Hong Kong-US Stock Brokers Comparison: Rich Road vs Micro Bull

With so many Chinese U.S. stock brokerages, which one should be safer and more secure??This article comprehensively compares the popular Hong Kong Futu Securities and Micro Bull Securities, and analyzes the differences in commissions, safety, investment products, and access fees.。

Hong Kong and U.S. stocks are becoming more and more popular among overseas brokerage firms, and investors need to consider carefully when choosing a safe and secure platform.。Futu Securities and Micro Bull Securities, invested by Tencent and Xiaomi respectively, are one of the top choices for many Hong Kong people to invest in U.S. stocks, and are well received both in terms of platform experience and community discussions.。This article will provide an in-depth review of Futu Securities and Weiniu Securities in Hong Kong to help investors make informed choices。

The analysis includes:

○ Brokerage background

○ Trading markets and investment products

○ Commissions and fees

○ Access and fees

○ Regulation and safety

| Brokers | Futu Securities (Hong Kong) | Micro Bull Securities (Hong Kong) |

|---|---|---|

| trading market | US, Hong Kong, Shanghai and Shenzhen (China A-shares) | US, Hong Kong, Shanghai and Shenzhen (China A-shares) |

| Trading products | Stocks, ETFs, options, warrants, futures, funds, etc. | Stocks, ETFs, Warrants, CBBCs, Borders, Funds, Options, etc. |

| Trading Commission (US Stock) | Zero | Zero |

| Platform Fee (US Stock) | Free platform fee for one year | Zero ★ ★ ★ |

| Trading Commission (Hong Kong Stock) | Zero | Zero |

| Platform Fee (Hong Kong Stock) | HKD 15 / order (or step-by-step HKD 1 to HKD 30 per order) | HKD 10 / Order ★ ★ ★ |

| Trading commissions (U.S. stock options) | USD 0.65 / contract; minimum USD 1 per order.99 | Zero ★ ★ ★ |

| Platform fees (US stock options) | Fixed: USD 0.30 / Contract (or stepped per order USD 0.05 to USD 0.6) | Zero ★ ★ ★ |

| Regulators | US SEC, FINRA Hong Kong SFC Singapore MAS | US SEC, FINRA Hong Kong SFC Singapore MAS |

