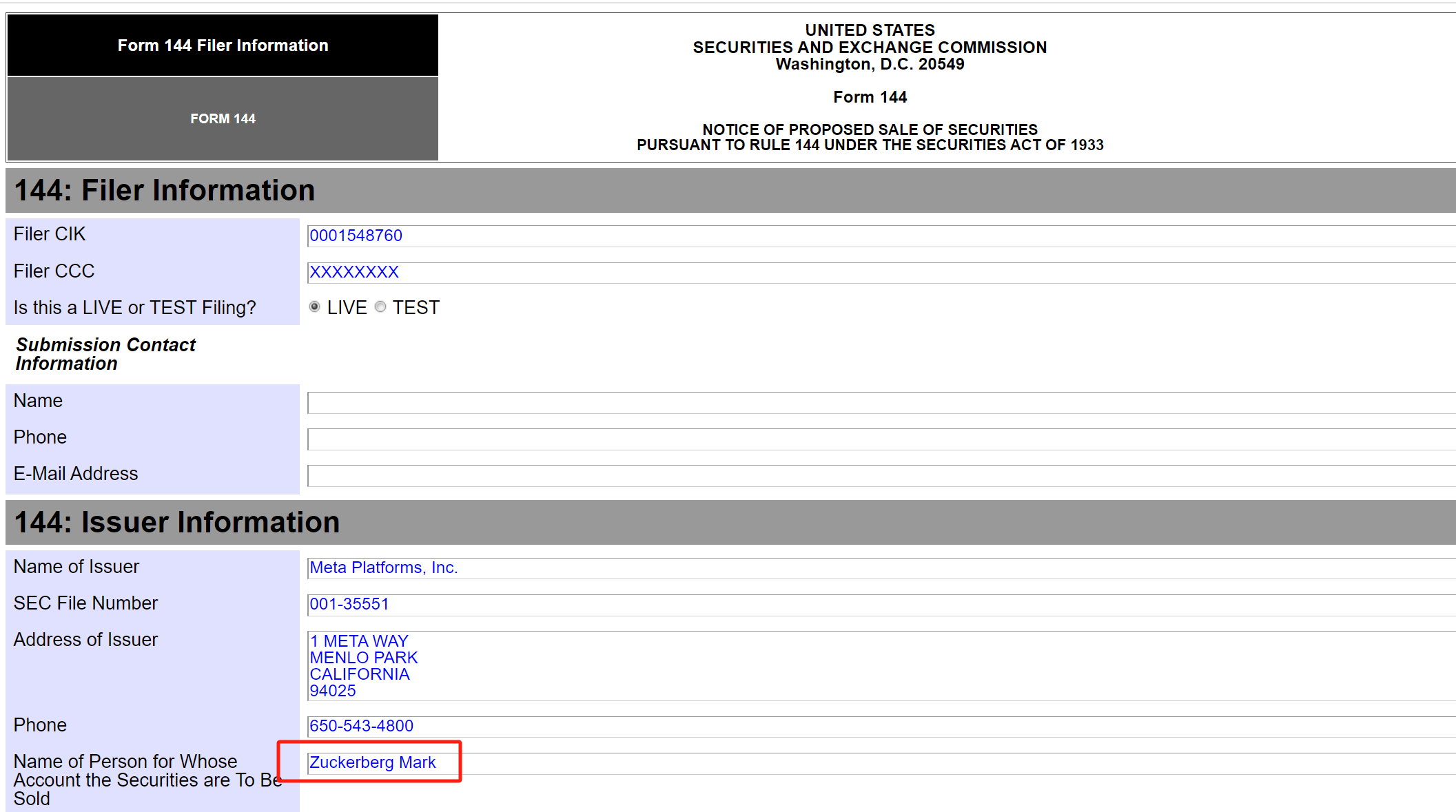

On January 2, local time, regulatory filings showed that Meta CEO Mark Zuckerberg sold about 1.28 million shares of Meta stock in the last two months of 2023, cashing in nearly $500 million.。

On January 2, local time, according to regulatory filings disclosed by the Securities and Exchange Commission, Meta's CEO Mark Zuckerberg sold about 1.28 million shares of Meta stock in the last two months of 2023.。

From November 1, 2023, to December 29, 2023, Zuckerberg had a total of 41 sell-offs, according to regulatory filings.。That is, for the last two months of 2023, Zuckerberg is selling shares every trading day。

After selling shares for two consecutive months, Zuckerberg cashed out a total of about 4.$2.8 billion, with an average of $10.4 million per sale。The largest of these sales occurred on December 28, cashing in $17.1 million.。

It's rare for Zuckerberg to sell Meta's stock on a large scale for such a long time, and the last time he sold Meta's stock was back in November 2021。

In 2022, Meta's share price plummeted by about 70% in the year, to a seven-year low, as the company's strategy tilted toward the meta-universe, hitting tens of billions of dollars without much splash, and the traditional social media business faced threats from new platforms such as TikTok.。

After a "miserable" year in 2022, Zuckerberg began to adjust the company's business development strategy, announcing the "Year of Efficiency" (Year of Efficiency)。He said at the time that the company would continue to build the meta-universe, but most of the effort would be focused on improving Meta's core social media businesses (Facebook, Instagram, etc.)。

Meta's performance starts to pick up in 2023, driven by Zuckerberg's "Year of Efficiency"。In the third quarter of 2023, Meta recorded its fastest quarterly growth since the third quarter of 2021 and its strongest quarterly results since the company changed its name from Facebook to Meta.。

In addition, under the AI boom last year, Meta's performance was also remarkable.。Last year, Meta released its own large-scale language model, LLaMA, and announced that it would be free and open source for developers to use。At last September's developer conference, Meta also introduced the first consumer-facing generative artificial intelligence features, including a variety of chatbots and image editing tools for platforms such as Instagram and Facebook.。

Under the influence of performance rebound and AI boom, Meta's share price rebounded by about 194% in 2023 from its low at the end of 2022。Stocks perform better than all big tech giants except Nvidia。This year is close to the record high of September 2021。

According to public data, the 39-year-old Zuckerberg currently owns about 13% of Meta and has a net worth of about $125 billion, making him the seventh richest person in the world.。

It's worth noting that not only is Zuckerberg selling Meta's stock, the company's other executives are cashing out more or less。Public data shows that apart from Zuckerberg, Meta insiders have sold a total of 29,163 shares in the past year and have no record of buying company shares.。This kind of continuous selling of shares by the company's top management to cash out inevitably raises questions about whether Meta lacks confidence in its growth in the new year.。

In addition, it is worth noting that at the beginning of 2024, the U.S. technology sector has a "dark" start.。

Data show that Apple, Amazon, Google, Microsoft, Meta, Tesla and Nvidia, the U.S. technology "Big Seven," have fallen in the past four trading days, the longest consecutive decline in nearly a month.。Among them, the poor performer was Apple, which fell 4.6%, evaporating more than $380 billion, while Tesla fell 8.8%。The "Big Seven" all rose more than 100% in 2023.。In addition, the Nasdaq 100, represented by technology stocks, has also fallen over the past four sessions。

Steve Sosnick, chief strategist at Interactive Brokers Group, said: "We don't know if last year's uptrend is completely over, but it's perfectly normal to expect the market to pull back after the uptrend as we saw.。Sosnick further said: "Without the end-of-year factors driving the rally, I think we are seeing a gradual end to the carnival.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.