| Deposit expenses | Zero, banks may charge | Zero, banks may charge |

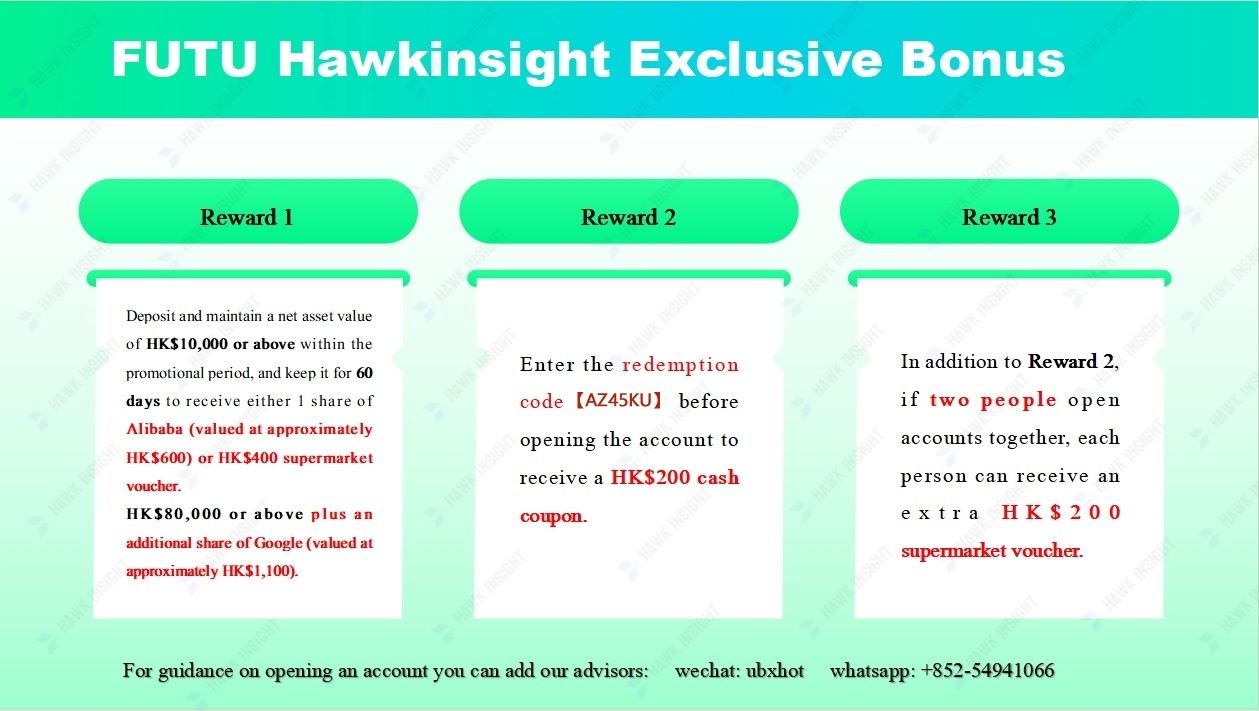

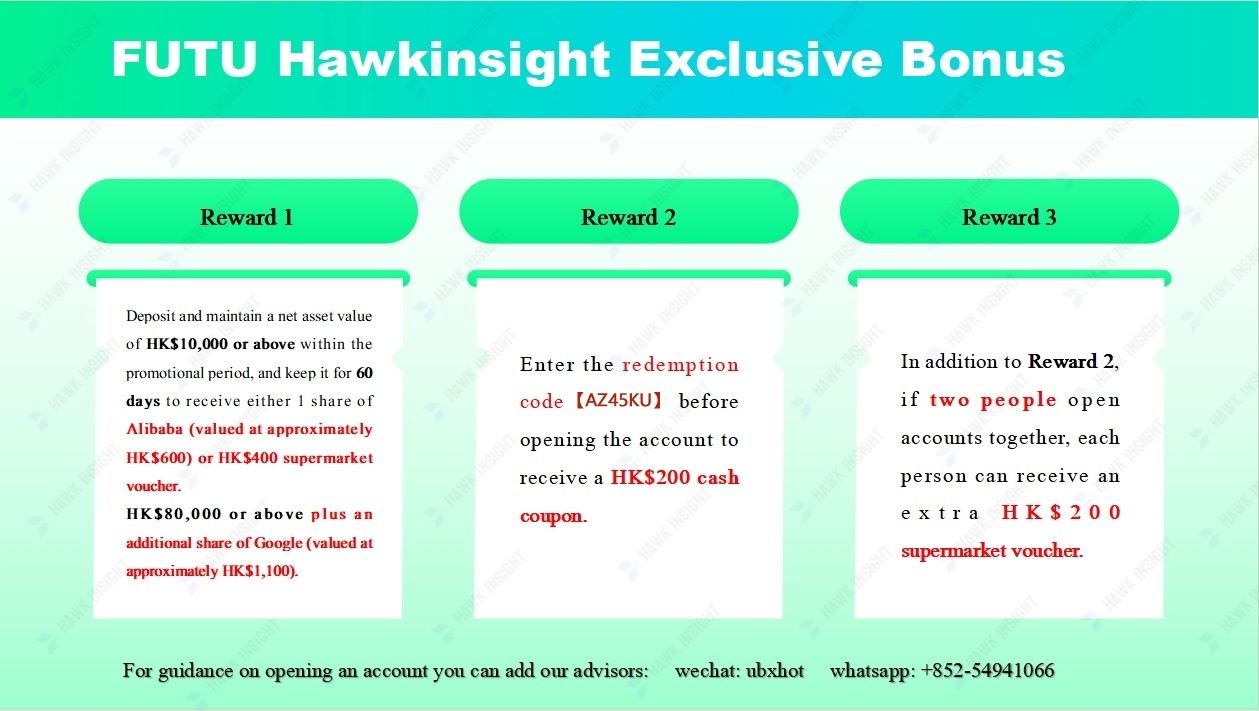

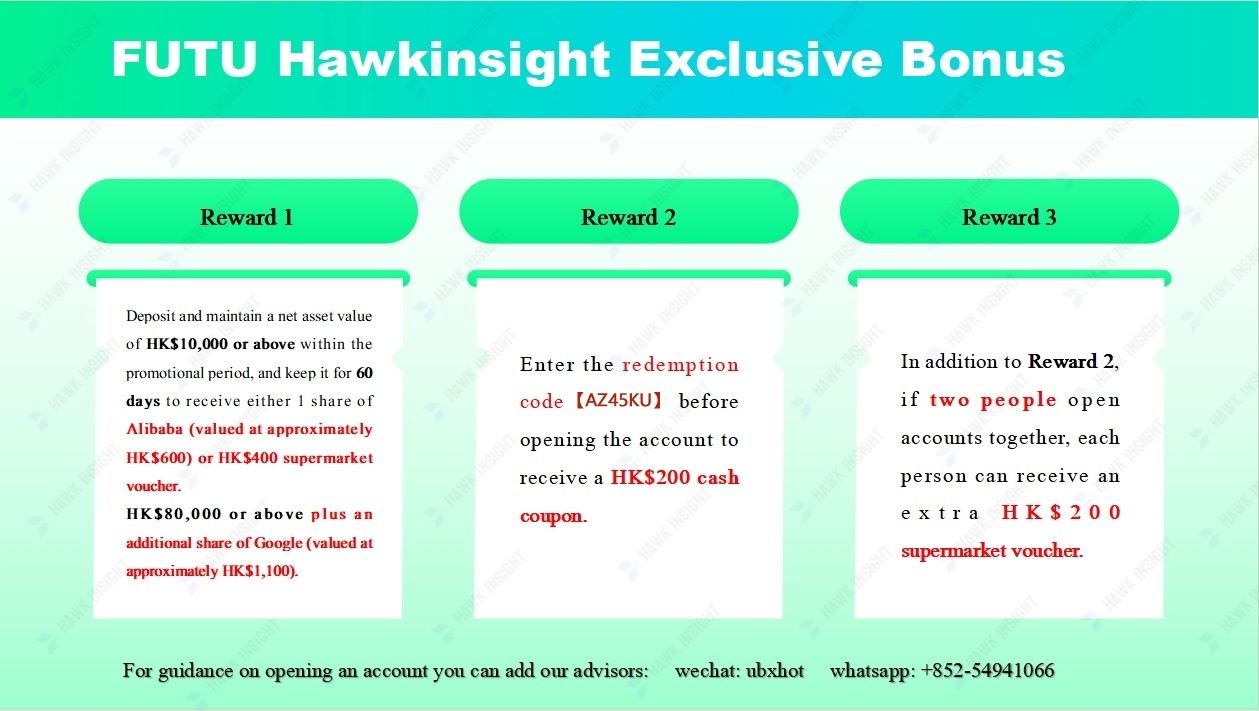

| Successful account opening and first deposit of designated funds |

Deposit funds up to HKD 10,000 1) 1 share of Tencent stock 2) Stock Cash Coupon (Value HKD 300) 3) 90-day fixed 7% annualized income coupon (value HKD 517) |

Deposited funds up to HKD 20,000 1) 1 share of Kellogg's stock (K) 2) 3 coupons for IPO subscription fee relief. 3) 3 months U.S. stock Level 2 depth market. 4) 1 share of ZOOM stock (nearby reward *) * requires a U.S. stock buy transaction within 60 days of opening an account |

| Preferential object | Hong Kong residents and overseas holders of foreign passports | Hong Kong residents to open accounts with Hong Kong identity cards |

★ ★ ★ represents more advantages

Broker background

1.Futu Securities (Hong Kong)

Futu Securities International (Hong Kong) is a subsidiary of Nasdaq-listed company Futu Holdings (Nasdaq: FUTU), a licensed corporation (Central Code: AZT137) regulated by the Hong Kong Securities and Futures Commission (SFC), which holds a Class 1, 2, 3, 4, 5, 7 and 9 licence.。

Founded in 2012, Futu Securities provides investors with multi-country financial trading services through its investment platform, Futu Niu Niu, and can invest in U.S. stocks, Hong Kong stocks and Chinese A-shares in one account.。Because of the strategic investment of Tencent, and the founder Li Hua is the 18th founding employee of Tencent, so Futu Securities is also known as the "Tencent system" of Hong Kong and U.S. stocks Internet brokerage.。

Futu Holdings and its subsidiaries hold a total of 43 financial licenses and qualifications in various mainstream financial markets around the world, covering U.S. stocks, Hong Kong stocks, A-shares, funds, futures, bonds and other aspects, with a total of more than 14 million platform users.

The following is a brief summary of the highlights of Futu Securities (Hong Kong).

| Year of Establishment | Established in 2012 |

| Trading platform | Futu Niu Niu trading platform supports computer version (Windows, macOS) and mobile App version (iOS, Android) |

| Account Type | Managed Account (Custodian Account) |

| tradable market | US, Hong Kong, Shanghai and Shenzhen (China A-shares) |

| Investment products | Stocks, ETFs, options, warrants, futures, funds, etc. support the subscription of new shares in U.S. and Hong Kong stocks. |

| Platform features | Provide ultra-low commission, low latency, stable and smooth, in-depth big data analysis, fundamental and technical analysis are suitable, online customer service response speed |

2.Micro Bull Securities (Hong Kong)

Founded in 2016, Webull Micro Bull Securities is a securities trading platform owned by Formi Technology, which belongs to one of Xiaomi's financial ecological chains and has more than 20 million users worldwide.。Micro Bull Securities entered the Hong Kong market in 2020 and is regulated by the Hong Kong Securities and Futures Commission (SFC) (Central Code: BNG 700), holding a Class 1 licence.。

Weiniu Securities focuses on "Enjoy Technology, Enjoy Investment," providing one-stop investment in U.S. stocks, Hong Kong stocks, China A-shares, but also enjoy U.S. stocks trading 0 commission, 0 platform fees, Hong Kong stocks trading all varieties of 0 commission, 0 membership fees, cash new shares subscription 0 fees ultra-low trading concessions, has become the first choice for many Hong Kong people to invest in Hong Kong U.S. stocks.。

The following is a brief summary of the highlights of Micro Bull Securities (Hong Kong).

|

Year of Establishment |

Established in 2016 |

|

Trading platform |

Micro cow support computer version (Windows, macOS) and mobile phone App version (iOS, Android) |

|

Account Type |

Managed Account (Custodian Account) |

|

tradable market |

US, Hong Kong, Shanghai and Shenzhen (China A-shares) |

|

Investment products |

Stocks, ETFs, warrants, CBBCs, Borders, funds, etc. Support for subscription of new shares in Hong Kong stocks |

|

Platform features |

U.S. and Hong Kong stocks double 0 commission, very low platform fees, Hong Kong stocks real-time quotes, U.S. stocks 50 buy and sell quotes, 13 line drawing tools, 54 technical indicators, fundamental and technical analysis are suitable. |

Then, we compare Futu Securities (Hong Kong) and Weiniu Securities (Hong Kong) from six aspects, including the trading market, which investment products to support trading, access fees, commission fees, platform supervision and fund security, and account deposit concessions.。

Market Comparison

Futu Securities (Hong Kong) and Weiniu Securities (Hong Kong) are similar in terms of marketable markets, also covering the U.S., Hong Kong, and Shanghai and Shenzhen (China A-shares) markets.。

|

trading market |

Futu Securities (Hong Kong) |

Micro Bull Securities (Hong Kong) |

|

美国 |

✓ |

✓ |

|

Hong Kong |

✓ |

✓ |

|

Shanghai and Shenzhen (China A-share) |

✓ |

✓ |

Comparison of investment products

Diversified investment product options to help investors flexibly allocate their portfolios, control risk and maximize returns。

Futu Securities (Hong Kong) and Micro Bull Securities (Hong Kong) support trading in roughly the same investment products, including equities, ETFs, warrants, funds。In contrast, Futu Securities (Hong Kong) supports options and futures trading, while Weiniu Securities (Hong Kong) does not support futures trading for the time being.。

In terms of new shares, Futu Securities (Hong Kong) supported the subscription of new shares in US and Hong Kong stocks, while Weiniu Securities (Hong Kong) launched the subscription of new shares in Hong Kong stocks.。

More specifically, Weiniu Securities (Hong Kong) supports fragmented trading, i.e. trading with less than one lot, providing more convenience for investors with smaller funds.。

|

Trading products |

Futu Securities (Hong Kong) |

Micro Bull Securities (Hong Kong) |

|

Stock |

✓ |

✓ |

|

ETF |

✓ |

✓ |

|

Option |

✓ |

✓ |

|

Warrant |

✓ |

✓ |

|

CBBC |

✓ |

✓ |

|

Futures |

✓ |

x |

|

Fund |

✓ |

✓ |

|

New Share Purchase (Hong Kong Stock) |

✓ |

✓ |

|

Purchase of new shares (U.S. stocks) |

✓ |

x |

Comparison of the cost of entry and exit fees

Futu Securities (Hong Kong) and Micro Bull Securities (Hong Kong) do not have a minimum threshold for deposit and withdrawal, and do not charge income or withdrawal fees; however, the banks and transit banks used may impose related fees。The specific fee is subject to the bank.。

1.Futu Securities (Hong Kong)

In terms of deposits, Futu Securities (Hong Kong) does not have a minimum deposit threshold and supports Hong Kong dollar, US dollar and offshore RMB deposits.。

Holding a Hong Kong bank card, you can use e-DDA fast deposit, bank transfer, FPS fast rotation, online banking remittance, ATM or over-the-counter transfer, cheque and other methods of deposit, free of handling fees, but the bank may charge。

* Note that users who open an account online in Hong Kong need to deposit no less than HK $10,000 for the first time.。

In terms of withdrawals, Futu Securities (Hong Kong) does not have a minimum withdrawal threshold and supports Hong Kong dollar and US dollar withdrawals.。

Available methods of withdrawal include Hong Kong bank cheque transfer, bank card transfer, free of charge, but banks may charge。Users can also choose to withdraw money to foreign banks, supporting the withdrawal of US dollars and Hong Kong dollars, each handling fee of HK $300 (withdrawal of Hong Kong dollars) or US $45 (withdrawal of US dollars).

2.Micro Bull Securities (Hong Kong)

In terms of gold deposits, Micro Bull Securities (Hong Kong) does not have a minimum deposit threshold and supports Hong Kong dollar, US dollar and RMB deposits.。

Holding a Hong Kong bank card, you can use FPS fast, CHATS, ATM or counter, check and other methods of deposit, free of fees, but the bank may charge, directly in the amount of deposit deduction.。

In terms of withdrawals, Weiniu Securities (Hong Kong) also has no minimum withdrawal threshold and supports Hong Kong dollar, US dollar and RMB withdrawals.。

Available methods of withdrawal include local banks in Hong Kong and wire transfers to overseas bank accounts.。Withdrawal to a local bank account in Hong Kong, Weiniu does not charge a fee, but the bank may charge a fee and deduct it directly from the amount withdrawn.

Wire transfer, micro-cattle levy a fee of HK $50 per withdrawal, bank charges will also be deducted from the withdrawal amount.。

In summary, in the way of deposit and withdrawal, Futu Securities (Hong Kong) supports e-DDA quick deposit, which is very convenient, while Weiniu does not support e-DDA quick deposit, so Futu Securities is slightly better.。

|

Futu Securities (Hong Kong) |

Micro Bull Securities (Hong Kong) |

|

|

Minimum amount of deposit and withdrawal |

x |

x |

|

Deposit method |

e-DDA quick deposit silver card transfer FPS fast revolution Online Banking Remittance ATM or Counter Transfer Cheque |

FPS fast revolution CHATS ATM or Counter Cheque |

|

Deposit expenses |

Zero Bank may charge |

Zero Bank may charge |

|

Payment expenses |

Zero Bank may charge * Withdrawal fee of HK $300 and US $45 to foreign banks |

Zero Bank may charge * Fee of HK $50 per wire transfer |

Commission Comparison

In terms of commission charges, the results of the comparison between the two brokerages are very direct。Weiniu Securities (Hong Kong) has a commission-free and platform fee-free system, which does not require any fees for trading U.S. stocks and U.S. stock options; Hong Kong stock trading is also commission-free, with platform fees as low as HK $10 per order.。

Compared with other Hong Kong and U.S. stock network securities dealers, the ultra-low transaction costs of micro-bull securities are more attractive.。

The following is a summary of the commission fee structure of Futu Securities (Hong Kong) and Micro Bull Securities (Hong Kong) for U.S. stocks, Hong Kong stocks, Chinese A-shares and U.S. stock options for your reference.。

| Investment products | Futu Securities (Hong Kong) | Micro Bull Securities (Hong Kong) |

| U.S. stocks | Commission: Zero Platform fee: free platform fee for one year |

Commission: Zero Platform fee: zero |

| Hong Kong Stock | Commission: Zero Platform Fee: HKD 15 / Order (or stepped HKD 1 to HKD 30 per order) |

Commission: Zero Platform Fee: HKD 10 / Order |

| China A Share | Commission: 0.03% * Transaction value Minimum CNH 3 per order Platform Fee: CNH 15 / Order |

Commission: 0.02% * Transaction value Minimum CNH 2 per order Platform Fee: CNH 12 / Order Minimum CNH per order 12 |

| U.S. Stock Options | Commission: USD 0.65 / contract; Minimum USD 1 per order.99 Platform fee: fixed as USD 0.30 / Contract (or stepped USD 0 per order.05 to USD 0.6) |

Commission: Zero Platform fee: zero |

security comparison

At all times, the safety of a brokerage firm is a primary consideration, and the number of financial licenses held and the number of countries under the supervision of the Securities and Futures Commission will affect the credibility of the brokerage firm.。After all, there is no license to protect the brokerage, the safety is definitely questioned.。

The following is an assessment of the safety of Futu Securities (Hong Kong) and Micro Bull Securities (Hong Kong) from both the regulatory and asset custody perspectives, all of which are based on the information disclosed on the official website of the brokerage firm.。

1.Regulators

○ Futu Securities (Hong Kong)

Futu Holdings and its subsidiaries hold a total of 43 financial licenses and qualifications in various mainstream financial markets around the world.。

In terms of U.S. regulation, Futu Holdings (U.S.) is regulated by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA).。SEC Registration Number is 8-69739 and FINRA Central Registration Number is CRD: 283078。He is also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).。

SIPC offers up to $500,000 (including $250,000 in cash) for users of Futu Securities' U.S. stock accounts.。

In terms of Hong Kong regulation, Futu Securities (Hong Kong) is a licensed corporation (Central Code: AZT137) regulated by the Hong Kong Securities and Futures Commission (SFC), holds a Type 1, 2, 3, 4, 5, 7 and 9 regulated activity license, strictly complies with the Securities and Futures Ordinance, and provides customers with safe and reliable securities trading services.。

○ Micro Bull Securities (Hong Kong)

Webull Financial LLC.) is a licensed securities broker in the United States, registered with the Securities and Exchange Commission (SEC), directly regulated by the Financial Industry Regulatory Authority (FINRA), and a member of the Securities Investor Protection Corporation (SIPC), the New York Stock Exchange (NYSE), the Nasdaq Exchange (NASDAQ) and the Chicago Board Options Exchange (CBOE) EDGX Stock Exchange.。

Micro Bull Securities entered the Hong Kong market in 2020 and is regulated by the Hong Kong Securities and Futures Commission (SFC) (Central Code: BNG 700) and holds a Type 1 regulated activity licence.。

At the same time, Micro Bull Securities (Hong Kong) is also a member of the Hong Kong Investor Compensation Fund (ICF), the Hong Kong Stock Exchange and the Central Clearing, with the Stock Exchange participant number 2175 and the Central Clearing participant number B02175.。

2.Asset Custody

Before using any brokerage platform, users should not only know whether the brokerage is legally regulated, but also check whether the asset custody entrusted by the brokerage is trustworthy.。

In general, brokerages will keep investors' funds and assets in trust with third parties to ensure security.。

○ Futu Securities (Hong Kong)

Futu Securities (Hong Kong) stated, "Futu Securities strictly complies with the requirements of the Securities and Futures Ordinance regarding client assets: licensed corporations are required to deposit money and securities belonging to clients in trust accounts and places designated by law, respectively;。"

Futu Securities also complies with the SFC's internal regulatory and risk control requirements by separating the functions of business operations, transaction settlement and security monitoring to ensure the safety of customer assets.。

Investor funds are protected by the Hong Kong Investor Compensation Fund (ICF) and the compensation limit for securities and futures contracts is HK $500,000 per person.。

○ Micro Bull Securities (Hong Kong)

Weiniu Securities independently custody client funds at Citibank (Citibank) and China Merchants Wing Lung Bank.。Investor funds are also protected by the Hong Kong Investor Compensation Fund (ICF), with a compensation limit of HK $500,000 per person for securities and futures contracts.。

In comparison, Futu Securities holds more licenses and qualifications and has a slightly higher safety index than Micro Bull Securities。

Futu Securities (Hong Kong) vs Micro Bull Securities (Hong Kong), how to choose?

Compared with Micro Bull Securities (Hong Kong), Futu Securities (Hong Kong) has more advantages in terms of licenses and qualifications held, thereby improving the safety index。In terms of new shares, Futu Securities (Hong Kong) supports new share purchases for Hong Kong and U.S. stocks, while Weiniu Securities (Hong Kong) is currently limited to new share purchases for Hong Kong stocks.。In terms of investment products, Futu Securities (Hong Kong) offers a variety of services such as stocks, ETFs, warrants, funds, options, etc., and has also opened futures trading, in contrast to its more diversified products.。

Relatively speaking, the advantage of Micro Bull Securities (Hong Kong) is its commission-free, platform fee-free trading system, which makes the transaction costs of U.S. stocks and U.S. stock options zero, while Hong Kong stock trading is also commission-free, only need to pay a platform fee of HK $10 per order.。This extremely low transaction fee allows investors to save a lot of transaction costs.。

In terms of investment products, although Weiniu Securities has relatively few investment products, investors can trade flexibly through its service of trading broken shares, and even less than one lot can buy and sell one share, thus lowering the investment threshold.。

So how should investors weigh the pros and cons when choosing a brokerage?

If you want to be able to participate in futures trading in addition to stocks, or are interested in new share purchases for U.S. and Hong Kong stocks, then Futu Securities (Hong Kong) may be a better fit for you。And if you're more concerned about transaction fee considerations, then the commission-free policy of Micro Bull Securities (Hong Kong) may be even more attractive, especially its very low platform fees for Hong Kong and U.S. stocks.。

Of course, you can also consider using both brokerages to trade U.S. and Hong Kong stocks using Weiniu Securities (Hong Kong), while participating in U.S. stocks through Futu Securities (Hong Kong) to play new, trading options, futures and other financial derivatives, the specific choice can be determined according to individual investment needs.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.